This year’s annual conference partnership between the National Remarketing Conference and the NAAA Convention was a great example of a forward-thinking combination of two very strong brands.

As Dan Kennedy (formerly of GM, now with Jack Cooper Logistics), Mike Broe (formerly of Manheim and now president of AutoIMS), my wife and I sat at the grand banquet, we saw and discussed the transition of the industry from one generation to the next.

Now as Dealers Auto Auction here in Phoenix transitions to the Mumford and Gingras team, it’s clear that the industry’s future is bright, and we think more partnerships are coming in the future.

In keeping with that theme, as the discussions at the conference trended from blockchain to operational mobility and online selling, it was clear that the next generation needed to be a group of disrupters, as well as a group of traditionalists, to maintain the growth and vision needed to keep our industry viable.

With that said, I think the debate over which platform is better, in-lane or online, has made something very clear: There is a need and a place for both.

Over the past decade, NRC has focused on unique and thought-provoking topics and honoring the next generation of leaders while NAAA has focused on safety training, condition report writing, arbitration rules and related topics and honoring its past leaders. It’s a combination that I think blends the best of the past and the future.

In my view, online selling and in-lane selling are not in revolutionary, but rather evolutionary stages. Despite the continuing use of the new “disrupters” buzzword, I remember when that was synergies, economies of scale and many more.

OVE, OPENLANE and simulcast are examples of evolution, because the imaging, condition reports and related items are improving. But the nature of arrival times affects the quality and quantity of much of the dealer consignment at auctions in this country.

More importantly, even as auctions like DAASW have converted to high speed fiber and cat-6 interfaces with HD cameras, that doesn’t mean that the viewing end of the buyers or the online reps has the same totality of upgrades, thus somewhat devaluing the upside of those changes.

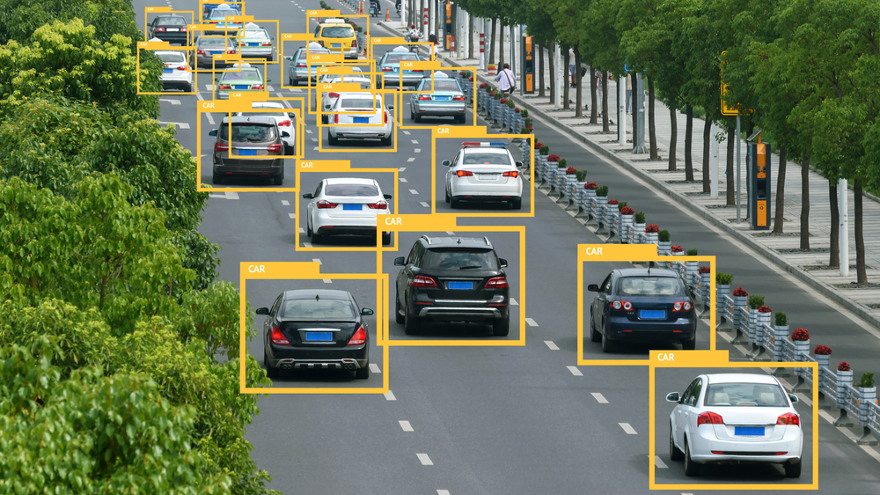

My vision for auction disruption has been within the operational areas of our industry, combining mobility with safety — another buzzword today that should never be a buzzword, but should have always been a fact of operational life.

It also amazes me that every auction in this country has not converted to operational mobility. So let me give you my thoughts on this concept.

— Vehicles arrive at check-in, and then a combination of check-in staff/CR writers check-in and CR dealer inventory with mobile devices. That is immediately sent to our website and to AutoIMS, and then they turn a corner and the same mobile devices image and upload standardized images, which again move wirelessly to all areas of our marketing platform.

— In the lanes, each lane leader has a mobile device to view run number assignments, announcements and related on each unit and to obtain emails for management on any issues relating to that unit. The ability to receive emails from the consignor or a buyer regarding that unit are also built into this system to increase customer service and reduce telephone calls.

— Of course, the repos, lease and factory units have different iterations of this process, but the mobile devices continue to create productivity and seamless platform integration there, as well.

