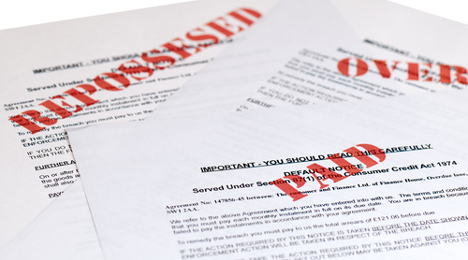

The Fair Debt Collection Practices Act (FDCPA) is the focal point of the next online training session ACA International is hosting for its members to help credit and collection professionals stay up-to-date on the latest FDCPA case law on leaving messages, settlement offers and validation notices.

Four topics will be covered by ACA International certified instructors who intend to examine a relevant court decision, Consumer Financial Protection Bureau guidance and regulatory enforcement actions impacting compliance with the FDCPA. The instructors plan to delve into:

— Methods of communication and technology

— Dispute, verification and cease communication requests

— Call frequency

— Collecting out-of-statute debts and settlement offers

Participants will also learn how to identify potential liability and defenses under the FDCPA.

The training session is set for Sept. 9 beginning at noon (ET).

“Overall, the training is critical to help industry professionals stay up-to-date on the latest FDCPA case law on leaving messages, settlement offers, validation notices and more,” officials said.

ACA International added that participants will receive .75 professional development units (PDU) for attending the training. PDUs can be applied toward the ACA’s Credit & Collection Compliance Professional (CCCP), Credit & Collection Compliance Officer (CCCO), Healthcare Collection Management designations, and scholar and fellow designations.

For more details or to register, go to this website.

DealerSocket chief executive officer Jonathan Ord described it as “very humbling” to have a conversation with employees last week when the technology company announced its fourth major acquisition since the beginning of the year.

Ord made that statement since DealerSocket has gone from an idea sprouted in a garage with fellow founder Brad Perry to the point where the company is making acquisitions costing more than $50 million.

The latest move came last week through a definitive agreement under which DealerSocket will acquire Dealertrack’s Inventory+ business in an all-cash transaction for approximately $55 million.

Under the terms of the agreement, Dealertrack’s Inventory+ suite of inventory management solutions, including its AAX product in the U.S. and Canada, as well as its eCarlist websites, will be acquired by DealerSocket.

This development arrived after DealerSocket added DealerFire, FEX DMS and AutoStar Solutions to its dealer technology portfolio to enhance its marketing theme of, “We are automotive.”

Ord touched why DealerSocket added these Dealertrack assets when he addressed dealer clients hours after the acquisition announcement when the company hosted its User Summit in San Diego.

“One of the main criteria to acquiring companies is that we acquire teams and product lines that think the same way we do and can integrate well into our culture,” Ord said during his closing address posted online here.

“To our customers, to our employees, we are so ready for the future. We are so excited about the next step in changing the world,” he continued.

DealerSocket’s employee and customer count jumped via the latest acquisition, which is expected to be completed by the end of the third quarter. The company added 209 employees who worked with Dealertrack to run the inventory tool.

“We’ve been watching that business for a long period of time,” said Ord, adding that a current DealerSocket executive helped to develop the AAX product before it became a part of the Dealertrack portfolio several years ago.

“Dealertrack had the asset and did a bunch of good things with it. It’s a great value proposition for us and for our customers. We look forward to integrating that inventory management functionality,” he continued.

Ord said the deal brings 3,388 dealer customers into the DealerSocket family, as well.

“Some of that is overlap with our current customer base, but much of it is green field and white space where we can help all of those customers use better CRM, website and inventory technologies,” he said.

Ord spent the remainder of his time on stage at the DealerSocket event thanking dealer customers for attending in hopes each one received more skills and resources to improve their businesses.

“Go back to your stores and be a change agent,” Ord said.

It’s possible that dealerships are losing as much as 84 percent or more of their inbound sales calls that are not converted to a deal.

That’s according to a recent analysis by IHS Automotive, commissioned by CallSource, which studied the performance of over 540 of the latter’s dealer customers over a year-long period (from April 2014 to March 2015).

