Group 1 tops annual Pied Piper Service Telephone Effectiveness Study, as some stores lean into AI tools

Charts courtesy of Pied Piper.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Group 1 Automotive is successful at more than just retailing cars nowadays. Its service department has made significant improvements, too.

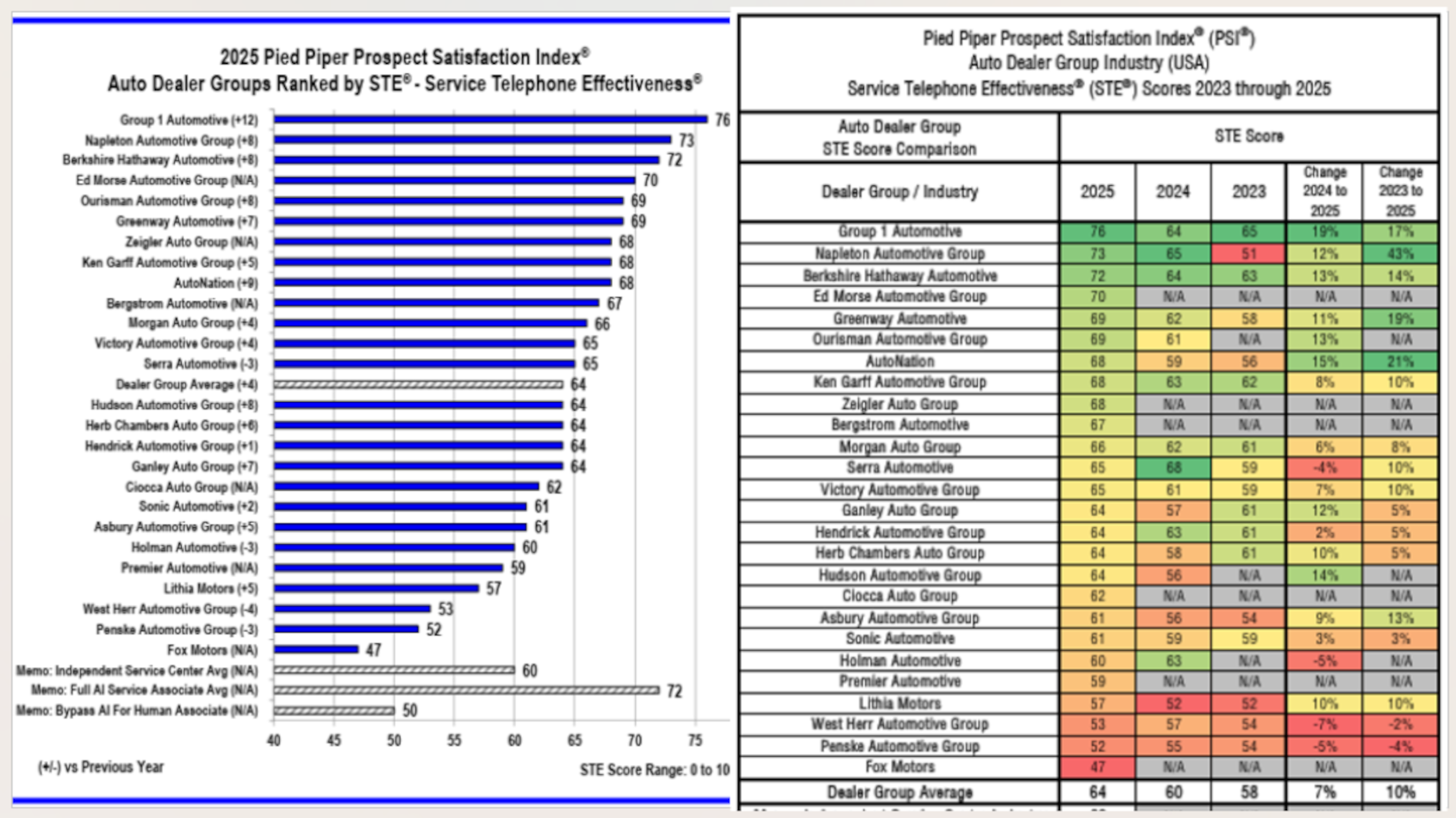

The publicly traded dealership organization ranked highest in Pied Piper’s 2025 PSI Service Telephone Effectiveness (STE) Auto Dealer Group Study, which measured efficiency and quality when attempting to schedule service appointments by telephone.

According to a news release, following Group 1 in the overall study standings were Napleton Automotive Group, Berkshire Hathaway Automotive, and Ed Morse Automotive Group.

Pied Piper highlighted that it submitted service calls to 2,105 dealerships representing 26 of the largest U.S. dealer groups, as well as to 200 independent service centers. Each location received an STE score ranging from 0 to 100 based on their performance in over 30 differently weighted measurements tied to best practices most likely to drive service revenue and customer loyalty.

Each dealer group’s average STE Score is a combined average of their individual dealership performances.

Researchers found that the industrywide average service telephone performance continued to improve. The average STE score came in at 64, up four points since last year and six points since 2023.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Pied Piper said the improvement in average STE score was in large part due to a reduced rate of negative behaviors compared to the previous year.

Service customers were placed on hold for more than two minutes only 2% of the time on average in 2025 compared to 13% of the time last year, according to Pied Piper.

Researchers added the share of service customers who hung up without having been offered an appointment dropped to 9% this year, down from 13% last year.

“A service customer’s initial phone call is a dealership’s first step toward building loyalty and generating revenue,” Pied Piper’s vice president of metrics and analytics Cameron O’Hagan said in a news release. “Yet because these calls often go unnoticed in daily operations, problems are easily overlooked. Increasing visibility leads directly to improvement.”

