A substantial American viewership for the 2014 World Cup was expected — but the resulting record-breaking number of people tuning in to the tournament shattered all expectations. And the car brands who may benefit the most? Kia, Hyundai and Volkswagen.

Over 26 million people in the U.S. viewed the World Cup Final between Germany and Argentina, averaging about 17.3 million on ABC (English) and 9.2 million on Univision (Spanish), the most to ever watch a single soccer game in America, according to those respective networks.

To put that into perspective, the last Super Bowl peaked at about 111.5 million American viewers, according to Nielsen ratings. And that was just one game, with an estimated 115 million viewers during the first 62 of the 64 World Cup games, on ESPN, ESPN2 and ABC alone, not taking into account viewers tuning in via various streaming methods or participating in public viewings.

According to a study from Jumpstart Automotive Group, which compared online traffic during the World Cup (which ran from June 12 through July 9) to the 30 days prior to its commencement, their family of publishing sites saw dramatic increases in Web activity related to the three automakers who made World Cup advertising their priority.

Kia, which featured Brazilian model Adriana Lima in its spots, saw the biggest bump in digital traffic with a 32-percent increase in interest while the World Cup was open.

Hyundai, who is the current official auto sponsor for the World Cup, saw a 31-percent increase in Web traffic on Jumpstart’s collection of sites. The automaker also experienced significant interest increases with their social media efforts, finding success via Tumblr and Twitter with their #BecauseFutbol hashtag, the latter maintaining a 30-percent share of the conversation versus other official World Cup hashtags.

Volkswagen, competing with the South Korean sister companies, viewed the World Cup as the perfect opportunity to market the 2015 GTI. As an unofficial sponsor, VW drummed up a 26 percent increase in digital interest via three official people: current ESPN analysts Alexi Lalas (former U.S. international player) and Michael Ballack (former German international player) along with Argentinian commentator Andres Cantor. Featuring figures from each of the two countries that played in the final was just convenient icing on the cake.

Perhaps even more convenient is the timing for Chevrolet, who timed the unveiling of the 2014-15 Manchester United kit perfectly in tune with the World Cup final, seeing an increase in 17-percent in online traffic. The automaker’s $559 million deal with the British giants will ensure seven years of world-wide exposure on the front of the Manchester United jerseys despite the fact General Motors announced last year it will stop selling new Chevrolets in Europe by the end of 2015, in an attempt to shift European focus to Opel.

To read Jumpstart’s World Cup Report in full, click here.

A recent study from DealerRater and Dataium confirmed that positive online reviews that provide employee-specific information drive website traffic and leads to dealers.

The study showed that DealerRater users were 90 percent more likely to visit a dealer website and 5.3 times more likely to convert to a lead when that dealer had a positive overall rating of 3.5 stars or higher.

Users reacted even stronger to review profiles that provided expanded information through DealerRater’s Certified Dealer Program. In particular, users were 12.1 times more likely to submit a lead to dealers that featured employee pages on their DealerRater review profiles.

Employee pages, available to participants in DealerRater’s Certified Dealer Program, allow a dealer’s customers to write reviews for individual dealer employees and feature specific information on the individual employee, such as an employee bio, photo and video greeting.

“The study validates what we’ve advised dealers on for years. Dealer reviews have a clear impact on the behavior of today’s auto shoppers. And the fact that auto shoppers are more engaged with the employee pages available from Certified Dealer profiles reveals that consumers are looking for more transparency as they research dealers,” DealerRater chief executive officer Gary Tucker said.

“When comparing multiple car dealerships, they’re looking for detailed reviews that provide a clear idea of what to expect from the car buying process,” he continued.

Tucker emphasized the study further illustrates the high value generated by DealerRater’s Certified Dealer Program, finding that participating dealers were able to attract, engage and convert more shoppers into leads than non-certified dealers.

