The workforce is changing.

Baby boomers are retiring. Millennials want jobs that offer clear career paths — plus training, flexibility to telecommute and/or spend more time with family, and they aren’t afraid to job hop.

Amanda Looney, manager of talent acquisition at Insurance Auto Auctions, and Will Farmer, executive director of dealer sales at TradeRev, said the auction industry faces the same challenges as other industries when it comes to hiring, training and retaining employees.

Partnering with local trade schools and creating career maps for employees are among the ways the auction industry can help keep employees happy, engaged and in some cases, on paths to promotions, said the two auction executives whose jobs involve keeping tabs on auction jobs.

“What we’ve done is put together entire career maps, virtual maps where you can see the position you are in with arrows pointing to every direction you can take within the field,” said Looney, 34.

“You can actually drill down through that career map and determine what skills are required for that position, what additional training you can get from your manager and the company as a whole. You can map out from day one on the job, exactly where you want to go within the organization, how you want to get there, and we build your performance reviews around it.

“Utilizing that as a tool has been a great technique from a recruiting standpoint.”

More transient millennials

Farmer, who manages a field sales team of about 165 in the U.S., said millennials are hard workers but tend to be more transient and more likely to move from job-to-job in search of a flexible work-life balance.

“I run the sales organization, I don’t work at the corporate office, and I telecommute when I’m not on the road visiting dealers,” said Farmer, 38. “There is a way to adapt to the needs of your employees.”

Looney and Farmer will share insights about recruiting and nurturing talent for traditional and technology driven auction jobs and careers during their presentation: “The Talent Shortage: Attracting the Next Generation of Auction Employees,” scheduled for Nov. 14 at Used Car Week, which is being held Nov. 12-16, in Scottsdale, Ariz.

Both IAA, a salvage auction company, and TradeRev, an appraisal tool and dealer-to-dealer digital auction marketplace, are owned by KAR Auction Services Inc.

KAR Auction has an “enterprise-wide people process” that includes identifying the career-steps for mid-level leaders and high potential employees and developing plans to get them ready for their next roles, the company said.

For example, Farmer cited an employee who joined TradeRev three years ago as an entry-level, market sales coordinator who is now a market sales manager for the company in a large Florida market.

The company has identified that she is on her way to becoming a district sales manager and given her a framework of the skills she needs to acquire over the next six to 12 months to reach that goal, Farmer said.

“To go from a market sales manager to a district sales manager, you become a people leader, meaning you have the ability to coach and hold accountability,” he said.

“Great salespeople don’t always have great leadership management skills immediately. Some skills you have to work on over time.”

In another example, some IAA regional directors started their careers as entry-level yard attendants whose duties are to process and move vehicles around an auction yard and photograph vehicles for online auctions, Looney said.

Connecting with careers

Though IAA has not had a problem attracting service technicians, Looney said the company helps fill that employee pipeline by partnering with programs such as SkillsUSA, described on its website as a national membership association serving high school, college and middle-school students who are preparing for careers in trade, technical and skilled service occupations.

“We have events on state and national levels in which we participate; we are sponsors of the events,” Looney said of IAA’s support of SkillsUSA.

“We speak to them about our company, we speak to them about career opportunities, we do mock interviews with the students and help them prepare for job seeking.”

IAA also works with Collision Repair Education Foundation, which “supports collision repair education programs, schools and students to create entry-level employees and connect them an array of career opportunities,” according to its website.

IAA, through its support of the foundation, donates vehicles to high schools for students to repair and sell, Looney said. Revenues from the sale of those vehicles are plowed back into the schools’ training programs “so they can continue to educate students,” she added.

Both Looney and Farmer said physical auctions are here to stay and are complimented by efficiencies created by technology.

TradeRev uses digital, mobile technology to run its auctions and strives to create a workplace culture that is “fun, honest, accountable and brave,” Farmer said.

