It's Super Bowl week, which means it's time for a visit with PureCars chief operating officer and automotive advertising expert Lauren Donalson to discuss what to expect from the automotive commercials on Super Sunday.

Plus, Donalson shares how dealers can parlay OEM ad momentum from the Big Game into their own marketing strategies, while also explaining the role of streaming and connected TV in today's advertising environment and much more.

To listen to the conversation, click on the link available below.

Download and subscribe to the Auto Remarketing Podcast on iTunes.

Cox Automotive and Roku are now working together to help determine how advertising on streaming TV can impact the consumer car-buying journey, including all stages of that process, from web browsing to purchase.

The partnership brings together automotive data from Cox and TV streaming data from Roku to help marketers “connect ad exposure to every stage of the shopping journey for the first time,” the companies said in a news release.

In a nutshell, here’s how it would work.

An automotive brand determines its target audience and launches a streaming ad campaign with Roku. The ad exposure data that Roku captures is then sent to Cox Automotive, which pairs it with the company’s first-party data set.

Cox can then provide reports showing how streaming ad exposure correlates with consumer behavior across its properties, like Kelley Blue Book or Autotrader.

“The ad measurement of the future will start with data from direct consumer relationships because it’s more accurate and scalable,” says Asaf Davidov, head of ad measurement and research at Roku, in a news release. “Roku and Cox are uniquely positioned to partner with auto marketers to go under the hood and make every marketing dollar work harder.”

Cox Automotive vice president of operations/advertising Steve Lind added: ““With our data capabilities combined, we will offer auto advertisers a holistic view of the consumer auto journey, revolutionizing how advertisers measure the impact of their digital advertising investment.

“Cox Automotive’s unparalleled audience paired with the data insights from Roku will provide a new look at performance during every stage of the car buyer journey,” Lind said.

Sales of electric vehicles (EVs) in the U.S. showed a sharp jump in sales, increasing by two-thirds in 2022, while the remaining portion of the auto market contracted.

According to a report in the Wall Street Journal, carmakers sold 807,180 fully electric vehicles in the U.S. this past year, equating to 5.8% of all vehicles sold, up from 3.2% a year earlier. This jump in EV sales sharply contrasts the 8% overall decline in total U.S. auto sales from the previous year.

Across the globe, EV sales are even more impressive, driving up the demand for these vehicles and spurring a bevy of activity from manufacturers racing to introduce more models. Here in the U.S., relaxed fuel economy targets, and weak charging infrastructures have stagnated demand, but there are signs that it will pick up at a torrid pace. New fuel economy regulations are being passed and the 2021 Infrastructure Investment and Jobs Act shows promise of a much stronger national charging infrastructure.

Super Bowl EV advertising

The story gets even more interesting at the beginning of 2023, when the Super Bowl is played on Sunday. Last year’s game saw a marked jump in the number of auto brands showcasing TV spots online and during the broadcast, featuring breathtaking vehicles that left viewers feeling the urge to finally rush out and purchase an EV.

This year’s big game is expected to showcase another round of EV excitement with new vehicles advertised and even broader, more well-rounded EV campaigns that reach across social, broadcast and web.

However, if the auto industry truly wants to push that 5.8% mark even higher in 2023, these advertising campaigns must go beyond just the promise of the vehicles and the technology itself. It’s time the industry provides more education of the broader EV experience — in driving, owning, maintaining, and especially, the sales process itself.

Why more people aren’t buying EVs

EV advertising messages must begin to educate and tap into the lifestyle wants and needs of drivers. Campaigns must begin to identify with people who aren’t just looking for the futuristic dream of what’s possible, but rather begin to answer questions on the process of “switching” over from a gas-powered vehicle.

We get it. The cars are really cool. They’re really quiet. They’re really good for the environment. And just having one in your driveway elevates your curb appeal – not to mention status among neighbors.

But the people who purchased the other 94.2% of non-EV cars and trucks in 2022 need more than just a cool looking car to get them to switch. They are now looking to be educated about what it’s like to walk into a dealership and purchase one — is the process different, how so? They want to know what it’s like to maintain an EV and take it in for service — what’s entailed with that and what’s different in the service process? And most of all, they want to know about the state of charging and the buildout of the charging infrastructure — how can advertising be used to persuade them that range anxiety is just a myth?

What’s more, dealers have a great opportunity to promote ad campaigns that showcase the sheer investments they’re making in outfitting their dealerships to cater to the needs of today’s EV driver.