On top of the high number of missed opportunities, the analysis also revealed that CallSource’s top-performing dealers were able, with proper management, to improve the incoming call-to-sale ratio by over 33 percent.

According to ADP Digital Marketing, dealer calls are still outpacing email leads by as much as 4-1, showing that improving in the area of phone handling could possibly work wonders for sales.

“Many dealers think they have a call-handling process in place, yet without phone skills training and missed opportunity alerts, they lose countless sales opportunities every month,” said David Greene, the vice president of CallSource’s auto division. “If call handlers could set just four more appointments each day and convert one of those to a sale, they would add and average of $2,200 in profit to the bottom line each day, or $66,000 per month.”

CallSource listed what it found to be the areas that call handlers fail in most often:

- Rude/unprofessional exchange

- Call handler’s lack of inventory knowledge

- No ‘needs analysis,’ so no alternative vehicle offered

- Call handler fails to ask for appointment

- Call handler asks the prospect to call back

- Salesperson unavailable

More information about CallSource can be found here.

Dealers making the most out of expected gains in used-vehicle supply are likely to be among those “edging out the competition,” according to the Dealership Action Report released today by DealerSocket.

These cars tend to be rather profitable and fast-turning for dealers, and time is of the essence to get your pre-owned department in order. Especially with 800,000 lease maturities on tap for 2016.

DealerSocket says in a recap of the report, released Tuesday at the company’s annual User Summit in San Diego, that it “underscores the importance of aligning now an operational focus on used-vehicle acquisition and sales to drive profitability as new-vehicle sales growth declines.”

The DAR’s statistics back that up. Average total gross profits on used units are at $3,091, which beat the figure for new cars ($2,717) by 14 percent throughout all lead sources, DealerSocket said.

As for the time it takes to close a lead? For used cars, it’s 44 days. For new cars, it’s 56 days.

The DAR recap also points out that used-car leads “generally deliver” between 500 percent and 700 percent return on investment. For new cars, the ROI is between 95 percent and 148 percent, the report notes.

“With more than 100 new or redesigned products hitting the market in 2015, product anticipation will diminish in 2016,” said Marylou Hastert, director of product marketing at DealerSocket.

“The 800,000 lease maturities expected to come back to the market in 2016 will prove a fruitful revenue stream,” she added, referring to statistics from J.D. Power.

The above tips from DealerSocket fall into strategies to “focus on remarketing as a profit center,” one of five steps the company outlines to “guide dealerships to improved processes and profit margins.”

The complete list is below:

- Develop loyal, profitable service customers

- Engage customers before competitors have a chance to

- Focus on remarketing as a profit center

- Confirm Appointments

- Nurture digital leads

DealerSocket noted that the DAR includes key performance data, survey results and information via J.D. Power's Power Information Network. The DAR is representative of DealerSocket's 6,500 dealership customers and 189,000 users.

Stay tuned to Auto Remarketing for more from the Dealership Action Report.

Vendor Transparency Solutions (VTS), a leading compliance management system for the auto finance and recovery industries, now offers a comprehensive continuing education portal to its clients. The company insisted that it created the portal stemming from regulators requiring financial institutions and their service providers to conduct ongoing training for their employees to ensure knowledge of and compliance with important rules and regulations.

VTS highlighted the portal offers training materials, educational videos and a testing module that is aimed to help ensure employees are up to date on privacy and Red Flag rules as well as other important areas including social media and confidentiality.

The module reports test results back to account administrators, which can allow for ongoing monitoring to ensure that test-takers understand the relevant materials and can provides remedial training for incorrectly answered questions.

“Continuing education is becoming an absolute requirement for companies in this industry,” VTS president Max Pineiro said. “Regulators want to see that financial institutions and the service providers that work with them are training and educating employees and making sure they have the necessary knowledge and information to do their jobs in the most compliant manner possible.”

All VTS subscribers have access to the portal. Administrators can manage and assign tests to all employees or they can pick and choose the most relevant tests.

Subscribed finance companies also have the ability to assign select modules to their service providers and monitor their progress, along with the ability to train and test on the modules themselves.