DealerRater users were 50 percent more likely to visit a Certified Dealer website, as well as spend 80 percent more time on-site, than a non-certified dealer website. Moreover, Certified Dealers showed an 8.8 times higher lead conversion for new vehicles and a 10.8 times higher lead conversion for used vehicles than non-certified dealers.

Dataium chief development officer Eric Brown further explained what he believes the study findings show.

“Online reviews have already helped consumers in the car buying process, but now we’re looking at the other side of the relationship by showing how dealers can benefit from reviews,” Brown said. “The numbers speak for themselves: dealers that provide great customer service are receiving positive online reviews that, in turn, attract and convert more shoppers.”

Brown and Tucker also pointed out the findings were corroborated by John Osinga, IT/Web manager of London City Chrysler, a DealerRater Certified Dealer located in London, Ontario.

“We have focused heavily on leveraging DealerRater reviews over the years and it has paid off,” Osinga said. “We are seeing more referral website traffic now than we ever have before thanks to our online reviews. In addition, visitors are spending more time and viewing more pages on our site.”

The study is based on Dataium’s comparative analysis of dealership website traffic and DealerRater review profiles for more than 1,000 dealers. Dealers interested in learning more about the study or how an online reputation can be leveraged to drive sales can visit www.dealerrater.com/dealer.aspx.

Even as liability proceedings regarding the automaker’s ignition switch recall unfolded Friday afternoon in a U.S. Bankruptcy Court in Manhattan, analysis from both Kelley Blue Book and Edmunds.com show that shoppers don’t appear to be shying away models from General Motors.

New survey data of Kelley Blue Book website users indicated only 5 percent of new-vehicle shoppers say the recent GM recall caused them not to consider purchasing a Chevrolet, Cadillac, GMC or Buick model.

“Shoppers are willing to forgive, but not forget,” KBB analyst Arthur Henry said. “Most likely, GM is maintaining its shopping traffic on KBB.com from buyers who are looking to capitalize on any deals that may be offered or because none of the current recalled vehicles are a part of manufacturer’s current product portfolio.”

KBB broke down the percentage of new-car shoppers who remembered a recall by brand. The results went as follows:

—Toyota: 48 percent

—General Motors: 40 percent

—Chevrolet: 38 percent

—Ford: 11 percent

—GMC: 9 percent

—Honda: 8 percent

—Chrysler: 7 percent

—Tesla: 4 percent

—Jeep: 4 percent

—Saturn: 3 percent

—Buick: 3 percent

—Nissan: 2 percent

—Pontiac 2 percent

While shoppers are aware of major recalls on Toyota and GM models due to their publicity in the media, analysts pointed out consumers are still shopping those brands on KBB.com.

Chevrolet’s traffic on KBB.com grew 25 percent year-over-year and the brand saw a short-term dip of 14 percent from December to April, which KBB said can be attributed to news of the recall.

KBB senior analyst Karl Brauer explained this trend confirms Chevrolet is benefitting from recent high-profile vehicle launches, including the all-new 2014 Corvette, Impala and Silverado. Brauer added these models are helping the automaker remain top-of-mind among shoppers despite recalls on older, discontinued models.

“Whatever negative connotations GM has suffered from the recent recalls is minor when compared to the growing consumer interest the company has generated with its current line of compelling product,” he said

Even though Chevrolet is maintaining its overall stride in KBB.com share of traffic, the perception of Chevrolet’s reputation has declined from the first quarter of 2013 to the first quarter of this year, sitting below the average among non-luxury brands like Honda and Ford, according to survey data.

“This further suggests consumers are being won over by Chevrolet’s existing model offerings, regardless of the latest hit to its reputation,” Brauer said.

Meanwhile, Edmunds.com uncovered similar consumer trends when analysts reviewed traffic on their website.

