Kontos on latest potential dealer predicament involving high wholesale prices

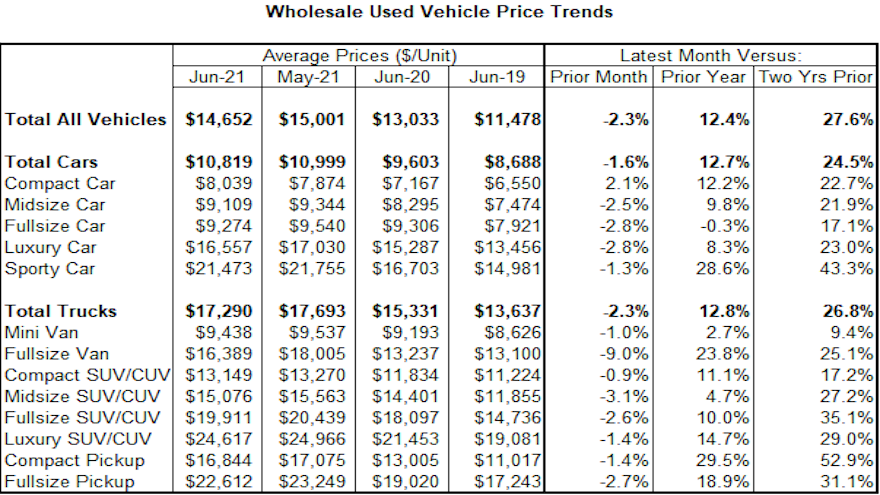

Chart courtesy of KAR Global.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

CARMEL, Ind. –

Just like dealers might be walking away from the lanes because prices are too high, Tom Kontos has a theory that potential buyers might be doing the same thing on dealership lots for similar reasons.

The KAR Global chief economist shared his theory in the newest Kontos Kommentary after examining the latest company data and other information sources connected to used vehicles.

According to KAR Global Analytical Services’ monthly analysis of wholesale used-vehicle prices by vehicle model class, wholesale prices in June averaged $14,652 — down 2.3% compared to May, but still 12.4% higher year-over-year.

Kontos added that the June reading also was 27.6% higher compared to the same month in 2019 to give a glimpse of pre-COVID trends.

“Average wholesale used vehicle prices fell modestly to below $15,000 in June after reaching that threshold for the first time in May, and this moderation continued into July,” he said in the newest Kontos Kommentary that also includes a video component.

“Lower conversion rates (vehicles sold as a percentage of vehicles offered) are a further indication that dealers may be pushing back on high wholesale used-vehicle prices,” Kontos continued. “High used vehicle prices have made national news lately, as the consumer price index rose by a nearly 13-year high of 5.4% annually in large part due to a 45.2% annual jump in the used-vehicle CPI.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Dealer pushback may therefore reflect consumer reluctance to buy used vehicles with prices so inflated, in turn causing dealers to avoid being stuck with high-priced inventory,” he went on to say.

Kontos also touched on the most coveted of wholesale volume; units that often are ripe to be retailed as certified pre-owned units.

When holding constant for sale type, model-year age, mileage and model class segment — using criteria that characterize off-lease units — Kontos indicated prices in June were up by over 40% versus June 2020 and June 2019 for both midsize cars and midsize SUV/CUVs.

Prices for those particular cars came in at $18,698 last month, while prices for those specific SUV/CUVs rose to $29,962.