The revolution, however, needs to be on the blocks and at our front counters.

If Apple can create paperless retail stores, why aren’t we tying in bid numbers, (we already have them assigned to mobile devices) to electronic signings and eliminating invoices with each invoice and perhaps next week’s sale information, texted or emailed to the buyers?

If you’re talking about safety, think how many times our buyers cross the bidding lanes to sign an invoice.

With regard to the front counters, with the ability of operating systems to run on iPads, why are we still using hardwired PCs and “chaining” employees to desks and customers to lines?

For instance, here in Arizona, e-titles on the wholesale level are coming in 2018; how does that change the role of a title clerk and third-party services?

As always, this is just one man’s opinion and I am always here to listen to any comments at [email protected].

Jim DesRochers is a consultant with Dealers Auto Auction of the Southwest and was its longtime vice president and general manager.

On Thursday, Cox Automotive presented its 2017 Community Impact Award to Heather Pullen, national remarketing manager at Porsche Cars North America.

The award — sponsored by Cox Automotive brand, Manheim — was presented by Grace Huang, president of Cox Automotive Inventory Solutions, during an awards luncheon at Used Car Week.

The honor is given to a remarketing industry leader “for their outstanding contributions to the community and the innovative ways they collaborate with community partners to help further their missions,” according to a Cox Automotive press release.

Huang had the following to say about this year’s recipient:

"Heather's enthusiasm and passion for community service exemplifies the spirit of the Cox Automotive Community Impact Award," said Huang. "Community service is a guiding value for how Cox Automotive operates its businesses, and we congratulate Heather on her inspirational work."

Pullen has been with Porsche for more than six years. And although she is passionate about performance cars, “her real passion starts with horses,” according to the press release from Cox Automotive. She is an avid polo player. In fact, she and her husband, Randy Pullen, formed a charity in 2016 named Pony Up For A Cause. The charity is designed to give back to local charities in the Atlanta area by raising money through an annual polo event produced by Pony Up For A Cause.

The charity partners with Atlanta Ronald McDonald House (ARMHC) to support its mission in the local community. Since its inception, Pony Up For A Cause has raised more than $30,000 for ARMHC.

Along with the award, in recognition of her leadership and commitment to “making a difference through community service,” Pullen’s charity will receive a $10,000 donation from Cox Automotive to further its work in the Atlanta area.

"Giving back to the community is simply part of the culture at Cox Automotive," said Pullen. "It is a sincere honor to be recognized, and I am humbled by the generosity of Cox Automotive."

Included in the full itinerary today at Used Car Week is the in-person recognition for the respective winners of three awards programs previously announced in Auto Remarketing magazine.

Those are:

- Best Auto Auctions to Work For, which is sponsored by CARS Recon. They are being recognized during a breakfast at 7:30 a.m. (PT), which is also sponsored by CARS Recon.

- Remarketing’s Under 40 awards, sponsored by Ally Auto, Cox Automotive, CARFAX and Equifax. They are being recognized during the NRC Awards Luncheon, which begins at 12:15 p.m. During that luncheon, there will also be a Cox Automotive Community Impact Award presented by Cox Automotive.

- Women in Remarketing, which is sponsored by Ally. In addition to our annual Women in Remarketing panel (1:45 p.m.), Used Car Week will include a second Women in Remarketing session this year. That session is titled, "Hiring for the Future: The search for authenticity," and is set for 2:45 p.m.

There will also be a Lifetime Achievement Award Presentation at 11 a.m.

Cherokee Media Group is proud to announce two speakers already lined up for its 2018 inaugural Automotive Intelligence Summit (AIS), which will be held July 24-26, 2018 at the Raleigh Marriott Crabtree Valley in Raleigh, N.C.

Joining the lineup for AIS 2018 are:

- Maryann Keller, Principal, Maryann Keller & Associates

- Lonnie Miller, Principal Industry Consultant for the automotive sector at SAS

“The Automotive Intelligence Summit was created to be a foundation to foster a high-level meeting of the minds,” said Bill Zadeits, president of Cherokee Media Group. “Having industry experts like Maryann Keller and Lonnie Miller on board is the most promising of starts toward achieving exactly that.

