Lane watch: Analysts take closer look at late models

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

After sharing top-line metrics from last week — wholesale values falling another 0.49%, auction conversion rates ticking up to 56%, and the estimated used retail days to turn staying at roughly 36 days — Black Book got into a discussion about 2023, 2024 and 2025 models.

Black Book began this portion of Market Insights by saying, “2025 model-year vehicles faced the most pricing pressure, particularly among non-core trims, while 2023–2024 units held closer to guide values. Luxury and full-size SUVs recorded the steepest depreciation, contrasting with mainstream sedans and compact crossovers, which continued to show resilience.

“Overall, wholesale prices trended lower for the week, but the uptick in conversion rates suggests early signs of stabilization as the market adjusts to seasonal patterns and measured buyer activity,” analysts continued in the report released on Tuesday.

Delving deeper into last week’s data, Black Book continued to see prices for the oldest units at auction drop by notable amounts. Values for cars between 8 and 16 years old decreased by 0.52%. Prices for trucks in the same age range softened by 0.47%.

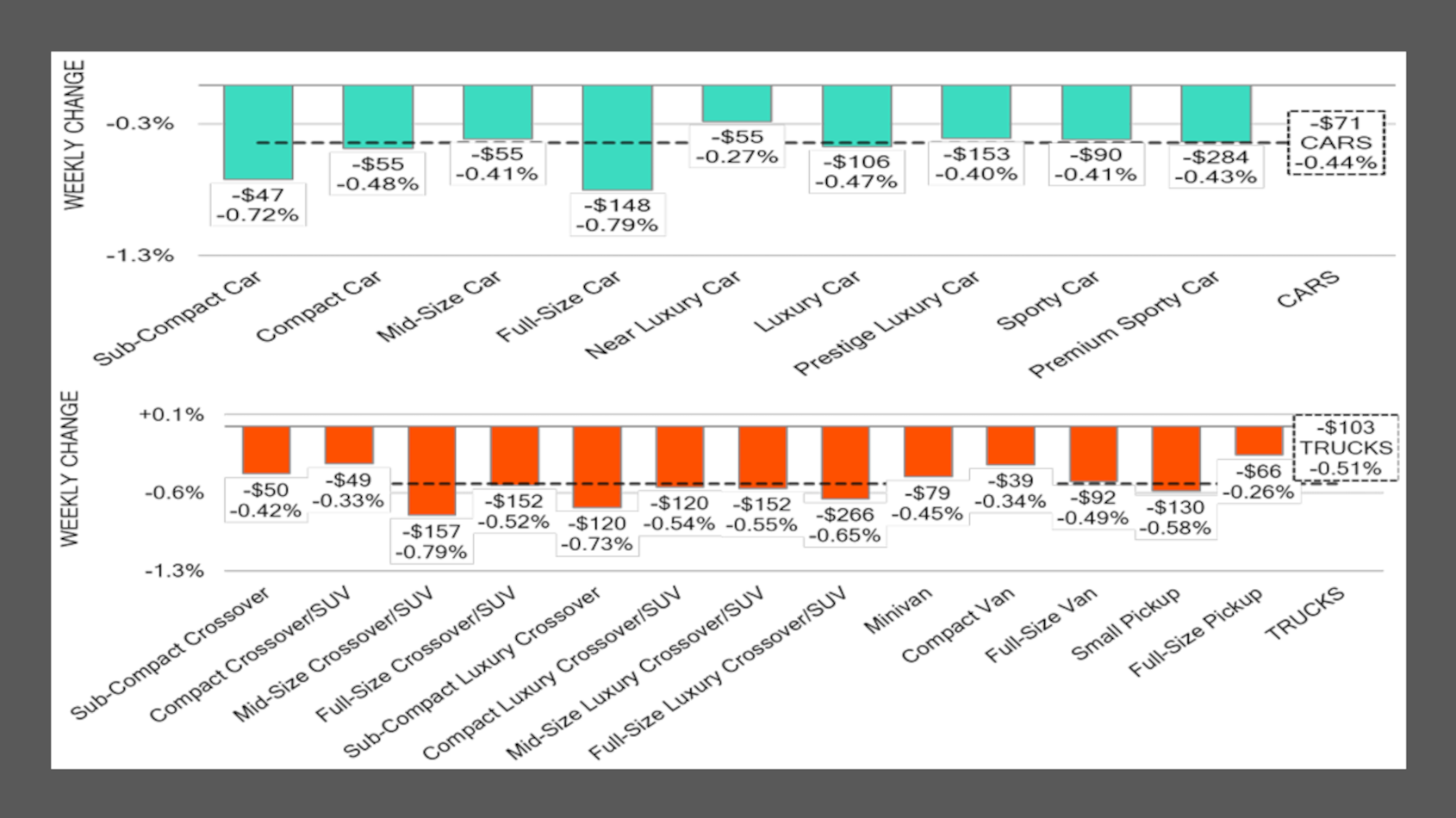

Perhaps reflecting the cooler weather of fall, Black Book saw prices for premium sporty cars decline by 0.43%.

Values for full-size cars and subcompact cars tumbled even more, dropping by 0.79% and 0.72%, respectively,

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

In fact, Black Book said prices for subcompact cars now have decreased for 23 weeks in a row, averaging a weekly drop of 0.68%. And the decrease for full-size cars caught analysts’ attention since values for those units increased by 0.22% during the previous week.

In the truck world, it’s small pickups that are sustaining significant depreciation.

Black Book said prices for small pickups less than 2 years old dropped by 0.76%, which is the largest single-week decline since December 2024.

And values of older small pickups are softening, too, with units between 8 and 16 years old dropping by 0.74% and 0.67% during the past two weeks.

“Historically, the fourth quarter represents the period of greatest market depreciation, and current trends suggest a return to this seasonal norm,” Black Book said. “Depreciation levels last week were consistent with the prior week and aligned with pre-pandemic patterns for this time of year.

“Additionally, sales rates showed modest improvement; however, purchasing activity remains measured, with buyers exhibiting continued selectivity,” analysts continued.

“As always, our team of analysts are focused on keeping their eyes on the market for developing trends and gathering insight,” Black Book went on to say.