What’s in your customer’s garage could indicate direction of future purchase

Image courtesy of LexisNexis Risk Solutions.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Looking for an indicator of which brand a prospective car buyer is going to purchase?

You might start with what’s already in that customer’s garage — even if the customer changes brands.

According to the U.S. Automotive Brand Loyalty Mid-Year 2025 Study from LexisNexis Risk Solutions, households with more than one vehicle can directly impact future purchases.

The survey of 1,000 vehicle owners found 65% of them owned multiple vehicles, and 42% of those had cars of more than one brand.

When consumers in that group replaced a vehicle, 23% of them switched to another brand they already owned, which LexisNexis said illustrates how being exposed to another brand every day positions that brand higher on the awareness and consideration scale.

“With one in four consumers defecting to another brand already in their garage, affinity plays a powerful role in the final decision,” LexisNexis Risk Solutions associate vice president Dave Nemtuda said. “As consumer behaviors evolve, OEMs and their franchise dealerships have a unique opportunity to strengthen loyalty by rethinking how and when they engage.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Overall, the study showed the majority of car shoppers are open to all brands, with 57% saying they looked at vehicle from their current brand but were also considering others. Almost a third (31%) said they were focused exclusively on their current brand, and 12% only considered changing to another brand.

LexisNexis said the survey showed electric vehicle purchases up 8% and hybrids up 6%, and found 64% of consumers who switched from gas-powered vehicles to those alternative-fuel vehicles defected to another brand.

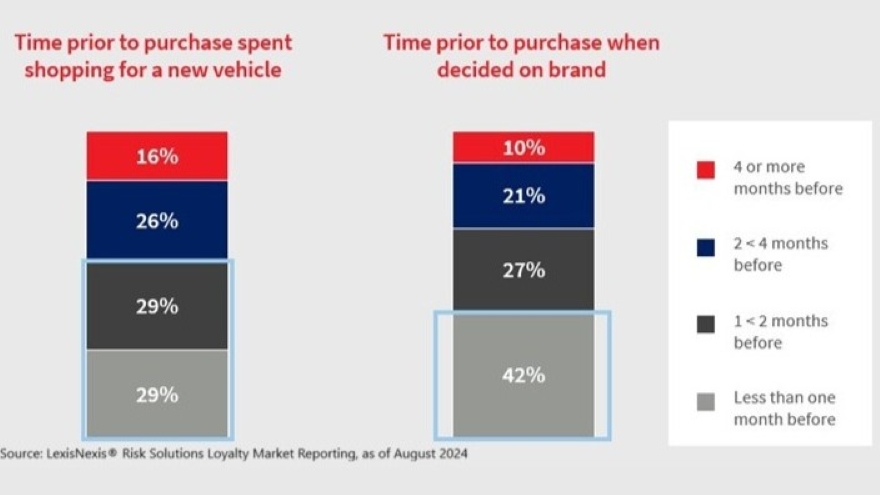

According to the survey, 58% of car shoppers begin their process within two months of when they actually buy a vehicle, but 42% don’t decide on the brand they’ll buy until less than a month before the purchase, noting communication they’ve received from OEMs played a role in their purchase decisions.

LexisNexis said all forms of communication had a positive impact on purchase consideration, with emails a brand ranking highest among channels, cited by 65% of respondents, ahead of direct mail (46%) and text (27%).

As for the content of the message, financial incentives (87%) edged loyalty programs (86%) for the top spot, followed by exclusive offers for existing brand owners and detailed information about features and improvements in new models, both at 85%.

New-vehicle model promotions (84%), competitive offers on current vehicle trade-in values (83%) and personalized invitations to drive new vehicles (82%) also ranked highly.

“The increasing shift towards electric and hybrid vehicles presents both an opportunity and a challenge for automakers to retain customers,” LexisNexis Risk Solutions product principle for vehicle intelligence solutions Mike Yakima said. “Buyers are receptive to timely, personalized communication across multiple channels, creating more touchpoints to reinforce brand value and trust. Those who embrace this shift can turn changing purchase patterns into a lasting advantage.”

A customized brand report can be downloaded here.