“Their respective experience and in-depth knowledge of the automotive industry sets the table for the type of educational content AIS 2018 has in store,” Zadeits said.

Keller has been in the auto industry for more than 40 years, including nearly three decades as a Wall Street analyst. She launched Maryann Keller & Associates in 2001 and is its principal.

Keller has held board of directors positions with Dollar Thrifty, Lithia Motors, Falcon Financial and Sonic Automotive, in addition to her current board of director posts at AutoCanada, DriveTime and Lee Auto Group.

She was also on National Research Council panel from 1992-2001.

At SAS, Miller focuses on market opportunities and risks with emerging technology and competitive market dynamics in the auto industry while advising how to leverage analytical approaches to improve connected vehicle, smart mobility and customer experience strategies.

Prior to joining SAS, Lonnie held a variety of senior leadership roles with R. L. Polk & Co. (now IHS Markit). This included leading company’s Loyalty Management Practice, their Marketing and Industry Analysis unit and the company’s Analytical Solutions team.

For more information on AIS as the itinerary continues to develop, visit AutoIntelSummit.com and sign up to receive updates.

AIS 2018 is delivering the opportunity to connect with leading minds who are involved within the automotive, auto finance and transportation-related industries.

The event is an executive-level meeting designed for C-suite leaders who desire access to the best intelligence, data and analysis available.

Core content topics of AIS 2018 will include:

- Predictive Analytics

- Transportation Research & Insights

- Connected Mobility

- Economic Forecasts & Market Assessments

- Fintech

- Disruptors

- Investment Capital

- Mergers & Acquisitions

- Compliance & Regulations

“AIS ’18 will focus on content and intel in areas where we are strongest- in the dynamic used car and auto finance markets and will look beyond those core areas to enhance and grow in sectors critical to executives at the top level of the OEM’s, dealerships, banks, finance companies, fleet, lease, rental, suppliers and more,” said Zadeits.

As an aggregator of the top industry minds, AIS 2018 will provide attendees an experience packed with powerful insights, information and knowledge that can make a significant impact on their business planning and success.

AIS 2018 organizers are leveraging experience and relationships from a wide swath of the automotive, financial and technology sectors to deliver a unique, three-day event that will give attendees a better understanding not only of what’s happening now, but also what’s ahead to keep you and your firm ahead of the technological curve.

Flashback with me for a second.

It’s the first day of the fall semester at college. For the freshmen and transfer students, it’s a brand new environment and perhaps a brand new experience altogether.

For the sophomores, juniors and seniors, the start of a semester may be old hat.

But there are still new classes, new classmates, new lessons to learn, new memories to make and more fun to be had.

Well, Used Car Week is sort of like that. Except no pop quizzes, and we stay in hotels instead of dorms.

But nonetheless, each Used Car Week is a fresh start, no matter how many times you have attended the event (even for us organizers).

Each year brings a new twist. For this year’s highlights, see below.

New format

After Used Car Week 2016, our conference team analyzed data from post-event surveys and chatted with participants one-on-one.

What that uncovered was a need to expand the auto finance and repossessions topics, and adjust the certified pre-owned conference into a more comprehensive picture of the entire retail used-car market.

We hope the new and improved format will provide you with a more valuable experience. The conference will now be split into two blocks.

The first will consist of the Pre-Owned Con, the Auto Fin Con and the Repo Con.

The second will be National Remarketing Conference and NAAA Convention.

Participants will have the opportunity to attend either 1st Block, 2nd Block or both with an All Access registration.

And within each block, it’s “choose your own adventure.”

If you are a 1st-Block participant and want to attend a Pre-Owned Con workshop in the morning and an Auto Fin Con workshop in the afternoon, go for it.

Longer networking breaks

One addition you might notice in the agenda is that some (but not all) of the breaks between sessions are 45 minutes instead of 15.

This is designed to give attendees a bit more time to explore the expo hall, talk with exhibitors and spend some time networking.

After all, in addition to the great educational sessions and awards, one of the big benefi ts of Used Car Week is the chance to gather with your peers and meet some new business contacts.

