Pictures — and perhaps even more so video — could be worth way more than 1,000 words when highlighting your dealership inventory.

Dealer Image Pro founder and chief executive officer Peter Duffy made his first appearance on the Auto Remarketing Podcast to share advice on how to make photo galleries and videos more appealing for vehicle shoppers.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Editor's note: This feature is part of the "Dealer Training" special section in the June issue of Auto Remarketing and available for Cherokee Media Group Premium subscribers prior to the issue's publications.

Similar to his early career outside the car business, Brian Pasch wears many hats in his work with auto dealers and the industry at-large.

As founder of PCG Companies — which includes Brian Pasch Enterprises, PCG Digital, and Localiente — Pasch’s work includes dealer training, consulting, running auto industry conferences, mentoring programs and more. He’s a researcher, author and educator.

“Well, I have a heart for the dealer and I love to teach,” Pasch said of the common thread throughout the various elements of his business. “So, I think the thread is education and teaching.”

And that makes sense, given one of Pasch’s early lines of work as …

Read more

Electric vehicles (EV) have become an extremely polarizing topic over the years. Every day there seems to be dozens, if not hundreds, of articles talking about this segment of the automotive market. However, EVs still make up less than 5% of the total number of cars and trucks sold today, according to the International Energy Agency.

That being said, global passenger EV sales rose by 94% year-over-year in the third quarter last year, reaching nearly 1.7 million units, according to CleanTechnica, which translates to more than 1 million EVs being sold for four consecutive quarters.

China and Europe are two global markets that have significantly driven up the demand for EVs, as they both see consumer’s appreciation going far beyond emissions’ mandates. Here in the U.S., relaxed fuel economy targets and weak charging infrastructures have caused demand to be more stagnant, but it is furiously picking up. New fuel economy regulations are being passed and the 2021 Infrastructure Investment and Jobs Act shows much promise of a stronger national charging infrastructure.

EV growth will only get bigger

Experts believe 2022 will be another record-breaking year for EV sales growth, with the potential of more than ten million units sold globally. China will be a key player, but U.S. EV sales are forecasted to double this year. And U.S. automotive dealerships continue to take note of the EV movement.

With hundreds of EVs quickly headed to showroom floors, industry leaders, EV experts and progressive dealers offered candid conversations at the recent NADA Expo in Las Vegas. There were endless sessions, workshops and demonstrations at the show to help dealers better understand the importance of and how to best sell EV cars and trucks.

How can dealers advertise for EV?

So you’ve made the electrifying decision to sell EV at your dealership, but the question remains; what’s the BEST way to locally advertise EVs to consumers who are still on the fence about making the switch?

Major auto brands and EV startups have begun to introduce smart, progressive advertising strategies for their new cars and batteries, along with modern sustainability commitments in hopes of making EVs the ultimate driving experience in coming years. General Motors aired a prime-time Super Bowl ad with a star-studded cast, while Hyundai is now airing EV ads starring Spider-Man. Ford hired an Oscar-winning director to illustrate how many of their most famous models have gone electric at the Tokyo Olympics, and Mercedes-Benz and startup Lucid have unveiled lavish showrooms in NYC to demonstrate benefits to inquisitive crowds. The list goes on and on.

Making a stronger ad push at the Tier 3 level

While a large majority of EV advertising remains at the Tier-1 OEM level, dealers must rev up their local EV-centric advertising strategies in order to educate consumers that they can shop and service new EVs right at their local dealership. It could be a very costly mistake…missing out on potential buyers because they think they can only shop for and order an EV through the manufacturer.

Don’t forget the fundamentals

Some of the fundamentals of automotive advertising will ring true for EV as well, and as always, the biggest key is knowing your audience on the most personalized level possible. EV buyers are extremely savvy shoppers, so focus your messaging on education as much as features and benefits. Keep service and maintenance in mind when illustrating your dealership’s full value. These savvy shoppers are also quick on their toes, so be sure to align your advertising with real-time inventory levels.

