Lane watch: Wholesale market continues to display ‘stable’ environment

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

If you’re looking for some calm in the car business nowadays, perhaps the wholesale market is the place to go.

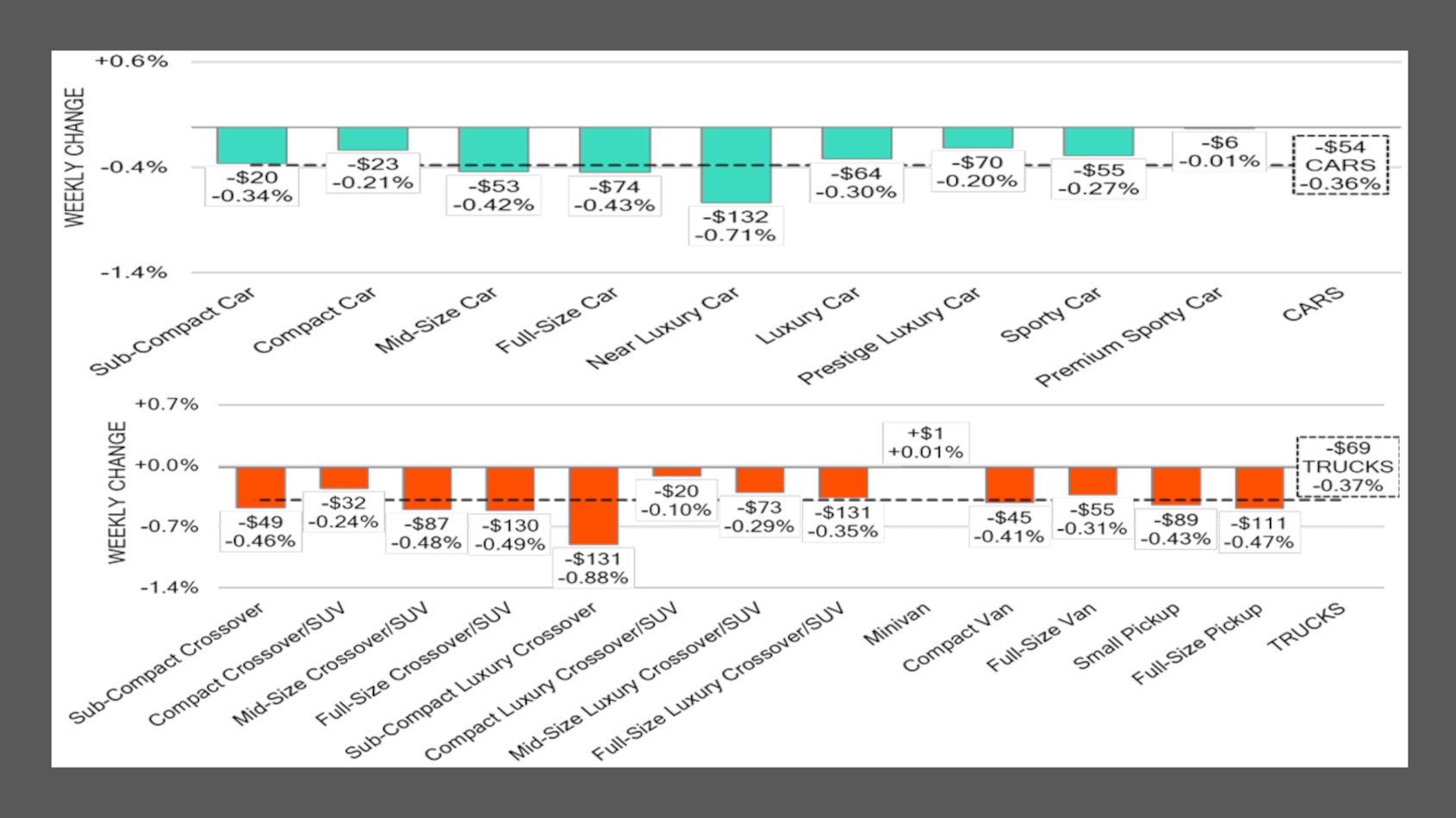

Black Book experts used “stable” multiple times in their newest Market Insights released on Tuesday that showed wholesale depreciation “remained mild” last week. Black Book reported values decreased 0.37% versus a pre-pandemic average of 0.54%.

Analysts added the auction conversion rate climbed to 64%, “indicating firmer demand for clean, front-line units.”

Black Book continued in the report, saying, “The market remains stable and balanced, with mainstream segments holding steady and heavier pressure limited to premium and EV categories.”

Of course, there were some pockets of greater price movements, as Black Book noticed values for near luxury cars sunk by 0.71% last week, marking its largest weekly drop since late November.

Over the past four weeks, analysts said the segment has averaged a 0.41% decline per week, “indicating a clear acceleration in depreciation from recent norms.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Elsewhere, Black Book indicated prices for sub-compact luxury crossovers/SUVs sustained the sharpest decline of any segment last week, sliding by 0.88%, which was nearly double its average weekly drop of 0.45% over the previous four weeks.

And after 13 consecutive weeks of declines averaging 0.52% per week, Black Book noticed values for minivan edged 0.01% higher.

“The segment’s last notable upward movement occurred in May of last year,” analysts said.

Perhaps the stable scene in the wholesale market is helping the retail world stay on an even keel. Black Book mentioned its estimated used retail days to turn is now at roughly 38.5 days.

It’s been more than a year since the estimate reached its recent high of almost 58 days in October 2024.

“While overall values continue to trend slightly lower, mainstream SUVs, sedans, and light trucks remain resilient, trading within guide expectations and sustaining healthy dealer interest,” Black Book said.

“The wholesale market remains orderly and stable, with gradual depreciation continuing across most segments. Buyers remain price sensitive, focusing on clean, market-ready units, while premium and EV-heavy segments face the sharpest adjustments,” analysts continued. “This measured pace of correction points to a market in equilibrium mode, gradually finding balance ahead of the spring tax-season uplift.

“As always, our team of analysts are focused on keeping their eyes on the market for developing trends and gathering insights,” Black Book went on to say.