Lane watch: ‘Orderly’ conditions seen as seasonal depreciation intensifies

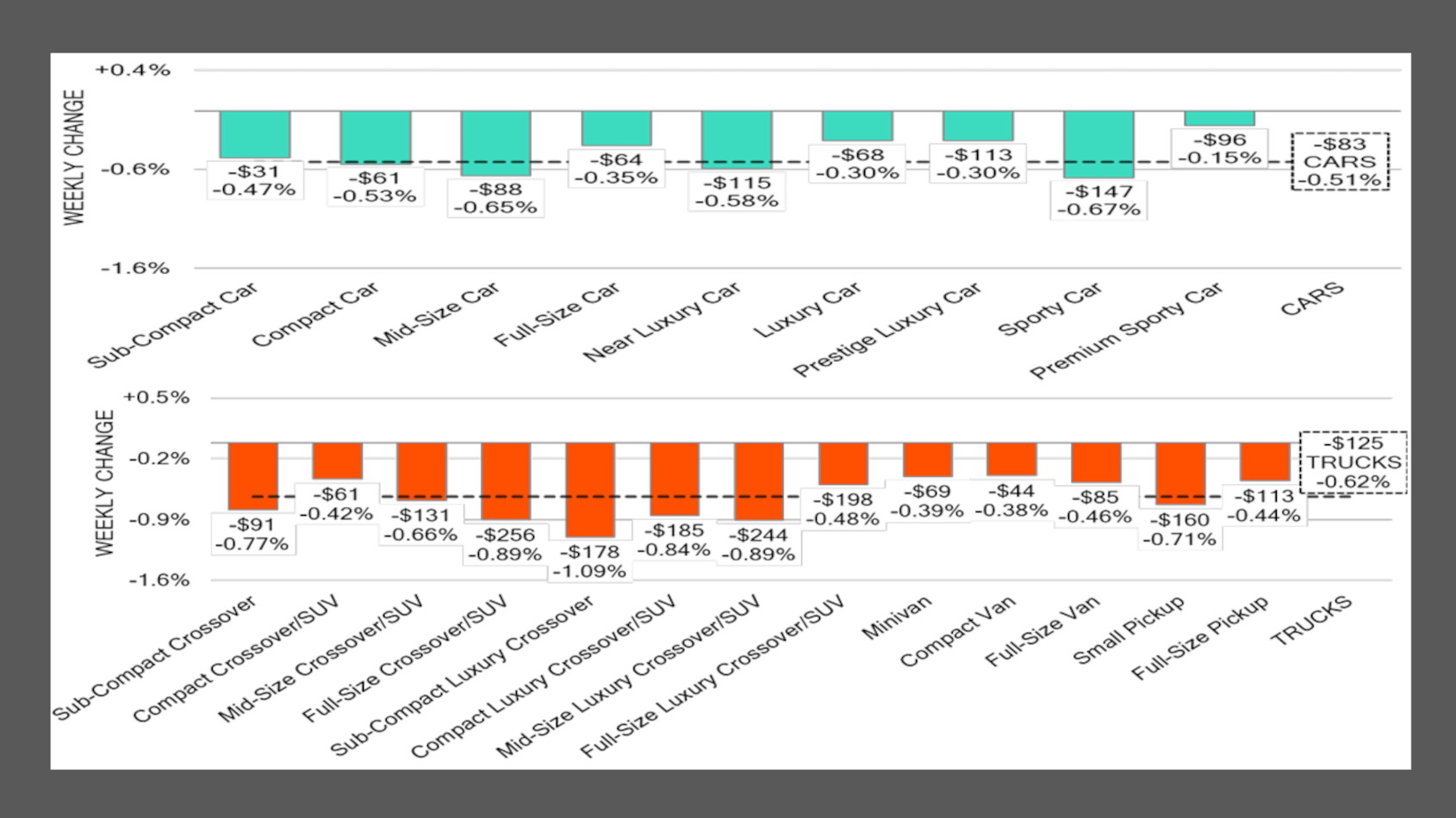

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Perhaps there’s a certain amount of chaos at your dealership or finance company, especially if vehicles aren’t turning or contract holders aren’t paying.

But at least based on Black Book’s newest observations, the wholesale market is relatively “orderly,” as overall prices softened a bit more than seasonal trends, but conversion rates stayed steady.

Black Book reported wholesale values decreased by 0.59% last week, which was 10 basis points higher than a week earlier, “reflecting a steeper pace of seasonal depreciation as fall market softness deepened.”

Analysts continued in their newest installment of Market Insights that the auction conversion held steady at 56%, “indicating steady but selective dealer participation.

“Clean, low-mileage units continued to command strong bids, while EVs and older SUVs lagged, trading below book values,” Black Book continued in the report. “Overall, market conditions remained orderly, with pricing trends aligned to seasonal expectations as the industry moves deeper into Q4.

“Conversion rates held unevenly across the lanes, with strong results for clean, late-model units offset by selective bidding and lower returns on aging and higher-mileage inventory,” analysts added. “Demand for traditional gas vehicles remained steady, while EV pricing and 2025-model values continued to face downward pressure amid heightened buyer caution.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Black Book’s latest report mentioned multiple price decreases of at least 0.60% in specific segments, including:

—Cars between 8 and 16 years old: Down 0.61%

—Sporty cars between 2 and 8 years old: Down 0.67%

—Trucks less than 2 years old: Down 0.61%

—Midsize luxury crossovers/SUVs less than 2 years old: Down 0.82%

—Midsize luxury crossovers/SUVs between 2 and 8 years old: Down 0.89%

“Luxury crossovers and mid-size SUVs posted the largest declines amid ongoing supply pressure,” Black Book said after analysts spotted depreciation for all 22 individual vehicle segments they track weekly.

With more than half of the month already passed, Black Book reiterated that, “As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight.”