AdTech will play a significant role

Dealers should also take advantage of the tools, technologies and resources available to them via Connected TV (CTV) – a platform that aligns well with an EV-centric audience. Dealers should be leveraging uniquely personalized ads with messaging targeted at specific households. Messaging with offers to buy an EV, trade in their existing vehicle to augment dealer inventory, or personalized and interactive CTV ads allowing a user to click their remote to set a sales appointment or get a trade-in quote are just a few examples. This same clickable interactivity could also give viewers access to payment calculators and real-time inventory on a dealer’s website, allowing them to get pre-qualified and matched with a vehicle while instantly negotiating payment terms…all from the comfort of the couch.

Additionally, smart retailers should leverage a top-notch engagement/conversion strategy, along with tools that help them efficiently align their internal processes to serve their EV customers, keeping them competitive in their market. These dealers are recognizing the importance of integrating a seamless e-commerce strategy with their lead-gen strategy and media mix. That way, they can reap the benefits of drastically lower costs per sale, faster processes, increased customer satisfaction and surging service retention.

Last but not least, leveraging payment-first technologies that provide a 1:1 personalized shopping experience could easily seal the deal. This allows buyers to simultaneously shop for their EV vehicle and get financing across a dealer’s entire offering: real-time inventory, all terms financing programs, with all rebates, incentives, specials, ePricing, and trade-in equity calculated and applied at the end.

With these strategies in place, dealers and their OEM partners can go beyond just the sizzle and finally start selling the steak to the rest of the car-shopping population. It’s a sound strategy considering they still felt more comfortable buying the other 94.2% of gas-powered cars and trucks in 2022.

Lauren Donalson is senior vice president of client experience and client services for PureCars. For more information, visit www.purecars.com.

Carvana might be having its well-documented retail and stock price challenges, but the online used-vehicle retailer still is getting set for the Daytona 500.

On Thursday, Carvana announced a new nationwide sweepstakes, offering the VIP treatment with seven-time NASCAR champion Jimmie Johnson as he returns to Daytona Beach, Fla., for one of the biggest races of the year.

Also debuting is Johnson’s new paint scheme, championing No. 84 as a detailed homage to his storied racing career, now under the newly minted Legacy Motor Club banner.

Running through Jan. 23, fans can follow Carvana Racing on social media (@carvanaracing) and enter for a chance to win a grand prize package that includes:

—Two VIP experiences in Daytona Beach

—Two round trip flights

—Lodging for two

—$500 food and beverage credit

—Meet and greet with Jimmie Johnson

Holding fast to the #NoFinishLines mantra, Carvana is supporting Johnson in his latest racing endeavor, intent on bringing the brand’s forward-thinking approach to fan engagement to stock car racing, just as it has over the last two INDYCAR seasons.

“We’re excited to be cheering Jimmie on as he heads back to NASCAR for the Daytona 500,” Carvana co-founder and chief brand officer Ryan Keeton said in a news release.

“The entire Carvana crew is inspired by his commitment and his determination to continue hurdling new challenges. We’re proud to champion Jimmie’s passion and dedication to the sport, and we’re looking forward to supporting his racing endeavors in 2023,” Keeton went on to say.

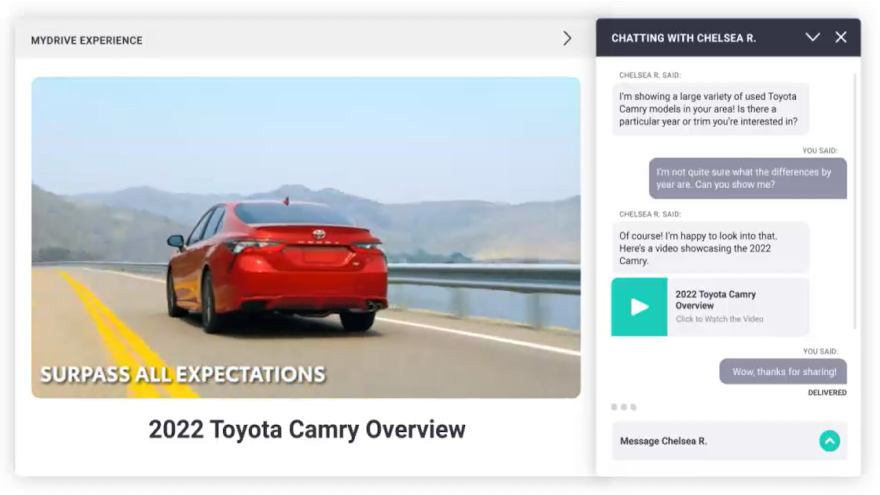

This week, ActivEngage introduced the MyDrive Experience to its core messaging solutions.