Location, location, location

This year’s location for Used Car Week — The La Quinta Resort & Club — promises to make you stop to smell the flowers and take in the spectacular view of the Santa Rosa Mountains. We hope that in between educational sessions and networking events you’ll find some time to enjoy this gorgeous oasis in the desert.

The resort has a campus-like set-up, rather than one set hotel building. It’s also the first time Used Car Week has been held at this location.

Used Car Awards

Also making their debut this year are the Used Car Awards (UCAs). The UCAs will honor the dealers and executives making positive impacts and building great businesses within the used-car industry.

Recognizing excellence has long been a key part of Used Car Week’s annual agenda, and with the launch of the UCAs, those awards and recognitions will be grouped together during the Used Car Awards Luncheon

Awards that have traditionally been a part of the event and some relative newcomers will all be part of the new UCA luncheon.

New awards will also be a part of this combined effort on the part of Auto Remarketing, SubPrime Auto Finance News and other Cherokee Media Group brands.

Among the new awards as part of the UCAs include:

• Franchise Dealer of the Year

• Independent Dealer of the Year

• And three tiers of Dealer Group(s) of the Year

The Used Car Awards will be presented during a luncheon sponsored by TradeRev during the First Block of Used Car Week on Tuesday.

Additional industry recognition and awards such as the Auto Remarketing Under 40, Women in Remarketing, Lifetime Achievement and the National Remarketing Executive of the Year will still be presented during the NRC/NAAA (Second Block) portion of the week.

All of the award winners and honorees during Used Car Week will be highlighted in a special December “Used Car Awards” edition of Auto Remarketing.

Extended Women in Remarketing content

In addition to our annual Women in Remarketing panel (1:45 p.m. on Nov. 16), Used Car Week will include a second Women in Remarketing session this year:

Hiring for the Future: The search for authenticity Nov. 16, 2:45 p.m.

Moderated by Kruse Control founder and chief executive officer Kathi Kruse, this panel will include:

• Carolyn Bogan, Vice President of Technology Services, KAR Auction Services

• Jeannie Chiaromonte, Vice President/National Remarketing Manager, Bank of America

• Samantha Zawilinski, Vice President of Account Services, Potratz Advertising

The panel will feature conversation focused on trends in recruiting and working in remarketing as the industry becomes increasingly technology-driven, the role of mentoring and developing women into industry leaders. The dialogue will also explore the impact of changing demographics.

For complete information on Used Car Week, visit UsedCarWeek.biz or download the Used Car Week app for your smartphone.

Used Car Week (which is next week, by the way!) has some exciting new twists in store.

One of those is the Used Car Awards (UCAs), which will make their debut during the conference, which is being held Nov. 13-17 at the La Quinta Resort & Club in Palm Springs, Calif.

The UCAs will honor the dealers and executives making positive impacts and building great businesses within the used-car industry.

Recognizing excellence has long been a key part of Used Car Week’s annual agenda, and with the launch of the UCAs, those awards and recognitions will be grouped together during the Used Car Awards Luncheon on Tuesday Nov. 14, which is being sponsored by TradeRev.

“We’re excited about the launch of the UCAs,” said Bill Zadeits, president of Cherokee Media Group and chairman of Used Car Week. “We’ve had tremendous response to efforts such as Women in Remarketing, Auto Remarketing’s Under 40 and others; this launch was taking the next step to brand and solidify our company’s commitment to recognizing the industry’s best and brightest.

“Used Car Week is the ideal opportunity to meet and honor those in our industry who are at the top of their game.”

Awards that have traditionally been a part of the event, as well as these new awards, will all be part of the UCA luncheon.

As part of this combined effort of Auto Remarketing, SubPrime Auto Finance News and other Cherokee Media Group brands, the new awards include:

- Franchise Dealer of the Year

- Independent Dealer of the Year

- And three tiers of Dealer Group(s) of the Year

Again, the Used Car Awards will be presented during a luncheon sponsored by TradeRev during the First Block of Used Car Week on Nov. 14.

