Lane watch: Selective buying surfaces as retail scene stays strong

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Black Book said on Tuesday its estimated used retail days to turn is now at roughly 36 days.

Perhaps, as a result, Black Book saw buyers being “more selective” in the lanes last week, as auction conversion rates have eased since Labor Day, but remain above 60%.

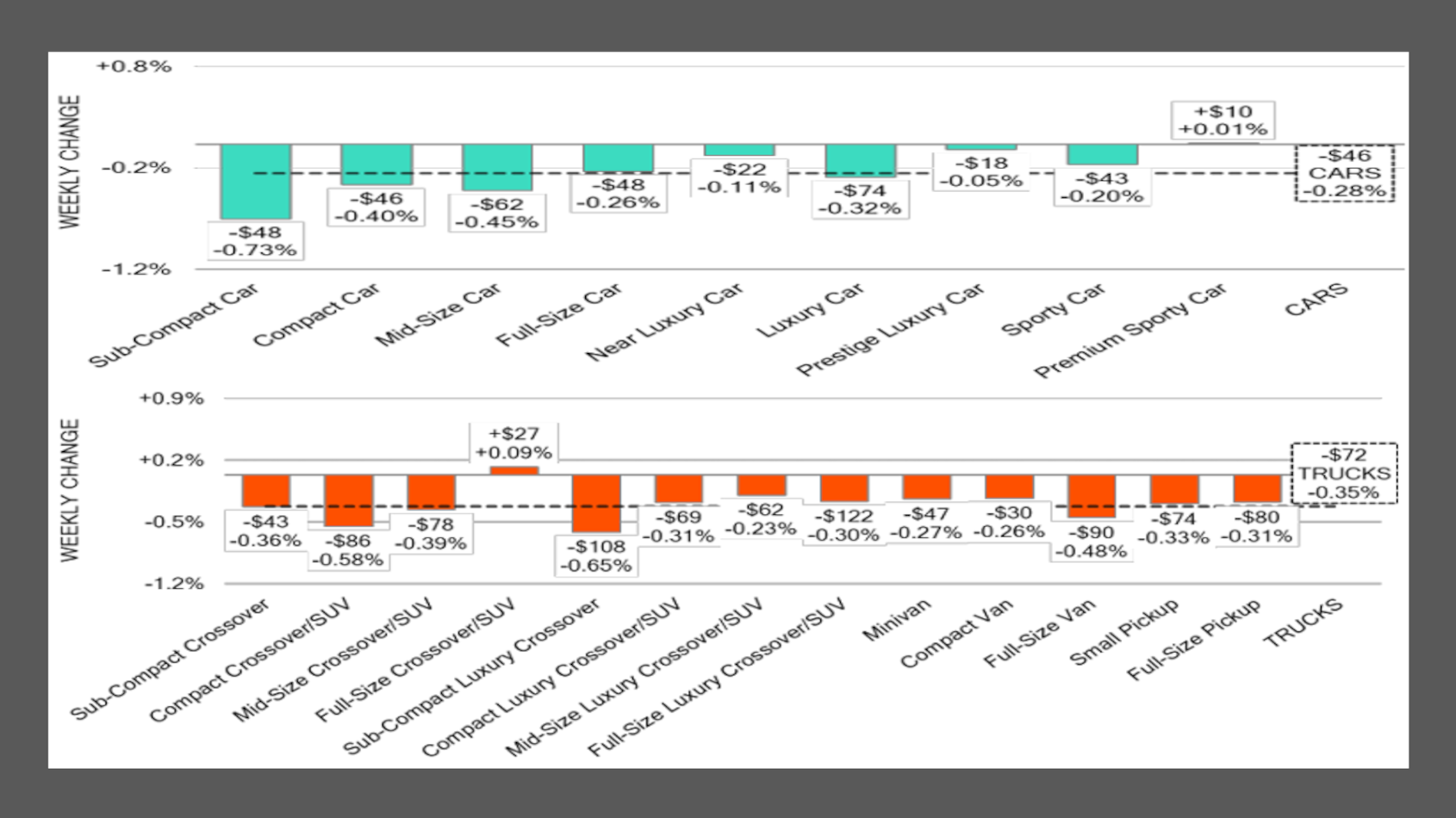

Overall, Black Book reported in its latest installment of Market Insights that wholesale prices softened by 0.33%, with cars dipping by 0.28% and trucks/SUVs falling by 0.34%.

“Auction performance moderated last week, with conversion rates varying widely between lanes,” analysts said in the report. “Buyer activity was steady but more selective, as values adjusted downward across most segments.

“Retail demand for premium vehicles remained firm, with sporty and high-end models showing stronger results, even as EV pricing continued to display mixed trends,” Black Book continued. “Repo volume added supply in several markets, contributing to softer outcomes for older units.

“Overall, buyer caution persisted, with strength concentrated in higher-demand segments and depreciation evident elsewhere,” Black Book went on to say.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Turning to some individual segments, Black Book highlighted a few that caught its attention from last week’s auction activity.

Prices for compact cars went from a gain 0.24% to a decline of 0.40% last week, “marking a sharp shift after briefly breaking their extended losing streak,” according to Black Book.

Depreciation for subcompact cars accelerated with values falling another 0.73% last week, “keeping them among the most consistently depreciating car segments,” analysts said.

And as analysts referenced, prices for cars 8 to 16 years old decreased by 0.33% and prices for trucks in the same age range dropped by 0.31%.

Black Book noticed prices for compact crossovers continued to weaken, as prices for those vehicles dropped by 0.58%. The decrease extended a depreciation trend that has averaged nearly 0.30% per week over the last month, according to Black Book tracking.

Analysts pointed out sub-compact luxury crossovers sustained the steepest value decline among SUVs, decreasing by 0.65%, “underscoring renewed pressure in entry-level luxury utilities.”

Altogether, Black Book said eight of the nine car segments and 12 of the 13 truck segments posted a decrease in value last week.

Might dealers continue to be “more selective” as the official arrival of fall comes next week?

“As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight,” Black Book said.