Before a potential buyer even steps onto the store blacktop, automotive dealers, dealer groups, OEMs and strategic partners using ActivEngage Messaging on their websites now can offer vehicle videos showcasing walkthroughs and virtual test drives by way of MyDrive, which are fueled by ActivEngage’s strategic partnerships with some of the best video and marketing technology providers.

“ActivEngage is on a mission to make digital consumer experiences with automotive retailers even more engaging, like the live, in-person feel you get on location at the dealership. Interactive, conversational tools gently steer shoppers toward the path to purchase and encourage deal completion,” ActivEngage CEO Ted Rubin said in a news release.

“Our cutting-edge technology and people-focused approach to selling cars arms engagement experts with innovative features, such as custom model videos, dealer recognition, and process videos to enhance the natural progression of conversations is only the beginning of our vision,” Rubin continued.

MyDrive is available on-demand during live messaging chats for sharing vehicle videos through a panel slide-out built inside the ActivEngage messaging window.

This feature can help to educate shoppers and keep their attention longer to gather deeper insights into shopper behavior, so dealership sales staff can have more productive conversations when connecting with the consumer.

Because MyDrive videos are triggered by entering a vehicle identification number or year, make, and model, shoppers can continually evolve further down-funnel to the sale with multiple vehicle details for easy comparisons.

“For over a decade, we have been uniquely positioned to innovate messaging technology, advancing the conversational flow between automotive dealers and consumers,” ActivEngage CIO Michael Third said.

“We have created both easy integrations and industry-leading stability. MyDrive is another significant step forward in enabling the next generation of tech-savvy car buying and enhancing the always-growing suite of ActivEngage automotive retailing technologies,” Third went on to say.

To learn more about MyDrive and the ActivEngage suite of automotive retailing technologies, visit activengage.com.

Another example of the racing and retailing worlds connecting surfaced on Monday.

Zeigler Auto Group will serve as primary sponsor onboard Josh Bilicki’s new No. 78 Chevrolet Camaro for Live Fast Motorsports during the 2023 NASCAR Cup Series Season.

As the youngest team in NASCAR according to a news release, Live Fast Motorsports welcomes Bilicki and Zeigler Auto Group in a new partnership. The Zeigler.com Chevy Camaro will make its official debut at Circuit of the Americas on March 26.

“We had a great season last year with Josh, and we are excited to partner with Live Fast Motorsports for 2023. Having our new team onboard gives us a fresh start on the track with owners that are focused on performing among the best at each race,” Zeigler Auto Group president and owner Aaron Zeigler said in the news release.

With Midwestern roots across Michigan, Indiana and Wisconsin as well as in Chicago, Zeigler Auto Group aligned with Bilicki — a Wisconsin-based driver — and Ohio native Matt Tifft, who is part owner of Live Fast Motorsports with BJ McLeod.

McLeod looks forward to working with Bilicki again, as Bilicki formerly raced with McLeod’s NASCAR Xfinity Series team.

Looking forward to 2023, Bilicki will pilot the Zeigler-sponsored No. 78 Camaro at multiple races. A major highlight will be racing at the inaugural NASCAR Cup Series Race at the Chicago Street Course during Fourth of July weekend.

Other notable stops for the team will be the FireKeepers Casino 400 at the Michigan International Speedway on Aug. 6 and the Verizon 200 at the historic Indianapolis Motor Speedway the following weekend.

Last year, Bilicki drove the Zeigler.com-sponsored Chevrolet, earning a top 10 finish at Daytona and scoring a top 20 finish at Atlanta Motor Speedway. Other highlights for Bilicki include a top 10 finish at the 2021 Coke Zero Sugar 400 at Daytona, 72 starts in the NASCAR Xfinity Series and nine in the NASCAR Craftsman Truck Series.

Bilicki is currently the only driver from Wisconsin competing in the NASCAR Cup Series.

“I am so happy to have the opportunity to join Live Fast Motorsports for the 2023 season and to once again represent the Zeigler Auto Group. The Zeigler team has become like family to me and I have driven for BJ McLeod in the past in the NASCAR Xfinity Series, so this felt like a very natural fit for all parties. I’m excited and thankful for the opportunity and can’t wait to get to work,” Bilicki said.

Each year toward the end of November and throughout December, the world of automotive enjoys its own version of the holidays with its flurry of end-of-year and seasonal promotional advertising. These ads are plentiful on television and typically bring excitement with big sales and big red bows on cars and trucks.

Sure, the last few years have taken on a slightly different tone because of the pandemic, but this year’s ads are most likely going to again shift their tone and message for a number of reasons.

