Lane watch: Signals of spring market already appearing

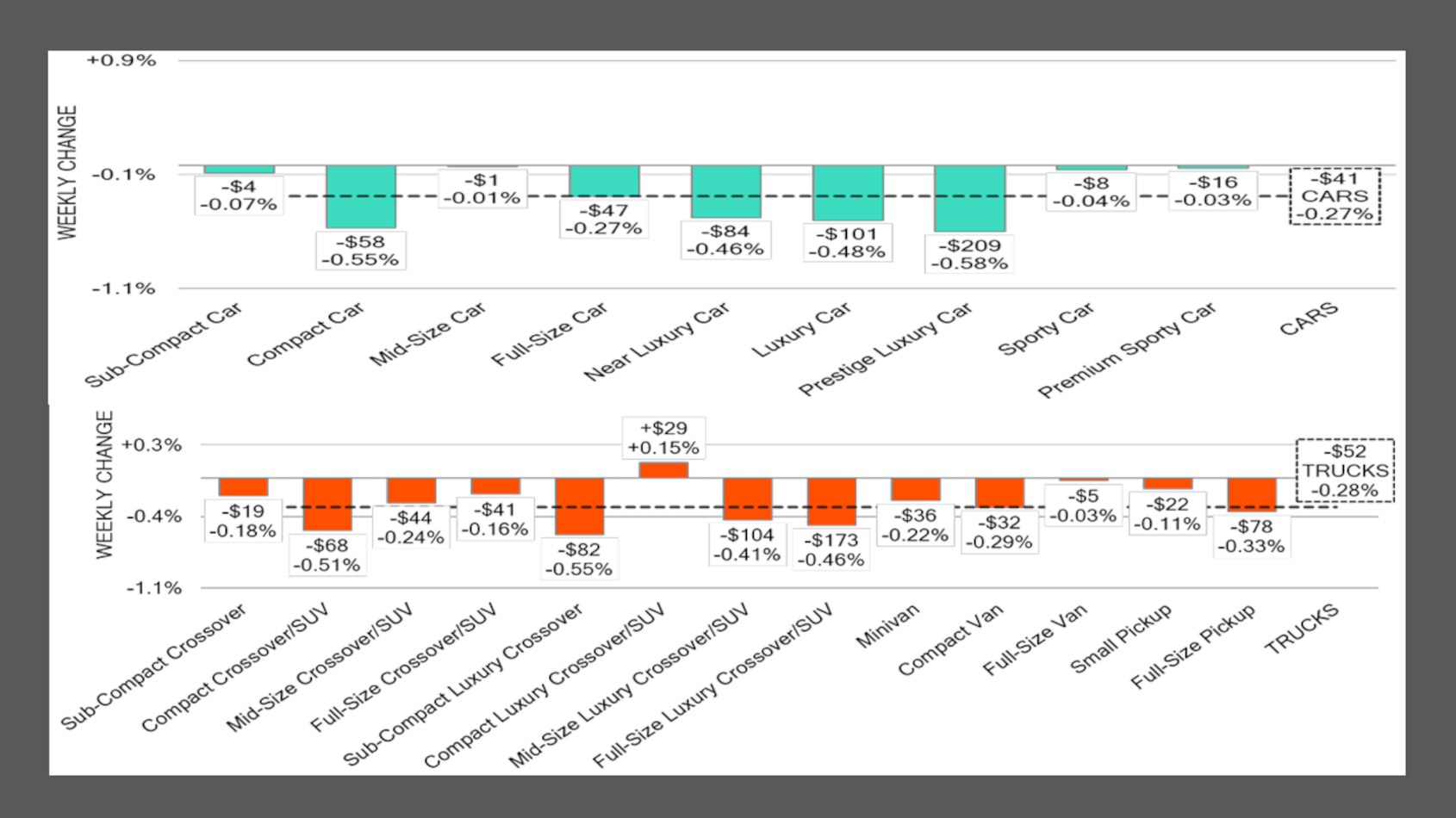

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Frigid temperatures are permeating much of the U.S., but Black Book is already discussing spring.

According to its latest edition of Market Insights, Black Book reported auction conversion rates stayed above 60%, while wholesale values decreased by only 0.28% last week.

“The market continues to gain momentum, with the overall pace of depreciation slowing and auction conversion rates once again surpassing 60%,” analysts said in the report. “These trends point to strengthening demand and suggest that an early spring market is already taking shape.”

Black Book also mentioned its estimated used retail days to turn is still at roughly 38 days, as individuals are beginning to receive W-2s, 1099s and other documents and details to file federal and state tax returns.

The Internal Revenue Service said it will begin to accept filings on Monday. The IRS expects to receive about 164 million individual income tax returns this year, with most taxpayers filing electronically.

And dealers are making sure their inventory matches what potential buyers want who are fueled by refund money for down payments.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Used-vehicle values declined modestly week-over-week, with cars down 0.27% and trucks down 0.28%, reflecting continued but orderly softening,” Black Book said in the report. “Despite broader pricing pressure, auction demand remained strong, supported by high conversion rates. Closed sales this week posted exceptionally high sell-through, with multiple lanes nearing full conversion.

“Core mainstream vehicles with average mileage sold at or near average book, indicating stable floor pricing,” analysts continued. “Older, higher-mileage units frequently exceeded expectations, highlighting sustained demand for lower-priced inventory.

“Truck segments remained a bright spot, with full- and mid-size pickup prices improving over the last two weeks. Overall, buyer competition remained elevated, suggesting demand is offsetting modest valuation declines,” Black Book went on to say.

Analysts touched on a few other specific segment movements, including:

—Prices for compact luxury crossovers/SUVs up to 2 years old rose 0.13% and units between 2 and 8 years old climbed by 0.15%. But compact luxury crossovers/SUVs between 8 and 16 years old declined 0.58% last week.

—Values for minivans of any age decreased by 0.22% last week.

—Prices for midsize cars up to 2 years old increased by 0.35%. “This marks the segment’s first measurable increase since a brief uptick during the week of Thanksgiving last year, signaling a potential early stabilization in values after an extended period of depreciation,” Black Book said.

With the end of the first month of 2026 already in sight, Black Book reiterated, “As always, our team of analysts are focused on keeping their eyes on the market for developing trends and gathering insights.”