Lane watch: Price inflexion point could be on horizon

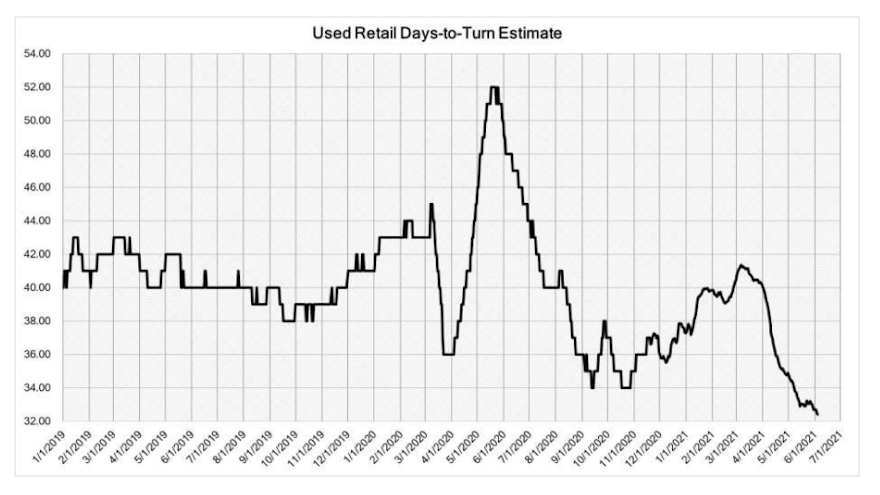

Chart courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

LAWRENCEVILLE, Ga. –

Last weekend might have marked more than just Americans commemorating Memorial Day. Black Book now is watching closely for a potential pivot in the wholesale market.

Analysts explained their reasonings in their latest installment of Market Insights released on Tuesday.

“Wholesale values have continued to rise for 19 consecutive weeks, although that rate of gains slowed for some segments and about 9% of vehicles had a downward change in wholesale prices,” Black Book said in the report.

“With that said, the market remains strong following the holiday weekend and we expect next week will be a good indicator of whether the market is softening, riding a plateau, or returning to the climb,” analysts added.

Those wholesale observations prompted Black Book to make a couple of comments about the retail side of the business, too.

First, Black Book estimated that days to turn for used vehicles now is approaching 32 days, the lowest reading in its data set that goes back to the beginning of 2019. That latest estimate is down from approximately 42 days in March and 52 days recorded last May.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Then, analysts added this point about the retail scene.

“Current used retail listing volume is about 13% below the start of the year,” Black Book said. “While inventory levels have been slowly but consistently increasing over the last six weeks, they seem to be evening out as we head into the summer months.”

And now with the unofficial start of summer already in the books, let’s take a closer look at Black Book’s latest wholesale price information.

Like the overall trend, analysts indicated car prices rose for the 19th week in a row, climbing by 0.8%. However — and again perhaps what’s intriguing Black Book — analysts pointed out that value increase for cars is the smallest they’ve seen in 15 weeks.

Prices for compact cars paced the segment increases, jumping another 1.25%. The increase marked 12 consecutive weeks that units typically sought by budget buyers gained the most in value.

Meanwhile, overall truck values surged more than 1.0% again as prices for these units increased 1.02% this past week. Prices in six truck segments rose more than the overall reading, as well.

But how about this? Analysts said values in one truck segment actually declined last week. Values for sub-compact luxury crossovers softened by 0.16%.

However, values in the compact crossover/SUV segment also are on a streak of 19 straight weeks of increasing. Last week, the segment led the truck division with a price jump of 1.59%.