Lane watch: Why last week’s price trends prompted analysts to think of the letter K

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Black Book didn’t need an entire word to describe the most significant element impacting the wholesale market last week. Analysts did it with a single letter: K.

The newest Market Insights highlighted that wholesale prices dropped 1.21% last week, prompting Black Book to say accelerated depreciation is “signaling a market under mounting pressure as the ‘K-shaped’ recovery deepens.

“Prime-credit consumers continue to support demand for newer and premium vehicles, while mainstream and budget segments face heavier declines amid tighter financing and increased repossessions,” analysts continued in the report. “The recent expiration of EV tax incentives adds further weight to late-model pricing.”

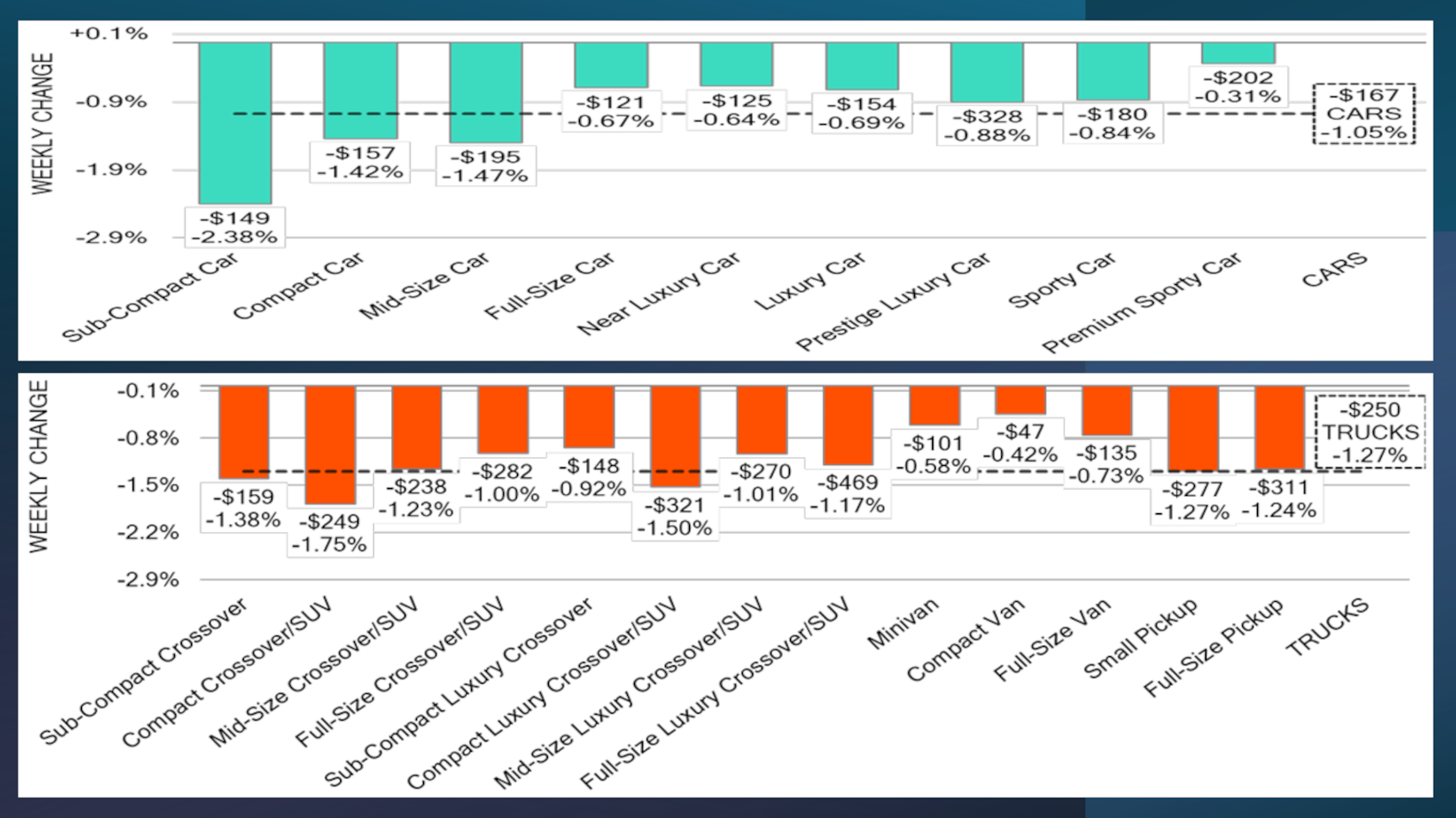

Generating that overall market decrease was prices for cars dropping by 1.05% and trucks sliding by 1.27%, on average.

Black Book noted auction conversion rates slipped to 57%, “as buyer caution and selective bidding persisted. Buyers continued to focus on clean, low-mileage inventory.”

And analysts added their estimated used retail days to turn remains at roughly 37 days.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

If dealers are turning vehicles and need to replenish inventory, auctions evidently have plenty of units to consider.

“Activity in the OEM lanes remained exceptionally strong, with several sales pushing well over 500 units at single locations, contributing to heightened overall volume,” Black Book said.

Analysts also mentioned a few trends in connection with specific vehicle segments:

—Prices for subcompact cars dropped another 2.38% after the previous week’s decrease of 2.44%. Excluding October 2022, analysts said these movements represent the segment’s largest recorded weekly declines.

—Depreciation for compact cars between 2 and 8 years old also accelerated, marking three consecutive weeks of losses above 1% with the decrease averaging 1.38% per week.

—Values for compact crossovers are sustaining widespread decreases. Prices for units less than 2 years old dropped 1.68% last week, on par with the decrease of 1.67% recorded a week earlier. Values of units between 2 and 8 years old fell by 1.75%, which approached the single-week record drop of 2.09% set in April 2020.

“The van segments — compact, full-size, and minivan — continued to follow typical seasonal trends, showing milder depreciation than most truck and SUV segments,” Black Book added.

What trends might surface next with places in the Midwest already shoveling snow and some folks in the South feeling freezing temperatures?

“As always, our team of analysts are focused on keeping their eyes on the market for developing trends and gathering insights,” Black Book said.