Infiniti dealers post record high score in study of responsiveness to online leads

Image courtesy of Pied Piper Management Company, LLC.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

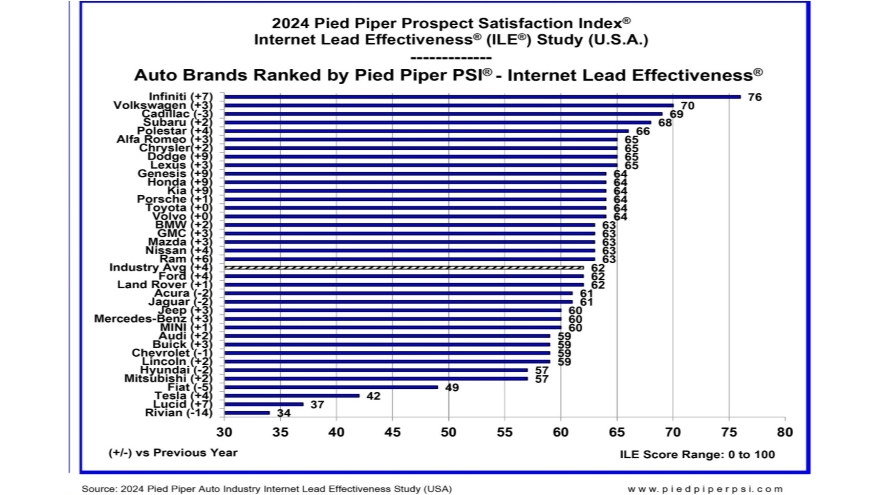

When it comes to responding to customers online, Infiniti dealers are No. 1, according to Pied Piper’s latest research.

The luxury brand topped Volkswagen, Cadillac, Subaru and Polestar in the 2024 Pied Piper PSI Internet Lead Effectiveness Study, which measured responsiveness to customer Internet leads coming though dealership websites.

Pied Piper submitted mystery-shopper customer inquiries through the individual websites of 3,957 dealerships, asking a specific question about a vehicle in inventory and providing a customer name, email address and local telephone number, then evaluated how the dealerships responded by email, telephone and text over the next 24 hours.

The company used more than 20 metrics to generate a score on a 100-point scale.

Infiniti’s score of 76 is best of any brand in the 14 years Pied Piper has tracked dealer response. It was also one of the most improved brands, up seven points from the 2023 study to rise from second past Cadillac into the top spot.

Infiniti’s score was boosted by its rate of response by phone call, jumped from 50% of the time on average in 2023 to 82% this year.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Dodge, Genesis, Honda, and Kia each rose nine points to tie for the largest improvement. Just seven of the 37 brands studied declined in responsiveness, with electric vehicle manufacturer Rivian dropping 14 points to rank last at 34 points, followed by Fiat (minus-5), Cadillac (minus-3), Acura (minus-2), Hyundai (minus-2), Jaguar (minus-2) and Chevrolet (minus-1).

The industry average was up four points to a record score of 62. The 2024 study found 34% of dealerships scored above 80 — which indicates providing a quick and thorough personal response — while 21% scored below 40 by failing to personally respond to their website customers.

“2024 is a more challenging business environment for car dealers,” Pied Piper CEO Fran O’Hagan said, “and many have responded by improving their interaction with online customers.”

Pied Piper said dealerships’ responses to online customer inquiries by phone or text improved overall. While the email response rare was flat compared to last year, Pied Piper said the quality of emails improved, with dealerships more likely to try to set an appointment, provide additional information to suggest next steps.

In addition, dealerships this year were more likely to reach out to their customers by more than one channel — email and phone, or text and phone — than in previous years.

“Top performing dealerships reach out to a customer using multiple paths,” O’Hagan said. “Then when the customer responds, they follow up using the same path chosen by the customer. Otherwise, too many customers are missed since they don’t see emails or texts, or don’t answer phone calls.”

The study showed Infiniti, Volkswagen and Volvo were the only brands whose dealers used multiple channels more than 60% of the time on average, while Mitsubishi, Fiat, Tesla, Lucid and Rivian did so less than 35% of the time.