Additional industry recognition and awards such as the Auto Remarketing Under 40, Women in Remarketing, Lifetime Achievement and the National Remarketing Executive of the Year will still be presented during the NRC/NAAA (Second Block) portion of the week.

All of the award winners and honorees during Used Car Week will be highlighted in a special December “Used Car Awards” edition of Auto Remarketing magazine.

The best part of the used-car industry for Scott Mousaw isn’t just applicable to the world of automotive.

“What I enjoy most about it is not unique to the business. I enjoy the process,” he said in a phone interview. “I enjoy looking at how or what we’re doing, what I’m doing as a consignor, and what could I do to make that better? What could I do to make that better, stronger, faster? What could I do to make that less expensive?”

While what he enjoys most isn’t unique to the business, his latest accomplishment puts Mousaw in some rare company.

Mousaw, who is director of loss mitigation at United Auto Credit, is the 2017 National Remarketing Executive of the Year, an award presented by ServNet.

Auto Remarketing is proud to honor Mousaw with this award — now in its fifth year — at the National Remarketing Conference/NAAA Convention portion of Used Car Week, which takes places Nov. 13-17 at the La Quinta Resort & Club in Palm Springs, Calif.

An early start in autos

Mousaw’s first job in the car business came at age 19, when he started as a lot attendant at a Pontiac dealership in Downey, Calif. His days included such tasks as parking and washing cars.

“The gentleman who hired me, he says, ‘You’re too young to be a salesperson, but you talk like one,” Mousaw said. “So, I’m going to make you a lot attendant … whenever you see salespeople talking, I want you to get in that circle and listen to watch what they’re saying.’

“Well, unbeknownst to me, that got me fired by the head lot attendant because he just saw me standing around all the time,” he said with a laugh.

Mousaw also worked on the wholesale side of the business for five years before moving into collections and skip-tracing in Tustin, Calif., with what eventually became Drive Financial Services. (Drive was later acquired by Santander in 2006.)

Mousaw was senior loss prevention manager at Drive, handing repossessions, insurance claims, impounds and more.

He joined United Auto Credit in 2002. And with the company being a branch network, each of those branches managed its own portfolio. That marked his first foray into the consignor side of the business.

In 2009, United Auto Credit centralized the recovery department in Irvine, Calif., and in 2010, there was further centralization, so Mousaw took on remarketing duties, as well.

Once back in autos, it was like a ‘snowball’

The auto industry wasn’t Mousaw’s initial career choice.

His goal early on was actually law enforcement. But things changed in the early 1990s after the Los Angeles riots, Mousaw said. He held an unsworn and unarmed intern role with the Los Angeles County Sheriff’s Department, working out of North Long Beach, Calif., during the time of the riots, he said.

“After that, there was a major hiring freeze. I’d never be full time at any realistic future point,” Mousaw said.

At that point, he “got back in and went into wholesale,” Mousaw said. “I’d already been a lot attendant at that point.”

When he got back into automotive, it was like a “snowball,” he said.

“From wholesale to retail, I think I knew I was a car guy,” Mousaw said.

And he discovered his “niche” upon moving into the lender side of the market.

“And then there’s just no looking back. Once you’re in, they suck you in and you’re stuck,” he said with a laugh. “For better or for worse.”

‘That’s what I enjoy’

Joking aside, Mousaw is a process guy, even more than he’s a car guy.

He said the industry has folks who might be able to look at a car from 100 yards away and spot needed fixes.

However, “that’s not me,” he said.

“I could tell you when a process is broken, and there’s a better way to do it,” Mousaw said. “Just by following what you’ve got going on, you find a way to make things better. That’s what I enjoy.

“And the fact that I learn something every day, whether it’d be about a car, about a process, about an auction, about whatever it is — this business is so multi-faceted,” he said.

Having worked in most of these areas the used-car business gives a good vantage point into understanding the various processes involved even more.

And answer questions like, “how does this change impact down-the-line users?” and “By making this change here, what does it do the process as a whole?”

Outside of the office, Mousaw — even though he claims he’s “not good at it” — likes a round of golf. “But I enjoy hitting a little white ball and then going to find it,” he said

And most importantly, Mousaw, who has two teenage kids, enjoys spending time with the family.

