KAR Auction Services chief economist Tom Kontos pointed out two specific reasons why May wholesale prices registered only a “modest” move lower year-over-year.

According to ADESA Analytical Services’ monthly analysis of wholesale used vehicle prices by vehicle model class, wholesale used-vehicle prices in May averaged $11,114. That figure was flat compared to April and down a “modest” 0.2 percent relative to May of last year, according to Kontos.

The latest installment of the Kontos Kommentary released on Monday also mentioned that average prices softened on a year-over-year basis for both cars and trucks, with mostly month-over-month declines for cars and mostly month-over-month increases for trucks. Kontos spotted a notable exception among the truck classes was the compact SUV/CUV segment, “which showed a seasonal decline perhaps reflective of the fact that these vehicles are starting to return to the wholesale market in larger numbers after several years of strong new-vehicle sales.”

Kontos also recapped that average wholesale used vehicle prices registered their third consecutive year-over-year price decline in May.

“However, prices were again seasonally strong, and retail used vehicle sales were solid, especially for independent used-vehicle dealers,” he said. “Wholesale prices remain strong for off-lease vehicles, which, as noted last month, is testimony to the effectiveness of upstream sales in preventing oversupply of these units at physical auctions.”

To reinforce that assessment, Kontos again shared metrics for two specific segments that are 3 years old with less than 45,000 miles.

When holding constant for sale type, model-year age, mileage, and model class segment, prices were up on a year-over-year basis for both midsize cars and midsize SUV/CUVs. Midsize car prices rose 3.5 percent or $408 to $11,943, while midsize SUV/CUV prices climbed 2.6 percent or $538 to $20,858.

“As noted last month, this analysis indicates that wholesale values for off-lease units are holding up well despite the overall softening market trend and is evidence of the effectiveness of new remarketing approaches in redistributing supply into various sales channels and geographically,” Kontos said.

Kontos relayed other ADESA information from May that showed average wholesale prices for used vehicles remarketed by manufacturers were down 2.0 percent month-over-month and up 5.7 percent year-over-year.

Prices for fleet/lease consignors ticked up 0.8 percent sequentially and 6.8 percent annually.

Average prices for dealer consignors dipped 1.5 percent versus April and 3.2 percent relative to last May.

Finally, Kontos closed with data from the National Automobile Dealers Association that indicated retail used-vehicle sales by franchised dealers slipped 1.5 percent year-over-year in May but climbed 2.4 percent for independent dealers.

He added that May certified pre-owned sales were up 12.5 percent from the prior month and up 4.8 percent year-over-year, according to figures from Autodata. On a year-to-date basis, CPO sales are up 2.2 percent versus last year.

Kontos elaborated more about the wholesale market in a video available here as well as at the top of the page.