“So, for us, it’s about promoting from within and finding tech savvy people who are really driven to grow the business.”

Some dealers might see car haulers arrive at their stores a dozen times or more during a 60-day span, depending on inventory needs and which units are crossing the block.

Manheim is offering its dealer clients an exclusive 60-day free trial to experience what the company believes is a cost-effective way for them to manage their vehicle transport needs.

Central Dispatch is a self-managed transportation solution that can matches shippers with a nationwide network of professional auto carriers for inbound and outbound transportation needs. The Central Dispatch Instant Access promotion is available for sign up through the end of the year.

“Central Dispatch transformed the auto transportation industry when its digital platform came online in 1999 and has grown into the world's largest real-time auto transport marketplace,” said Jim Williams, senior vice president of logistics for Cox Automotive Inventory Solutions.

“Our free trial offer is a valuable opportunity for clients to experience the benefits of connecting and negotiating directly with nearly 12,000 auto transport companies who are eager to ship their cars, trucks and other vehicles,” Williams continued.

A solution of Manheim Logistics, Central Dispatch is one of the largest transportation platforms in the industry, averaging more than 500,000 posts monthly. The subscription service can connect shippers directly with a network of nearly 12,000 transport carriers on a platform that can provide competitive pricing and more control, including the ability to view ratings, insurance documentation and credentials to select the ideal carrier for their move.

Carriers use Central Dispatch as an inventory source with access to millions of cars representing more than $3 billion in load revenue annually.

Available to Manheim dealers who do not have an active Central Dispatch subscription, the company explained the Instant Access program can enable them to have easy access to the self-managed transportation solution, with a fast sign-up process and no credit card required.

“This extended free trial period ensures that Manheim dealers can take full advantage of the Central Dispatch platform and experience its benefits commitment-free for 60 days,” the company said.

More information about the program is available at logistics.mymanheim.com. To sign up for the 60-day free trial, Manheim clients can call (877) 694-9275 or email [email protected].

More than a year later, Hurricane Harvey still is influencing how wholesale prices and used-vehicle sales are analyzed. The record-setting storm that blasted Texas created comparisons that might make metrics appear odd.

According to ADESA Analytical Services’ monthly analysis of wholesale used-vehicle prices by vehicle model class, wholesale used-vehicle prices in September averaged $10,981 — down 0.6 percent compared to August and 0.6 percent lower than September of last year.

KAR Auction Services chief economist Tom Kontos explained prices for the truck model class segments, on average, fell at a similar rate as car prices, supporting his theory that the two groups will tend to move in parity as truck supply outpaces car supply.

In his latest edition of the Kontos Kommentary, he explained how he and the company analyst team are entering the timeframe when Harvey-influenced figures will be involved, especially with their year-over-year examinations.

“As the wholesale used-vehicle market enters the period of time comparable with last year’s hurricane season, wholesale prices will be challenged to meet last year’s high, demand-driven levels,” Kontos said.

“This is reflected in average wholesale prices in September, which fell on both a month-over-month and year-over-year basis, and significantly lower retail used-vehicle sales than last year,” he continued.

“Prices for off-lease units remained strong, however, as upstream remarketing continues to deny volume from physical auctions and causes dealers unable or unwilling to participate in online-only auctions to bid aggressively on the remaining downstream units,” Kontos went on to say, elaborating further in this online video.

A regular part of Kontos’ updates also includes analysis of fleet/lease sales of 3-year-old units with mileage between 36,000 and 45,000 miles. When holding constant for sale type, model-year age, mileage, and model class segment, Kontos discovered prices were up significantly on a year-over-year basis for both midsize cars and midsize SUV/CUVs.

Prices for those midsize cars rose 6.0 percent or $699 to $12,298, while prices for those midsize SUV/CUVs climbed 4.6 percent or $901 to $20,634.

“Midsize car prices continue to outperform prices for midsize SUVs and crossovers, due, as mentioned above, to the incoming supply of trucks outpacing that of cars,” Kontos said.