A review of shopper consideration on Edmunds.com determined that the recalls have had very little — if any — impact on GM brands. A week-by-week comparison can be found below:

| Make |

1/5/2014 |

1/12/2014 |

1/19/2014 |

1/26/2014 |

| Buick |

1.5% |

1.5% |

1.6% |

1.6% |

| Cadillac |

2.1% |

2.2% |

2.4% |

2.2% |

| Chevrolet |

8.2% |

8.8% |

9.7% |

9.5% |

| GMC |

2.4% |

2.4% |

2.4% |

2.5% |

| |

|

|

|

|

| Make |

2/2/2014 |

2/9/2014 |

2/16/2014 |

2/23/2014 |

| Buick |

1.5% |

1.6% |

1.7% |

1.7% |

| Cadillac |

2.3% |

2.6% |

2.2% |

2.2% |

| Chevrolet |

9.2% |

9.1% |

9.6% |

9.4% |

| GMC |

2.3% |

2.4% |

2.5% |

2.6% |

| |

|

|

|

|

| Make |

3/2/2014 |

3/9/2014 |

3/16/2014 |

3/23/2014 |

| Buick |

1.7% |

1.6% |

1.6% |

1.7% |

| Cadillac |

2.1% |

2.1% |

2.0% |

2.0% |

| Chevrolet |

8.9% |

8.7% |

8.3% |

8.3% |

| GMC |

2.3% |

2.3% |

2.2% |

2.1% |

| |

|

|

|

|

| Make |

3/30/2014 |

4/6/2014 |

4/13/2014 |

4/20/2014 |

| Buick |

1.7% |

1.5% |

1.6% |

1.6% |

| Cadillac |

1.9% |

1.9% |

2.2% |

1.8% |

| Chevrolet |

9.1% |

8.7% |

9.3% |

8.7% |

| GMC |

2.2% |

2.2% |

2.1% |

1.9% |

| |

|

|

|

|

| Make |

4/27/2014 |

|

|

|

| Buick |

1.6% |

|

|

|

| Cadillac |

1.8% |

|

|

|

| Chevrolet |

8.3% |

|

|

|

| GMC |

2.0% |

|

|

|

“This analysis shows that shoppers continue to consider GM models at about the same level as before news of the recalls broke,” the Edmunds analysis said.

Legal Proceedings

Meanwhile, GM’s legal team was engaged on two fronts on Friday.

The automaker’s counsel participating in a proceeding in front of the same judge who oversaw GM’s bankruptcy in 2009. Judge Robert Gerber is now considering whether the automaker committed fraud in not disclosing potential awareness of ignition problems in discontinued models, allowing civil suits from more than 100 law firms to push forward.

At the same time, Bob Hilliard, a Texas lawyer and one of the nation’s key players in the pursuit of claims against GM, attended what he described as a requested “settlement meeting” with GM’s compensation attorney Kenneth Feinberg in Washington D.C.

During the full-day meeting, Hilliard, who represents 53 families who claim to have lost loved ones due to GM’s ignition switch as well as 273 injured victims, said he discussed with Feinberg full resolution of all claims.

“My numerous clients include those who have suffered serious injuries or the loss of loved ones. Each individual investigation has confirmed the accident scenario was caused by the defect in the GM vehicle,” Hilliard said.

Newest Recalls by Cadillac & Honda

The National Highway Traffic Safety Administration shared details about the newest recall coming from GM.

The automaker is recalling 50,571 Cadillac SRX vehicles from the 2013 model year. These units manufactured from May 29, 2012, through June 26, 2013, and are equipped with 3.6-liter engines.

“In the affected vehicles, in certain driving situations, there may be a three- to four-second lag in acceleration due to the transmission control module (TCM) programming,” NHTSA officials said.

“A three- to four-second lag in acceleration may increase the risk of crash,” they continued.

GM told NHTSA it will notify owners, and franchised dealers will reprogram the transmission control module, free of charge. The manufacturer has not yet provided a notification schedule.

In the meantime, owners can contact Cadillac customer service at (800) 458-8006 and reference recall No. 14132.

