The service department certainly helped steer many dealerships through the recession, says Xtime’s Jim Roche.

But as he illustrates through an Xtime presentation during an interview with Auto Remarketing at the NADA Convention & Expo in April, it’s still a resource whose potential is not yet fully realized.

Roughly 11 percent of the revenue from a typical dealership is through fixed operations and the service department, said Roche, who is senior vice president of marketing and managed services for the company that provides retention solutions.

However, service generates more than 60 percent of the profit. What’s more, new- and used-vehicle profit margins that are slimming down.

But still, dealerships capture less than a third of service visits, Roche said, citing research from parent company Cox Automotive.

“So, if the goal is profitable growth and new cars and used cars are trending down, the opportunity is in service,” he said.

And it largely boils down to customer retention.

In fact, the 2016 Xtime Market Research Study found that 64 percent of dealerships said their primary concern overall is customer retention.

Looking at the following statistics, it’s not hard to see why.

Roche shared a cost-benefit analysis when it comes to loyalty. Citing John Wiley & Sons, he points out that it is 10 times more expensive to get a new customer than to retain an existing one.

Meanwhile, citing a GM Authority blog post, Roche shared data from a General Motors presentation indicating that annual revenue climbs $700 million for every percentage point that sales retention increases.

In its own market research study, Xtime found that a big impact to the service operations is the “consumer expectations of the experience,” Roche said.

In fact, high consumer expectations in the service lane was often the first thing that service managements/upper management pointed to, Xtime’s presentation shows.

Consumers are emphasizing a personal touch, amenities (like Wi-Fi or a latte), transparency, nice waiting rooms and strong communications during the service process.

Their expectations, Roche said, “are driven by non-automotive companies,” like Amazon or Uber.

Or better yet, Dominos, where you can “configure” your pizza online and track its cooking-to-delivery progress.

“That’s the experience you can get for a $10 pizza, but you can’t get that experience for a $25,000 car,” he said.

That’s what Xtime hopes to change. And to their credit, many dealers appear to recognize that.

Xtime’s study found that 94 percent of dealers believe the experience is actually more important the repair itself.

Bearing these trends in mind, Xtime launched a new service retention platform called Spectrum on April 1. The program is cloud-based system that integrates four Xtime products — Invite, Schedule, Engage and Inspect powered by Service Pro.

“Growing profitably is a dealership's No. 1 objective, and customer loyalty is the most effective way to achieve it,” Roche said in the news release on the product.

“But 83 percent of surveyed dealers state that their existing systems do not support a superior ownership experience,” he continued, citing FARM Market Research: 2016. “That's why we developed Spectrum. Its integrated, cloud-based tools can deliver the valuable, convenient, trustworthy service experience that today's customers are looking for — the kind that can turn one-time buyers into repeat customers and enables profitable growth.”

The four elements of Spectrum work together to “modernize the service experience at every touchpoint,” the company said. Xtime explained how that works:

• The Invite dashboard shows real-time shop capacity. This lets the dealer determine which time lots are available, then use promotions to get customers in those spots.

• The Schedule function then reaches out to the customer for service scheduling via consistent messaging through Web, mobile and in-car systems.

• Through the Engage function, tablet-friendly access is available for menus, pricing and service history, plus integrated checkout and bill pay.

• Lastly, Inspect powered by Service Pro offers an electronic inspection tool along with workflow collaboration and interactive customer approvals.

All four of the products operate within the Xtime Cloud.

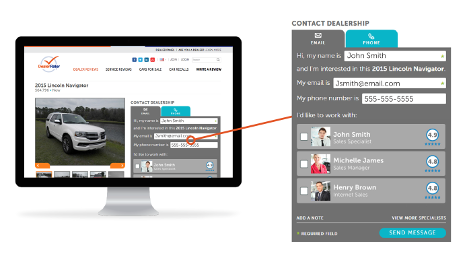

DealerRater announced the official release of CustomerConnect, a new product that aims to connect the in-market shopper and a top-reviewed dealership salesperson in real time — and before the showroom visit.

DealerRater found through a recent survey that 97 percent of prospective car buyers would rather choose a salesperson or service advisor to work with before they get to the store.

CustomerConnect allows them to do so.

Through this platform, dealerships can feature their best-reviewed employees on DealerRater search directories and vehicle detail pages. The shopper and salespeople can connect via SMS texting, email and click-to-call.