“The strength of prices for both groups in this analysis indicates, again as mentioned above, that upstream sales are preventing an oversupply of off-lease units from reaching physical auction lots,” he added.

Looking at the September data for the entire market, Kontos shared that average wholesale prices for used vehicles remarketed by manufacturers softened 1.9 percent month-over-month but ticked up 0.7 percent year-over-year.

Kontos noted prices for fleet/lease consignors dipped 1.3 percent sequentially but rose 6.6 percent annually.

Furthermore, he added average prices in September for dealer consignors ticked 0.4 percent lower versus August and 0.3 percent relative to the same month last year.

Kontos closed his latest update by reviewing September sales information he received from the National Automobile Dealers Association and Autodata Corp.

Based on NADA data, Kontos said retail used-vehicle sales by franchised dealers slid 6.3 percent year-over-year in September, and deliveries dropped 8.7 percent for independent dealers.

Kontos also pointed out that September certified pre-owned sales declined 8.9 percent compared to the prior month and 3.9 percent year-over-year, according to figures from Autodata. On a year-to-date basis, he added CPO sales remain up 1.8 percent versus last year.

ADESA Wholesale Used-Vehicle Price Trends

| |

Average |

Price |

($/Unit) |

Latest |

Month Versus |

| |

Sept. 2018 |

Aug. 2018 |

Sept. 2017 |

Prior Month |

Prior Year |

| |

|

|

|

|

|

| Total All Vehicles |

$10,981 |

$11,048 |

$11,046 |

–0.6% |

–0.6% |

| |

|

|

|

|

|

| Total Cars |

$8,617 |

$8,692 |

$8,777 |

-0.9% |

-1.8% |

| Compact Car |

$6,533 |

$6,481 |

$6,681 |

0.8% |

-2.2% |

| Midsize Car |

$7,491 |

$7,590 |

$7,788 |

-1.3% |

-3.8% |

| Full-size Car |

$7,655 |

$7,510 |

$7,243 |

1.9% |

5.7% |

| Luxury Car |

$13,380 |

$13,615 |

$14,016 |

-1.7% |

-4.5% |

| Sporty Car |

$14,327 |

$14,367 |

$13,906 |

-0.3% |

3.0% |

| |

|

|

|

|

|

| Total Trucks |

$12,949 |

$13,040 |

$13,183 |

–0.7% |

-1.8% |

| Minivan |

$8,314 |

$8,222 |

$9,061 |

1.1% |

-8.2% |

| Full-size Van |

$13,365 |

$13,784 |

$13,165 |

-3.0% |

1.5% |

| Compact SUV/CUV |

$10,781 |

$10,765 |

$10,679 |

0.2% |

1.0% |

| Midsize SUV/CUV |

$11,144 |

$11,060 |

$11,424 |

0.8% |

-2.5% |

| Full-size SUV/CUV |

$13,941 |

$13,370 |

$13,742 |

4.3% |

1.5% |

| Luxury SUV/CUV |

$18,285 |

$18,491 |

$19,209 |

-1.1% |

-4.8% |

| Compact Pickup |

$9,981 |

$10,228 |

$9,591 |

-2.4% |

4.1% |

| Full-size Pickup |

$16,317 |

$16,638 |

$16,963 |

-1.9% |

-3.8% |

Source: ADESA Analytical Services. August data revised.

TradeRev — sponsor of the Used Car Awards Luncheon during Used Car Week 2018 — announced the release of the company’s new MOVE METAL service options for sellers.

TradeRev highlighted the offering includes three customized tiers ranging from self-service to full-service, all aimed at helping dealers sell unwanted inventory faster and easier.

Also offered is the company’s new TradeReady seller protection, an optional service that can guarantee no post-sale returns or arbitrations.