In short, building concise advertising strategies that eliminate wasteful spending on your part and wasted time for your buyers, will help to achieve the best ROI. Reducing advertising waste is crucial to boosting dealership profitability, especially during a heavy advertising period like unveiling an exciting new EV model. Today’s advanced advertising data and marketing technology can help dealers follow and capture demand during these launches by identifying which vehicles they should be aggressively marketing — all with the goal of optimizing to the lowest cost per sale, rather than vanity metrics like CPC and impression volume.

Sophisticated AdTech will play a key role

Dealers should also take advantage of the tools, technologies and resources available to them via Connected TV (CTV) — a platform that aligns well with an EV-centric audience. You should be leveraging uniquely personalized ads with messaging targeted at specific households. Messaging with offers to buy an EV, trade-in their existing vehicle to augment dealer inventory, or personalized and interactive CTV ads allowing a user to click their remote to schedule service or get a trade-in quote are just a few examples. This same clickable interactivity could also give viewers access to payment calculators and real-time inventory on a dealer’s website, allowing them to get pre-qualified and matched with a vehicle while instantly negotiating payment terms…all from the comfort of the couch.

Additionally, smart retailers today should leverage a top-notch engagement/conversion strategy, along with tools that help them to efficiently align their internal processes to serve their EV customers in order to stay competitive in their market. These dealers are recognizing the importance of integrating a seamless e-commerce strategy with their lead-gen strategy and media mix, to reap the benefits of drastically lower costs per sale, faster processes, increased customer satisfaction and surging service retention.

Last but not least, leveraging payment-first technologies that provide a 1:1 personalized shopping experience could easily seal the deal. This allows buyers to simultaneously shop for their EV vehicle and financing across a dealer’s entire offering: real-time inventory, all terms financing programs, with all rebates, incentives, specials, ePricing, and trade-in equity calculated and applied at the end.

With these advertising strategies in mind, dealers focusing on promoting EV cars and trucks will certainly gain a leg up on the competition and electrify more interest in their local markets!

Jeff Allen has worked in the automotive industry for over more than years and has been at the forefront of transforming shopper data into information across all three automotive tiers. Before coming to PureCars, Jeff was the Director of Analytics at 22Squared, working directly with Southeast Toyota and large retail brands to improve their bottom line. Today he serves as VP of CX for PureCars, working internally as well as externally with clients to remove blind spots to realize performance. For more information, visit www.purecars.com.

Continuing our series of special episodes of the Auto Remarketing Podcasts featuring general sessions from this year’s Auto Intel Summit — an added benefit for Cherokee Media Group Premium Members — we share a presentation about another way to retail vehicles.

In a keynote presentation, Chip Perry of A2Z Sync asks the question: “Is one-person selling right for your dealership?”

To listen to the episode, go to this webpage.

automotiveMastermind (aM), which provides car dealers with predicative analytics and marketing automation solutions, has expanded its industry education efforts.

The company, which is part of S&P Global Mobility, has debuted Mastermind Academy, its first-ever external learning management system.

The program is geared toward helping dealers best utilize Mastermind, which is its flagship automated sales and marketing platform.

Mastermind Academy is designed to enhance aM’s onsite and virtual training programs, which it holds every 30 to 45 days typically.

The program includes on-demand, self-paced online sessions to help both existing sales personnel at dealerships and new hires.

There are three training routes:

— Courses: Covering fundamentals and tactics for using Mastermind

— Best Practices: Providing short articles and how-to videos on specific product features, plus downloadable scripts and templates.

— Dealer Resource: Providing updates on the latest offerings and events from aM.

“At automotiveMastermind, we consider ourselves an extension of our dealer partners' sales and management teams. The launch of Mastermind Academy is the next evolution of expanding a core value of ours, which is to provide our dealer partners an unmatched level of support,” aM chief executive officer Matt Leone said in a news release.

“Enhanced training designed for veteran Mastermind users, as well as new hires, ensures that dealerships are leveraging Mastermind to their greatest advantage and keeps everyone aligned with the dealership's goals and priorities,” Leone said.