ADESA Wholesale Used-Vehicle Price Trends

| |

Average |

Price |

($/Unit) |

Latest |

Month Versus |

| |

May 2018 |

April 2018 |

May 2017 |

Prior Month |

Prior Year |

| |

|

|

|

|

|

| Total All Vehicles |

$11,114 |

$11,116 |

$11,1401 |

0.0% |

–0.2% |

| |

|

|

|

|

|

| Total Cars |

$8,662 |

$8,778 |

$8,955 |

-1.3% |

-3.3% |

| Compact Car |

$6,483 |

$6,562 |

$6,836 |

-1.2% |

-5.2% |

| Midsize Car |

$7,626 |

$7,701 |

$7,967 |

-1.0% |

-4.3% |

| Full-size Car |

$7,845 |

$7,753 |

$8,395 |

1.2% |

-6.5% |

| Luxury Car |

$13,304 |

$13,474 |

$13,767 |

-1.3% |

-3.4% |

| Sporty Car |

$14,453 |

$14,625 |

$14,310 |

-1.2% |

1.0% |

| |

|

|

|

|

|

| Total Trucks |

$13,200 |

$13,139 |

$13,247 |

0.5% |

–0.3% |

| Minivan |

$9,939 |

$9,901 |

$9,117 |

0.4% |

9.0% |

| Full-size Van |

$13,636 |

$13,807 |

$13,360 |

-1.2% |

2.1% |

| Compact SUV/CUV |

$11,051 |

$11,096 |

$10,877 |

-0.4% |

1.6% |

| Midsize SUV/CUV |

$11,449 |

$11,425 |

$11,860 |

0.2% |

-3.5% |

| Full-size SUV/CUV |

$14,291 |

$13,878 |

$14,077 |

3.0% |

1.5% |

| Luxury SUV/CUV |

$18,678 |

$18,645 |

$19,321 |

0.2% |

-3.3% |

| Compact Pickup |

$9,422 |

$9,407 |

$9,368 |

0.2% |

0.6% |

| Full-size Pickup |

$16,278 |

$16,137 |

$16,778 |

0.9% |

-3.0% |

Source: ADESA Analytical Services.

Dealers Auto Auction Group continues to spread its reach throughout the Southeast.

The company announced that it has purchased Tri-Cities Auto Auction in Bluff City, Tenn. A news release indicated the auction will be renamed Dealers Auto Auction of East Tennessee.

The facility operates with four lanes along with detail and mechanical departments and offers more than 250 units every Wednesday starting at 10 a.m. ET.

The company added that Gary Montgomery will continue as general manager.

“We are very excited with the acquisition of Tri-Cities Auto Auction into the DAAG family,” Dealers Auto Auction Group chief executive officer David Andrews said.

“We feel that this location is a good fit within the overall footprint of our auctions and will be able to offer our customers another outlet to buy and sell their vehicles,” Andrews continued.

With the purchase of this operation, Dealers Auto Auction Group now possesses seven locations. Dealers Auto Auction Group was started back in 2001 with its first auction in Horn Lake, Miss. The company portfolio now includes:

— Dealers Auto Auction of Jackson

— Dealers Auto Auction of Memphis

— Dealers Auto Auction of Murfreesboro

— Dealers Auto Auction of Chattanooga

— Dealers Auto Auction of Huntsville

— Dealers Auto Auction of Mobile

— Dealers Auto Auction East Tennessee

Scott Keener, director of operations for DAAG added, “DAAG has a business growth plan to expand our footprint over the next five years, and this acquisition is one of many more to come.”

For more information, visit www.dealersauto.com.

Alan Mulally, who was Ford Motor Co.’s president and chief executive officer from 2006 to 2014, will be a keynote speaker at the National Auto Auction Association’s annual convention in November, the trade group said Tuesday.

Mulally’s keynote presentation will be during NAAA’s opening luncheon Nov. 14, and it will be followed by a moderated Q&A session that also includes:

- Cox Automotive president Sandy Schwartz

- KAR Auction Services chairman and CEO Jim Hallett

- BSC America chairman and CEO Ray Nichols

The NAAA Convention is held in partnership with the National Remarketing Conference as part of Used Car Week, which takes place Nov. 12-16 at the Westin Kierland in Scottsdale, Ariz.

“We’re honored and thrilled to have someone of Alan Mulally’s leadership caliber and business acumen in the industry deliver our keynote address,” NAAA chief executive Frank Hackett said in a news release.

“The Ford Motor Company has been a loyal member of our association and has graciously sponsored a vehicle for NAAA presidents to use as official transportation during their annual term,” Hackett said.

When it was announced in May 2014 that Mulally would be retiring from his role leading Ford that July, the automaker had achieved 19 consecutive quarters of profits.

He is largely credited for being the key cog to the automaker’s turnaround.

“Alan deservedly will be long remembered for engineering one of the most successful business turnarounds in history,” Ford’s executive chairman Bill Ford said in a statement when Mulally’s retirement was announced in 2014.

“Under Alan’s leadership, Ford not only survived the global economic crisis, it emerged as one of the world’s strongest auto companies. We always will be grateful to Alan for his leadership, compelling vision and for fostering a culture of working together that will serve our company for decades to come.”

To register for the NRC/NAAA Convention and Used Car Week, visit https://www.usedcarweek.biz/register/.