The company indicated all service levels include access to TradeRev’s mobile app and desktop marketplace that facilitates live-bidding, one-hour wholesale auctions among thousands of dealers from coast to coast.

TradeRev’s new MOVE METAL service options will be available to qualifying U.S.-based dealers nationwide beginning on Nov. 1.

“TradeRev knows every dealer is unique, and that selling and sourcing inventory is never one-size-fits-all,” said Becca Polak, TradeRev president and chief legal officer for TradeRev’s parent company, KAR Auction Services.

“Our new service levels put dealers in control of their TradeRev auction experience and help them sell their way all day, every day. And to make sure every sale is final, our optional TradeReady seller protection gives sold vehicles an arbitration-free, no-hassle, one-way ticket off the lot,” continued Polak, who is among the collection of industry executives and leaders set to appear during Used Car Week that begins Nov. 12 in Scottsdale, Ariz.

The company mentioned all TradeRev registered sellers can receive in-dealership onboarding and training as well as hands-on support planning and promoting the dealership’s “first sale” event. Sellers at the general TradeRev level can image and launch their own vehicles using the TradeRev mobile app and the company’s artificial intelligence technology.

For dealers who upgrade to the VIP level, TradeRev’s field crew will come to their lot to image vehicles, perform detailed inspections and complete onsite condition reports.

And for dealers who want permanent peace-of-mind on every sale, TradeRev’s all-access level provides the additional power of TradeReady seller protection.

“On the lot or on the phone, the TradeRev crew is all about hustle — we’ll do everything we can to help our dealers win,” said Keith Crerar, executive vice president of U.S. sales and global operations for TradeRev.

“If you love imaging and launching your own trades, keep doing what you’re doing — our coast-to-coast team is standing by to help whenever you need it. But if you’re short on time or manpower, just upgrade your plan, give us the keys and we’ll handle the rest,” Crerar went on to say.

TradeRev’s MOVE METAL service offerings also include two optional add-on services that can be applied on a vehicle-by-vehicle basis.

The negotiation feature can allow sellers to extend the auction time and negotiate one-on-one with the highest bidder directly through the app.

And for dealers who select the new lot sweep service, TradeRev will haul sold vehicles off their lot to an advanced logistics center to clear space for new dealer inventory.

Interested dealers can visit www.TradeRev.com and click “Join Now” to enroll or contact TradeRev customer service at (844) 881-8738 to upgrade their current plan.

With the wholesale price declines for cars beginning to accelerate, Black Book representatives mingling with dealers in lanes nationwide uncovered five interesting trends; ones that might be happening at your local sale or your favorite online bidding platform, too.

First, let’s look at the numbers included in this week’s edition of Black Book Market Insights.

Volume-weighted, editors indicated overall car segment values decreased by 0.54 percent last week. That’s a much higher pace than what Black Book recorded during the previous four-week span when car values decreased by only 0.16 percent on average.

As what was noted from the previous update, as well, Black Book said the sporty car segment experienced the biggest drop, sliding by 0.91 percent or $140.

Meanwhile the volume-weighted data on the truck side showed segment values (including pickups, SUVs and vans) decreased by 0.37 percent last week. Like cars, truck values are softening at a greater rate since market values had dipped by just 0.10 percent on average during the prior four-week period.

Among trucks, Black Book reported the minivan and small pickup segments performed the worst as minivans dropped by 0.95 percent or $123, and small pickups declined by 0.83 percent or $131.

“The decline in used-vehicle values accelerated steeply last week. There was a broad drop in the market, particularly in the car segments,” said Anil Goyal, executive vice president of operations for Black Book.

And finally, here are those observations from throughout the country. See what matches up to your recent experience.

— From Florida: “The buyers were picky as they seem to be doing less speculating for inventory. Trucks continue to perform well here.”

— From Washington: “A more normal fall sale as prices seemed to soften on most vehicles. The dealers that I spoke with were enjoying the decline in values along with a good run of vehicles to choose from.”