Inventory levels are slowly returning

For starters, inventory levels are coming back, which means there may be fewer ads offering pre-orders. More new cars and trucks are beginning to arrive at dealerships as the supply-chain problems begin to ease and auto makers look to increase factory output.

Adding to this changing inventory dynamic is the need to move 2022 model year vehicles still sitting on back order. These vehicles are still considered new, despite now being older. At some point early in 2023, manufacturers will need to work with dealer partners to finalize these and begin to move them – most likely at a discount. New legislation may have a direct impact on U.S. manufacturers gaining access to more chips. What better time to begin advertising these models than during the upcoming holidays.

More supply means reintroducing rebates

Because of the increasing supply of vehicles, manufacturers and dealer partners may also use the holiday season to reintroduce and promote end-of-year rebates and incentives offered on a variety of cars and trucks.

With inventories gradually increasing and more supply for consumers to choose from, it is inevitable that OEM incentives and rebates will be (re)introduced to influence consumer behavior. A resulting drop in transactional pricing on new vehicles will automatically influence the prices of used cars. A massive challenge can be expected as a result of negative equity in both new and used cars. This is nothing new – and the industry has been through this before.

These challenges may play a significant role in the type of messaging end-of-year dealership and manufacturing advertising displays on television, radio, online and social platforms.

EV advertising will also look different

The last area that may force advertising differences this year could be the way dealers and manufacturers position electric vehicles. While these were a significant focus of last year’s Super Bowl, and have been extremely prevalent on television ads through 2022, advertising messaging may look and feel different. Instead of focusing specifically on the wow factor of the particular vehicle’s features and benefits, this year holiday ads may instead talk about tax credits, the desire to switch from gas-powered to electric, and even the investments individual dealerships are making to cater to an EV-specific audience that wants to know they can have their vehicle serviced and maintained properly.

Advertising more on new digital channels

It’s not just the message that might be changing this holiday season, but where people see it. Sure, cable television is going to once again be a big player for holiday ads, and radio will again cater to a dedicated audience. However, streaming television, OTT platforms (connected television) and streaming audio should also see a larger share of ads this holiday season.

The first connected television (CTV) benefit is scale, where dealers can leverage large programming opportunities and access across major recognizable logos that have strong coverage across networks and devices during the holidays. Second, dealers and their partners in CTV are continuously working to understand the market penetration they are gaining or losing, and have access to unique data technology to ensure campaigns are on par with the reach of top cable providers.

These partners also offer dealers access to digital media purchase technology that leverages a Demand Side Platform (DSP), which is software that allows media buyers to buy each impression based on whether the viewer meets their audience parameters. They can also help ensure ad content is not played alongside or in tandem with violence or other sensitive subjects that would be detrimental to a dealer’s overall brand values. Each of these benefits can be significantly important during special times of the year, such as holidays, when promotions need to be ultra-timely.

Online campaigns this holiday season should leverage Google’s Performance Max technology more. The platform separates itself because it can complement keyword-focused search campaigns through automated bidding and targeting across all channels. All of this is critically important because ad tech is now turning data into information that can significantly impact profits. Attribution platforms are now grounded in serving the best ad to the right individual, at the right time, regardless of where they are online or where they are consuming media.

The platform allows digital advertising partners to leverage the best of Google’s automation capabilities (regardless of where they are found online) and serve them with a high-value creative message and offer. Some of these “best of” automations include smart bidding and finding new in-market customers.

Lastly, streaming audio will also receive more attention this season. For those unfamiliar with the medium, think of it as radio on-demand or a prerecorded audio program or show. It’s hosted on the web and available for download on personal computers or mobile devices to be listened to on demand — similar to how a person watches a show on Netflix. This platform has grown significantly and today is considered one of the most popular ways to listen to music and podcasts. Because of this, dealers have recognized it as a great channel for timely promotions with access to a very loyal audience with growing spending power — millennials.

Dealers that work with their digital advertising partners on proactive end-of-year and holiday advertising strategies will see better sales activity in November and December because they will be pushing the messages that resonate with car buyers on the right digital platforms.

Lauren Donalson is senior vice president of client experience and client services for PureCars. For more information, visit www.purecars.com.

Pohanka Automotive Group recently invested in Orbee, a leading provider of marketing technologies.

According to a news release, Pohanka’s investment into Orbee revolves around the common goal of driving innovation across the automotive software ecosystem. The dealer group’s strategy of connecting legacy systems with new capabilities such as Orbee’s Customer Data Platform (CDP) and Marketing Automation Platform (MAP), will provide a reference design for other dealership groups, too.