Furthermore, American Honda also announced a recall. Honda will voluntarily recall 24,889 Odyssey vehicles in the U.S. and another 1,501 units in Canada from the 2014 model year

OEM officials explained the recall stems from the need to replace the shorting coupler, an electrical component in the side curtain airbag system. The repair will be made free of charge.

“During assembly of the electrical coupler for the side curtain airbag on the passenger's side of the vehicle, it is possible that the shorting terminal, which is used to prevent deployment of the airbag before it is assembled into the vehicle, may have been damaged,” Honda said.

“A damaged shorting terminal may illuminate the Supplemental Restraint System (SRS) indicator as well as prevent the side curtain airbag from deploying during a crash, increasing the risk of injury,” the automaker continued. “No crashes or injuries have been reported related to this issue, which was discovered through warranty repairs.”

Honda is announcing this recall to encourage all owners that purchased an affected vehicle to take it to an authorized franchised dealer as soon as they receive notification of this recall from Honda.

Mailed notification to customers will begin on May 16.

In addition to contacting customers by mail, at that time, U.S. owners of these vehicles will be able to determine if their vehicles require repair by going to www.recalls.honda.com or by calling (800) 999-1009, and selecting option No 4.

Owners of these vehicles in Canada will be able to determine if their vehicles require repair by going to www.honda.ca/recalls or by calling (888) 946-6329.

As Earth Day rolled around last week, analysts took a look at the fast-growing hybrid and electric vehicle segments, which have become increasingly popular given how more and more consumers are focusing on environmental sustainability while looking for their next vehicle.

While Experian Automotive looked at the financial factors behind why a consumer chooses to buy electric versus hybrid, Cars.com and CarGurus each listed that the U.S. cities that tout the greenest car shoppers.

The respective order of the top five hybrid models on the road in 2013 may not come as a surprise, as the Toyota Prius continued to top the list, according to Experian data.

The Toyota Camry, Honda Civic, Toyota Highlander and Ford Fusion, followed the popular model, respectively.

The top five electric vehicle models on the road last year were the Nissan Leaf, Tesla Model S, Ford Focus, FIAT 500e and Mitsubishi i-MiEV, Experian reported.

The Hybrid Vs. Electric Comparison

In comparing hybrid and electric vehicles and the consumer base that buys them, Experian began their analysis with this telling statistic.

The number of electric vehicles in operation grew by 245 percent last year, but hybrid vehicles still made up 98 percent of all alternative-powered vehicles on the road. This statistic is even more surprising given how the number of hybrids on the road only grew by roughly 19 percent last year.

Some of the biggest reasons behind this discrepancy are evident after taking a look at some of the types of people who shop for these environmentally friendly vehicles.

Let’s start with cost.

According to the Experian study, consumers who are purchasing an electric vehicle are younger and more affluent than those buying a hybrid.

As far as earnings go, nearly 21 percent of consumers who purchased an electric car in 2013 had an average household income of $175,000 or more.

On the other hand, only 12 percent of consumers purchasing a hybrid had an average household income on the same level.

This may not be surprising, as the study found the average monthly payment for a new electric vehicle was $549, which was $82 more than a new hybrid ($467).

The study also showed that consumers purchasing a new electric vehicle had a higher credit VantageScore (749) than those purchasing a new hybrid (741).

Interestingly, according to the study results, electric-car buyers are younger, as well.

Findings from the analysis showed that in 2013, more than 45 percent of hybrid car buyers were 56 years old or older, while roughly 26 percent of electric car buyers were of the same age.

The greater percentage (55 percent) of electric buyers were between the ages of 36 years old and 55 years old.

“At first glance, one would imagine that consumers purchasing either a hybrid or electric vehicle would be nearly identical; both are environmentally conscious, are of similar ages and have higher income levels,” said Melinda Zabritski, senior director for Experian Automotive. “While for the most part those statements ring true, our research shows that there are slight differences between the two. One possible reason for the disparity could be the growing popularity of the higher-end luxury electric models available.”