— From Illinois: “Representatives from two of the largest remarketers stated they are seeing proceeds come down.”

— From Georgia: “There may be a new pattern emerging: Higher mileage and lower condition vehicles more in demand over the cleaner vehicles.”

— From Wisconsin: “We had more no-sales than usual today along with more vehicles in poor condition.”

Federal officials said Hurricane Michael made landfall near Mexico Beach, Fla., on Wednesday afternoon as a Category 4 storm with maximum sustained winds surpassing 150 mph.

The second major hurricane to strike the Southeast during the past month prompted Cox Automotive experts again to project how many more vehicles will be lost because of intense wind and rain. According to an update shared with the media, including Auto Remarketing, Cox Automotive indicated losses likely will be in the range of 10,000 to 20,000 units, considering vehicle registrations, population and the nature of the event.

“Hurricane Michael is directly hitting a less-densely-populated section of Florida and the fast-moving nature of the storm will likely mean less-severe flooding inland, away from the storm surge. Property damage will likely be significant due to flooding at the coast, but evacuations will help reduce the number of vehicles lost,” Cox Automotive said.

“While significant, that volume should have minimal impact on the overall U.S. auto industry,” the company added.

As both new- and used-vehicle inventories are relatively low, Cox Automotive is expecting temporary upward pricing pressure in the areas most impacted by the storm, particularly on the used-vehicle side.

“Any vehicle loss is a tragedy and hardship for someone. Fortunately, in this case, loss volume will be relatively low,” Cox Automotive said.

After making landfall along the Florida Panhandle, Michael was predicted to steam through Georgia and the Carolinas as that area still is in recovery mode from Hurricane Florence drenching the region in September.

“I ask all Georgians to join me in praying for the safety of our people and all those in the path of Hurricane Michael,” Georgia Gov. Nathan Deal said.

Sagent Lending Technologies, a joint venture between Fiserv and Warburg Pincus that was previously known as Fiserv Lending Solutions, announced last week that its VehicleLinq auto account servicing platform has been integrated into AutoIMS.

AutoIMS is a technology service provider for the vehicle remarketing industry, and its platform connects commercial consignors, auctions and third-party providers.

The integration of the VehicleLinq and AutoIMS platforms is designed to help lenders remarket vehicles quicker and at a strong resale value, Sagent said in a news release.

Users can tap into the integrated dashboard to view data and photos of their inventory as it makes its way through the remarketing process.

“By integrating AutoIMS with VehicleLinq, we are creating a platform that not only speeds up the remarketing process, but maximizes the resale value on inventory for all our auto finance clients,” Sagent chief product officer Charles Sutherland said in a news release. “We have a common goal with AutoIMS, and that is to exceed market expectations today while innovating for the future.”

AutoIMS vice president of client experience Joe Miller added: “AutoIMS is pleased to welcome Sagent as a partner. This integration promises to advance our goal of connecting the remarketing industry in ways that add significant value to all constituents.”

It was announced last month that Fiserv Lending Solutions was launching a new brand identity known as Sagent Lending Technologies.

Auto Fin Journal senior editor Nick Zulovich spoke to Sutherland about that rebranding in the below episode of the Auto Remarketing Podcast.

Likewise, Cherokee Media Group president Bill Zadeits connected with Miller and retiring AutoIMS chief executive officer Mike Broe in March to talk about the company’s 20th anniversary, which it is celebrating this year. Their discussion can be found below.

With pumpkins permeating everything from lattes to yard décor, the appeal of summertime vehicles, especially sporty cars, is softening.

This week’s edition of Black Book Market Insights showed the premium sporty car segment experienced the biggest drop, sliding by 0.53 percent or $209.

Reviewing overall car segment values, editors found their volume-weighted information represented a decrease of 0.21 percent last week. In comparison, Black Book noted the market values of cars had decreased by just 0.09 percent on average during the prior four-week period.