With the Fourth of July holiday within striking distance, Black Book is seeing typical depreciation patterns common for this time of year.

Editors noted in this week’s Black Book Market Insights report that overall depreciation remained in check as prices for a handful of car and truck segments were unchanged or even increased a little.

“Overall depreciation rates are stable for car and truck segments for this time of the year. Midsize cars did experience a higher drop last week,” said Anil Goyal, executive vice president of operations at Black Book.

Volume-weighted, editors indicated that overall car segment values decreased by 0.35 percent last week. In comparison, these values had decreased on average by 0.23 percent per week in the previous four weeks.

As Goyal mentioned, Black Book found that prices for midsize and compact cars decreased the most among car segments, softening by 0.62 percent or $57 and 0.51 percent or $42, respectively.

Again volume-weighted, editors pointed out that overall truck segment values — including pickups, SUVs and vans — dipped by 0.28 percent last week. That figure represents a jump from values decreasing by 0.14 percent on average per week during the previous four weeks.

Among truck segments, Black Book noticed prices for compact luxury crossover/SUVs and minivans declined the most last week, dropping by 0.50 percent or $99 and 0.45 percent or $58, respectively.

Turning next to what Black Book representatives spotted in the lanes last week, much of the sales recaps originated from the buyer perspective, including:

— From Georgia: “It was a better day to be a seller than a buyer as prices remain pretty strong. Buyers continue to purchase vehicles without much concern over the condition of the vehicle.”

— From Colorado: “Buyers are at the auctions, but there aren’t enough cars to satisfy the demand.”

— From Massachusetts: “Every dealer and captive consignor said the money was good and even better than last week.”

— From North Carolina: “A buyer said that his buy-here, pay-here business is better than it has been in many years.”

The final anecdote of the week came from a Black Book representative stationed in Texas describing buyers from more than 1,000 miles away.

“A very successful dealer in Pennsylvania says that he is having difficulty sourcing the type of vehicles that he retails. His sweet spot is the 4- to 7-year old, low-mileage vehicle,” the lane watcher in the Lone Star State said.

The National Auto Auction Association (NAAA) has invited auctions to take part in this year’s NAAA Auction of the Year Award for Excellence for Community Service contest.

Auctions can now nominate themselves or auction group members for honorable volunteer efforts easily from NAAA’s website.

In addition to winning $25,000 to gifted to any charity of choice, the recognized auction will get a cover photo and feature story in both NAAA’s On The Block magazine and 2019 membership directory, along with a crystal trophy.

Auctions can enter to win the award or nominate a member up until July 13.

Click here for more details about the award and how to submit a nomination entry.

Rawls AA boasts 80 years in business

In celebration of reaching 80 years in business, Rawls Auto Auction held a special anniversary sale last month.

NAAA recognizes the business as the beginning of the auto auction industry, Rawls AA owner and general manager Jimmy Rawls said in a news release.

About 80 years ago, Rawls’ father J. M. “Martin” Rawls held the first auto auction in Leesville, S.C.

From 1938, Rawls AA has grown to house seven auction lanes, as well as both full mechanic and reconditioning facilities.

This year, the auction received upgraded Auction Edge Simulcast high definition cameras and renovated lane flooring, according to Rawls AA.

Xcira Cubed platform turns 1

Xcira has offered its Cubed Platform that is designed to help auctions easily facilitate and manage transactions for a full year now.

The platform is made up of an integrated auction management system, a dealer community, a floor plan loan management system and the OnLine Ringman system.

The company announced on Wednesday that the Xcira Cubed Platform is currently in use by Flint, Michigan’s Fastlane Auto Exchange.

Early last year, Fastlane Auto Exchange began looking for available technology options that can help the company grow when it found Xcira, according to the company.

“Tonya, Greg and the Fastlane Auto Exchange team have been wonderful partners for the Cubed Platform, bringing outstanding auction operational insights and valuable dealer feedback,” Xcira vice president Bill Cieslak said in a news release. “I am thrilled that Xcira and Cubed has been part of Fastlane Auto Exchange’s growth, and I look forward to our collective successful journey together.”