For further information on Vendor Transparency Solutions, contact Max Pineiro at (520) 468-3990 ext. 102 or [email protected], or Jeff Koistinen, director of operations, at (520) 468-3990 ext. 100 or [email protected].

Even though S&P Dow Jones Indices and Experian just reported auto loan defaults still are near the all-time low, Digital Recognition Network is continuing to counsel finance companies about how its data can help not only during the recovery process, but also with mitigating risk during underwriting.

DRN chief executive officer Chris Metaxas explained the reasoning and more trends as part of Auto Remarketing’s annual Power 300 issue.

Below is our Q&A with Metaxas — who again will be one of the keynote speakers as DRN is a presenting sponsor of the Re3 Conference at Used Car Week — as featured in the Aug. 1 issue of the magazine:

Auto Remarketing: How much more crucial is risk mitigation in light of lengthening contract terms and larger sums being financed?

Chris Metaxas: Risk mitigation acts as the foundation that drives the ability for lenders to continue the expansion we’ve seen over the last few years. One of the key elements associated with risk mitigation is the ability to increase the rate of recovery of vehicles and to prevent the repossession function from occurring.

One of the most interesting findings we’ve seen from lenders is that if a vehicle has been scored highly with DRN’s data and analytics, then the risk on that loan is lower, and the profitability is more than 2 percent greater. This ability to use DRN data insights as predictive indicator on risk has a direct impact on profitability.

Additionally, DRN has implemented new solutions with lenders that allow the lenders to reach consumers at new, previously unknown, locations (called DRN Addresses) for the purpose of having the conversation with the consumer about payment plans. And finally, our live recovery solutions have increased dramatically the rate of repossession volumes. All these factors are significant drivers in mitigating risk with a direct impact on increasing loan volumes and larger loan values.

AR: What regulatory challenges still concern providers of license plate recognition technology?

CM: I’m really very proud of my government affairs team in keeping a lid on any adverse legislation associated with LPR solutions. We’ve been instrumental in helping legislators craft new laws that support a healthy balance of protecting privacy while supporting those constitutional rights we have to use data insights to mitigate risk and ensure public safety (DRN has a public safety interest as well).

We’ve seen most of the legislative challenges in 2015 mitigated where we are even seeing positive progress in California where we hope to see a progressive bill emerge out of this current session. In addition to regulatory challenges we are seeing Intellectual Property Rights Challenges act a limiter to lenders seeking to take advantage of LPR technology to improve their results. To combat the unlicensed use of LPR Intellectual Property DRN has teamed with its competitor, MVTRAC, to enforce their combined IP rights. Intellectual property rights are another regulated element that lenders need to ensure compliance with to avoid portfolio risks.

AR: What factor do you see impacting the auto finance industry most for the remainder of 2015 and going into next year?

CM: I am really not sure that lenders understand the formula of risk and return. As a lender would you make the investment decision to eradicate the last 10 percent of risk from your portfolio if it delivered a return of 300 percent? The answer would be yes, of course.

However, many lenders are more expense minded than return minded and have not pushed banking philosophies down to decision makers in the trenches of the auto finance market. There is a natural industry constraint that is grounded in legacy norms on how auto finance lenders look at how they pay for risk reduction. Fortunately, we’ve been able to develop relationships with some very progressive lenders who are now stepping out of the box and looking at return on investment factors as the basis for decisioning. These are the lenders we feel will be the most progressive and competitive in the market

AR: How much more robust is the data in DRN’s portfolio than it was three years ago or even last year?

CM: The data is really becoming meaningful right now. As it relates to repossession activity, our data is responsible for nearly 7 percent of all repossession across all lenders. In other words, without our data insights repossessions would be 7 percent less. That’s really big.

Our recovery network has grown over 42 percent this past year where we now have the ability to deliver solutions that give lenders the ability to reach their consumer at locations they’ve never known about; we have the ability to give lenders insights on where their consumer is so they can predictively make contact or perform a repossession without wasting time or sending someone to the wrong location. We also have the ability to use our data insights to expand the loans lenders make to new types of underserved consumers by having our data contribute to the insights lenders use to understand the stability of that consumer.