“Everything I do and aspire to be is for them,” he said, later adding: “When I’m off it’s all about (spending time with) the family, and it’s my driving force.”

Technology is evolving at an exciting pace.

Artificial intelligence. Blockchain. Mobile e-commerce. Ride sharing.

They’re not fictional. If they’re not already being utilized at your company, they’re being incubated.

Bearing that in mind, Cherokee Media Group is launching the Automotive Intelligence Summit (AIS), which will be held July 24-26, 2018 at the Raleigh Marriott Crabtree Valley in Raleigh, N.C.

The Automotive Intelligence Summit (AIS) 2018 is delivering the opportunity to connect with leading minds who are involved within the automotive, auto finance and transportation-related industries.

AIS 2018 is an executive-level meeting designed for C-suite leaders who desire access to the best intelligence, data and analysis available.

Core content topics of AIS 2018 will include:

- Predictive Analytics

- Transportation Research & Insights

- Connected Mobility

- Economic Forecasts & Market Assessments

- Fintech

- Disruptors

- Investment Capital

- Mergers & Acquisitions

- Compliance & Regulations

“AIS ’18 will focus on content and intel in areas where we are strongest- in the dynamic used car and auto finance markets and will look beyond those core areas to enhance and grow in sectors critical to executives at the top level of the OEM’s, dealerships, banks, finance companies, fleet, lease, rental, suppliers and more,” said Bill Zadeits, president of Cherokee Media Group.

As an aggregator of the top industry minds, AIS 2018 will provide attendees an experience packed with powerful insights, information and knowledge that can make a significant impact on their business planning and success.

AIS 2018 organizers are leveraging experience and relationships from a wide swath of the automotive, financial and technology sectors to deliver a unique, three-day event that will give attendees a better understanding not only of what’s happening now, but also what’s ahead to keep you and your firm ahead of the technological curve.

Among the confirmed speakers is Lonnie Miller, Principal Industry Consultant for the automotive sector at SAS.

He focuses on market opportunities and risks with emerging technology and competitive market dynamics in the auto industry while advising how to leverage analytical approaches to improve connected vehicle, smart mobility and customer experience strategies.

Prior to joining SAS, Lonnie held a variety of senior leadership roles with R. L. Polk & Co. (now IHS Markit). This included leading company’s Loyalty Management Practice, their Marketing and Industry Analysis unit and the company’s Analytical Solutions team.

For more information, visit AutoIntelSummit.com and sign up to receive updates.

“The predictive analytics and data science that C-suite executives are leveraging to improve business intelligence is developing at a rapid pace. The industry is experiencing a dramatic shift related to business intel — the Automotive Intelligence Summit has been created to be a foundation to foster a high-level meeting of the minds, bringing the smartest people together in one room,” Zadeits said. “The event will prove to be a tremendous learning and networking opportunity for executives from across North America and beyond.”

CarStory launched a product Tuesday that uses artificial intelligence and machine-learning, along with predictive analytics, to gauge when a car will sell and project its sale price.

CarStory Insights is designed to predict incoming trends and give dealers guidance based on that predictive insight. Through analysis of a dealer’s lot, it offers alerts, sales predictions and pricing recommendations.

“It all started from conversations that we were having in the market with dealers. We really wanted to understand what problems weren’t being solved. What were the things that dealers wished they would know, but they couldn’t get today?” said Chad Bockius, who created CarStory, in a phone interview Monday.

“And the common thing we heard was that dealers have access to more information than they ever had, but they still don’t have answers,” Bockius said.

“And we got to the point with all the data that we’ve collected, all the analytics that we’ve been working on, and now where, just the state of artificial intelligence and machine learning, that for the first time, we can actually give dealers answers, not just give them more information.”

Use of artificial intelligence

When you hear the word “artificial intelligence,” you might think Will Smith or Tom Cruise movies full of robots and dystopian futures.

But in the case of CarStory Insights, think “Watson” — as in, the computer platform from IBM that competed on “Jeopardy!” in 2011.

Bockius said that with this new platform, CarStory is “doing the same thing that Watson did.”