Again volume-weighted, Black Book determined overall truck segment values — including pickups, SUVs and vans — softened by 0.16 percent last week. Editors indicated truck market values had decreased by 0.07 percent on average during the previous four-week span.

Among trucks, the report showed the full-size luxury crossover/SUV segment performed the worst, declining by 0.61 percent or $192.

“Overall, wholesale market values were relatively steady last week with the exception of some luxury and sporty car segments,” said Anil Goyal, executive vice president of operations for Black Book, who is among the collection of experts scheduled to share perspectives during Used Car Week 2018, which begins Nov. 12 at the Westin Keirland Resort and Spa in Scottsdale, Ariz.

Moving along to observations Black Book collected by attending nearly 60 sales nationwide, lane watchers touched on autumn arriving and how dealers are turning the metal they acquire at auction. Here is the rundown:

— From Tennessee: “Retail sales are slow, indicating a return to the more normal fall automotive season. Compact SUVs were the big attraction at the auction today.”

— From Massachusetts: “Today marked the first time in a long time that I heard the term ‘market adjustment’ mentioned. Prices across the board were just OK.”

— From Michigan: “The weather has turned more fall-like setting the tone for a softer market. Dealers were reporting a weaker retail market this week.”

— From Indiana: “Dealers are still buying as business remains strong especially for the nice, cleaner units.”

— From Illinois: “The auctioneers and several remarketers noted that prices were down slightly.”

Update on the specialty markets

The latest analysis from Black Book also included its monthly view of how the specialty markets are behavior. Editors summarized things this way:

— Collectible cars: When “Smokey and the Bandit” was released, Black Book pointed out that performance cars were at a low point, and the Pontiac Trans Am was really the only one still in the game. “The exposure it received revitalized the entire genre and made fast cars ‘cool’ again, leading to a resurgence we are still enjoying to this day,” editors said.

— Recreational vehicles: Black Book noted that the average selling price of towables at auction last month dropped nearly 10 percent, “which is a surprise, given their recent market trends.” Editors went on to say that “it’s important to note that they are still above where they were three months ago, and roughly the same as they have been for most of the year.”

—Powersports: Black Book said overall pricing in the Powersports market is mostly steady this month, with several segments that normally decline this time of year actually ticking up “a little bit.”

— Heavy duty: Editors noticed that buyers with equipment needs continue to pay for good spec, low-mileage trucks. “But they need to be more flexible as the real low mileage trucks become rare,” editors added.

— Medium duty: Editors closed by stating, “We’ve seen less depreciation on the older units mainly due to a limited supply and increased demand.”

Manheim says it will have invested more than $100 million in its digital platforms, through upgrades that started at the beginning of this year and will continue through 2019.

This comes amid a growing push of online wholesale sales, both at Manheim and elsewhere in the auction business.

At Manheim, specifically, in the first half of the year, 45 percent of vehicle sales were digital, compared to 39 percent last year, the company said in a news release Tuesday.

Similarly, over at rival auction chain ADESA, online-only volumes (655,000 units) were up 42 percent year-over-year in the first half, climbing 31 percent when acquisitions were taken out of the equation, according to second-quarter earnings slides from parent company KAR Auction Services.

And independents are getting in on the action, too, giving their buyers alternative methods for wholesale buying.

“As ServNet owners look to enhance their facilities to ensure that that the physical space of the auction stays relevant and efficient, they have also worked hard throughout the year to use and improve the many alternate tools to ensure success for their customers: selling upstream, expanding online capabilities and engaging buyers after the vehicle has crossed the block,” ServNet president Eric Autenrieth writes in a mid-year report from the network of independent auctions.

“ServNet recently conducted a highly successful and first-of-its-kind sale for U-Haul using an innovative approach,” he said.

“We grouped over 100 U-Haul vehicles from the 22 ServNet auctions across the country and offered them in a weekend online-only event through SmartAuction. It was one of the many ways that ServNet auctions collaborate to enhance market exposure for its customers, and is the kind of event we expect to use even more in the future.”

