Insurance Auto Auctions announced Thursday the launch of its newest auction channel for targeted buying and selling — Ignite Auction — in conjunction with the grand opening of its IAA Ignite Auction location in Portage, Wis.

Via IAA Ignite, sellers can consign vehicles utilizing the platforms suite of auction channels, IAA Live and Online, IAA Timed Auctions and IAA Buy Now.

“We wanted to create an efficient marketplace for independent dealers and rebuilders with access to the clear title, run and drive, higher mileage segment of inventory they desire,” IAA chief executive officer and president John Kett said in a news release. “By leveraging our multi-channel auction model, we can match the right buyer to the right seller. Our new location in Portage, Wisconsin will serve as the launching point for the IAA Ignite brand.”

The company’s new Portage IAA Ignite Auction, previously ADESA Wisconsin, will operate much like an IAA Auction, aside from the specific inventory that the location will offer.

This news follows IAA’s early January announcement that it has relocated its Jackson, Miss., branch and expanded its Grenada facility in the same state to boost the company’s inventory capacity.

A 2018 Chevrolet Corvette Carbon 65 from GM Financial, one of only 650 limited edition vehicles produced to commemorate the Corvette’s 1953 debut., was auctioned off at ADESA Los Angeles on Jan. 25.

GM Financial said Wednesday that the amount the special vehicle sold for is currently undisclosed, however, Chevrolet's first retail production model of the 2018 Corvette Carbon 65 was auctioned off to benefit military veterans on Jan. 20 for $1.4 million at Barrett-Jackson in Scottsdale, Ariz.

The Carbon 65 that was sold last week at ADESA Los Angeles is an early production number of the commemorative model, according John Sullivan, GM Financial vice president of remarketing, auction operations.

“It’s an early production number, the first one was actually sold this past week at Barrett-Jackson,” Sullivan explained during a late-January phone interview with Auto Remarketing.

“General Motors donated the vehicle, and another first 2019 Corvette; but this one, the Carbon Fiber, was signed by President George [W.] Bush, and it was auctioned off for charity, and it brought $1.4 million at Barrett-Jackson last week,” he said, referring to the vehicle sold Jan. 20.

Atlantic Automotive Group owner John Staluppi bought the signed Corvette sold at Barrett-Jackson, according to a Chevrolet news release, and proceeds from the sale went to the Bush Center’s Military Service Initiative.

The track-inspired Carbon Edition 65 package is offered on 2018 Grand Sport and Z06 models.

According to Sullivan, the package is approximately $15,000.

Some of the Carbon 65 package’s unique features include:

- Ceramic matrix gray exterior (blue top on convertibles)

- Carbon flash badges and outside mirrors

- Jet black suede-wrapped interior with blue stitching

- Carbon-fiber steering wheel rim and gloss carbon-fiber interior trim

- Competition sport seats

- Carbon Edition sill plates

Editor's Note: Updated and corrected for clarity regarding models and sales.

ADESA will have a new president on Feb. 26.

Parent company KAR Auction Services said late Thursday afternoon that Stéphane St-Hilaire, who has been ADESA’s president since early 2014, is resigning.

Taking on the role is John Hammer, who had been chief executive of KAR’s Automotive Finance Corp. business until 2016. Hammer was most recently CEO of U.S. Auto Sales, Inc.

St-Hilaire will remain with the company until the end of February to aid in the transition; Hammer will rejoin KAR on Feb. 26.

“John has a 25-year track record of delivering successful results. He knows our industry, he knows our company and above all, he knows our culture,” KAR chairman and CEO Jim Hallett said in a news release.

“ADESA is well positioned for the future, and John’s expertise and entrepreneurial drive will positively impact our customers at every level. He’s a seasoned leader who is committed to employee engagement and collaboration — so I am eager to see what we can accomplish together.”

Hammer’s responsibilities include the operations of ADESA and 75 auction locations throughout North America. He will report directly to Hallett and serve on KAR’s senior leadership team.

“I am thrilled to lead ADESA and rejoin the incredible KAR management team that Jim Hallett has strategically assembled,” Hammer said in the release. “KAR and ADESA have made meaningful investments in people, technology and data analytics that will help us rapidly deploy new, innovative customer solutions. I look forward to leveraging KAR’s diverse capabilities, and getting out to the field to hear from our customers and our employees.”

