Work Truck Solutions completes bailment pool pilot, plans to expand program

Image courtesy of Work Truck Solutions.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

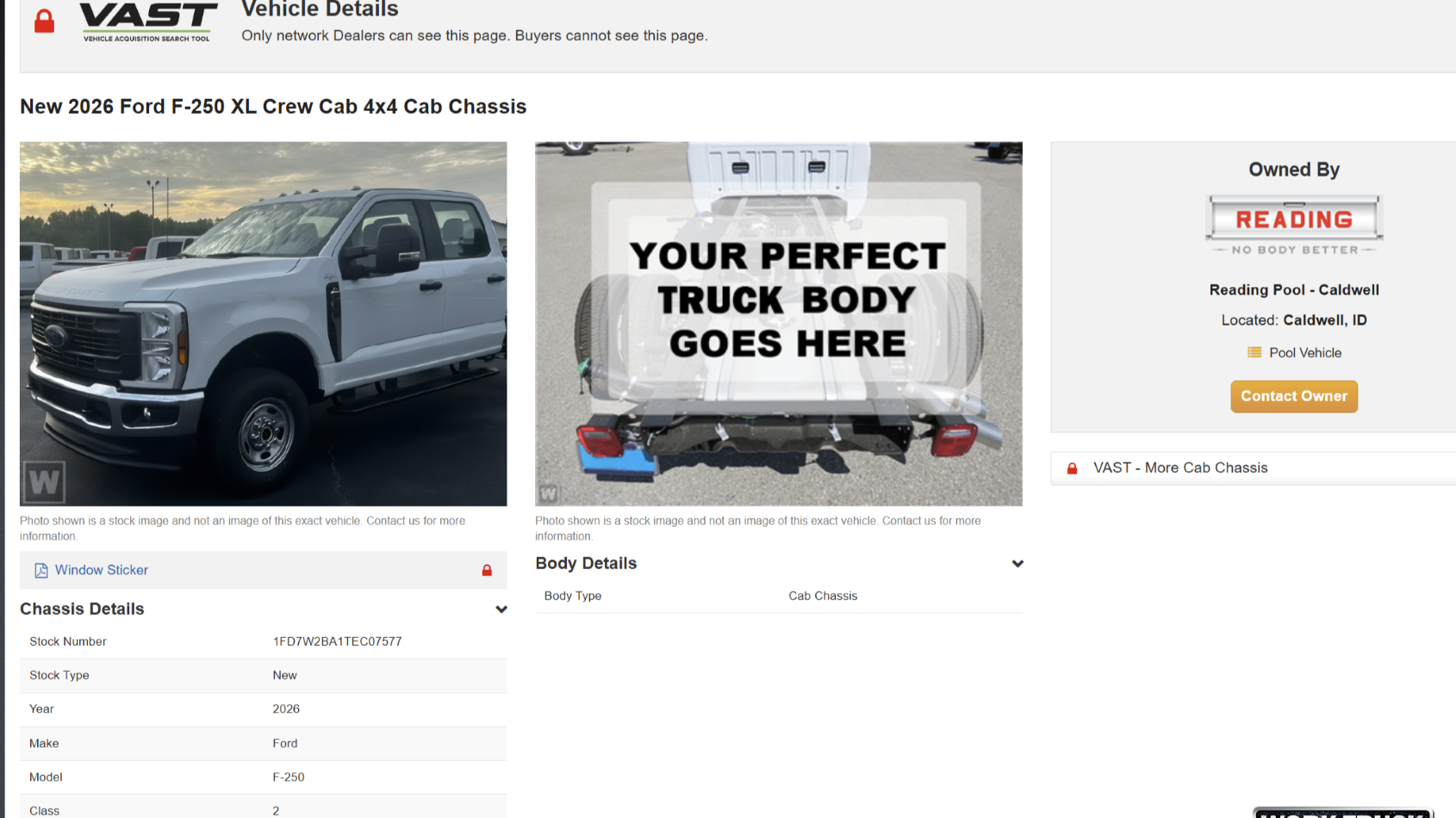

Work Truck Solutions has completed the first phase of a program aimed at making the commercial vehicle bailment pool process more efficient and transparent for the entire supply chain.

The commercial vehicle industry technology platform said its Bailment Pool Pilot involved a major OEM, three upfitters and a group of dealerships, with the goal of improving visibility, transparency and days-to-turn for commercial inventory.

“As a result of the pilot stage of the program, we’ve been able to identify key areas where we can enhance the commercial vehicle upfit and ordering process for our dealership partners, which will also provide value to both OEMs and upfitters,” Work Truck Solutions founder and chief vision officer Kathryn Schifferle said.

“By providing commercial vehicle dealers with better visibility of and access to pool inventory, we help reduce the overall days it takes to turn cab chassis and vans into the finished vehicle, which improves the overall customer experience.”

OEMs use bailment pools to provide upfitters with access to their inventory of chassis and vans by flooring them at the upfitters’ locations to be ready for modification. OEMs retain ownership of the vehicles and upfitters can pay flooring fees to have the inventory immediately available for upfit orders.

When a dealership places an order for a specific vehicle configuration, the OEM reassigns ownership of that vehicle to the dealership, which must sell the vehicle under a certain timeline or purchase the vehicle itself.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Historically, Work Truck Solutions said, transparency has been lacking regarding the availability, configuration and status of OEM bailment pool vehicles available from upfitters at any given time.

OEMs know what chassis has been assigned to which upfitters, but they don’t know what bodies or modifications will be or have been made to the chassis and have no way to track that information or the details of the final sale of the chassis.

Upfitters typically share inventory information with prospective dealership buyers through weekly spreadsheets, but that quickly becomes outdated as vehicles are reassigned to dealerships that ordered them from the pool.

And because dealerships don’t have an efficient way to search upfitter pool inventory or view the status of their orders, they can’t market the inventory until they have the finished vehicles on their lot.

Because of those issues, Work Truck Solutions said, a complete transaction, from an OEM assigning a chassis to an upfitter to the finished commercial vehicle being sold to an end buyer, can take up to 12 months.

The company said its pilot program addresses those problems by giving all parties access to current information about available pool inventory and orders in progress, built on the foundation of the Vehicle Acquisition Search Tool network, streamlining the overall vehicle ordering and completion process and reducing time from initial assignment to final sale.

By integrating and standardizing data feeds from upfitters, dealerships are able to order and display on-order vehicles on their websites, which allows customers to shop for and acquire vehicles still in production to speed the process.

In a Work Truck Solutions news release, Eric McNally, vice president of sales and business development for upfitter Reading Truck, said his company has “received excellent feedback from our dealer partners” about the pilot program, “with several successfully selling trucks that were still in our shops being upfitted.”

Schifferle said Work Truck Solutions plans to extend the program beyond the pilot group.

“The insights we gained confirmed the value in expanding the program, and we are now starting to bring these benefits to a wider network of upfitters and dealerships, along with their customers,” she said. “We have the green light from all three domestic commercial OEMs to work with their pool holders and have started the outreach with specifics on how to leverage this new technology for their benefit.”