Fastlane Auto Exchange started full-scale production use of Xcira’s Cubed Platform without the floor plan component last May.

“The new auction management system component of the Cubed Platform has made our auction process much more efficient,” said Tonya Price, Fastlane Auto Exchange’s business manager.

“Administratively and operationally, the single-clerk, paperless system is seamless. As well, we have received positive feedback regarding its ease of functionality from our online client base.

“Financially, Cubed provides daily accounting balances, which offers us the ability to quickly reconcile and review our financial status and has reduced our overall technology expenses affording us the ability to invest in our growth,” explained Price.

The experts at Black Book and J.D. Power Valuation Services are seeing a wide array of factors ranging the juncture of the calendar to fuel costs to volume in the lanes all impacting their forecasts and most recent wholesale price recaps.

Before looking at what happened at last month as well as last week throughout the auction world, let’s first focus on what the wholesale price expectations are for June.

J.D. Power Valuation Services projected that wholesale prices of vehicles up to 8 years in age are expected to soften by about 0.2 percent. However, when considering full-year expectations, analysts continue to peg wholesale prices ticking up by about 0.8 percent, triggered in part by what they dubbed “exceptionally strong performances” recorded earlier in 2018.

“Negative forecast factors hurting used vehicles continue to be incentives, an anticipated increase in used supply, worsening credit conditions and increasing gasoline prices,” J.D. Power Valuation Services said in its latest issue of Guidelines.

“However, positive factors — such as favorable labor conditions, strengthening housing prices, along with long-term quality improvements — will outweigh the negatives,” analysts continued in the report.

Looking at how analysts arrived that forecast, J.D. Power Valuation Services described the wholesale market turning in a “typical performance” in May.

The J.D. Power Valuations Services’ Seasonally Adjusted Used Vehicle Price remained flat in May when compared to April, sitting at 117.0. That reading settled 3.1 points above the year-ago level and 2.5 points ahead of where the index stood in January.

While the index didn’t shift, analysts determined wholesale prices for vehicles up to 8 years old fell by 1.7 percent in May on a month-over-month basis. The softening was on par for what J.D. Power Valuation Services often spots during this month and actually wasn’t quite as severe as the five-year average, which represented a 2.2-percent drop.

Analysts pointed out that prices for midsize and large trucks went counter to the overall May movement as the former eked out a 0.3-percent price uptick while the latter remained flat.

Prices for large utilities dropped the most in May, according to Guidelines, softening by 3 percent. Not far off that pace were compact utilities (down 1.6 percent) and compact cars (down 2.1 percent).

On the luxury side, J.D. Power Valuation Services noticed large luxury utilities sustained a 4.9-percent price tumble, the most intense monthly drop for the segment since 2008. Analysts mentioned that these units typically hold up well as the 5-year average stood at dip of less than 1 percent.

Prices for luxury compact utilities (down 3.5 percent) and luxury midsize cars (down 3.4 percent) also sustained notable drops in May, according to Guidelines.

Weekly price movement

As they do on a regular basis, the editors at Black Book chimed in with their analysis looking at how wholesale prices moved on a weekly comparison.

This week’s Black Book Market Insights report highlighted that car values in particular showed some of their highest value declines in the last four months, with segments such as Luxury and compact cars leading the way.

Conversely, editors pointed out that the only segment out of all cars and trucks to still show a price increase involved sporty cars.

“As the weather warms up, widespread seasonal declines begin to show in used vehicle values across most segments,” said Anil Goyal, executive vice president of operations at Black Book.

Volume-weighted, Black Book determined that overall car segment values decreased by 0.38 percent last week. In comparison, the values had decreased on average by 0.20 percent per week during the previous four weeks.

Among car segments, those luxury cars declined by 0.59 percent or $112. Sporty cars edged up by 0.12 percent or $18.

Volume-weighted, Black Book noticed overall truck segment values — including pickups, SUVs, and vans dropped by 0.24 percent last week. In comparison, the values had decreased on average of just 0.09 percent per week during the previous four weeks.