More on Manheim’s $100M investment

The investments Manheim is making cover a wide swath of platforms and services offered by the auto auction company.

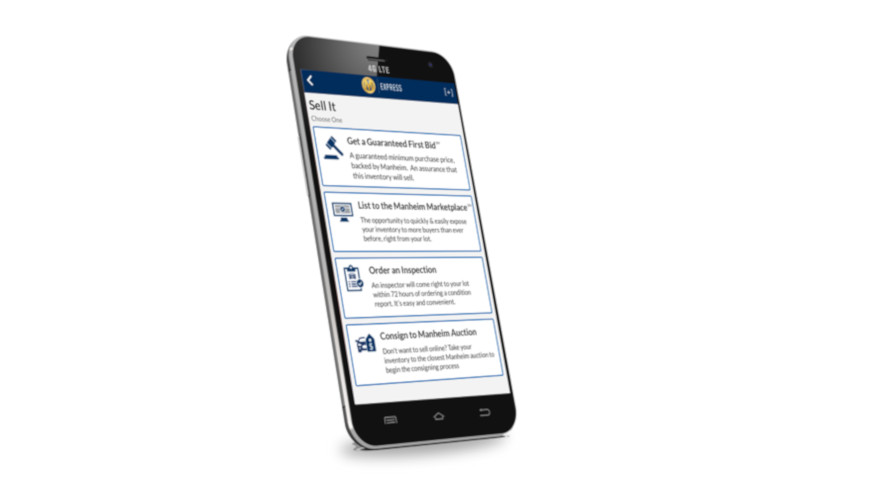

For instance, the Cox Automotive company launched a Manheim Express mobile app in July and plans to roll out a full-service concierge program giving dealers specifically trained advisers on vehicle listing and profitability.

“The Manheim Express app makes it easy to list a vehicle in minutes, with the best imaging in the industry, simple seller disclosures and our Guaranteed First Bid, giving the dealer a hard cash back-up to support the trade-in process” said Derek Hansen, vice president of offsite at Manheim, in a news release.

“And coming soon, we’ll be able to offer a full concierge service for the dealers who prefer not to list cars themselves,” Hansen said. “We’re excited to deploy this force of highly-trained, consultative specialists who can help our dealers maximize efficiency and profitability.”

Manheim has made and continues to make upgrades to platforms like OVE (where it overhauled the search experience), RMS Automotive, Simulcast and Manheim.com, the company said.

“With wave after wave of enhancements, we are delivering a future-proof digital marketplace,” said Nick Peluso, president of Manheim Digital Marketplace and RMS Automotive, in the release.

“We are committed to delivering an omni-channel marketplace that dealers can tap that offers the type of choices they need to compete and thrive in today’s fast-moving used vehicle marketplace.”

Investing in digital ‘the right choice’

Over at KAR, chairman and chief executive Jim Hallett began the ADESA-specific portion of Q2 earnings call's opening comments by emphasizing how prudent it has been to invest in digital platforms.

“First, it is clear to me that we made absolutely the right choice in developing our online selling platforms,” Hallett said.

He pointed to physical auction volumes falling 4 percent in Q2, which “were more than offset” by a 41-percent uptick in online-only volumes during Q2. All told, ADESA had a 9-percent uptick in total volume for the quarter.

“We're gaining market share with our technology-based offerings. We are the clear leader in the private-label auction sites for commercial vehicles, and we are working hard to develop the market-leading dealer-to-dealer mobile application in the industry,” Hallett said.

“We sold 30,000 vehicles on TradeRev platform in the second quarter, and this was more than a 100-percent increase over the prior year. And we are now setting new records for sales on our private-label sites. In fact, we sold 316,000 vehicles on our private label sites, an increase of 29 percent over the prior year,” he said. “And as I think back, I can remember the year that we acquired OPENLANE in 2011 when we sold less than 300,000 vehicles for the entire year.”

