J.D. Power continues to see wholesale trends favoring consignors versus dealers

Chart courtesy of J.D. Power Valuation Services

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

CARY, N.C. –

J.D. Power Valuation Services — the presenting sponsor of Pre-Owned Con at Used Car Week — offered its latest assessments of wholesale prices and volume through its latest installment of Guidelines.

For consignors with vehicles to send to auction, the trends continue to be favorable. For dealers needing inventory to keep their blacktops from looking too bare, the conditions continue to remain challenging.

In September, the J.D. Power Used Vehicle Price Index increased 11.2 points compared to August, with the wholesale price metric closing out the month 35% higher relative to the same nine-month period in 2020.

“The used market continues to exhibit great strength as dealers and shoppers lean on used vehicles to help fill the gap from ongoing industry supply chain challenges that are constricting new vehicle production and ultimately sales,” J.D. Power said in its analysis sent to Auto Remarketing.

“Back in late June and July, used prices cooled for seven consecutive weeks, which appeared to be the beginning of typical summer seasonal price declines as the market moves into the fall and the traditional new model year. However, prices gradually increased each week in August and September,” analysts continued.

“Used prices are expected to remain very strong for the foreseeable future, with fluctuations up and down as the new market continues to work towards recovery,” J.D. Power went on to say.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

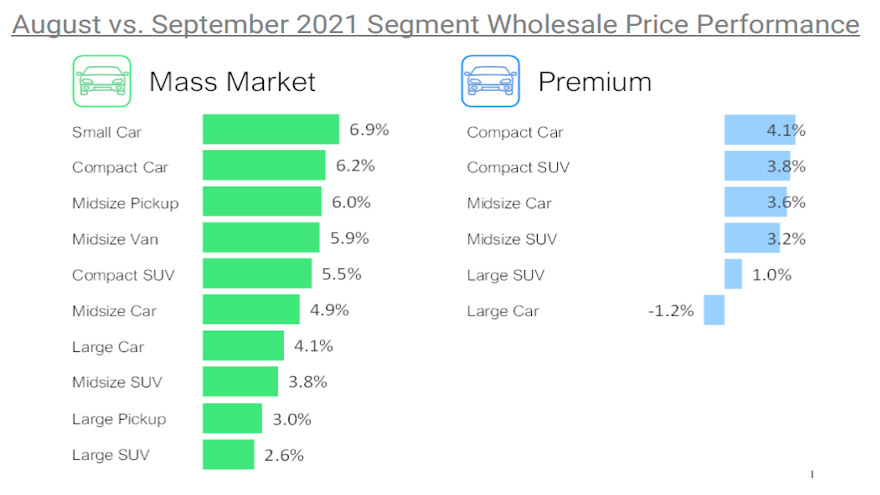

Looking closer at the price movements, J.D. Power indicated values for mass market small and compact car prices rose most in September increasing month-over-month by 6.9% and 6.2%, respectively. Analysts said prices for large pickups jumped another 3%, too, but the trend might be changing.

“Large pickup prices have been some of the strongest in the industry throughout the past year,” J.D. Power said. “However, they are softening due to inventory on the new side of the market improving and putting pressure on used prices.”

On the premium side of the market in September, J.D. Power indicated vehicle segment price movements were generally higher except for large premium cars, which softened by 1.2%.

“Premium prices are not often as strong as their mass market counterparts. Premium prices have been under more pressure because wholesale volumes haven’t been nearly as constrained,” J.D. Power said.

And speaking of volume, analysts pointed out that overall volume is 12% lower this year when compared with the first nine months of 2020.

The volume decline is even more significant when compared to pre-pandemic levels. This year’s volume is off by nearly 26% when viewed versus 2019, according to J.D. Power.

“Mass market sales are certainly more constrained, currently 14% lower than a year ago, which is being amplified by massive reductions in passenger car wholesale volume,” analysts said.

“Premium wholesale sales are faring better, as sales for this sector have grown an average of 1% when compared with the same period a year ago,” analysts continued. “This is a major contributing factor as to why premium prices aren’t up quite as much as mass market.”