“Cars are still sold one at a time, between two people,” says Gary Tucker, chief executive officer of DealerRater. “But today’s consumer wants a different car-buying experience than they have had in the past — one that respects the considerable time and effort they put into researching automotive products, pricing, and places online, and that lowers the anxiety prospects often feel before they have even set foot on a dealer lot.”

Auto Remarketing talked to Tucker in-depth about this platform at NADA for this feature story.

To learn more about CustomerConnect, visit http://info.dealerrater.com/CustomerConnect.

Over the years, the Internet role’s in car research opened up greater access to information and pushed more of the consumer decision-making online, DealerRater chief executive officer Gary Tucker said in an interview here at the NADA Convention.

Choices that were largely offline-based — what am I going to buy? What price is fair? What dealership am I going to buy from? — are now largely decided based on online research, he said.

DealerRater is banking on yet another step to move further online, as well

“If you think about those as the first three ‘P’s’ of the customer journey — product, price and place — what we’re betting on is that the availability and access to information is going to transform the fourth ‘P,’ which is person. Who do I want to buy from?” Tucker said. “What do I want to buy? What’s a fair price to pay? Where am I going to go? And who am I going to ask for?”

The latter is “incredibly powerful,” he said.

Picture this. The car shopper has already been researching for 14 hours. He or she already has a car choice in mind and has figured out a fair price to pay. The shopper has also picked out a dealership that has that car.

Then the shopper drives up to the lot, Tucker says.

And there are more than a dozen salespeople lined up.

The shopper’s “heart rate goes through the roof,” he said.

It’s no wonder: this is the “highest anxiety moment for a buyer,” according to DealerRater research that Tucker references

His company is looking for a way to help dealers soothe those nerves.

“We know that if we can arm the consumer either with a path to make a digital connection with the salesperson before they get there, which the majority of customers are willing to do, or if we can at least arm them with enough information about those salespeople so they know which one to ask for, then they can confidently walk past that lineup” and ask for a specific salesperson, Tucker said.

The company launched a new platform at NADA called CustomerConnect that “showcases the employees much more prominently” to help connect the shopper and a specific salesperson.

Tucker showed Auto Remarketing an example dealer page that DealerRater had set up. Say the shopper is looking at a car the dealership has in its inventory, Tucker said. The shopper will see the usual VDP info, but he or she will also see the dealership’s three highest-rated salespeople.

“Now as a consumer, I have the opportunity to engage with somebody specifically about that car, rather than send in a question to the dealership and wonder who’s going to get back to me,” he said.

Feedback from recovery professionals who attended this year’s North American Repossessors Summit (NARS) highlighted how much the event was successful and demonstrated the ongoing improvement and evolution of the space.

Organizers of the event hosted by American Recovery Association indicated that the summit ushered in a “new era” for the recovery and remarketing industry. From a record-breaking attendance of nearly 600 attendees, including recovery and remarketing professionals and finance companies, to a wildly successful auction contributing $9,600 to the Recovery Agents Benefit Fund, organizers believe NARS has proven to be a “must attend” event.

“The new lender meetings were a tremendous benefit to both lenders and attendees,” said John Messiha, department manager repo operations at Capital One Auto Finance and one of Auto Remarketing’s inaugural group of Remarketing & Used-Car Industry’s 40 Under 40.

“There’s no better place to connect with talented recovery and remarketing professionals who would be a great asset to our teams,” Messiha added.

John Lewis elaborated about those points and more in a blog post published by masterQueue, which is powered by Intellaegis. Lewis is the president of Intellaegis and has served in moderator roles for the Re3 Conference at Used Car Week, as well.

“There is a great deal of value and insight lenders can bring and gain,” and if (ARA consultant Les McCook) and his team continue to keep working on the agenda, educational topics, and networking opportunities between all forwarders, skip companies, repossessors (small and large) and all lenders who are pushing the work and managing these critical relationships, it’s a win for everyone,” Lewis wrote here.

“Additionally, we’re starting to see a larger impact in the industry by a variety of technology vendors, and when you put everyone together, great things can and are happening,” he continued. “Given the constant regulatory scrutiny, and especially in light of the tricky waters we all have to keep trying our best to navigate, events like this are critical and should be mandatory on every lenders calendar.”

