S&P Global analysis: Aftermarket to boom as America becomes a nation of old cars

Chart courtesy of S&P Global Mobility

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

With the average age of U.S. vehicles at a record-high 12.5 years — and older cars being driven more miles than traditionally expected — strong growth is anticipated for the aftermarket in repair and maintenance work, according to analysis by S&P Global Mobility.

While two years of short supply of new vehicles has driven consumers into the used-car market, the company said there could now be a counterintuitive shift: surging new-vehicle supply could further boost expansion of the used-vehicle fleet, bringing more high-mileage vehicles into service bays.

S&P said the repair business sweet spot has been 6- to 11-year-old vehicles, but as the nation’s vehicles get older, 12- and 13-year-old vehicles are becoming a bigger part of the business, even though they were originally sold during the slow sales years of the Great Recession.

Todd Campau, S&P’s associate director for aftermarket solutions, pointed out that growth in vehicle age is not uniform. While the share of 7-year-old vehicles in operation is expected to decline through 2028, vehicles more than eight years old will swell in number.

That age group is expected to grow by more than 25 million units by 2028, according to S&P Global Mobility projections.

“As vehicles with more electronic sophistication continue to age and increase in overall share, the aftermarket’s role in maintaining the aging vehicle fleet will become increasingly critical,” Campau said in a news release. “That’s where the real opportunity is in the aftermarket space.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

In addition, drivers of older, lower-priced, out-of-warranty vehicles are likely to drive more miles, the company said, because they are more likely to have jobs without a work-from-home option.

Vehicles from 6 to 13 years old — the new aftermarket sweet spot — will increase their share of annual miles traveled, outstripping both vehicles 5 and fewer years old and 14 years-plus, according to S&P Global Mobility projections.

A market in transition

For the past three years, pandemic-related supply-chain headaches have kept automotive production below demand.

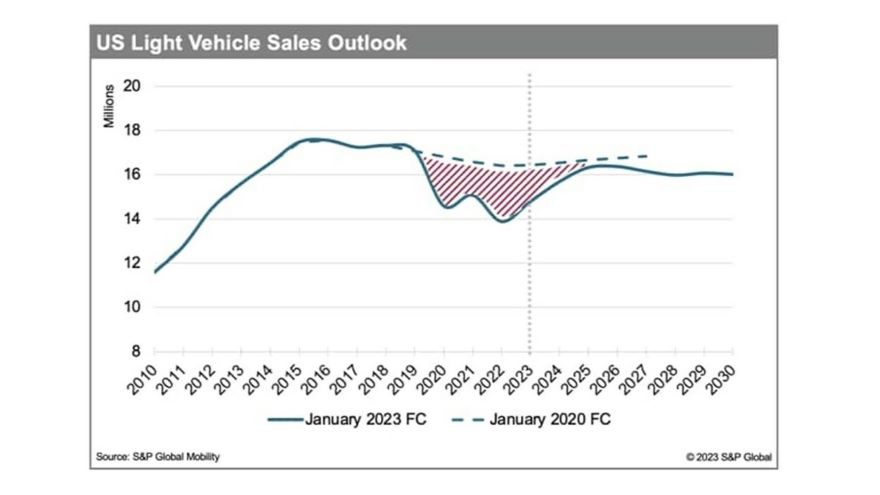

Light vehicle sales of 13.8 million in the U.S. in 2022 — the lowest in a decade — were a key factor boosting the average vehicle age to 12.5 years, S&P said.

The situation wasn’t entirely unwelcome for automakers and dealers. Automakers shifted their production mix to high-ticket, high-margin vehicles. At the same time, tight inventories meant dealers could sell new vehicles quickly to desperate shoppers willing to pay sticker prices — or higher.

Now that’s changing, Campau said. As expected, as the availability of components like semiconductor chips improved new vehicle sales are increasing, he said, slowing the rate of used vehicle growth.

S&P Global Mobility predicts 15.4 million new light vehicle sales in the U.S. this year, followed by 15.8 million in 2024 and 16.5 million in 2025, based on its July forecast.

But the consumer side of the equation remains a little shaky, despite some positive macroeconomic signs. S&P’s analysis said lingering inflation and high interest rates are expected to weaken the recovery of new vehicle demand just as inventory increases.

The market is transitioning from being supply-constrained to being demand-constrained, Campau said.

One key indicator: Demand for auto loans has slipped below third-quarter 2020 levels, according to analysis by S&P Global Mobility and TransUnion.

The question now, Campau said, is whether OEMs will start building more economy or mid-priced vehicles and trims to provide affordable options to middle- and lower-income families currently trapped in a used-vehicle spiral, or if automakers will stick with a mix that favors higher-margin vehicles.

“Will consumers continue to support that premium model?” Campau asked. “The question is: Who’s going to blink first?”

Of course, S&P said, automakers can always stimulate demand by the age-old method of piling on incentives.

Incentives are already increasing as new-vehicle inventories have risen this year, Campau said, though they are still at less than half of pre-pandemic levels. That said, price cuts by Tesla and Ford on their EV lines show inventory concerns are growing.

Used cars becoming harder to fix

All of that suggests that a growing used-vehicle fleet will continue to benefit the aftermarket business, S&P said. But while aftermarket repair shops should see more business coming in the door, they also face new challenges.

The vehicles in their service bays will be increasingly loaded with sensors for infotainment, communications and advanced driver assistance systems like adaptive cruise control, lane departure warning and collision avoidance.

Adaptive cruise, in particular, has been on a steady upward penetration trend since 2015. It’s projected to be in nearly 70 percent of model-year 2023 vehicles, according to S&P Global Mobility estimates.

“Sensors are where the next big opportunity is for the aftermarket,” Campau said.

Likewise, as 5G connectivity becomes dominant in new vehicles, a growing share of vehicles in operation will be capable of receiving over-the-air software updates. By 2028, S&P Global Mobility projects, more than a third of vehicles in operation will be connected, with more than 95 percent of those OTA-ready.

As used vehicles grow in technological sophistication, right-to-repair issues will come to the fore, S&P said, with automakers wrestling with wanting to maintain control over intellectual property while their service bays become more crowded.

“For consumers, the option to have the choice to maintain their vehicle in a timely fashion where convenient will be increasingly important,” Campau said.

“The volume of the vehicle fleet will make cooperation between OE aftersales service and aftermarket service shops a requirement to keep the nearly 300 million-vehicle population working as safely and efficiently as possible.”