After sharing his recommendations for finance companies, Automotive Personnel founder Don Jasensky made a return visit on the Auto Remarketing Podcast to offer insights about how dealerships can find the salespeople they need to cater to today’s vehicle buyers.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

During this episode of the Auto Remarketing Podcast recorded this month at NADA Show 2022 in Las Vegas, Ian Isch, executive director of sales and leader development at Edmunds, explained how record used-vehicle prices have complicated the negotiation between dealers and potential buyers about an appraisal and trade-in value.

Isch also shared his main recommendations to help dealerships of all sizes.

To listen to this conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Rich Levene spent more than a decade in various executive roles within the wholesale market. Then a little more than a year ago, Levene started his own firm, Dignity Leadership Consulting, which helps its clients develop strategic, profit-generating, high-production teams.

Levene discussed how individuals new to the automotive business as well as industry veterans can become successful leaders during this episode of the Auto Remarketing Podcast.

To listen to the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

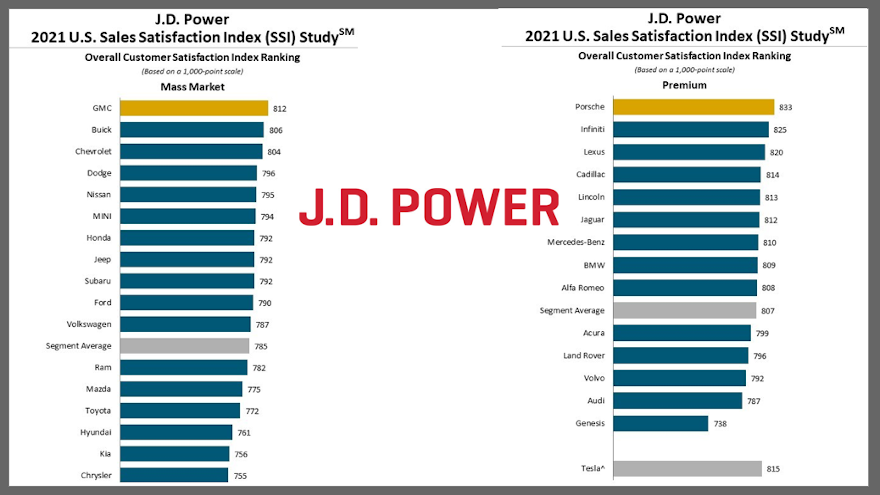

Perhaps there are some strategy recommendations to help dealerships sell used vehicles that can be plucked from the J.D. Power 2021 Sales Satisfaction Index (SSI) Study, which focuses on retailing new models.

Three of the four key findings might be especially relevant to used departments since they are associated with subjects such as trade-in values, inventory availability and digital retailing.

According to study results released on Wednesday, overall sales satisfaction remains at 789 points (on a 1,000-point scale). Satisfaction among dealers where buyers purchased their vehicle increases 2 points to 841, while satisfaction with rejected dealers declined six points to 632.

J.D. Power — the presenting sponsor of Pre-Owned Con at Used Car Week that begins Monday in Las Vegas — said the buyer satisfaction increase was buoyed by buyers receiving more money for their trade-in than they expected at the time of new-vehicle purchase.

Year-over-year, J.D. Power reported that the percentage of buyers who got more than they expected for their trade-in increased 9 percentage points in the mass market segment and increased 8 percentage points in the premium segment.

However, J.D. Power pointed out that satisfaction among vehicle buyers significantly decreased year-over-year in the inventory-related factors for website (down 14 points) and at the dealership facility (down 16 points).

“Despite the lack of inventory, dealerships have overcome what might be thought of as a challenging sales environment for shoppers,” said Chris Sutton, vice president of automotive retail at J.D. Power. “Right now, it’s hard to see the light at the end of the supply chain tunnel, so dealerships need to continue to sell vehicles through their inbound pipeline and help customers with special orders.

“However, the silver lining for customers is that trade-in values remain high and this has had a positive effect on customer sales satisfaction,” Sutton continued in a news release.