Where the Buyers Are

Now that we know a bit more about the financial and social demographics of these environmentally-conscious buyers, it’s time to look into where to find them.

Both Cars.com and CarGurus released studies last week highlighting the nation’s cities and regions with the greenest car shoppers.

In its study ranking U.S. cities driving demand for hybrid cars, CarGurus found that “West Coasters” are out ahead of the pack when it comes to interest in buying used green cars.

San Jose, Calif.; San Francisco; Portland, Ore.; Los Angeles and Seattle top the list of cities with the highest percentage of shopper purchase inquiries on used hybrid car listings, while cities in the country's Eastern region held strong at the list's bottom, the site reported last week.

Detroit; Virgina Beach, Va.; Pittsburgh; New Orleans and Cincinnati showed up in the results as the cities with the lowest demand for green cars, according to CarGurus.

Over at Cars.com, the site released its annual list of the U.S. cities with the most eco-friendly car shoppers last week.

Data for the list is compiled based on car shopper searches on Cars.com for hybrid and electric cars.

Not surprisingly, a West Coast state led the nation in this regard.

Based on the results from the list, car shoppers in California continue to be the most eco-conscious state, with seven of the top 10 cities falling in the state.

“With gas prices continuing to rise, car shoppers have more reason than ever to shop for eco-friendly cars,” said Joe Wiesenfelder, Cars.com's executive editor and resident green expert. “Not only do these high-efficiency cars save money at the pump, but they are also great for the environment.”

Cities with the greenest car shoppers, according to Cars.com search data are as follows (ranked from greenest to least green):

1. San Francisco — Oakland — San Jose, Calif.

2. Charlottesville, Va.

3. Los Angeles

4. San Diego

5. Monterey — Salinas, Calif.

6. Chico — Redding, Calif.

7. Santa Barbara — Santa Mario — San Luis Obispo, Calif.

8. Portland, Ore.

9. Sacramento — Stockton — Modesto, Calif.

10. Seattle — Tacoma, Wash.

"While California continues to lead in car shoppers' adoption of hybrid and electric cars, overall demand for these green cars has led car companies to make hybrids in all shapes and sizes, capable of accommodating the needs of just about any type of driver," said Wiesenfelder. "Inventory of hybrid and electric cars on Cars.com is already up 22 percent this year, further demonstrating that automakers are catching up to car shopper demand."

Billions of dollars are spent each year on digital marketing, and J.D. Power intends to measure the link between that marketing and actual vehicle sales.

On Wednesday, J.D. Power announced the acquisition of Korrelate, an Orlando-based company that measures consumers' online behaviors and links them to offline sales activity.

By combining Korrelate's privacy-safe method of matching anonymous online behaviors with J.D. Power's Power Information Network new- and used-vehicle retail sales data, company officials say the result will be a timely, in-depth and transparent measurement of digital marketing effectiveness.

"We are delighted to add Korrelate and its cutting-edge capabilities to J.D. Power," said Finbarr O'Neill, president of J.D. Power.

"Consumer behavior is changing dramatically in today's Internet-powered world. The auto industry spends billions of dollars annually on digital marketing. Measuring online activity and linking it to actual vehicle sales will enable marketers to measure and optimize their digital strategy," he said.

Combining the two company’s capabilities, J.D. Power will be able to identify which websites and ad campaigns shoppers are exposed to before they buy their vehicle.

That will allow it to measure and enhance the effectiveness of automaker, dealer and third-party websites and ad campaigns, the company said, and help ad networks and online publishers report ad effectiveness.

Dealers know that satisfied customers are walking advertisements. And in today’s digital world, online reviews have real impact on sales and service operations.

