Lane watch: Scene getting back to normal as May finishes

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Perhaps the tariff turmoil has worked itself out of the wholesale market, at least for now.

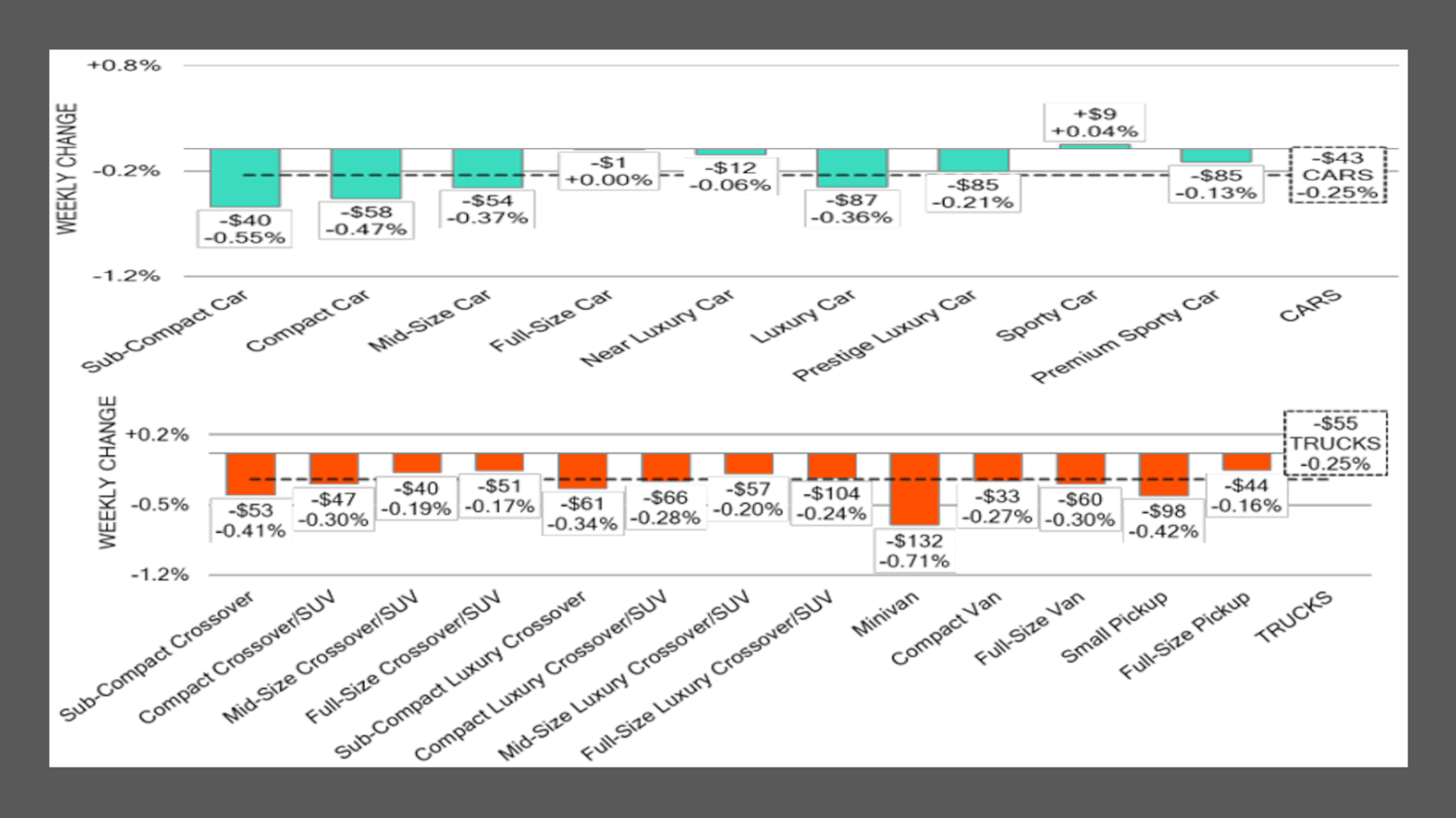

Black Book said overall wholesale prices dropping by 0.25% last week “marked a significant milestone as depreciation returned to a level typical for this time of year.”

Analysts pointed out in the newest installment of Market Insights that the pre-pandemic seasonal average amount of depreciation was 0.22%.

Black Book then touched on the two other overall metrics analysts highlight each week, mentioning the estimated used retail days to turn remained stable at roughly 34 days. Analysts elaborated about why last week’s auction conversion rate came in at 57%.

“Last week, we concluded the month of May,” Black Book said in the report. “Early in the month, wholesale prices for both the car and truck segments experienced an uptick. However, as the month progressed, these prices began to gradually decline.

“The final week of May saw a more pronounced downward trend, with the sub-compact car segment recording the largest drop at 0.55% and the minivan segment down by 0.71%,” analysts continued. “The Memorial Day holiday likely played a role in the slower auction conversions observed last week, particularly as some auctions were affected due to the holiday falling on Monday.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Looking deeper into last week’s data, Black Book said eight of nine car segments registered a value decrease, with sporty cars remaining the sole market segment showing consistent rises across all age groups.

Analysts indicated prices for sporty cars less than 2 years old ticked up 0.08%, while prices for units between 2 and 8 years old edged 0.04% higher. And values for sporty cars between 8 and 16 years old moved up by 0.13% last week.

After 12 consecutive weeks of increases, Black Book noted that prices for full-size cars softened for the first time since late February. And values for the oldest full-size cars at auction now have decreased for six weeks in a row, according to Black Book tracking.

Meanwhile, analysts determined prices for all 13 truck segments dropped last week, paced by minivans, which slid by 0.71%. This move marked the largest single-week decline for minivans since early January.

Black Book noted that minivans had been on a price surge, increasing for 10 straight weeks with the value rise averaging a weekly gain of 0.44%.

Also reversing their value trajectory in Black Book’s data were full-size pickups, which ticked down by 0.16% last week, stopping a string of 13 consecutive weeks of upward price movements.

With June including both Canada’s Used Car Week in Toronto and the annual convention and expo hosted by the National Independent Automobile Dealers Association in Las Vegas, Black Book reiterated, “as always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight.”