ZeroSum sees used & CPO sales as treatment for new-car retailing ‘hangover’

Charts courtesy of ZeroSum.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Fourth of July gatherings might have created some hangovers for party goers who had a bit too much to drink. Experts at ZeroSum see dealerships enduring a “hangover,” as well.

And while there is a wide array of remedies to overcome alcohol hangovers, ZeroSum explained the dealerships’ used-car and certified pre-owned departments are the proper treatment, especially for stores that generated nearly three months of robust new-car sales due to tariff-related pull-ahead demand.

Dealers will need to focus more on used and CPO vehicles to find profits in July, according to ZeroSum’s State of the Dealer report released just before the holiday weekend.

“June proved to be a continuation of recent trends, with reduced inventories, elevated vehicle movement and turn rates, and higher pricing,” said Josh Stoll, vice president of dealer success at ZeroSum.

“But with half a million pull-ahead sales and tariffs a continuing reality, we are expecting the summer months to exhibit some ‘hangover’ effects that will make new vehicle sales more challenging going forward,” Stoll continued in a news release.

Like needing multiple rounds of headache medicine to make a hangover subside, ZeroSum sees dealerships’ CPO and used departments needing some care to put stores in position for a profitable July.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

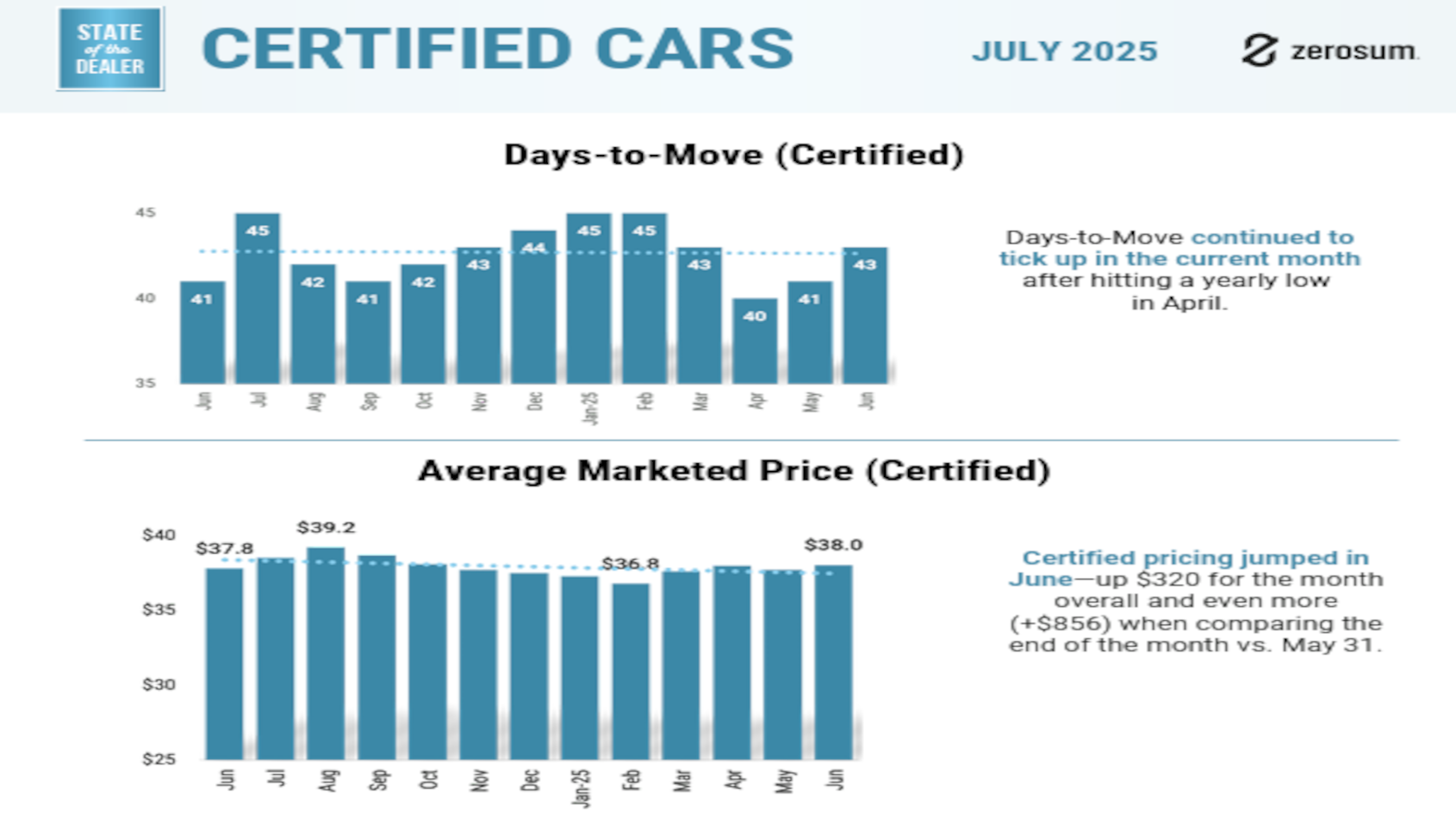

ZeroSum reported the average marketed price (AMP) for used vehicles was up from $26,258 in May to $26,681 in June — an increase of $423 month-over-month. Meanwhile, average certified vehicle prices jumped from $37,716 in May to $38,036 in June.

Experts explained price hikes appear to be reflective of increased demand for these vehicles as tariffs continue to roil the new-vehicle sector.

“Certified vehicles have had a strong run, but more recent results indicate that — like with new vehicles—more challenging times may be ahead,” ZeroSum said in the report that’s available online. “Growing supply and waning demand have translated into lower turn rates in the current period, so keeping real-time tabs on this sector will be important as the summer kicks off.

“It is noted that — similar to the used marketplace — pricing premiums are still moving forward for now, so managing supply and demand will be particularly crucial for this aspect of the business in order to maximize sales and profitability,” ZeroSum continued.

Looking solely at used cars, ZeroSum pointed out that turn rates have remained stable, hovering around 70% for the past three months.

Meanwhile, turn rates for certified units are off, according to ZeroSum tracking, falling to 69% in June after being as high as 86% in both March and last August.

The used vehicle sector is continuing to benefit from the turbulence in the new marketplace,” Stoll said in the report. “And with many of the OEMs rolling out of their pricing programs and new prices starting to go up, used vehicles will become an even more important safe haven for buyers going forward.

“Dealers should take a very close look at their inventory positions and pricing strategies compared to their competitors in order to maximize their sales and the profitability of these vehicles,” Stoll went on to say.