This week, eReputationBuilder launched Dealer Influence, a product which aims to encourage an increase in reviews that represent the overall sentiment of the customer, and proactively build dealers’ online presence.

Dealer Influence serves as an all-in-one automotive reputation, SEO and social media management product, company officials said.

“Our goal is to make the whole greater than the sum of its parts when it comes to a dealership’s digital presence,” said JD Rucker, founder of Dealer Authority.

“Many services today are offering little social media with their reputation management product, or perhaps some reputation monitoring with their social media product. But Dealer Influence will make search, social and reputation work together to improve each.”

The new product comes as a result of Internet marketing agency Dealer Authority’s acquisition of an equity stake in eReputationBuilder earlier this year.

eReputationBuilder is an email marketing system that encourages dealership customers to leave reviews on websites such as Yelp, Google Local and DealerRater.

The firms combined their software solutions and digital marketing strategies to create Dealer Influence, which directs consumers who say they are “not satisfied” with a dealership to contact the dealership and give staff the opportunity to remedy the situation before publishing a negative review to the Internet.

“When I first launched eReputationBuilder back in 2012, it was solely focused on leveraging our email marketing expertise to generate reviews so not to compete with other companies that were dabbling in the ORM arena,” said Peter Martin, president and founder of eReputationBuilder.

“As more and more clients signed on, we realized how big a need there is in the automotive industry for a fully integrated and automated reputation management service.

“The only components this product lacked were SEO and social media. Our partnership with Dealer Authority has closed that gap and now we are now able to offer a complete product designed specifically for the automotive industry,” he said.

Social media gives automakers and dealerships just one more opportunity to engage and interact with potential customers as well as drive consumer purchase and service decisions.

And J.D. Power’s 2014 Social Media Benchmark Study shows just which brands are most successful at reaching their client base through social media.

Toyota ranks highest among automotive brands, with a score of 845 on a 1,000-point scale. Ford ranks second with a score of 842, followed by Chevrolet at 838.

Rounding out the top five are Lincoln (836) and BMW (831).

The social media benchmark auto industry average is 824.

The 2014 Social Media Benchmark Study — Auto is based on responses from more than 9,800 U.S. online consumers who have interacted with a company via that company’s social media channel. The study was fielded from Nov. 18 through February 9.

And results show automakers might not be doing enough to reach all generations of consumers — perhaps mistakenly focusing on younger social media users.

“Auto manufacturers that focus just on reaching Millennials through social media are missing a tremendous opportunity, as social media is a channel that reaches all generations of consumers,” said Arianne Walker, senior director, automotive media and marketing at J.D. Power. “Today for the first time, we have an in-depth understanding of what helps drive satisfaction in social media interactions across generations, and not just among consumers who are highly engaged in social media, but also those who are more casually engaged with a brand through this channel.

“It is important to provide a satisfying social media experience for all consumers because it helps drive current and future business.”

The study, which is in its second year, showed 20 percent of consumers use social media as their primary source of information about automotive brands.

That means one fifth of franchised dealerships' potential customers aren’t even making it to a dealership direct website, but rather have already made their car-purchase decisions while researching on one of the corresponding automaker's social media site.

And according to a new infographic from Kenshoo based on the results of a recent FordDirect and Research Now study, 56 percent of car buyers who contacted a dealer because of social media advertising made a purchase.

“As social loyalty and sharing grows, expect the number to grow and more automotive purchases to be impacted by social channels,” the infographic reads.

According to the J.D Power study, the most frequently used social media marketing channel is Facebook (29 percent), followed by YouTube (19) percent and Twitter (11 percent).

Interestingly, it’s not just the automaker’s social media sites these social-savvy consumers are checking.

The study showed that nearly one-third (29 percent) of social media users get recommendations about a product or service from friends and family exclusively through social media.

Though this may seem out of dealership and automaker control, many dealerships are now using referral and review tools that encourage customers to post about their experience on their social media channel — which may create a domino effect, if the study results are any indicator.

