Used cars a bargain even at near-record prices, Edmunds report says

Image courtesy of Edmunds.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Used-car prices are at near-record levels. But those high-priced vehicles are still the biggest bargains on the market.

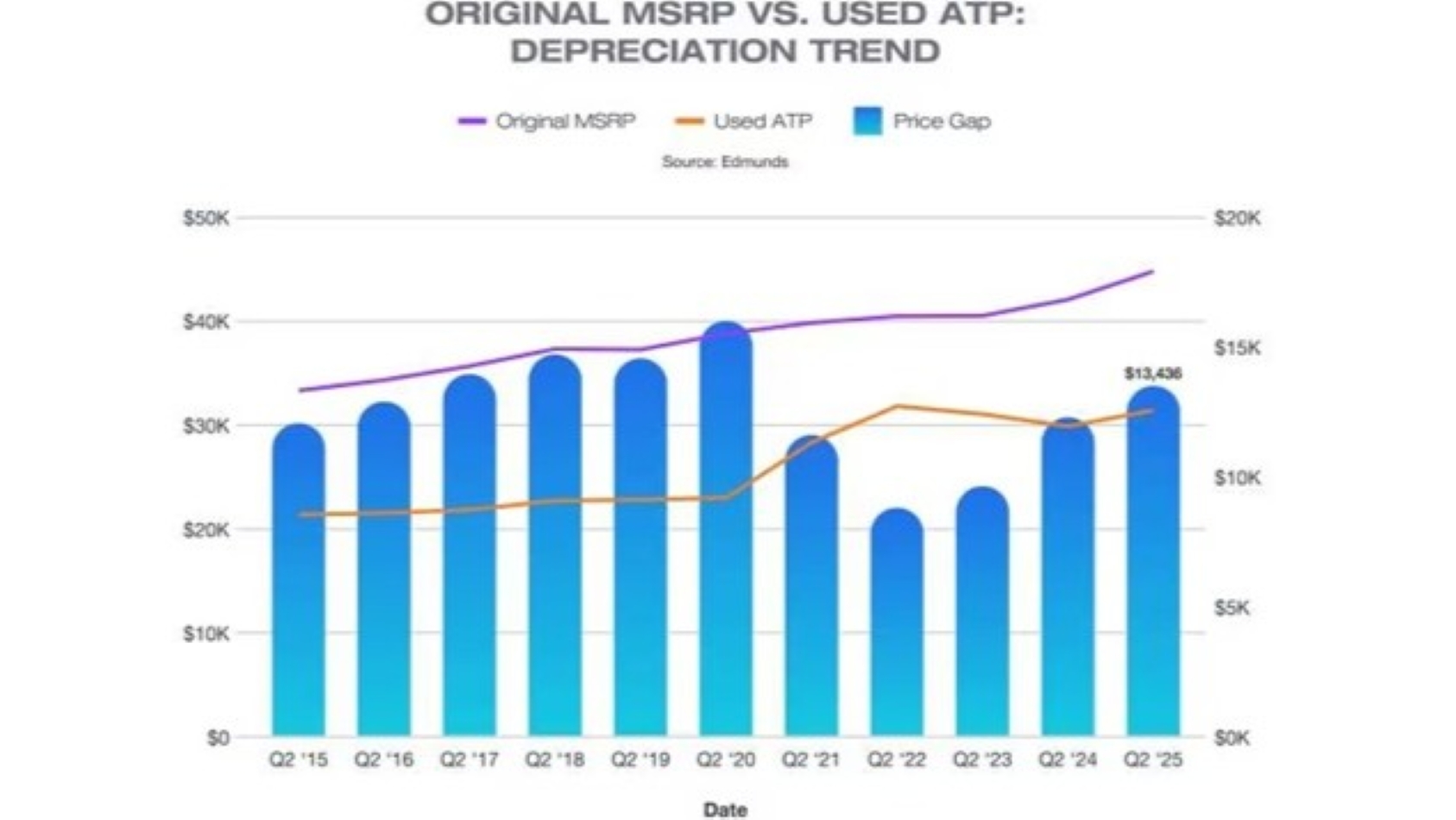

Edmunds’ Q2 2025 Used Vehicle Report found the average transaction price of 3-year-old used vehicles in the second quarter rose 5.2% year-over-year to $31,216, just $412 short of the all-time high of $31,628, set in Q2 2022.

But, Edmunds director of insights Ivan Drury pointed out in the report, there’s more to it than just the raw number.

According to the report, the average 3-year-old vehicle in 2022 originally cost $40,314 as a new 2019 model, while the current 3-year-old crop averaged $44,651 as new cars in 2022.

That difference of more than $4,000 in their new value, Drury said, “makes used cars a better deal than during the pandemic peak.” In fact, the current gap of almost $13,500 between current 3-year-old price and its original MSRP is the largest it’s been since the pandemic lockdowns began in 2020.

Why does that matter?

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Back in 2022, people were paying a crazy amount for used cars,” he explained, “and now it might seem like we’re back to the same point. And, yeah, technically you’re paying the same amount, but you’re getting more car. You’re getting that car that started with a higher MSRP. It’s probably more configured, probably has a bunch of technology — it might even be like an EV.

“It’s that value you get by going with a 3-year-old car today, even though it might not seem like one, because the price is similar to what it was at its height. But if you look at what you’re actually getting dollar for dollar, you’re getting a better deal today than… I’m not going to go crazy and say it’s better than it’s ever been, because there have been some insane times out there. But there are actually some bargains to be had.”

Still, the elevated price is making car shoppers hesitate. Edmunds’ data showed turn time for 3-year-old vehicles was six days slower than Q2 last year at 38 days, the second longest Edmunds has recorded since the second quarter of 2019, behind only the COVID shutdown in Q2 2020.

“The used market is entering a new phase,” Drury wrote in the report. “Fewer near-new vehicles are available, and those that do make it to dealer lots started with historically high MSRPs. While average transaction prices for 3-year-old vehicles are trending above what many consumers may expect, their value proposition is shifting.

“Compared to both today’s new car prices and what those vehicles originally sold for, used cars now look like a smarter deal than they have in years.”

And they might become an even better deal. The report showed residual values heading downward, with the highest-priced vehicles showing the biggest decreases. Vehicles that originally cost more than $100,000 retained just 57% of their value, down from 68% in 2022, and those priced from $50,000-$60,000 are holding 66%, down from 74%.

“These deals aren’t universal since off-lease supply remains tight,” the report said, “but downward pressure on used pricing will likely continue. Looking forward, as automakers continue to apply incentives to move new inventory while attempting to absorb as much of the tariff impact as possible, the used market is expected to soften further.”

The full report is available here.