Report shows used supply rising, prices falling, vehicles getting older

Image courtesy of Cars Commerce.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Used-car supply is rising at the lower end of the pricing scale – but those cars are getting older.

Cars Commerce’s Industry Insights Report for February found the overall supply of used cars was up 2.4% year-over-year, but for vehicles priced less than $30,000, it shot up 7.5% from the same month in 2023.

That trend was led by the lowest priced vehicles, with the number of units listed for less than $10,000 rising 17% and vehicles in the $10,000-$19,000 range up 7.7%. The supply of used vehicles priced $30,000 or more, meanwhile, fell 6.5%.

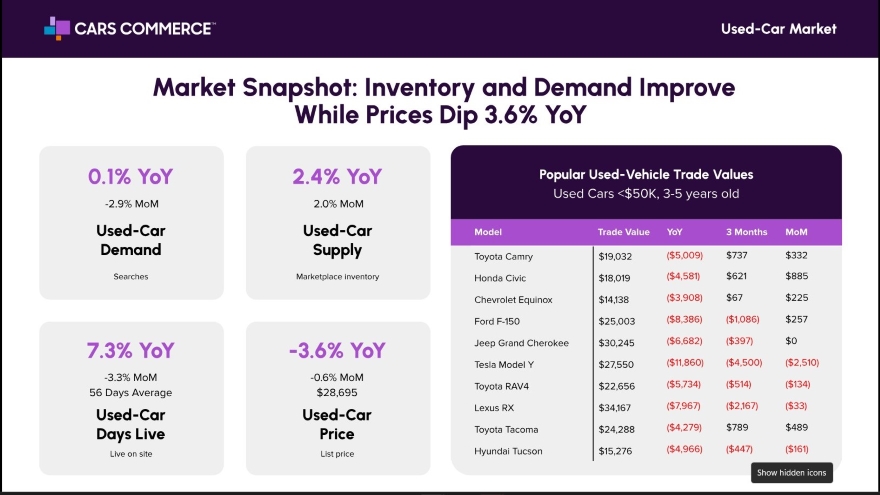

Those numbers are driven in part by the recent drop in prices across the board. The Cars Commerce report showed used-vehicle prices down 3.6% year-over-year to an average of $28,695 while demand held steady, up just 0.1% from February 2023.

But those lower-end vehicles also have more wear and tear on them. On average, used vehicles costing less than $20,000 are 2.7 years older and have 22,300 more miles on their odometers than those of the same price level in February 2019, before the COVID pandemic. Models under $30,000 average about 10,000 more miles.

The average vehicle under $10,000 is now 13.2 years old, the report said, and those at $10,000-$19,000 average of 7.4 years.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The report also showed a list of popular 3-5-year-old vehicles whose trade values have plummeted since last February. The list included the Ford F-150, which lost $8,386 in trade value year-over-year to its current $25,003; the Jeep Grand Cherokee, down $6,682 to $30,245; the Toyota Camry, down $5,009 to $19,032; and the Tesla Model Y, down $11,860 to $27,550.

The Model Y is an illustration of the rapidly falling prices of used electric vehicles, which decreased by 19.3% in the past year to an average of $38,000. As a result, Cars Commerce said, used EV demand has surged, up 29.5% year-over-year as new EV demand decreased 5.1%. Used EV supply grew 25.8% while new supply soared 129.4%.

While the report said the Chevrolet Bolt EUV is currently the fastest-selling used EV model, followed by the Rivian R1s, the Rivian R1T, the Kia EV6 and Tesla’s Model Y, Teslas dominated the list of used EVs most searched for on Cars.com, with the Model 3, Model S, Model Y and Model X taking the first four spots, ahead of the Porsche Taycan.

The Ford F-150 was the most searched for used vehicle overall, followed by the Chevy Silverado 1500, Toyota Tacoma, Chevy Corvette and Ford Mustang.

On the new-car side, the average list price was down just 0.6% percent year-over-year, but that pushed it below $49,000 for the first time in more than a year. The current average of $48,942, is down from a high of $50,000 in August 2023 and, Cars Commerce said, reflects increased dealer discounts and automaker incentives, as well as “the buyer-friendly market conditions seen before the pandemic.”

It also reflects decreased demand for new cars, which the report said sank 14.2% since last February. With supply increasing, that led to new car days on lot jumping 41% to 65 days, compared to 56 days for used cars.