The study also showed consumers are much more likely to buy if they are satisfied with their social media experience while searching for a car.

According to the study, consumers who are happy with their servicing and marketing experiencing “have a positive impression of the automotive brand and an increased likelihood to repurchase from the same brand in the future.”

Gubagoo announced Tuesday its behavioral analytics-based chat and website engagement platform for dealer websites is now fully optimized for mobile.

What does this mean for dealers using the tool?

Gubagoo explained its dealer customers can now track and then relevantly target every visitor that hits their website via a smartphone or tablet with the free mobile tool.

Gubagoo Mobile works on any native smartphone or tablet device and requires no app downloads.

On the other side of sales, it keeps car shoppers right on the dealership’s mobile site, and doesn't force the consumer onto another page, the company noted.

“The auto industry is just starting to talk about ‘responsive’ dealer website design for desktop. But at Gubagoo we’ve been putting a powerful analytics ‘brain’ – which tracks, scores, and then relevantly engages every site visitor – to work on dealership sites for over a year. And now all our unique analytics, chat and engagement tools are available on mobile,” said Brad Title, chief executive officer of Gubagoo. “Very soon, mobile will overtake the desktop as the way most people access dealer sites. And if a dealer’s vendors don’t enable smarter chat and more relevant site communications on mobile, they’re throwing 30-40 percent of their traffic away.”

The company also shared some statistics that show Gubagoo Mobile’s pilot success.

The 1,200 dealerships that tested Gubagoo Mobile over the past five months noticed their mobile chat-to-lead conversion rates were higher (74 percent) than for chats happening through the desktop (71 percent).

“When we ‘flipped the mobile switch’ on the Gubagoo platform, our dealer websites had such a surge in chats and calls, that we had to dramatically staff up our 3rd-party chat and call labs. That’s the power of mobile car-shopping in action,” said Title.

Men and women shop for products differently, and one of the key differences is the question of environmental impact. Women have historically been the early adopters of all things green, so it's important to understand how “green” marketing can improve your reach with women consumers. With Earth Day this month, let's talk a little bit about ways to bring some green into your marketing efforts, winning trust and loyalty with women. Women consumers are motivated by causes that mean something to them, and Earth Day is the perfect time to play up the green!

Green Car Care Tips

For the service provider, utilizing green car care tips and practices to help your women customers burn less fuel, produce less emissions, and drive greener will position you as not only an expert technician, but someone who truly cares about the causes she supports. Here are a few green car tips you can utilize in your checkups and consultations:

- Getting a tune-up can improve gas mileage by an average of 4 percent.

- Avoid sudden starts and stops and go the speed limit. Jerky and aggressive driving decreases your miles per gallon (MPG) and increases wear and tear on your vehicle.

- Get the junk out of the trunk! Extra items weigh the vehicle down and cause an increase in gas usage.

- A cooling system thermostat that causes the engine to run too cold will lower the fuel efficiency of a car by as much as one or two mpg.

- Check your vehicle’s gas cap. A loose, damaged or missing gas caps means gas is evaporating, harming the environment and wasting money.

- When filling up your car, remember to stop when the nozzle shuts off! Topping off the gas tank can release harmful vapors into the environment and waste money.

- Replace your car’s fuel filter every two years or 24,000 miles and have your fuel injectors flushed our every 30,000 miles.

Green Tire Tips and More

Another great green car tip deals with tires — reminding and emphasizing the importance of proper tire pressure will help your customers get the most MPG, and decrease wear on their tires as well. For the savvy tire dealer, familiarizing yourself with the manufacturers who make green tires can also help you win the hearts of your women customers.

- Michelin's Green X tires feature low rolling resistance, improved fuel efficiency, and decreased pollution.

- Bridgestone Ecopia tires reduce rolling resistance and increase fuel efficiency.

- Yokohama uses orange oil in place of some petroleum-based products in their tires.