St-Hilaire became ADESA Canada’s chief financial officer in 1998 and held various senior positions with the company during the last two decades.

“Over the past 20 years, Stéphane St-Hilaire has remained a dedicated and committed member of the KAR team and we wish him the best in his next chapter,” said Hallett.

One discussion topic that often comes up at used-car industry conferences is this: the increased digitalization of the wholesale vehicle market, be it through third-party platforms or the online offerings of auction players.

Well, a few statistics released Tuesday show some concrete proof of how far that digitalization has come.

Saying the company saw “unprecedented growth of its offsite channels,” Manheim said 40 percent of cars sold through the auction company last year were bought on digital screens.

In fact, Manheim reported 2 million purchases via digital transactions in 2017. Of that total, 630,000 were done through “pure digital platforms” — i.e. on the Manheim.com, OVE and RMS platforms. The latter figure is an increase of 15 percent.

The 2 million figure includes Simulcast sales. And interestingly enough, Simulcast users represented more than half of Manheim’s physical auction attendance last year, the company said.

Going beyond the brick-and-mortar, there was a 30-percent hike in offsite transactions (what Manheim describes as purchases outside physical auction).

“Our goal is to enable clients to conduct transactions in the office, on the lot or on the go — helping them operate their business in the way that best suits their needs,” said Derek Hansen, vice president of Offsite Solutions at Manheim, in a news release.

“Using Manheim’s digital and mobile channels, we deliver efficiency, cost savings and convenience for dealers buying and selling used vehicles,” he said.

Manheim has three upgrades in its offsite business expected to launch shortly: new search capabilities on OVE; mobile app upgrades; and seller tool enhancements that are designed to “link Marketplace channels, putting comprehensive options at sellers’ fingertips, including the ability to easily list inventory on multiple digital channels to obtain greater vehicle value before consigning it to a physical auction,” the company said.

“Also in 2018, capitalizing on the flexibility provided by a digital channel, Manheim will launch customizable storefronts that address unique seller, buyer or inventory needs,” said Zach Hallowell, vice president, Manheim Digital Marketplace and RMS Automotive, in the news release. “We will enhance clients’ Manheim Marketplace experience and efficiencies to make it much easier to locate and manage inventory across all our channels.”

‘Reaches across the entire nation’

The response to digital demand has been similar among Manheim’s peers.

Shortly after the company released its third-quarter earnings in the fall, KAR Auction Services chief executive officer Jim Hallett pointed out how active the ADESA auction company’s OPENLANE online platform had been in the wake of Hurricane Harvey.

“Because that platform reaches across the entire nation,” Hallett said in a phone interview, “and you don’t have to wait until sale day to buy a car. You can buy a car 24/7, any day of the week. So, those sites were very, very active. They sold a lot of vehicles online. Our online sales were up 34 percent in the quarter, and our physical sales were down 1 percent.”

The 34-percent spike in online volume was “not totally, but heavily impacted” by the storms, Hallett said.

It also was the highest growth rate they had experienced since the first half of 2014, which was early stages of the cyclical recovery, KAR chief financial officer Eric Loughmiller said during the same call.

And not only does this illustrate just how much online buying there was, it also speaks to KAR’s strategy of offering “all the venues” wherever dealers want to buy the vehicles, Loughmiller said.

So what else drove such a massive spike? Loughmiller points out, “that’s where the supply starts (at) what we call the top of the funnel … I don’t know that it was demand-driven.

“If you read what the dealers are saying, they’re actually selling the cars now,” Loughmiller said. “Those dealers in Texas knew they had to start accumulating inventory for when the buyer came to their lot.”

Since the inventory was showing up online first, dealers thought it prudent to buy there because there was a “good chance” it would have been sold before the dealer could have bought it in his or her market.

Loughmiller later added, “And we experienced this when there was a shortage of vehicles; you get the inventory when you can.”

Likewise, for Auction Edge — a technology and software provider for the independent auction market — its auction customers were turning to its Edge Pipeline platform to expand the viewing area of the inventory listings.

So, auctions in Indiana were attracting Texas dealers, in need of an inventory boost following the storms, via simulcast, Auction Edge CEO Dan Diedrich said in an interview late last year.

In short, auctions were generating activity from areas they might not have otherwise had exposure, Diedrich said.