NARS 2017 dates will be announced soon, ARA said.

The content at this year’s summit wasn’t just focused on skip-tracing and repossessing vehicles. The keynote address came from Vietnam veteran and four-time Super Bowl champ Rocky Bleier.

“Bleier brought the house down with his concluding presentation about perseverance and how the smallest to biggest things can help ensure you’re living out your purpose,” ARA said. “The football legend not only talked about success and what it takes to achieve it, but also brought the fruits of his labor for all to admire — his four Super Bowl rings.”

It hasn’t even been a month since the National Automobile Dealers Association hosted its annual Convention & Expo in Las Vegas, but NADA’s staff is already looking ahead to the 2017 event in New Orleans.

On Tuesday, NADA issued a call for 2017 convention workshop proposals, which the association described as one of the event’s main attractions. The association tabulated that nearly 16,200 participants, which included franchised dealers, dealership managers and industry professionals, attended workshop sessions at last month’s convention in Las Vegas.

The deadline to submit a workshop proposal is May 16. For detailed instructions on how to submit a workshop proposal, go to this website.

For potential workshop presenters who want to sharpen their proposals, NADA will be hosting a webinar, “Tips for Submitting a Great Workshop Proposal,” at 1 p.m. (EDT) on April 20. Registration can be completed here.

Dealerships of all sizes are trying a wide array of strategies to reach millennials — individuals born between 1982 and 1994 — in order to keep vehicles turning and service bays humming.

J.D. Power recently released what analysts titled the Millennials Insight Report: The Customer Experience Perspective; a report aimed at defining the quintessential makeup and customer experience preferences of millennials

The following five points are a sampling of the report’s highlights:

• Millennials are not as fickle or anti-establishment as you think: Overall, across the 15 industries studied, millennials are generally more satisfied consumers (5 points higher, on average, on a 1,000-point scale) than Boomers (born 1946-1964). The difference is most prominent in the utilities (plus 37 points), healthcare (plus 28 points) and telecom (plus 13 points) industries.

• Customer Service Is critical to millennial loyalty: Millennials have the lowest tolerance for errors and delays of any other generation studied — they simply expect things to work. However, when there is a problem and it is resolved fully, millennials are substantially more likely than Boomers to reuse a product or service.

• Value for money is king: The secret to millennial satisfaction? It’s value for money. Unlike other generations that tend to buy things for status, image or brand loyalty, millennials are most likely to make a purchase decision based on value for money — across virtually every product category.

• Privacy: What’s in it for me? Millennials are less concerned than other generations about privacy. They accept the erosion of privacy as inevitable and are generally willing to have their information collected if it comes with benefits in the form of targeted offers and personalized services.

• Optimism abounds: Despite having lower accumulated wealth, less income and higher debt than other generations, Millennials are much more optimistic about the economy and their own personal financial outlook.

“Our studies indicate that millennials are different from previous generations; however, it’s really the nuances of the customer experience that set them apart from the rest,” said Keith Webster, senior vice president and general manager of service industries Americas at J.D. Power.

“And it’s those nuances that are so critical for business leaders to know right now as they wrestle with the challenge of anticipating customer demand in an incredibly fast-moving marketplace where getting it wrong can have catastrophic effects,” Webster continued.

“We believe this research helps to demystify the millennial generation by offering concrete data on their real-world consumer interactions,” he went on to say.

By digging deeper than ever before into the millennial customer experience, J.D. Power believes the Millennials Insight Report can deliver a detailed look into the hearts and minds of this “chronically misunderstood” generation.

For companies that want their brand promises to resonate with millennials, J.D. Power stressed that understanding the subtleties and nuances that both differentiate and connect this generation with others — as well as providing products and services that cater to their individual requirements — is essential.

Considered the most comprehensive report on millennials to date, J.D. Power highlighted the inaugural report is based on in-depth proprietary benchmark research, analyses and insights gleaned from more than 600,000 consumer responses (126,315 from millennial consumers) and interviews with verified customers derived from nearly two dozen J.D. Power syndicated studies conducted in 2015 in the United States.

“So much has been written about millennials, yet much of the information provided is just one very small slice of their total makeup and is often limited to just one industry,” said Jay Meyers, vice president for the analytical center of excellence division at J.D. Power. “The Millennials Insight Report is a one-of-a-kind analysis providing a 360 degree perspective and showing that the millennial generation is a heterogeneous group that is simultaneously very different from and — in some ways — very similar to other generations of U.S. consumers.

