Used-inventory trends top CarGurus’ 2025 Mid-Year Auto Market Review

Graphs courtesy of CarGurus.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

This week, CarGurus released its 2025 Mid-Year Auto Market Review, highlighting five primary points, including the impact of tariff uncertainty, shifting inventory dynamics and evolving consumer preferences on the new- and used-vehicle market.

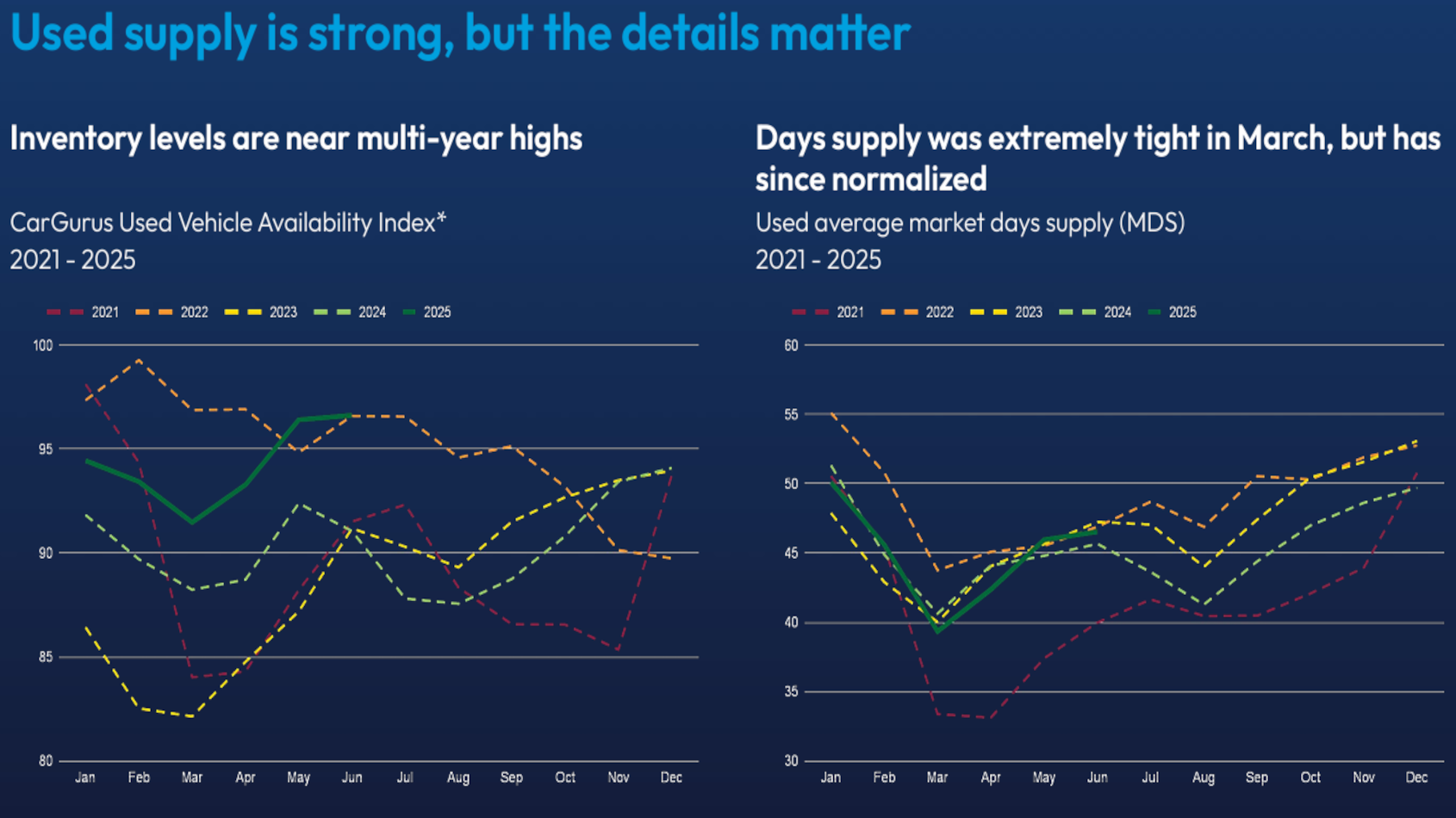

Among those top findings, CarGurus indicated used inventory has reached multi-year highs, but value has been redefined.

Despite abundant used-car supply, CarGurus pointed out that 3- to 4-year-old models — the sweet spot for value-conscious buyers — remain scarce and priced at a premium due to lingering effects of pandemic-era production disruptions.

For shoppers in the market for a used car costing less than $20,000, analysts acknowledged options are increasingly older and higher mileage.

At both ends of the age spectrum, however, fuel-efficient models (spanning hybrids, EVs, and compacts) lead the pack in demand, according to CarGurus.

Here are the other four primary findings CarGurus highlighted:

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—Tariff-driven sales surge has reduced affordable new inventory: New vehicle sales spiked 48% year-over-year in the days after the March tariff announcement as buyers raced to beat potential price increases, according to CarGurus tracking.

While sales demand has since normalized to more seasonal patterns, analysts said the affordable segment is showing lasting impacts.

CarGurus reported listings for new cars under $30,000 have dropped by 15% since late March, with compacts and crossovers like the Honda Civic, Buick Encore GX, Jeep Compass, and Mazda CX-30 seeing the steepest declines.

—The average new vehicle price is holding steady: While more than 60% of new vehicle listings today are post-tariff inventory, CarGurus determined the average new car price has remained relatively stable at approximately $49,600.

Analysts pointed out that model-level price changes tell a more nuanced story, with luxury SUVs seeing some of the largest price increases since tariffs went into effect in April and electric vehicles posting the biggest price decreases.

—Aged new car inventory may offer value: Despite the spring sales surge, CarGurus found that 2024 and older model-year vehicles are maintaining a high share of inventory — approaching levels not seen since 2020.

At mid-year, analysts reported more than 7% of new car listings were 2024 or older, with Ford trucks and SUVs among the top models with older model year supply, creating a chance for shoppers to find a potential deal on pre-tariff inventory.

—Hybrids stand out for pricing and demand: CarGurus went on to mention hybrids continued to lead new vehicle sales growth in 2025, buoyed by strong demand and attractive pricing.

According to CarGurus, average list prices for new hybrids decreased by about $1,400 year-over-year, helping drive a 43% increase in retail sales compared to 2024.

Analysts also noticed hybrid and gas models are now the most commonly cross-shopped combinations, as shoppers increasingly prioritize practicality and affordability.

“So far this year, the auto market has been shaped by dramatic shifts in consumer behavior fueled by shifting policies and economic uncertainty,” CarGurus director of economic and market intelligence Kevin Roberts said in a news release.

“These pressures have amplified what car shoppers demand most: affordability and efficiency. While vehicle prices have mostly held steady despite tariffs, it remains to be seen how long the current balance of pricing and demand can last, especially as value-driven options become harder to find,” Roberts added.