The study also mentioned that satisfaction with the variety of dealership inventory significantly decreased 0.55 points (on a 10-point scale) among mass market shoppers and 0.42 points among premium shoppers during a three-month period from March through May 2021.

Other key findings of the 2021 study included:

— If you build new vehicles, buyers will come

J.D. Power acknowledged that manufacturers struggling most with inventory shortages are losing shoppers to competitors.

The percentage of shoppers rejecting a brand due to inventory shortages is most prevalent among domestic truck brands — Ram (37%) GMC (36%) and Chevrolet (35%). Genesis has the highest percentage of rejecters (39%) among all brands because dealerships didn’t have the exact vehicle they wanted, which is 14 percentage points above the industry average of 25%.

“The good news for dealers is that 78% of rejecters who reject a dealership due to inventory shortages indicate they will consider the dealership for future vehicle purchases. In other words, they’re not blaming the retailer for an inability to find their new vehicle,” Sutton said.

— Buyers of new battery-electric vehicles less satisfied with sales experience

There is a large disparity in satisfaction among buyers of battery-electric vehicles (BEVs) and buyers of internal combustion engine (ICE) vehicles.

J.D. Power indicated the overall buyer satisfaction index is 54 points lower for BEVs (790) than for traditional gasoline-powered vehicles (844). Experts explained a cause for this is dealership personnel vehicle knowledge/expertise, with more than a full point difference in sales satisfaction between BEV buyers (7.59 on a 10-point scale) and gasoline buyers (8.72).

“BEV buyers are a unique challenge for dealers,” Sutton said. “As manufacturers ready new model launches, now is the time to ramp up training and knowledge of BEVs and related services — such as charging and aftersales requirements — as buyers will undoubtedly have more questions about them.”

— Remote buyers more satisfied with digital retailing

The study found that, among those buyers who are willing and able to purchase their vehicle without having to physically visit their selling dealer, satisfaction is much higher in both the premium and mass market segments than among those buyers who go to the dealership.

“The ‘Amazon effect’ of seeing, buying and having a product delivered to your doorstep has made its way into vehicle buying and it is here to stay,” Sutton said.

— Tesla’s unofficial score improved from 2020

J.D. Power said Tesla received an SSI score of 815, an increase from its unofficial score of 804 a year ago.

The automaker is not officially ranked among other brands in the study because it doesn’t meet ranking criteria. Unlike other manufacturers, Tesla doesn’t grant J.D. Power permission to survey its owners in 15 states where it is required.

However, Tesla’s score was calculated based on a sample of surveys from owners in the other 35 states, according to J.D. Power.

J.D. Power highlighted that Porsche ranked highest in satisfaction with dealer service among premium brands with a score of 833. Infiniti (825) ranked second, followed by Lexus (820), Cadillac (814) and Lincoln (813).

J.D. Power then reported that GMC ranked highest in satisfaction with dealer service among mass market brands with a score of 812. Buick (806) came in second, followed by Chevrolet (804), Dodge (796) and Nissan (795).

Brands showing the greatest improvement in satisfaction scores year-over-year included Jeep (up 24 points), Chevrolet (up 17 points), Dodge (up 17 points) and Ram (up 14 points).

Now in its 36th year, J.D. Power recapped that the U.S. Sales Satisfaction Index (SSI) Study measures satisfaction with the sales experience among new-vehicle buyers and rejecters (those who shop a dealership and purchase elsewhere).

The firm explained buyer satisfaction is based on six factors (in order of importance):

— Delivery process (28%)

— Dealer personnel (21%)

— Working out the deal (19%)

— Paperwork completion (19%)

— Dealership facility (10%)

— Dealership website (4%)

J.D. Power then noted that rejecter satisfaction is based on five factors:

— Salesperson (40%)

— Price (23%)

— Facility (15%)

— Variety of inventory (12%)

— Negotiation (10%)

J.D. Power also said the 2021 U.S. Sales Satisfaction Index (SSI) Study is based on responses from 35,387 buyers who purchased or leased their new vehicle from March through May.

