Cadillac claims top spot in Pied Piper online lead study

Chart courtesy of Pied Piper.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

General Motors had a reason to celebrate some of its franchised dealers on Monday.

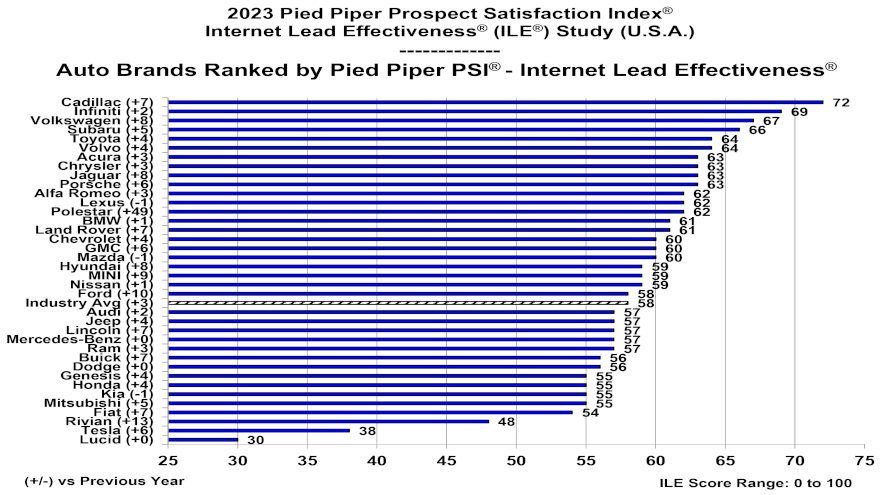

The 2023 Pied Piper PSI Internet Lead Effectiveness (ILE) Study — which measures responsiveness to Internet leads coming though dealership websites — showed Cadillac dealerships ranked highest.

Following Cadillac were Infiniti, Volkswagen, Subaru, Toyota and Volvo.

“Auto dealers industrywide were quicker on average to respond to their website customers this year,” Pied Piper CEO Fran O’Hagan said in a news release. “Dealers have learned that they meet most of their customers online today before anyone visits in person, and dealers who respond quickly, personally, and completely to website customer inquiries simply sell more vehicles.”

Pied Piper submitted mystery-shopper customer inquiries through the individual websites of 5,428 dealerships, asking a specific question about a vehicle in inventory, and providing a customer name, email address and local telephone number.

Pied Piper then evaluated how the dealerships responded by email, telephone and text message over the next 24 hours.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Brands with the greatest improvement since last year’s study included Polestar, Rivian, Ford, MINI, Volkswagen, Jaguar and Hyundai.

Only six brands failed to improve from 2022 to 2023. That group included Lexus, Mazda, Kia, Lucid, Dodge and Mercedes-Benz.

Industry average performance increased three points to a score of 58, an all-time high during the 13 years Pied Piper has measured and reported dealer web-response performance.

Pied Piper explained 20 different measurements generate dealership ILE scores, on a scale of 100.

In a traditional bell curve of performance, 30% of all auto dealerships nationwide scored above 80 (providing a quick and thorough personal response), while 29% of dealerships scored below 40 (failing to personally respond to their website customers).

On average industrywide, Pied Piper indicated dealerships this year were more likely to respond with reasons to act quickly, with reasons to purchase from their specific dealership, and they were more likely to provide a price.

Despite the substantial increase in the use of texting, from 46% of the time last year to 61% of the time this year, the project determined customers were still likely to receive an answer to their question by email (51% of the time), or to receive a phone call (56% of the time.)

“The top performing dealerships reach out to a customer using multiple paths, then when the customer responds, they follow-up using the same path used by the customer,” O’Hagan said.

Response to customer web inquiries varied by brand and dealership, and the following are examples of performance variation by brand:

How often did the brand’s dealerships email or text an answer to a website customer’s question within 30 minutes?

More than 50% of the time on average: Cadillac, Infiniti, Polestar, Volkswagen.

Less than 30% of the time on average: Lucid, Tesla, Rivian, MINI.

How often did the brand’s dealerships use a text message to answer a website customer’s inquiry?

More than 30% of the time on average: Mitsubishi, Ram, Jeep, Kia, Mazda, Volvo.

Less than 10% of the time on average: Lucid, Tesla, Rivian, Polestar.

How often did the brand’s dealerships respond by phone to a website customer’s inquiry?

More than 70% of the time on average: Subaru, Acura.

Less than 35% of the time on average: Lucid, Tesla, Rivian, Land Rover, Fiat.

Although not part of ILE scoring, Pied Piper also measured dealer-website responsiveness to a site’s chat function (if offered). How often did a “human” respond to a customer question within 30 seconds?

More than 90% of the time on average: Volvo, Genesis, Mercedes-Benz.

Less than 50% of the time on average: Tesla, Rivian, Alfa Romeo.

The Pied Piper PSI Internet Lead Effectiveness (ILE) Studies have been conducted annually since 2011.

The 2023 Pied Piper PSI-ILE Study was conducted between July and January by submitting website inquiries directly to a sample of 5,428 dealerships nationwide representing all major automotive brands.