“For businesses catering to this generation, the insights uncovered in our report provide a starting point for understanding the nuanced approach required to build real, lasting engagement,” Meyers went on to say.

The full report contains a wide range of data points and analyses that capture millennials’ voice of the customer experience, covering such business segments as automotive, banking, credit card, hotel, wireless, investments, primary mortgage and health insurance, as well as Internet and media usage.

For more information about the Millennials Insight Report: The Customer Experience Perspective, visit http://www.jdpower.com/millennials.

Fleurette Runyan from Consolidated Asset Recovery Systems (CARS) plans to answer four important questions during a free webinar the company is hosting at two different times next week.

CARS’ director of sales for the central U.S. indicated many auto finance companies and other clients are curious about market averages for repossessions and other services. So Runyan plans to discuss those topics and answer these questions:

—What should a repossession cost?

—What is the market average?

—Does geography affect the cost?

—How much of a premium does performing a compliant repossession add to the service?

CARS is holding one-hour webinars where Runyan plans to highlight marketplace trends and share best practices within the recovery space. One session begins at noon EDT on April 13 while the other session starts at 2 p.m. EDT on April 14.

Finance company executives and managers can register for the webinar at the time when their schedule allows by going to this website.

Readers who follow me in this periodical or by viewing my LotParty inventory learning shows know my hot buttons — forget “set and forget” pricing, never neglect to enrich online vehicle descriptions, and always respect the shopper by loading up lots of high-quality, 360-degree walk-around photos of every unit you market online.

Those are all profitable used-car inventory practices. A dealer who daily monitors and optimizes his or her online inventory will always sell more cars at higher gross than a used-car manager who does not.

Yes, it requires energy, time, and focus on running this important operation with the attention and intentionality this multi-million dollar business is.

My point is, breaking free of standard practices can propel a dealership into a new category of efficiency and profitability. An area that will benefit from such new thinking is your reconditioning operation.

By applying workflow software and lean manufacturing assembly processes to the recon function, dealers are halving the days they take to get cars from trade and auction to the frontline.

What I too often see in my work helping dealers achieve more lucrative used-car results is an under appreciation of the time they take to bring vehicles from auctions or trades to the frontline.

If it is taking 10 or more days to get cars to the front line, too often the used-car manager sets the days in inventory clock at that moment. When you look at the data for such operations, you’ll cringe to learn those cars on the lot for 20 days actually, may be 30 to 40 or more days old — and quickly depreciating.

If the manager has priced that unit a little too high, it will likely continue to age out unless the price is changed, but that window may have closed by then.

The better alternative is to reduce recon time to get cars frontline ready faster to give used cars more prime gross selling time. Reducing recon turnaround three days can make a dealership hugely profitable, regardless of its typical turn rate.

To give you a little more detail on this topic, I talked recently to Dennis McGinn, whose company, Rapid Recon, started in 2010 to bring accountability and process management to recon. He shared that spreadsheets and whiteboards don’t work, as it is a challenge to transfer and share that information in an accessible and timely way among those departments.

“In my early work with dealerships, I discovered that almost none were getting cars frontline in less than 10 days — and many were at 16 to 20 days,” McGinn told me. “That is a terrible recon cycle, but nobody had yet figured out the solution was workflow software that helped structure and define processes and drive time-based accountability. When this takes place, we call it a Time-to-Market culture that’s driven by a committed GM or dealer.

“If you calculate holding costs, an accumulating sum of each vehicle’s share of overhead costs from the time you own the vehicle until it is sold, a vehicle that doesn’t get to the front line in 15 days has already eroded $480 in gross potential. For an average dealership with 100 used this calculates out to be $230,000/year in lost gross. NCM Associates calculate this daily cost at $32, for mainline models,” he said.

“So the financial motivation is there to reduce recon time. That objective is best achieved by putting in place processes that assign steps to each vehicle’s journey from acquisition to retail that also automates this progress and makes it easier for everyone to see and understand those steps. Workflow Time-to-Market software enables dealers to smooth out kinks in a recon cycle to reduce that time to under five days, in most cases, and sometimes to just two,” McGinn explained.