What Watson did on the TV show was to generate three answers whenever there was a question. Each answer had a different level of confidence.

“And if the level of confidence in the first answer was high enough, Watson would ring in and deliver that answer. It didn’t’ always get them right, obviously. There was never an answer where Watson was 100-percent confident, but a lot of them were very high,” Bockius said.

“We use AI in the same way to actually generate those sales predictions as well as price predictions,” he said. “So for us, we need to look at all that data that we were able to pull together, and then say, ‘When does the machine believe this vehicle will sell?’

“And the machine is either going to have a very strong belief that it’s correct, or it will be weak. And obviously we’re reporting on the safest cases where the probably is strong, where the confidence is strong.”

The company also uses AI to run what-if scenarios to determine, for instance, how much the car’s price would have to be reduced to make it sell faster.

Bockius also noted: “At the end of the day, when you talk about things like machine-learning and artificial intelligence, this really gets down to the types of algorithms that we’re using under the covers.”

Machine learning, he said, is a crucial piece to the AI stack. Through machine learning, the company can feed the computers wide swaths of data and then use the algorithms to pick out “interesting points,” Bockius said.

“So for example, one of the things that we discovered is really important is to figure out which features on a car affect whether or not it will sell quickly. We call those ‘turn-drivers’ … and that was one of the ways that we used machine learning to feed into these predictions about when a vehicle will sell,” he said.

“Because obviously, the more features that affect turn a car has, the more likely it is to sell quickly,” Bockius said.

“So, then you get to a point where you aggregate all of this data to essentially start making predictions.”

'Predict the future'

With the CarStory Market Reports product, the company has, for a while, been examining what demand is expected to be for specific vehicles. And that can be impacted by factors like seasonality, gas prices and more.

“And we can start to see behavior changes online that help our predictive model” determine what may happen, he said.

“Now that technology is at a point where it’s cheaper and easier to do machine learning and AI, and we actually have the data to train the computers, it would be silly to continue to rely on historical averages if you can predict the future,” Bockius said.

“And I think that’s what we’re going to see, not only in the space we’re working in, but I think in every space across automotive, you’re going to see this being applied, whether it’s in customer service or in marketing or in sales or in sourcing inventory,” he said.

“There’s simply no area that’s going to be safe from disruption when you have this ability, because it’s just a better way of doing it. No one would sit here and say, ‘I don’t need the answer, I just need more information.’”

5 features of CarStory Insights

In a news release, the company lists these as key features of the product:

- Turn Drivers: Highlights the vehicle features that help cars sell in a local market and compares those to every vehicle on a dealer’s lot.

- Smart Pricing: Provides pricing recommendations based on how each price will change the days to sell.

- Market Rank: Provides a detailed comparison how each vehicle stacks up against the local competition.

- Sales Alerts: Get notified via phone or email whenever Insights detects an issue in the market or on your lot.

- Instant Share: Notifications can be easily shared with members of a dealer team.

When asked specifically about the sales alerts function and the issues in the market that might arise, Bockius said the alerts boil down to a slow-seller alert and a fast-seller alert.

“Now, there can be a lot of things that cause those alerts to be triggered. For example, you might have Hertz dropping 200 Honda Accords on the market, and all of a sudden, that dramatically changes when those Accords on your lot are going to sell,” he said.

“Nothing changed with your vehicle obviously, but the market changed. Alternatively, we could see consumer demand going up or down, and again, that could have a dramatic effect on when your vehicle is going to sell. So what we do is we take all that complexity, we look at all the signals, make sense of them all and then simply alert the dealer to a problem.”

Like, for instance, your vehicle might take longer than expected to sell.

Then it gives guidance to the dealer on what they would have to do regarding price for that car to move faster. And the same goes with cars turning too quickly.

Currently there are 1,500 dealers on waitlist for CarStory Insights, Bockius said.

It will be rolled out first to CarStory Market Report Customers. The company will be activating the product for dealers who were early beta participants, then opening it to the wait list. The goal is to have it open to everyone by the end of the year, Bockius said.

Many young professionals are taking leadership roles in the auto industry and impacting the remarketing and used-car business.