So, how did Group 1 top the chart?

Researchers indicated Group 1 dealerships improved their average STE score by 12 points over the past year, achieving a record average STE score of 76.

Pied Piper noted that only 4% of Group 1 service callers weren’t offered an appointment. That’s down from 10% last year and less than half this year’s dealer group average.

Researchers went on to mention the average Group 1 caller reached a service associate in 51 seconds — 8 seconds faster than Group 1’s performance last year, and 9 seconds quicker than this year’s dealer group average.

Pied Piper added Group 1 callers were also half as likely to be placed on hold compared to the industry and 9% less likely to experience hold times exceeding two minutes.

More dealer group performance analysis

Pied Piper drilled deeper into its data to see how dealer groups performed in a variety of ways connected with their service departments.

How often did customers of the group’s dealerships reach a service associate within one minute?

More than 80% of the time on average: Zeigler Auto Group, Greenway Automotive, Serra Automotive, Bergstrom Automotive.

Less than 40% of the time on average: Ken Garff Automotive Group, Ciocca Auto Group, Penske Automotive Group.

How often did the group’s dealerships offer an appointment for a specific date and time?

More than 95% of the time on average: Napleton Automotive Group, Ed Morse Automotive Group, Group 1 Automotive, Bergstrom Automotive, Morgan Auto Group.

Less than 80% of the time on average: West Herr Automotive Group, Fox Motors.

What was the group’s dealerships’ average number of days out until the earliest available appointment?

Less than two days on average: Napleton Automotive Group, Berkshire Hathaway Automotive, Group 1 Automotive, Ourisman Automotive Group, Greenway Automotive.

More than seven days on average: West Herr Automotive Group, Fox Motors.

How often would calling a group’s dealerships for service result in an issue that prevented communication (placed on hold indefinitely, straight to voicemail, stuck in phone tree, etc.)?

Less than 3% of the time on average: Ed Morse Automotive Group, Napleton Automotive Group, Zeigler Auto Group, Group 1 Automotive.

More than 15% of the time on average: Penske Automotive Group, West Herr Automotive Group, Fox Motors.

Rise of AI in service calls

Researchers noticed the use of artificial intelligence to interact with service customer calls continues to grow.

And for the study, Pied Piper collected data comparing the experience of service phone customers who interacted with AI versus those who interacted with a human.

For dealerships using AI to answer service calls, those calls were handled successfully by the AI 91% of the time, including addressing the customer’s request to schedule an appointment, without any reliance on a human service employee.

Overall, Pied Piper said customers successfully scheduled a service appointment 86% of the time at dealerships that rely on AI, compared to 90% of the time at dealerships that rely on humans to interact with customers.

Perhaps justifying the technology investment, Pied Piper found that service drive AI outperformed the majority of human associates.

The average STE score when AI successfully handled the entire service call was 72, which was 8 points higher than the 2025 national dealer group average, and nearly as high as the STE average scores of top performing dealer groups.

Researchers added 84% of these successful AI interactions achieved STE scores equal to or better than this year’s dealer group average STE score.

And what about when the AI tool cannot handle the service call?

While some customer requests are simple, such as oil changes or standard maintenance, Pied Piper acknowledged other customers call about recalls or a combination of issues, which usually requires a transfer to a human representative.

Researchers said AI was unable to handle the customer request 9% of the time, and when attempting to transfer to a human associate, those handoffs failed 56% of the time.

Pied Piper noticed typical issues include requiring the customer to call back later, sending to voicemail, endless hold, and call dropped when transferred.

According to the study, the average A.I. transfer occurs 88 seconds into the call, “meaning that the failure may leave the customer disgruntled over having wasted their time, compared to the alternative of having to leave a voicemail at the start of a call.”

Furthermore, at dealerships using AI, when the tool transfers customers to a human service associate, whether by customer request or reaching the limit of AI capability, Pied Piper determined the average STE score was 50, which was 14 points lower than the dealer group average and 22 points below the current “full capability” AI average score.

And at dealerships using AI, the study showed only 28% of transferred customers interacted with service staff whose performance achieved an STE score higher than the average AI STE score.

“AI now often outperforms human staff on service calls, but handoffs to people frequently fall apart,” O’Hagan said. “Dealers must use AI as a tool — not a crutch — and stay committed to staffing and smooth transitions.”

Competitive threat from independent service centers

New for 2025, the study also included measurements of independent service center STE performance.

The findings showed that independent service center performance was mixed, but for some important measurements their performance exceeded the dealer group average.

Four different independent service center brands were studied. Average STE scores for each independent were as follows:

—Midas: 65

—Firestone: 62

—Meineke: 57

—Pep Boys: 56

The overall independent service center industry average STE score came in at 60, compared to the dealer group average STE score of 64.

While 51% of independent service centers outperformed dealers, researchers found that the independent service centers offered an appointment only 79% of the time on average, compared to 90% of the time on average for the dealer groups.

While the average dealer group STE score is higher, Pied Piper noticed independent service centers excel in some individual behaviors.

They are twice as likely to offer a cost estimate over the phone and most notably, the average days out until the earliest available appointment hovered around 1 day on average, compared to 4 days out for the dealer groups nationally.

“Failure to schedule an appointment quickly may be all it takes for a dealership’s service customer to choose an independent shop,” O’Hagan said. “Dealerships work hard to avoid losing service customers, and the faster availability and greater price transparency of independents can be a real threat.”

For more than 15 years, Pied Piper has independently published annual industry studies that rank the omnichannel performance of brands and dealer groups. These studies track how industry performance changes over time and let clients understand how their own performance compares.