Lane watch: Buyers & sellers finding more common ground

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The practice is as old as commerce itself; the process of buyers and sellers meeting on the price of that good or service.

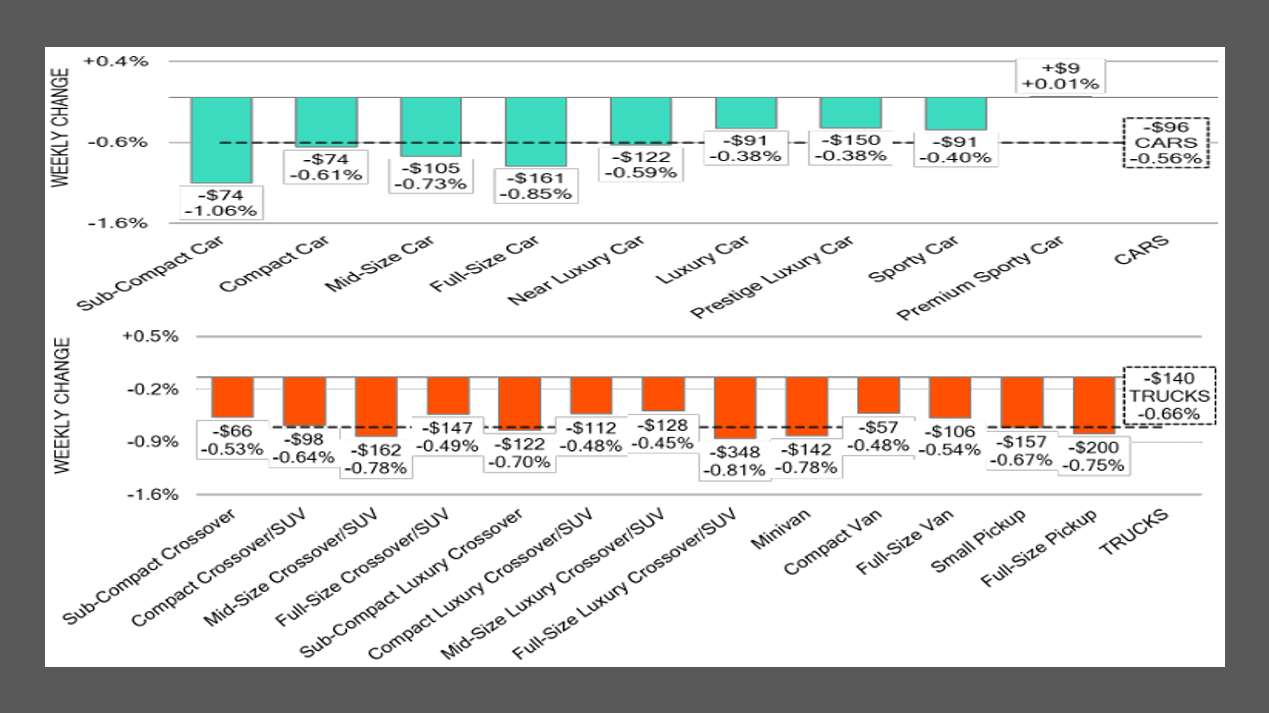

Well, it seems that practice was prevalent at the auctions last week, based on the latest observations from Black Book, which said wholesale values softened by 0.63%. That’s a rate more than double the previous week (which included Fourth of July) and the average spotted during the same weeks in 2017-2019.

“Depreciation picked up speed last week following the July 4th holiday, though activity at auctions remained strong,” Black Book said in its latest installment of Market Insights released on Tuesday.

“Nationwide conversion rates are holding steady in the high 50% range, as sellers set realistic floor prices, allowing engaged bidders to secure competitively priced inventory,” analysts continued in the report. “Notably, newer used full-size pickups warrant attention, as incentives on new models are impacting 0 to 2-year-old units in the market.”

Black Book reported prices for those full-size pickups less than 2 years old decreased by 0.96%, marking the largest single-week drop since November 2023. Analysts added units between 2 and 8 years old experienced their steepest decline since December.

A couple of other specific vehicle segments sustained significant depreciation last week, according to Black Book tracking.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

They included subcompact cars between 2 and 8 years old (down 1.06%) and minivans less than 2 years old (down 0.84%). For those big family haulers, the move marked the largest price drop since late December.

Analysts went on to mention two overall trends. Black Book indicated that last week’s auction conversion rate was 58%.

And Black Book said its estimated used retail days to turn is now at roughly 40 days.

Black Book closed with observations that reinforced by the National Auto Auction Association data tabulated for June.

“As declining prices continue to shape the market, we are witnessing a noticeable reduction in total auction volumes nationwide,” analysts said. “Over the past three weeks, the number of vehicles appearing at auctions has steadily declined.

“Despite the drop in auction volumes, auction conversion rates have remained robust, demonstrating sustained buyer activity and competitive demand for the reduced supply available,” Black Book continued.

“As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight,” Black Book went on to say.