A 2.5-day reduction in recon cycle time equates to an additional inventory turn; cut recon time by five days, and you’ll add two turns.

In summary, recognize that more efficient inventory management begins well before vehicles get to the lot. Pricing, describing, and merchandising inventory online can start when inventory arrives, but it needs to be retail ready within a few days if you want every edge to sell it within 30 days total.

Jasen Rice is the owner of Lotpop.

With a record-breaking 2015 under our belts, and 2016 shaping up to be another strong year for new-car sales, many dealers are feeling confident for the coming months.

If you’re in the used-car business, however, April’s showers may not bring May flowers unless you have the right tools and strategies in hand.

Profitable trade-ins and eager buyers will begin to disappear as the traditional tax return-driven sales cycle comes to a close, while diminished profitability and increased inventory are forecasted.

Proprietary data collected from more than 2,000 dealerships shows that average total gross profitability for used-vehicle sales peaks in March and declines through the remainder of the year — a trend that will be exacerbated by the more than 800,000 lease maturities hitting the market. A prepared dealer will have plans to take advantage of this inventory influx.

As the dealership network weathers this influx of lease maturities, it’s likely that as supply rises and dealers are forced into a period of heightened competition, gross profits will decline.

To best position themselves for success — and, in some instances, survival — dealers must rely on compelling data from their technology partners to shape strategic plans, identify lucrative remarketing opportunities and develop profitable exit strategies for each vehicle they acquire.

Maximize profitability

The key to maintaining front-end gross is to evaluate historic and market data at the point of appraisal. Your priority should be identifying “core” vehicles: the models that sell fastest, most consistently and most profitably. These vehicles are prime remarketing opportunities, ensuring quick and profitable sales and reducing overall risk of wholesale losses.

A top-performing dealership’s inventory is composed of 40 percent to 50 percent “core” vehicles. An average dealership’s inventory hovers around 29 percent and drops lower when accepting non-core trade-ins in exchange for closing new-car sales.

In addition to using technology and data to identify a store’s — or group’s — most lucrative remarketing opportunities, dealers must resist the urge to succumb to tunnel vision. Too often, sellers commit to a one-size-fits-all approach and stock only their store’s brand or only vehicles that have done well in the past.

As the “traditional” customer continues to evolve and has significantly more choice, it’s critical that managers leverage a fully integrated inventory management platform to ensure that science, rather than anecdotes and gut feeling, is driving their vehicle-acquisition strategy.

In today’s fast-changing market, a fully integrated inventory management platform is a requirement. Use a fact-based approach: Analyze purchase behaviors not only at stores, but also across brands, group partners and geographic regions.

Build a data-driven strategy

The average dealership close rate was 49 percent in January, and after rising to 51 percent during tax-refund season, it declined steadily — as was the case with front-end gross — through the end of the year, dropping to 46 percent in December. Often, this close-rate decline is preventable by ensuring vehicle pricing is aligned with market trends.

Many dealerships stocked up for the planned increase in used-car business in February through April. As such, now is the time to consider an exit strategy for those remaining surplus vehicles by building an aggressive plan to divest inventory as sales begin to slow. Data demonstrates that used-vehicle front-end gross and dealership appraisal close rates decline in the second half of the year.

As a means of developing an inventory reduction strategy now, before the inevitable pressure of lower sales volumes hits, dealers should aggressively develop a data-driven plan. Dealers can use technology to determine each vehicle’s profit level per day and then carefully monitor it throughout the month.

To prevent significant wholesale losses, dealers should develop a 30-day strategy for moving inventory and plan to keep vehicles on the lot no longer than 40 days to avoid wholesale losses. If a store typically doesn’t do well with a particular model it acquires, sellers can lean on technology to achieve a balance between discount and profit based on current trends.

As sales begin to decline, aggregated inventory management data demonstrates that reconditioning costs will begin to rise, aside from a dip through the summer. To effectively reallocate assets and make use of free cash flow during that temporary dip, dealers should more actively pursue the use of digital marketing to highlight both core and non-core vehicles that may be approaching that 30-day mark.

By using a data-driven strategy to price vehicles in line with prevailing market trends, sellers protect themselves by increasing vehicle turns, reducing the likelihood of profits eroding from wholesale losses.