With more than 100 years in business, Pohanka is one of the oldest automobile dealerships in the nation with locations in Maryland, Virginia and Texas, employing more than 1,700 team members. The group sells a wide range of vehicle makes, including Honda, Lexus, Acura, Hyundai, Nissan, Chevrolet, Mercedes-Benz, Toyota, Volkswagen, Ford, CDJR and Kia.

“Unlocking siloed data about each customer’s journey from DMS databases and OEM marketing programs will allow dealerships to engage with their customers, with the right message, at the right time, with the right offer” said Andrew Carrington, chief of innovation, technology and applications at Pohanka Automotive Group. “Orbee’s enterprise marketing system enables us to increase the untapped lifetime value of our customer relationships while offering each one a personalized experience, especially in high-margin fixed operations.”

Pohanka is joining Holman and Flow Automotive in its investment in Orbee. Holman made its move in August.

As dealership groups with strong brand equity continue to expand their customer base and rooftop footprint, Orbee said they have reached a point where connecting and activating their rich datasets becomes daunting.

Orbee has created a data-centric marketing cloud that makes it easy to analyze, segment and engage customers with automated marketing across all first-party and third-party channels.

Orbee’s open platform enables robust integrations through Application Programming Interfaces (APIs), Software Dev Kits (SDKs), a strong product pipeline, and through custom development services.

“We are so thrilled to have the Pohanka Automotive Group join our strong investor base that all share our vision where data connectivity takes the customer experience and marketing efficiency to new heights,” Orbee co-founder and CEO Atul Patel said. “With our direct collaboration with the technology team at Pohanka, Orbee will further enhance its capabilities and know-how so that we can help every dealership increase their enterprise value through data they already own and marketing they can control.”

In another episode of the Auto Remarketing Podcast originating from Used Car Week 2022, Stephane Ferri and Lauren Donalson of PureCars discussed the most interesting and successful dealership advertising campaigns they’ve seen this year.

And the PureCars pair also gave a glimpse of the new solutions the company is set to launch in 2023.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Coinciding with the close of the third quarter, PureCars rolled out its latest whitepaper to help dealerships sharpen their advertising strategies.

The provider of digital marketing technology and services for automotive dealers called its new whitepaper: “5 Key Takeaways from the 2022 PureCars Digital Advertising Survey.”

The paper looks at specific digital advertising trends facing dealers in today’s economy and offers key takeaways to help their businesses overcome industry challenges heading into 2023.

Pulling back on ad spending

With softening sales this year due to tighter Inventories and higher prices and interest rates, PureCars said dealers have reported pulling back on their digital advertising. However, rather than pulling back, today’s leading dealers are reallocating their spend to focus on other key areas.

The whitepaper can help dealers understand that if their issue is that they have more customers than cars, there are effective uses of their advertising budget.

“The first is to run pre-order campaigns to keep in-demand models top of mind and establish a pipeline of future sales,” PureCars said. “Secondly, when inventory is low, this is a perfect opportunity to focus on fixed ops to keep a consistent revenue stream. Use digital ads to promote service offers, reasons to schedule service, and amenities the dealership offers to enhance the customer experience.

Conflicting appetite for streaming media

PureCars determined that few dealers say they are including streaming audio and video in their digital advertising budgets.

However, a large majority also say they believe streaming media offers great ROI, according to PureCars.

With traditional TV and radio in decline, combined with the expanding popularity of streaming video and audio, dealers should consider adding channels like Amazon, Spotify, or Disney/Hulu to their marketing mix,” firm experts said.

“Streaming video and audio also provide advanced targeting options. This gives dealers the opportunity to have their messages seen and heard by some very specific audience segments,” they continued.

Search, social, email still significant investments

The whitepaper explains that search/display, social, and email are still considered to be the highest drivers of traffic to dealership websites.

However, PureCars pointed out that today’s dealers can’t just think about driving traffic, they also must position for higher conversions.

Newer advertising channels, such as online video, are growing in consideration for many dealers, who should always review their results to make informed decisions about budget and strategy. PureCars recommends a mix of online video for reach and awareness with higher converting social and search campaigns to effectively balance the channel mix.

“This year and entering 2023 have brought about new obstacles for dealers and their digital advertising partners because of continued inventory and new economic challenges,” PureCars senior vice president of client experience Lauren Donalson said. “As a leading digital advertising partner for dealers nationwide, we are continuously providing them with the tools, insights and education they need to help them make informed decisions for their business.

“This latest whitepaper report looks at new and changing dynamics in the industry and offers tips on how to leverage advertising and marketing opportunities for continued growth potential,” Donalson continued.

To download the whitepaper, go to this website.