Lane watch: Price softening intensifies as November arrives

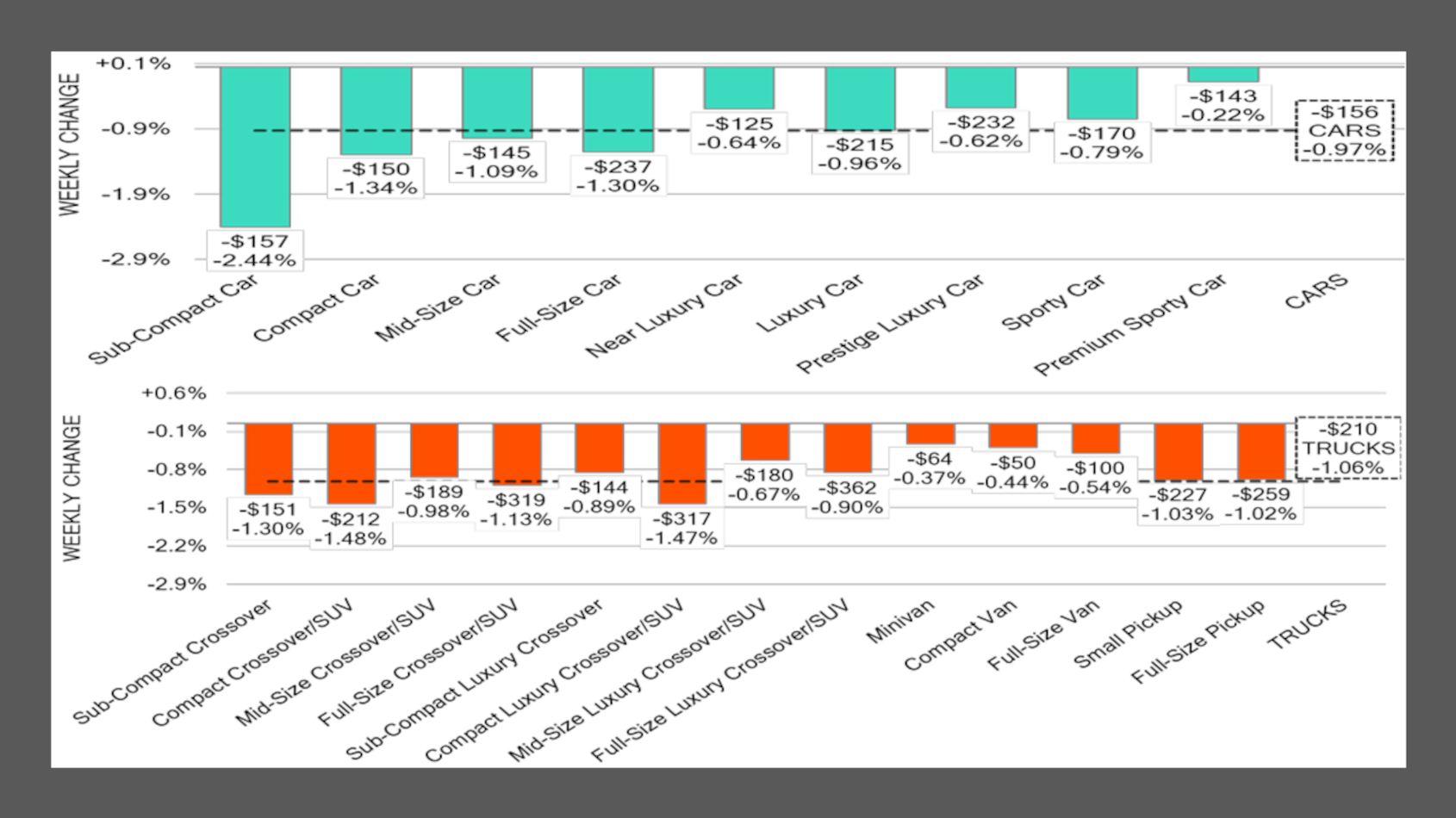

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The wholesale market turned the calendar to November on Saturday, and wholesale values are cooling similarly to the deep autumn temperatures.

Black Book reported that overall wholesale prices decreased by 1.04% last week, with vehicles less than 2 years old dropping slightly more, sliding by 1.07%.

The newest installment of Market Insights also mentioned last week’s auction conversion rate held steady at 58%. And Black Book estimated the used retail days to turn is now at roughly 37 days.

The overall metrics didn’t necessarily surprise analysts.

“Inventory remained stable, while attendance improved, though buyers stayed highly selective and price sensitive,” Black Book said in the report, while noting, “2023–2024 models led volume, while 2025 entries continued to show downward pricing momentum.

“Compact and subcompact segments saw the largest declines, pressured by elevated supply levels,” analysts continued. “Luxury and sporty models remained comparatively stable, posting only minor week-over-week shifts. Overall, the market reflected seasonal softening, with buyer discipline and pricing caution shaping activity.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Black Book indicated values for compact crossovers less than 2 years old plummeted by 1.67%, “marking its largest single-week decline on record — surpassing even the sharp drops seen at the onset of the pandemic.”

Prices for those specific units between 2 and 8 years old also dropped significantly, too, declining by 1.48%.

Analysts said prices for compact cars less than 2 years old dropped by an even swifter pace, sliding by 1.87% last week after decreasing by 1.62% a week earlier.

Values for compact cars between 2 and 8 years old decreased by 1.34% a week ago after dropping 1.28% during the previous week, according to Black Book tracking.

All 22 vehicle segments watched by Black Book posted value decreases last week, with subcompact cars sustaining the largest percentage decline (down 2.44%) and compact luxury crossovers/SUVs enduring the largest dollar drop (down $317).

Perhaps what might happen next in the wholesale market could be influenced by dealers expanding inventory for tax season or the steady flow of repossessions.

“As always, our team of analysts are focused on keeping their eyes on the market for developing trends and gathering insights,” Black Book said.