As the “perfect storm” of second-half stagnating sales, increased in-market vehicle availability and a slackening in consumer demand hits the market, smart dealers will increasingly look to data to assist in:

a) Monitoring reconditioning costs to keep them down in order to free cash for marketing-related activities

b) Leveraging market data to make solid retail or wholesale decisions at appraisal

As wholesale losses increase in summer months, dealers should rely on data to make smarter inventory decisions and to take in core vehicles or create an exit strategy for newly acquired vehicles, such as transferring them to an affiliated store that sells a particular model more effectively or evaluating those tagged for wholesale accordingly with wholesale pricing in mind.

Leverage technology

Pricing vehicles appropriately — and in line with market, brand and group trends — needn’t carry the same level of “accuracy” as the average five-day weather forecast. The use of inventory management tools creates visibility across dealerships, positioning them to turn vehicles for a profit faster and reducing the likelihood they’ll hold onto vehicles too long, negatively impacting grosses.

Technology is the great enabler: It allows dealers to seamlessly link across departments and empowers them to integrate complex data sets, nurturing customers and prospects throughout the sales process.

Following heightened first-quarter sales, inventory levels rise by a total of 10 percent through year’s end. Use a technology platform to:

a) Decrease the amount of time vehicles remain in inventory

b) Devise an exit strategy for vehicles that are sitting on the lot

c) Maximize front-end gross profits

Careful examination of a vehicle’s daily profitability is a dealer’s secret weapon.

By using technology to seamlessly link and drive profitability across departments, dealers are able to more effectively generate greater revenue on the sales floor and in the sales drive. For example, with a data-mining platform that constantly scans a dealership’s DMS for customers in a position to spend money at that store, a dealer can match a customer interested in a particular make and model and sell the vehicle to him or her prior to making it available to the public. This is an extremely powerful tool that significantly reduces the time and resources expended during the sales process.

To prevent significant wholesale losses, develop a 30-day strategy for releasing inventory. Consider transitioning inventory to a group partner. If a non-core vehicle has lingered too long, parse data to create an exit strategy, achieving a balance between discount and profit based on current trends.

Effectively engaging a comprehensive analytics suite that leverages technology not only to capture data, but also to make informed decisions is how the best-performing dealerships weather the storm. Inventory management technology should be integrated with CRM to ensure matches are made and potential buyers are engaged before competitors have a chance to engage them (data mining) and also to nurture them through the sales process (CRM).

The storm is predictable

Lease returns are forecast to flood the market in 2016, and used-car sales will be the key to weather the storm. Dealers who effectively use the data and the technology available to them will be better positioned to maintain volume and gross.

The approaching down cycle is predictable, but if a dealer is properly prepared, it can do better than hunker down and ride out the storm. Inventory management, vehicle merchandising and market-facing strategies are all individual aspects of creating a strong and effective strategic plan. By preparing with core modeling, smart inventory purchases, exit strategies and data-driven decisions to maximize profits, your store can emerge stronger than before.

Mike Waterman is DealerSocket’s divisional vice president and can be reached at [email protected]. The full Market Action Guide can be downloaded at dealersocket.com/MAG.

More often than not, when a consumer first sets out to start the car-shopping process, he or she has an open mind.

New. Used. All kinds of different makes and models. It’s all fair game at the beginning; you’ve got a chance to influence that shopper.

But you had better do it before he or she sets foot on a dealership lot.

According to inaugural Car Buyer Journey study commissioned by Autotrader and conducted by IHS Automotive, six out of every 10 car buyers are open to various makes and models when they first begin looking for a car.

What’s more, more than a third (36 percent) of folks who ended up buying new actually considered new cars and used cars. Likewise, 55 percent of used-car buyers were open to both new and used cars.

But here’s the rub.

Once they step on a lot, it’s probably too late to change their minds.

According to Autotrader, 71 percent of consumers said they bought the car they initially planned on purchasing once they visited a store.

“The study findings reinforce why it is so important for dealers to communicate on experience in addition to product and price,” Cox Automotive Media president Jared Rowe said in a news release with the study.

“Dealers have less than a 30 percent chance of changing a purchase decision once a customer is on the lot. Today, car shopping is all about matchmaking — uniting sellers and buyers online,” he said. “To create a perfect match, dealers should communicate a differentiator that represents their unique value so that consumers can easily identify dealers that offer the specific car shopping experience they desire.”