“If you just take a market event like that, where you have hundreds of thousands of vehicles being taken out of the market, when there’s a void there, auctions that aren’t necessarily local can expose their inventory and be there to service the needs of buyers in a scenario like that,” he said.

Hence, the beauty — and sometimes necessity — of the online capability for auctions, independent and corporately owned.

While more than a week remains in January, dealers might already be venturing into the wholesale market with spring on their minds, hoping retail sales increases bloom nicely.

What managers are going to have to pay for inventory varies based on the latest analysis from Black Book and RVI Group.

The December figures from RVI Group showed five vehicle segments generating year-over-year value upticks of at least 1.7 percent. Multiple segments were connected with units more popular when weather is more favorable. The rundown included:

—Sports car: up 2.3 percent

—Luxury small sedan: up 2.1 percent

—Full-size pickup: 1.9 percent

—Luxury full-size sedan: up 1.9 percent

—Sporty coupe: up 1.7 percent.

However, RVI Group also found that there were six vehicle segments that saw their values soften by at least 1 percent. Should these units turn in your market, RVI Group mentioned these segments as possibilities for lower acquisition costs for possible higher margins:

—Luxury coupe: down 4.2 percent

—Sub-compact: down 3.3 percent

—Small pickup: down 2.7 percent

—Small sedan: down 2.0 percent

—Full-size sedan: down 1.3 percent

—Compact: down 1.0 percent

Meanwhile the editorial team that compiled this week’s Black Book Market Insights report illustrated where cars saw larger-than-normal depreciation, especially with the spring selling season right around the corner.

The report also highlighted that within the 2015 model year segment retention, small pickups are holding 72.9 percent of their value; the strongest of any vehicle segment.

"The depreciation rate on car segments increased while strong sales volumes with more supply were reported at the auto auctions," said Anil Goyal, Black Book’s senior vice president of automotive valuation and analytics.

Volume-weighted, Black Book determined overall car segment values decreased by 0.76 percent last week, higher than the average weekly decrease of 0.60 percent in values editors noticed during the previous four weeks.

Editors added that the compact car, mid-size car and near luxury car segments decreased in value the most among all the car segments.

Again considering volume-weighted data, Black Book found that overall truck segment values — including pickups, SUVs and vans softened by 0.48 percent last week, better than the average weekly decrease of 0.57 percent in values editors tallied during the previous four weeks.

Editors also mentioned sub-compact crossover, minivan and mid-size crossover/SUV segments decreased in value the most among all the truck segments.

Closing this report with what Black Book’s representatives gathering in the lanes, dealers seem to be somewhat upbeat as 2018 moves along.

Beginning in California, Black Book’s lane watcher mentioned, “Fairly strong sale today with good action in the auction arena as well as the online buying.”

In nearby Nevada, what’s happened on Capitol Hill is pushing dealers to make moves as Black Book found, “Dealers are optimistic that the new tax plan will stimulate many anxious buyers who have been on the sidelines for a while.”

Continuing to move East, Black Book’s representative in Colorado reported, “A pretty good sale here as the market is picking up after the holiday season. Attendance and sales were both up.”

Finally in Georgia, Black Book’s representative noticed, “A lot of vehicles were in good condition and sellers were dropping their floors in order to sell as many as possible. The in-lane attendance was up as well.”

The International Automotive Remarketers Alliance announced the sessions that will follow its Spring Roundtable at Caesars Palace on March 5.

Different IARA sessions held concurrent with the Conference of Automotive Remarketers will be hosted on March 6 and March 7.

Session moderators and participants include representatives from ARI, ADESA, America’s Auto Auction, Avis Budget, Element and the RVI Group.

In addition to Paul Seger, vice president of asset remarketing for Element, who will moderate a consignor-only session addressing issues that matter to consignors, industry leaders Doug Turner of America’s Auto Auction and Kurt Madvig of ADESA will discuss justifying reconditioning investments in an open to all attendees session.

IARA said the discussion will look at the key factors in optimizing reconditioning budgets to increase return on investment and defend the initial dollars invested.

During a panel discussion moderated by Rene Abdalah, senior vice president at RVI Group, participants will assess how it is more crucial for remarketers to monitor the market for changing residual values.

Additionally, IARA said co-presenters Andrea Amico, president of Jack Cooper Logistics, and Faye Francy, executive director at Auto-ISAC, will examine industry best practices to safeguard vehicles’ data and information in a session.

A full conference pass is $895 before Feb. 2. Following that day passes will be an additional $100.