“The study is a comprehensive analysis of the new-vehicle purchase experience and measures customer satisfaction with the selling dealer (satisfaction among buyers),” J.D. Power said. “The study also measures satisfaction with brands and dealerships that were shopped but ultimately rejected in favor of the selling dealership (satisfaction among rejecters).

The firm mentioned the study was fielded from July through September.

For more information about the U.S. Sales Satisfaction Index (SSI) Study, visit https://www.jdpower.com/business/automotive/us-sales-satisfaction-index-ssi-study.

The main segments of CarGurus most recent COVID-19 sentiment study came in groups of three, as analysts spelled out short-term and long-term trends as well as recommendations for dealerships.

CarGurus highlighted that this research project is the latest iteration in a series of previous studies that were run in April, June and November of last year, exploring topics such as digital retail, vehicle inventory and shared mobility.

“Our most recent COVID-19 consumer sentiment study has shown that the pandemic has reshaped transportation and car-shopping for the foreseeable future,” said Madison Gross, director of consumer insights at CarGurus, which is presenting the Women in Retail honorees who will be given their accolades at Used Car Week at the Red Rock Resort in Las Vegas.

“As consumers continue to steer clear of shared mobility and turn to purchasing their own vehicle instead, they’re faced with rising prices due to the current inventory constraints,” Gross continued in a news release.

“At the same time, shoppers have gotten used to the ease of digital retail, with more people hoping to complete part of the car-buying process at home,” she went on to say.

First, let’s go over the short-term trends CarGurus identified in the study, including:

• Demand has rebounded following dips early in the pandemic: Due to decreased spending and an inflow of stimulus money, CarGurus found that buying confidence has recovered. Major life changes like moving to a new house (29%), getting a new job (22%), and working from home (12%) have also made people more interested in buying a car this year.

• The inventory shortage is hitting buyers: The majority (58%) of shoppers are aware of high vehicle prices as a result of low inventory, an increase from 26% in November.

• In-person shopping returns cautiously: Consumers are much more comfortable shopping in-store this year, but they are still wanting a safe experience with the majority (51%) expecting dealers to continue wearing masks.

Next, CarGurus delved into a trio of long-term trends found through the new research, including:

• Shared mobility continues to decline: During the pandemic, demand for shared transportation halted, and analysts discovered consumers aren’t eager to return. Only half (54%) of consumers who previously used ride-share services expect to return to their pre-pandemic activity in the next year, and few more (59%) plan to in the long term.

• Shoppers are more interested in digital retail: Consumers are more interested than ever in shopping for cars online. CarGurus indicated that 60% of respondents say they’d prefer to do more of the vehicle-buying process at home for their next vehicle purchase.

• Consumers’ expectations will stay high: With dealers having adapted to the pandemic through offering various contactless services, consumers hope that these changes will stay. Shoppers are most interested in pre-scheduled dealership appointments (46%), solo test drives (42%), test drive at home (32%), and at-home delivery (30%).

Now those recommendations for dealerships. Here they are from CarGurus:

1. Prioritize digital retail in your sales process.

With most shoppers wanting to do more of the process online, analysts pointed out that it’s important that dealers are equipped to handle these preferences. They suggested that stores implement digital retail products that allow shoppers to take the transaction as far as they want — and make sure your staff is trained to handle this new online business.

2. Test new ways of acquiring inventory.

CarGurus noted that dealers can’t rely on auctions to keep lots stocked. Analysts suggested that managers consider investing in technology that allows them to acquire in-demand vehicles more efficiently in their local market, and perfect your trade-in process to keep a supply of used vehicles up on the lot.

3. Continue to provide a safe, convenient buying process.

CarGurus emphasized that the dealership experience is crucial to winning more sales, and many shoppers expect contactless services to stick around long term. Analysts said dealerships should continue to offer services like appointments, solo and at home test drives and at-home delivery to ensure consumers feel comfortable shopping at your store.