In Year 3 of Auto Remarketing’s annual Remarketing & Used-Car Industry’s 40 Under 40, you will find the current- and next-generation leaders of the business who are making big differences in the industry and at their respective companies.

Auto Remarketing is honored and thrilled to recognize these folks and celebrate their accomplishments.

And be sure you don’t miss the special ceremony at Used Car Week to recognize this year’s group of honorees. More on that can be found at www.usedcarweek. biz.

Auto Remarketing would also like to thank everyone for nominating dozens and dozens of outstanding folks.

This group represents just a fraction of the incredible young leaders this industry has to offer. We look forward to many more years of honoring these change-makers.

And without further ado, our 2017 Remarketing and Used-Car Industry’s 40 Under 40 (in alphabetical order, by first name):

- Aaron McConkey, Product Director, Auction Edge Inc.

- Aaron Pyle, Director of Wholesale Operations, Mountain State Auto Auction/Capital City Auto Auction

- Chad Cunningham, Vice President, Wholesale Inc. and Wholesale Express

- Chad Perry, Senior Director of New Accounts, DealerSocket

- Chase Abbott, Vice President of Sales, VinSolutions and Dealertrack F&I

- Chris Karwoski, Senior Director National Accounts, Cox Automotive

- Clint Weaver, General Manager, America’s Auto Auction Harrisburg

- Danny Hammack, Manager Partner, Columbia Honda

- David Pendergraft, General Manager, DAA Northwest

- Elizabeth Murphy, Associate Corporate Counsel, ADESA

- Eric Jenkins, General Manager, ADESA Birmingham

- Greta Crowley, Senior Director of Consumer Marketing, Autotrader and Kelley Blue Book

- Jake Tudor, General Manager, Jim Norton Chevrolet

- Jeff Swinney, Director of Finance and Technology, XLerate Group

- Jeni Hamlin, Remarketing Manager, Gateway Financial Solutions

- Joe Caruso, Director of Online Sales, ADESA

- Joe Guarascio, Director of Fleet and Pre-Owned Strategy & Sales, Nissan North America

- Joe LeMonds, National Remarketing Manager, Carolina Auto Auction

- Joe Neiman, Founder of ACV Auctions and Head of Product

- John Carter, Remarketing Solutions Sales Operations Manager, GM Financial

- John North, Senior Vice President and Chief Financial Officer, Lithia Motors

- Kartheek Veeravalli, Chief Product Officer, defi SOLUTIONS

- Kristen Trout, Director of Legal, PAR North America

- Kristin Gaffney, Vehicle Remarketing Representative, Capital One

- Laura Clapp, Director, Digital Agency, CDK Global

- Leslie Ruhe, Vice President, Sales & Relationship Manager, U.S. Bank

- Leslie Vander Baan, Vice President, Integration, DRIVIN

- Luke Smith, President, MVTRAC

- Mandy Savage, General Manager, Manheim Detroit

- Michael Sadowski, Vice President of Operations and General Manager, Kelley Blue Book

- Paul Lynch, Vice President of Sales and Marketing, DePaula Auto Group

- Peter Fusz, Vice President of Pre-Owned Operations, Lou Fusz Automotive Network

- Renee Perri, Vice President of Corporate Division, Wheel’s Automotive Dealer Supplies Inc.

- Ryan LaFontaine, Chief Operating Officer, LaFontaine Automotive Group

- Ryan Mulligan, Senior Partner Development Manager, Carfax

- Scott Liniado, Associate Vice President, Technology, Cox Automotive

- Scott Pechstein, Vice President of Sales, Autobytel Inc.

- Sean Cason, Director of Strategic Initiatives, Automotive Finance Corporation

- Todd Linn, IT Delivery Manager, Automotive, Equifax

- Tyler Daws, Senior Manager, Regional Auction Sales, Hyundai Capital America

- Vincent Salvagni, Chief Financial Officer, Sun Auto Group/Used Car King

- Will Farmer, Regional Sales Director, Southeast U.S., TradeRev

For more on these outstanding honorees, see the Sept. 1 issue of Auto Remarketing.