Within truck segments, editors pinpointed that prices for full-Size vans decreased the most last week, sliding by 0.56 percent of $86.

Black Book closed its latest update by sharing some of the best anecdotes from its representatives stationed at roughly 60 sales nationwide. Two of the recaps surfaced out of Illinois.

“Overall, it was a good sale. Full size SUVs continue to drop in value but have slowed down the pace in the last couple of weeks,” one lane watcher in Illinois shared.

The other representative from the Land of Lincoln added: “A new-car dealer who sold 25 here today said that he was pleased with the activity as well as the prices.”

As Goyal referenced, the influence of summer is impacting auction activity, and it was apparent in Michigan where the observer noted, “A normal summer pattern as vehicles with issues sold only if they were floored very low.”

Over in Massachusetts, dealers didn’t dip into their floor plan unless the vehicle met their specifications.

“Nice, clean cars brought good money, but everything else was a challenge in both activity and value,” Black Book representative from Massachusetts said.

Finally, the story out West went this way: “We had a decent sale today, but I had several dealers tell me that prices are inching down in retail,” the lane watcher in Arizona said.

Though it is currently a bit softer than year-ago figures, overall auction volume should exceed 2017 levels “soon,” according to the latest Guidelines report from J.D. Power Valuation Services.

The report released this week is updated through the year’s first five months. It found that overall auction volume is down 0.7 percent.

However, that could change.

“Year over-year volume continues to grow with each passing month, and as a result there should be a transition soon where there is more overall auction volume compared to 2017,” J.D. Power analysts said in the report.

Looking at late-model units, specifically, they had a 12-percent month-over-month gain in volume during May. Late-model volume climbed 2.6 percent year-over-year last month.

Separately, J.D. Power Valuation Services looked at used-car supply trends in detail as part of its spring Perspective report.

In that report, analysts project a 4.1-percent year-over-year hike in the total supply of used cars up to 5 years old in 2018. There is likely to be a 14.2-percent increase in the crop of off-lease units, in particular, which remain the key catalyst to supply growth.

Retail purchase supply is likely to grow 2.6 percent, with rental and commercial volume falling about 3 percent — which would be the first “material decline” for that crowd in four years, according to J.D. Power.

All this follows last year’s 7-percent growth in supply of used cars up to 5 years. Off-lease volume was up 13.5 percent in 2017.

In its 2018 Used Car Market Report & Outlook released earlier this year, Cox Automotive said it expects another year of 10 million wholesale vehicles at traditional, brick-and-mortar auto auctions in 2018.

The report’s section on wholesale volumes and pricing was written by Zohaib Rahim, manager of economic industry insights at Cox Automotive .

In that section, Rahim said wholesale volumes at physical auctions should remain at this “near-record” height referenced above. In 2017, the tally was close to 10 million, according to an estimate of member auction sales by the National Auto Auction Association cited in the Cox report.

Students in the Auction Academy's fifth class are done with half of this year’s training and development agenda for the two-year program, having already attended multiple sessions in Dallas and Birmingham, Ala., this year.

In addition to beginning Certified Automotive Remarketer certification training last month, Auction Academy students got an opportunity to visit America’s Birmingham Auto Auction and ADESA Birmingham.

In Birmingham, Jason Murdock, a recent Auction Academy graduate, also directed the group during a hands-on workshop concentrated on vehicle frame damage and repair education.

Auction Academy’s second half of remaining 2018 sessions includes an upcoming trip to Chicago, followed by a last session of the year in Detroit.

While in Chicago, the class has plans to visit America’s Chicago Auto Auction, led by auction manager Larry Hero, as well as meet with representatives from Donlen, NCM Associates and World Omni Financial.

The class' visit to Dallas last month began at Santander Consumer USA with executive vice president of asset remarketing, loan and lease servicing Brent Huisman, along with a dinner hosted by America’s AA chief executive officer Ben Lange.

