Lane watch: Recapping 2024 spring market

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Black Book’s Used Vehicle Retention Index for April and its latest weekly look at wholesale value movements summarized the likely conclusion of this year’s spring market.

Beginning with the index, Black Book said its seasonally adjusted index decreased 1.1% (1.8 points) to 150.0 from the March reading of 151.8. Examining year-over-year, Black Book said the index landed 14.5% below last April.

However, the index still came in 31% above the March 2020 reading — the last pre-pandemic month.

Analysts reiterated the Black Book Used Vehicle Retention Index is calculated using Black Book’s published wholesale average value on 2- to 6-year-old used vehicles, as percent of original typically equipped MSRP. It is weighted based on registration volume and adjusted for seasonality, vehicle age, mileage and condition.

“Although wholesale prices increased across almost all segments and age buckets in April, seasonally adjusted retention index declined slightly last month, indicating that price gains were weaker than during a ‘typical’ spring market,” Black Book chief data science officer Alex Yurchenko said in a news release.

“The wholesale market picked up more steam in April with both improved sales rate and sold volume. In addition, vehicles were moving much faster off dealers’ lots (as measured by days-to-turn) as average listing price declined last month,” Yurchenko continued.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

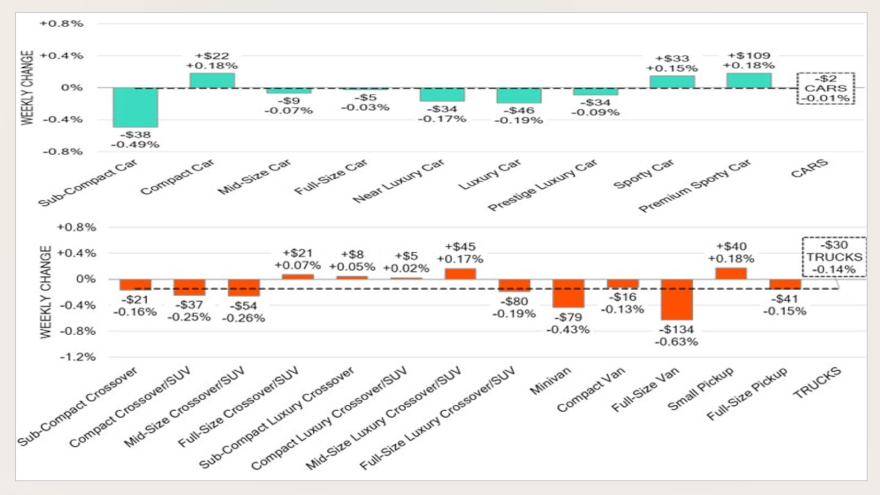

Moving on to the week that finished just ahead of Mother’s Day, Black Book watched overall wholesale values dip 0.11%, just 2 basis points more than a week earlier and 9 basis points less than what analysts recorded on average during the same week in 2017 through 2019.

Black Book delved deeper into last week’s value movements while noting the average auction sales rate remained stable at 57%.

“Another week of stability indicates moderate activity in the wholesale market with an overall lack of notable price changes,” analysts said in the newest installment of Market Insights released on Tuesday. “The consistent pricing across both car and truck categories suggests a period of equilibrium. However, the subcompact car and full-size van segments did not follow this broader trend and instead faced the most significant price declines within their respective categories.

“The reduction in auction inventory this week at some of the larger auctions may indicate a slight shift in the market dynamics,” Black Book continued in its report. “This decrease could be due to a variety of factors such as seasonal changes, which can affect the number and types of vehicles being sold; shifts in supply and demand, dealer inventory strategies, or broader economic conditions.”

As mentioned, subcompact cars and full-size vans sustained the most significant price drops last week, according to Black Book tracking.

Analysts noticed values for subcompact cars softened by 0.49% last week. That drop came after a decrease of 0.58% a week earlier.

Meanwhile, Black Book determined prices for full-size vans slid another 0.63%. A week earlier, analysts pegged the price drop for these workhorses at 0.90%.

Analysts added that values for full-size vans have declined 1% on average during the past seven weeks.

Black Book also mentioned depreciation for minivans has accelerated, with the segment experiencing a 0.43% drop last week, marking its steepest weekly decline since the final week of January.

Going counter to the overall trends of the spring-market winddown is the sporty car segment. Perhaps with an eye toward summer, Black Book said prices for sporty cars rose another 0.15% last week. Analysts said values for those fun-time rides have increased for seven weeks in a row, with an average weekly rise of 0.33%.

Presumably with the spring market in the rearview mirror, Black Book reiterated, “as always, our team of analyst are focused on the keeping their eyes on the market for developing trends and gathering insight.”