Digital to continue gains

In its news release on the $100 million investment, Manheim is anticipating more digital adoption in what it calls the “off-site market,” given the continued additions to Manheim Express, like the full-service concierge, integration with the vAuto Provision product, inventory management dashboard and more.

And in terms of its overall online offerings, Manheim is seeing more folks embrace this way of wholesaling.

The company said in the news release, “Online inventory channels help dealers and commercial sellers develop more cost-effective wholesale operations, reach broader audiences and increase their satisfaction with transactions. Increasingly they are embracing this way to do business, recognizing they can move inventory faster online with 24/7 access to buyers and sellers.”

Carolina Auto Auction expanded its management team, naming two assistant general managers on Monday.

General manager and managing partner Eric Autenrieth announced that Joe LeMonds has been promoted to the post of assistant general manager of sales and marketing. And new to the auction is Vann Humphrey, who has been named assistant general manager of operations.

“I am very pleased to introduce Joe LeMonds and Vann Humphrey as assistant general managers at Carolina Auto Auction,” Autenrieth said. “Both are preeminently qualified in their areas of expertise and will play pivotal roles in our continuing focus to provide a superior buying and selling experience for all our customers.”

Autenrieth noted that LeMonds has worked for Carolina AAA since 2015, most recently as national remarketing manager. In his new role, LeMonds will continue to oversee the auction’s national accounts as well as managing both the fleet/lease and dealer sales team and the auction’s marketing efforts.

“Joe has brought tremendous energy and vision to the auction since joining us three years ago,” Autenrieth said. “He has demonstrated great success in developing strong customer relationships and has a keen understanding of how operations and sales work together. His skills will prove invaluable in taking our sales and marketing team to the next level and building an environment of increased trust and satisfaction for all our customers.”

LeMonds described what it’s like working for this operation, which is a member of ServNet and the National Auto Auction Association.

“At Carolina Auto Auction we are committed to providing a unique customer experience that far surpasses what you see at other competitors’ facilities,” LeMonds said. “Every business day we work to fortify that experience in every auction transaction, from the way vehicles are processed to the way we interact with buyers and sellers.

“We are consistently recognized with top rankings from our commercial accounts, and I’m excited to build on that success for both our dealer and fleet/lease customers,” he went on to say.

Although Humphrey is new to his role as assistant general manager of operations, Carolina Auto Auction has enjoyed a long relationship with him. Auterieth mentioned that Humphrey was an auction customer for many years as the director of remarketing for First Investors.

“We are delighted that Vann has joined the team at Carolina Auto Auction,” Autenrieth said. “He brings with him a strong background in quality control and compliance, and has tremendous skill in seeking out the most efficient and effective ways to get a process done. His experience as auction customer provides a valuable perspective and will enhance all areas of our auction operations.”

Humphrey touched on making the transition from being with a consignor to auction management.

“My relationship with Carolina Auto Auction goes back nearly two decades, and I considered CAA to be one of the top auctions for the better part of my career as a vehicle remarketer,” Humphrey said. “I’m thrilled to be on the auction side of the table, and am excited to work with a great group of auction professionals.

"In overseeing dealer registration, CR writing, lot operations and recon, my goal will be to make our already superior team function with ever increasing levels of quality and efficiency, to the ultimate benefit of every auction customer," he went on to say.

Carolina Auto Auction was founded in 1990 and is a part of the Stanley-Autenrieth Auction Group, owned by Henry and Patty Stanley and led by their son Eric Autenrieth.

Situated in Anderson, S.C., midway between Atlanta and Charlotte, N.C., the auction serves customers throughout the United States with a full offering of dealer consignment, fleet, lease, daily rental, insurance and financial institution vehicles.

The eight-lane facility also offers one of the largest dealer consignments in South Carolina and the Southeast.