With Huisman, students learned about how his staff remarkets vehicles for both Santander and Chrysler Capital, while Lange shared how he grew America’s AA through methodical strategic acquisitions in conjunction with the development of greenfield auction sites, according to Auction Academy.

A day later, Dallas’ Metro Auto Auction general manager Scott Stalder and assistant GM Rob Gorman hosted the class for another session comprised of training from four industry leaders.

Auction Academy said United Auto Credit director of loss mitigation Scott Mousaw, who covered strategy for purging repossessed vehicles, joined CEO of Liquid Motors Michael Daseke and Chase Tidwell, who serves as National Independent Automobile Dealers Association VP of sales and marketing.

Meanwhile, in addition to Auction Academy’s two-year training and development events, its additional seminar series recently sustained the continuing education program ’s very first session on workplace culture involving a particular presentation titled “Respect in the Workplace, Beyond #MeToo,” from employment and labor law firm Littler Mendelson’s C. Eric Stevens.

“We chose as the first topic area for 2018 the various aspects of workplace culture, specifically to include harassment of any type: physical, sexual, verbal or visual.” Auction Academy presidenty Penny Wanna said. “Not only is this a timely subject, given what we see in the worlds of media, entertainment and government, but it is a critical subject with profound implications for the workplace in our industry.”

Moreover, in a news release, Wanna touts that Auction Academy’s seminar series brings additional one-day intensive sessions that are designed to deliver practical hands-on information concerning a specific auto auction business topic or functional area once per quarter.

In March, along with Stevens, seminar participants also heard from Daoud Abudiab, president of the Faith and Culture Center of Nashville, Tenn.,, Arthur J. Gallagher and Co.’s Mike Roy, who covered employment practices liability insurance, as well as Clint Bruce from domestic limited liability company Tacletics and CARS Recon chief operating officer Kay Hudson, who spoke about HR employee practices, according to Auction Academy.

Additionally, Wanna said that pre-registration for its next class in spring 2019 is now open.

The fifth class will graduate in March during the 2019 CAR Conference in Las Vegas, according to Auction Academy.

Amid a backdrop of companies in the wholesale automotive space investing in mobility, Manheim opened a 20,000-square-foot Retail Reconditioning facility at its San Francisco Bay location on Wednesday that will serve new vehicle mobility providers, along with the auction company’s more traditional customer base of dealers and commercial consignors.

The $500,000 facility is part of a three-year, $1.5 million investment Manheim has made at the Hayward, Calif., auction.

“We are uniquely positioned to offer end-to-end solutions to independent and franchise dealers, fleet operators, ride sharing companies and manufacturers,” Manheim San Francisco Bay general manager Greg Beck said in a news release.

“Our proximity to Silicon Valley, home to many of tomorrow’s vehicle mobility providers, is just one more way we are poised to deliver tremendous value and meet client and industry needs,” Beck said.

This new Retail Reconditioning facility in earshot of Silicon Valley follows a mobility play that Manheim’s parent company made just two weeks ago.

Cox Automotive announced at the end of May it was the lead investor in a $28.61 million Series B funding round for Ridecell, a software platform used to run mobility services like carsharing, ridesharing and autonomous fleet management.

That continued a series of moves Cox Automotive has made in the space since 2014, including investments in LiDAR sensor developer Ouster, vehicle subscription provider Clutch and the Getaround car-sharing platform. In 2014, Cox Automotive began incubating the Flexdrive subscription platform that is now a joint venture with Holman Enterprises.

Similarly, rival KAR Auction Services, the parent company to ADESA auctions, made a major mobility investment with its purchase of STRATIM in February, a move that has implications for ancillary auction services like reconditioning.

$24 billion business

Manheim, which entered the retail recon space in 2015, offers these services to everyone from dealers and OEMs to consignors and mobility players. The opportunity is a prime one for auctions, as Manheim pinpointed retail recon as a $24 billion business.

With the addition of Manheim San Francisco Bay, the auction company has 19 Retail Reconditioning centers. Each is affiliated with a Manheim auction location, a company spokesperson confirmed.

The latest center has seven lifts and its sale-preparation services run the gamut from inspection, mechanical/body recon and paintwork to detailing, merchandising and imaging.