More information is available here.

ServNet recently announced that it has expanded its scholarship program and will hand out up to 10 awards this year.

The program which was launched in 2016, exists to financially help ServNet auction employees and their families pursue higher education.

Five $2,500 awards are for students attending a four-year college or university, and five awards of $1,500 are for students who will enroll in a two-year college or vocational-technical school, according to ServNet.

This year’s application deadline for ServNet scholarship awards is March 30.

The scholarship program can assist full-time ServNet auction employees, their children, stepchildren and grandchildren.

Greater Rockford AA completes project to improve safety

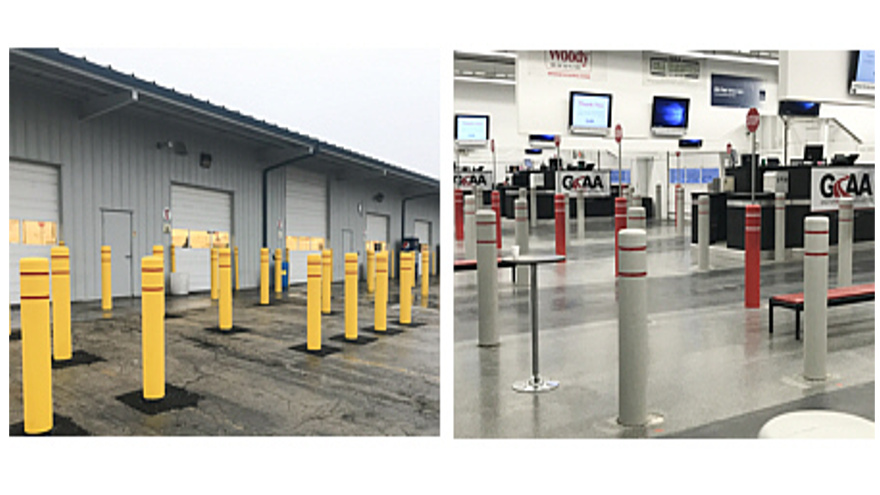

Additionally, in other news, Greater Rockford Auto Auction has completed a large bollard installation project, according to ServNet.

To protect people from vehicles, the auction had a total of 161 total bollards installed in its six-lane facility.

New bollards were installed on both the sale apron approach and inside the sale lanes. The planning and design stages of the project began in June of 2017, and the project was finally completed in December.

The bollard initiative stems from GRAA's Customer Care Project, which includes a full and comprehensive plan for the safety of auction customers, employees and vendors.

"We are excited to complete our bollard installation as a piece of our Customer Care Project," GRAA auction general manager Chad Anderson said in a news release. "The safety of our customers and employees is a top priority and the response from everyone has been nothing short of outstanding. We continue to work on new and improved safety initiatives daily as we move forward."

While there likely are households and businesses still trying to recover from Hurricanes Harvey and Irma, KAR Auction Services chief economist Tom Kontos thinks the impact from those storms is no longer strongly influencing wholesale vehicle prices.

According to ADESA Analytical Services’ monthly analysis of wholesale used-vehicle prices by vehicle model class, wholesale used-vehicle prices in December averaged $10,804, which represented a 0.1 percent uptick compared to November and a 1.5-percent rise relative to December 2016.

However, Kontos pointed out that car prices were down both month-over-month and year-over-year, while the opposite was true for truck prices.

“With the impacts of Hurricanes Harvey and Irma having lasted primarily from late-August through mid-November, wholesale prices in December returned to patterns seen prior to those events,” Kontos said in his latest edition of the Kontos Kommentary.

“Namely, prices for cars continue to soften while prices for trucks were up,” he continued.

As he does now on a regular basis, Kontos took a closer look at 3-year old vehicles with 36,000 to 45,000 miles. For midsize cars, prices averaged $10,438 in December, marking a $299 softening year-over-year. For midsize SUV/CUVs, prices averaged $17,512 in December, edging $51 above the year-ago reading.

“Although midsize SUV/CUV prices were up in December in this analysis, the increase was modest compared to September through November,” Kontos said about those figures that came when holding constant for sale type, model-year age, mileage and model class segment.

“This may be indicative of a cessation in truck demand growth in Texas after Hurricane Harvey,” he added.

