Lane watch: No sign of summertime slowdown at the auctions

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Except for sales spikes when some operations host concerts and other special activities, the auction scene sometimes sags during this juncture of the summer.

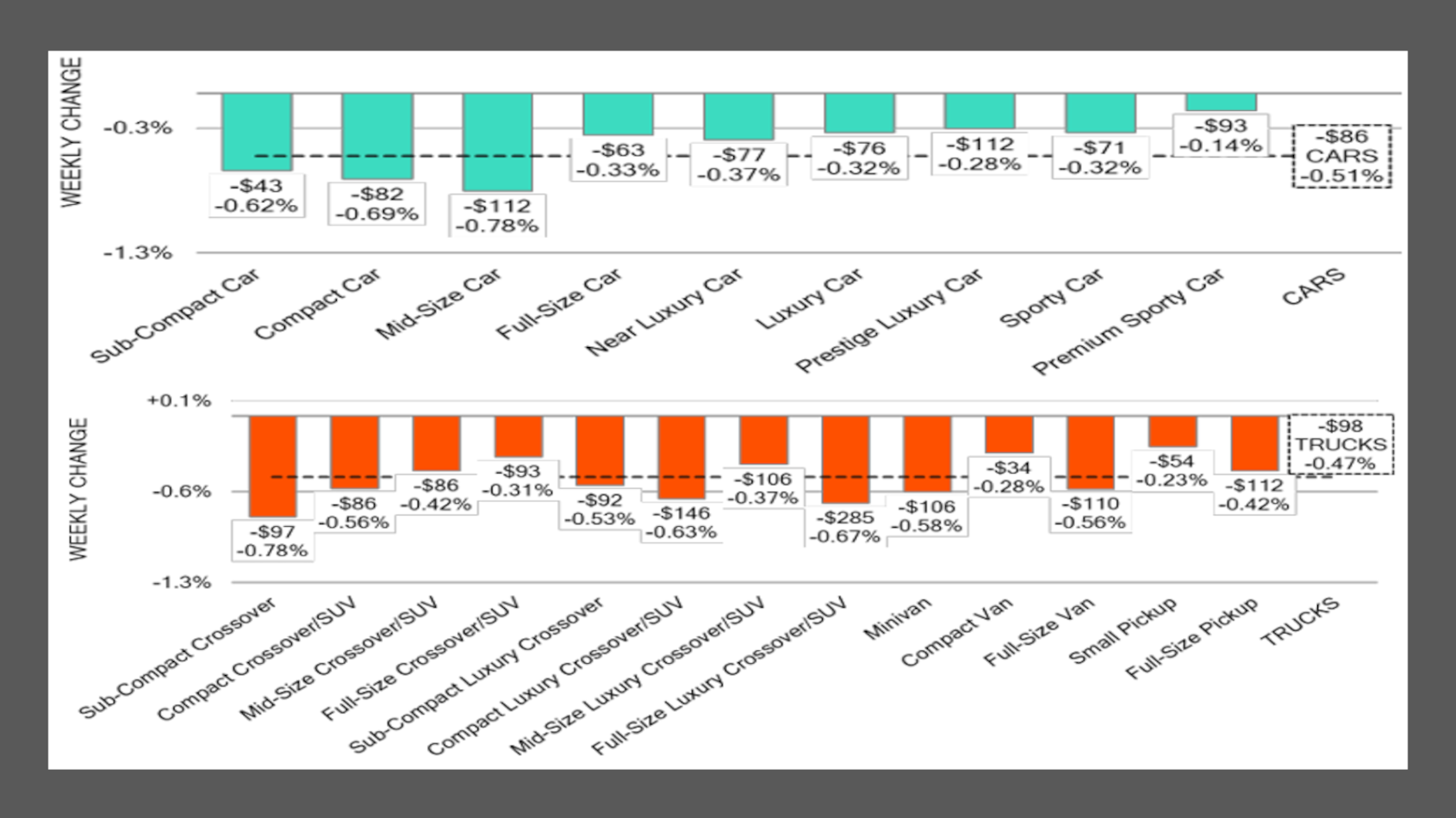

But that’s not the case this year, according to Black Book’s newest installment of Market Insights, which indicated that wholesale values dropped by 0.48% last week.

“We are now in mid-July, a time typically characterized by a summertime slowdown,” Black Book said in the report. “However, this year the trend is breaking, with auction conversion rates and weekly car sales continuing to climb. Such elevated sales activity is highly unusual for this season, highlighting a significant deviation from traditional seasonal patterns.”

Black Book reported last week’s auction conversion rate came in at 59%. The metric has been below 50% since the holiday season, according to Black Book tracking.

Analysts offered another view of how the wholesale market is behaving differently.

“Depreciation continues to outpace typical seasonal trends; however, the market remains significantly stronger than it was in 2024.” Black Book said. “At this time last year, cumulative 12-month depreciation stood at 23.6%, compared to just 9.6% this year.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Meanwhile, Black Book indicated its estimated used retail days to turn is now at roughly 40 days.

Which vehicles might dealers be sending to auction triggering a price drop?

Well, analysts noticed midsize cars sustained the highest depreciation last week, with values dropping by 0.78%. Black Book noted that depreciation for these units continues to accelerate, with a four-week average decline of 0.61% per week.

Black Book mentioned that prices for subcompact crossovers/SUVs also fell by 0.78%. Values for these vehicles now have decreased for nine consecutive weeks, with an average weekly decline of 0.58%, according to Black Book tracking.

All told, each of the 22 vehicle segments that Black Book watches weekly suffered a value drop last week.

“As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight,” Black Book said.