Manheim mid-month update shows steady & stable wholesale market

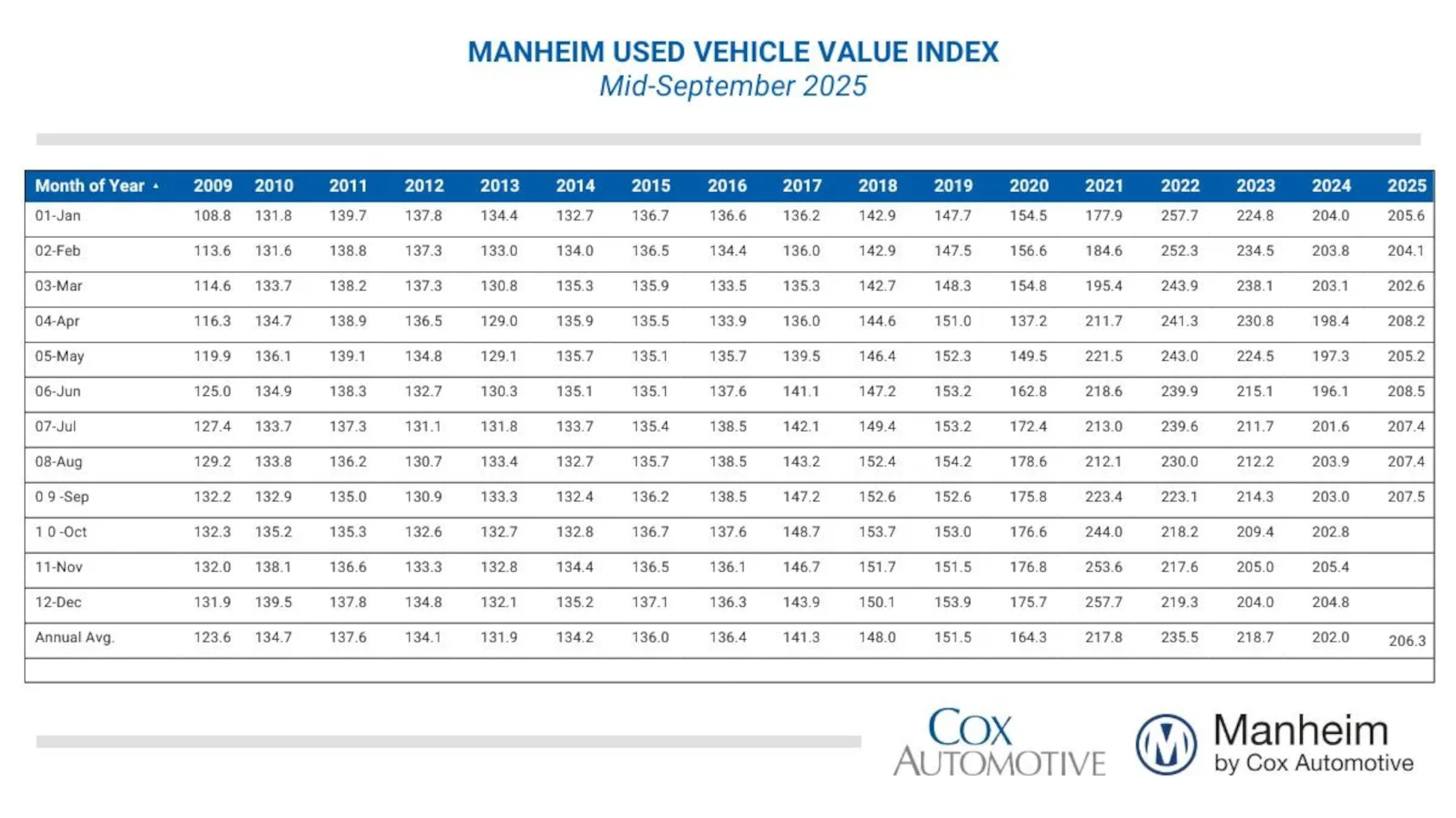

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Steady prices and stable volume.

That’s the crux of information from the first 15 days of September included in the mid-month Manheim Used Vehicle Value Index, which technically increased from 207.4 in August to 207.5 at this month’s midpoint.

While the month-over-month change in wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) was negligible, Cox Automotive acknowledged the index was 2.2% higher than the full month of September 2024.

Analysts determined the non-adjusted price change in the first half of September rose 0.3% compared to August, and the unadjusted price is higher by 2.3% year-over-year.

Cox Automotive said the average move for the full month of September is a decline of 0.3 percentage points for non-adjusted values, indicating the pricing moves observed so far in September are quite a bit stronger than normally seen for the full month.

Leveraging Manheim sales and inventory data, analysts said wholesale supply ended August at an estimated 25 days, down one day against the end of July and down one day compared to August of last year (at 26 days).

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cox Automotive acknowledged wholesale supply remains tight for this time of the year, running roughly two days lower than the longer-term levels.

As of Sept. 15, analysts added wholesale supply has not changed since the end of August, at 25 days, and was 5% (1 day) lower versus last year.

“Wholesale values are continuing to buck traditional trends as they have for most of 2025, as prices have yet to return to normal depreciation levels,” Cox Automotive deputy chief economist Jeremy Robb said in a report. “We are continuing to see elevated new and used retail sales trends in the first part of September, and that is keeping retail days’ supply relatively tighter, pushing buyers through the doors at Manheim.

“As we approach the end of September, when tax incentives on EVs end, we are seeing demand trends that are keeping used EV sales strong and values even stronger, even as EVs rise in sales mix at Manheim. The automotive market continues to show resiliency overall, both at the retail and wholesale level, as they are tied so closely to each other,” Robb continued.

As Robb mentioned, Cox Automotive reported that EVs continue to show strongest year-over-year gains currently, as demand continues to be robust for these units.

Analysts indicated EVs showed a year-over-year increase of 5.5% in early September, while the non-EV segment increased by 1.4%.

Compared to August values, Robb reiterated EVs were on par with the industry, showing no change in the first half of September, while non-EVs were lower by 0.7% against August in the first half of the month.