The San Francisco Bay location’s technicians can process work on approximately 100 vehicles each week, Manheim said.

“By outsourcing such services to a single point of contact at one location, clients can focus on customers, fulfill retail demand faster, and save time and money,” the company said in a news release. “Further, this alternative to in-house recon frees up a dealer’s own service bays for paying customers and gets retail-ready vehicles to their lot quickly — typically within four to 10 days, depending on client specifications and vehicle condition.”

Beck, the Manheim San Francisco Bay auction GM, added, “The conveniences and flexibility generated by Manheim’s Retail Reconditioning solution help dealers improve efficiency, speed, capacity and margins. It can even help reduce costs, by avoiding vehicle transport to/from multiple locations and enhance the unit’s value.”

All told, Manheim has put more than $17 million behind these Retail Reconditioning facilities over the years, and it prepped more than 30,000 vehicles at these locations in 2017.

Auto Remarketing was on hand for the grand opening of one of these facilities (Darlington, S.C.) in May 2016. At that time, the program now known as Retail Reconditioning was referred to as Retail Solutions.

Operators feeling charitable can help the National Independent Automobile Dealers Association next week.

For the sixth consecutive year, ADESA, a business unit of KAR Auction Services, will auction off a premier vehicle during the NIADA Convention and Expo to benefit the NIADA Foundation.

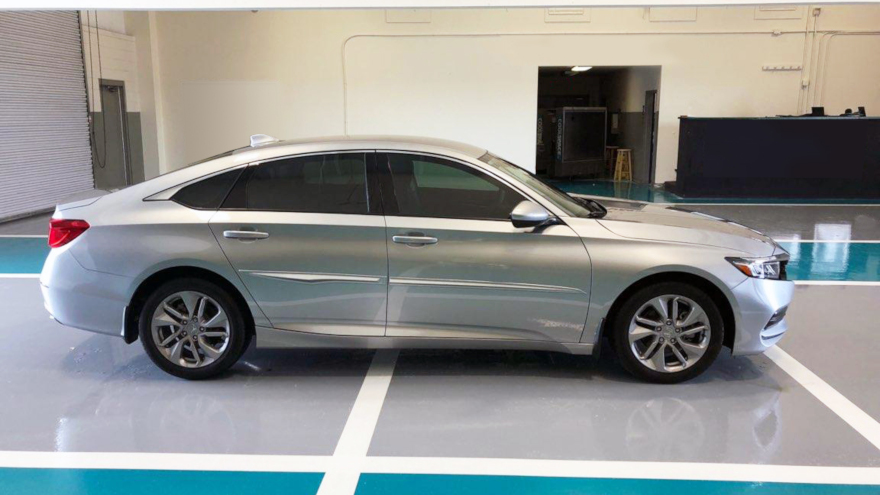

This year's vehicle is a silver 2018 Honda Accord sedan with a mere 1,188 miles on the odometer. The vehicle will be on display in the Expo Hall during the Convention, which begins Monday at the Rosen Shingle Creek Resort in Orlando, Fla. The Expo opens the next evening.

The auction will be held at 1:30 p.m. ET on Thursday at the NIADA Dealer Lounge in the center of the Expo Hall.

ADESA will transport the vehicle free for the winning bidder to any location in the continental U.S.

All proceeds from the auction will benefit the NIADA Foundation, which coordinates the association's commitment to charitable giving as well as awarding scholarships to deserving college-bound students across the nation and providing training and educational opportunities to automobile dealers and the general public.

Past foundation activities include raising more than $180,000 to assist members of the automotive community affected by last year's hurricanes, as well as additional disaster relief efforts, making significant donations to charities nationwide, providing matching funds for local charitable projects and funding endowments for university scholarships.

During the past five years, officials tabulated that ADESA-sponsored auctions at the NIADA Convention have raised a total of $125,200 for the NIADA Foundation. During last year's event, a 2016 Nissan Frontier SV pickup sold for $28,000.

More details about this year's NIADA events can be found here.