- Hankook's Kontrol Technology creates tires that will last longer.

- Goodyear's Assurance Fuel Max tires are designed specifically to save fuel.

- The Scorpion Verde by Pirelli is a high mileage, eco-friendly tire that's designed to increase MPG and decrease emissions.

What else can you do?

In the auto industry, the existing regulations mean you're already pretty green. However, since to us practices like tire recycling are business-as-usual, you may not be properly educating your customers that these practices exist! Inform your customers of your existing green practices, and augment those with a few extra small steps.

Switching from incandescent to CFL bulbs, using recycled products in your office, or even utilizing products made of recycled tires such as flooring, mulch, and more can really help to emphasize your green-friendly stance and go a long way to improve women consumer's impression of your business.

Take small steps to be a little greener, and before you know it, you'll be the talk of the town among women customers!

Jody DeVere is the CEO of AskPatty.com.

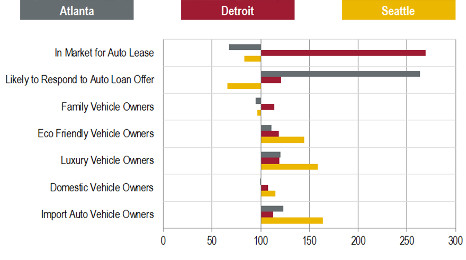

Equifax recently considered the difficult online advertising challenges faced by automakers, ad agencies, finance companies and dealers and how they can vary greatly by region. Analysts dissected trends from three major markets — Atlanta, Detroit and Seattle — in association with leasing potential.

Equifax found that these three markets demonstrate how complex it is to put the right message in front of optimal customers.

“A consumer may aspire to own a luxury sedan, but they may not be able to afford it, or they may need to buy a family car instead. That’s why it’s important for all of these groups to reach the right audience with the right offer for their brands and models,” Equifax’s Jeff Sporn wrote in a blog post on the company’s website.

“The easiest way to do this is to differentiate online consumers in real-time by understanding their preferences,” Sporn continued. “Many online advertisers simply focus on ‘auto intenders;’ but what, exactly, is the ‘intent’ of the intender? Auto marketers need deeper information that helps them determine whether an online consumer is more likely to purchase a luxury car versus a minivan. Or whether they prefer a loan or a lease. Armed with this insight, auto marketers can reach the right audience. When you deliver the right message to the right consumer you can significantly improve the ROI of your online spend.”

With those considerations in mind, Equifax examined trends originating from Atlanta, Detroit and Seattle and summarized them in the chart above. This information was compiled using the Equifax IXI auto-specific digital targeting segments. The bars represent an index value indicating how much more or less likely the cities are to have the listed attribute than the national average of 100.

“We can see clearly that Detroit is far above the national average when it comes to consumers likely to be in-market for an auto lease, while the other two cities are well below,” Sporn said. “Atlanta has more consumers likely to respond to a loan offer, while Detroit is also above the national average. Seattle is well below the national average, so advertisers extending lease or loan offers could divert their budget toward consumers in the other two cities.”

Sporn went on to mention another element about Seattle that makes it unique compared to the other two markets included in this study.

“The city indexes highest for luxury vehicle owners, eco-friendly vehicle owners, and import vehicle owners. Using other measures, we know that 17.0 percent of Seattle’s population is likely to have income greater than $150,000 (compared to 11.6 percent for Atlanta and 9.5 percent for Detroit),” Sporn said. “This means that Seattle is clearly an area that luxury brands will want to target, especially foreign brands and eco-friendly models. Their ads are likely to resonate better in the Northwest than in the other two cities.”

Sporn made one last point about the important of targeted online marketing.

“It’s important to note that these segments do not include any personally identifiable information so brands are not actually targeting or tracking known individuals,” he said. “Segments are estimates of likely household characteristics built using anonymous, aggregated, neighborhood-level data.”