Napleton again leads dealer groups in responding to internet leads

Chart courtesy of Pied Piper.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

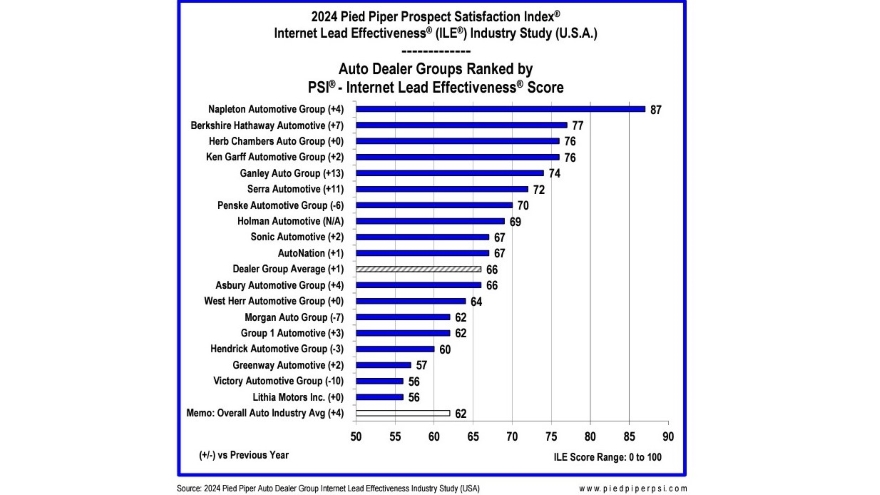

Some things never change. One of those, it seems, is Napleton Auto Group’s position as the dealership group most responsive to internet leads.

Pied Piper’s 2024 PSI Internet Lead Effectiveness Study, which measures responsiveness to internet leads coming though dealer websites, shows Napleton at the top of the list for the third consecutive year by a wide margin.

Napleton, which operates more than 80 dealerships in seven states, posted an internet lead effectiveness score of 87, up four points from the 2023 study and 10 points more than runner-up Berkshire Hathaway Automotive.

Herb Chambers Auto Group (76), Ken Garff Automotive Group (76) and Ganley Auto Group (74) completed the top five.

Pied Piper’s study measured responsiveness to internet leads submitted by mystery-shopper inquiries through the individual websites of all dealerships owned by 18 of the nation’s largest dealer groups. The study evaluated how the dealerships responded by email, telephone and text message over the next 24 hours, using more than 20 different measurements to create a total score ranging between 0 and 100.

In the 2024 study, 42% of dealerships scored above 80, which Pied Piper said shows a quick and thorough personal response. On the other hand, 18% scored below 40, failing to personally respond to website customers.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Pied Piper said 84% of Napleton’s dealerships topped the 80-poimt mark, while just 6% scored less than 40.

“Top performing dealerships focus on their behaviors, but they also carefully track what their website customers are really experiencing – which is often a surprise,” Pied Piper CEO Fran O’Hagan said in a news release. “Without that step, dealership reports can encourage employees to pretend to respond, with automated responses to quickly ‘stop the clock,’ instead of the personal replies needed by customers.”

Ganley was the most improved dealer group, raising its 2023 score by 13 points, followed by Serra Automotive, up 11 points to 72, which placed sixth.

Victory Automotive Group went backward, dropping by 10 points into a tie with Lithia Motors for last among the groups studied with 56 points. Morgan Auto Group (62) was down seven points and Penske Automotive Group (70) was down six points to fall from second last year to seventh.

The dealer group industry average ILE score rose one point to 66, four points better than the 2024 ILE average score for the overall auto industry, Pied Piper said. The study attributed the improvement to dealers responding quicker to online customers by phone and increased use of multiple communication channels — phone, email and text — to respond to customers.

Napleton improved not only in both those areas, but also in seeking to schedule an appointment and answering more questions by text.

Among the study’s results:

- Napleton, Herb Chambers and Serra dealerships emailed in response to a website customer’s question more than 75% of the time on average, while Lithia, Hendrick and Victory did so less than 50% of the time. The average among the dealer groups was 58%.

- Ken Garff, Napleton and Holman Automotive answered by text more than half the time, compared to the dealer group average of 36%. Serra Automotive, Herb Chambers AG, West Herr AG texted back less than 25% of the time.

- Napleton, Berkshire Hathaway, Ken Garff and Ganley led dealers in responding by phone call, each averaging more than 85%. West Herr Auto Group and Victory AG were below 50%, while the average for the groups was 69%

- The groups that “did both fast” — answering a customer’s question by email or text, and also phoning the customer, all within 30 minutes – more than 50% of the time were Napleton, Herb Chambers and Ganley. On the downside, Victory, Lithia Motors, AutoNation and Greenway Automotive managed it less than 25% of the time, well below the average of 34%.