Looking back at the overall December data, Kontos mentioned average wholesale prices for used vehicles remarketed by manufacturers dropped 3.3 percent month-over-month but climbed 8.3 percent year-over-year.

He indicated prices for fleet/lease consignors were down 1.9 percent sequentially but up 0.4 percent annually.

Finally, Kontos said average prices for dealer consignors were down 0.1 percent versus November and up 3.6 percent relative to December 2016.

Kontos closed his regular update by mentioning some data from the National Automobile Dealers Association that indicated December retail used-vehicle sales by franchised and independent dealers were down a combined 3.4 percent year-over-year, after being down in October and November, as well.

ADESA Wholesale Used-Vehicle Price Trends

| |

Average |

Price |

($/Unit) |

Latest |

Month Versus |

| |

December 2017 |

November 2017 |

December 2016 |

Prior Month |

Prior Year |

| |

|

|

|

|

|

| Total All Vehicles |

$10,804 |

$10,797 |

$10,642 |

0.1% |

1.5% |

| |

|

|

|

|

|

| Total Cars |

$8,502 |

$8,546 |

$8,576 |

–0.5% |

-0.9% |

| Compact Car |

$6,452 |

$6,565 |

$6,413 |

-1.7% |

0.6% |

| Midsize Car |

$7,651 |

$7,794 |

$7,773 |

-1.8% |

-1.6% |

| Full-size Car |

$7,551 |

$7,190 |

$7,971 |

5.0% |

-5.3% |

| Luxury Car |

$12,959 |

$13,223 |

$13,049 |

-2.0% |

-0.7% |

| Sporty Car |

$13,846 |

$13,739 |

$12,748 |

0.8% |

8.6% |

| |

|

|

|

|

|

| Total Trucks |

$12,966 |

$12,950 |

$12,645 |

0.1% |

2.5% |

| Minivan |

$8,891 |

$8,554 |

$8,897 |

3.9% |

-0.1% |

| Full-size Van |

$12,619 |

$12,940 |

$11,317 |

-2.5% |

11.5% |

| Compact SUV/CUV |

$10,508 |

$10,599 |

$10,481 |

-0.9% |

0.3% |

| Midsize SUV/CUV |

$11,148 |

$11,133 |

$11,336 |

0.1% |

-1.7% |

| Full-size SUV/CUV |

$14,856 |

$14,208 |

$14,379 |

4.6% |

3.3% |

| Luxury SUV/CUV |

$18,711 |

$18,844 |

$18,141 |

-0.7% |

3.1% |

| Compact Pickup |

$9,209 |

$9,102 |

$8,757 |

1.2% |

5.2% |

| Full-size Pickup |

$16,189 |

$16,419 |

$15,624 |

-1.4% |

3.6% |

Source: ADESA Analytical Services.

AuctionVcommerce recently announced the release of its Dealer Service Center tool, which is an independent-auction-branded customer interface that is designed to give dealers and consignors the ability to expedite requests directly to any auction department.

The company said that it is releasing the system to all of its members as a targeted communication strategy for the year and will begin with Columbus Fair Auto Auction, Dealer’s Auto Auction of the Southwest, and Indianapolis Car Exchange the week of Jan. 22.

Other members are expected to be launched by early February, according to the company.

"Emails and verbal exchanges are not reliable in a multi-dimensional workplace, and I think many auctions are finding this out the hard way," AuctionVcommerce president Kelly Bianchi said in a news release. "What we have developed is a centralized communication system that digitally distributes information exactly where it needs to go, and yet keeps it all accessible from a single-entry point."

With the tool, Bianchi said auctions can expect to reduce office-related expenses and increase productivity.

The Dealer Service Center is accessible from a desktop or mobile device and provides an option to receive text notifications and track requests.

AuctionVcommerce said the tool also offers customers a digital option for initiating auction services which allows them to avoid counter lines, hold messages and limit business hours.

At Used Car Week this past fall, Joe Overby sat down with Joe Miller and Venkat Krishnamoorthy of AutoIMS to talk about the company's “Simplifying Auction Charges” whitepaper released this fall.

Plus, Miller and Krishnamoorthy discuss the next steps in auto industry disruption/digitalization and 20 years of AutoIMS.

Check out the conversation below.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

You can also listen to the latest episode in the window below.

All episodes can be found on our Soundcloud page or by visiting www.autoremarketing.com/ar-podcast. Please complete our audience survey; we appreciate your feedback on the show!