DRN has entered into the insurance market as well where our data insights now contribute to how insurers determine garaging fraud and rate evasion. We hope to keep expanding the use of our data in industries with permissible purpose.

Other features in this special section include:

4 questions with NextGear’s Brian Geitner

4 questions with NADA Used Car Guide's Larry Dixon

4 questions with Infiniti CPO manager Sam Liang

4 questions with Black Book’s Anil Goyal

4 questions with Autotrader president Jared Rowe

4 questions with Geoff Parker of ADESA Cincinnati-Dayton

4 questions with Hudson Cook chairman Tom Hudson

4 questions with Edmunds CEO Avi Steinlauf

4 questions with Experian Automotive’s Melinda Zabritski

It’s one thing to appear to have a huge social media following. But if you’re not actively engaged with your customers, it may all be for naught.

That’s the message from Naked Lime Marketing’s vice president of sales Chris Walsh, who spoke at the Automotive Social Media Summit 2015 in June.

“Using social media for business is not about making one sale; it’s about making repeat sales, based on long-term relationships,” Walsh said. “Those dealers who are leveraging social media today are putting themselves in the best position to nurture stronger prospect and customer relationships now and in the future.”

According to Walsh, dealers should use social media as a relationship-building tool. And what are relationships built on? Trust and authenticity.

“The consumer walking into a dealership today is much different than the one walking in five years ago,” Walsh said. “Today’s car buyers are more informed, and they place a higher value on authenticity and transparency. Social media helps dealers engage with consumers online to help share information and build the kinds of relationships that translate into better business results in the long run.”

Here are four ways social media can help dealers reach out to customers and build relationships, as listed by Naked Lime:

- Brand visibility: Search engines judge what online content is trusted and authoritative and serve that content up to consumers. Walsh said dealers can use social media as part of their search engine optimization (SEO) strategy, increasing the likelihood of their dealership being found by consumers in organic search results, social media search results, and local search.

- Data-driven marketing: Using data collected on consumers' behaviors, dealerships can tailor their offline and online marketing and advertising to better reach the right consumers at the right time with the right message. Walsh cited the Facebook Insights tool and Custom Audiences as examples of how dealers are using social data to tailor their advertising strategy.

- Multi-screen viewers: With three in four TV watchers using another device simultaneously, dealers can use social media to actively engage consumers on their smartphones, laptops, or tablets. Walsh challenged dealers to think creatively about how they can encourage consumers to take social actions after they see a dealer's TV ad so dealers can build additional relationship capital.

- Reputation management: Walsh noted that, in times of uncertainty, people often look to the crowd for what to do. When it comes to dealerships, online reviews are a form of "social proof" consumers use to determine which dealership to visit for vehicle sales and service. Walsh stressed that dealers should pay attention to their online reputation and have a response plan for negative social media comments and reviews.

To read more insight from Naked Lime, check out its whitepapers here.

There continues to be a great deal of misconception in sales managers’ thinking about why they’re not able to increase used-vehicle volume. Industry metrics confirm that those dealers not performing at a minimum 1-to-1 new-to-used retail sales ratio are just not participating in the opportunities of the current market.

So why do our managers continue to have these misconceptions?

What follows are some common reasons we hear during our dealership consulting engagements. My responses should help you combat these misunderstandings that are prevalent in our industry today, and they’ll also help you have the conversation that will turn this thinking around.

“I need more inventory to sell more cars.”

You might, but first, do you understand and practice an aggressive “turn” mentality? If not, you are five years behind in your skill set. If you have an aging issue right now — why?

Should your dealer give you more dollars to invest unwisely? Just a hint: great operators do believe a 30-day (or faster) turn is attainable. Our Benchmark metrics validate that a 45-day turn is very common, regardless of franchise. Do you understand that if you turn your inventory more efficiently, your volume will increase?

“I cannot find the ‘right cars’ and when I do, they are too expensive.”

Come on! The vehicles are out there! You might have to work every day to source them. What makes you think you are smarter than the market which dictates the cost and sales price of inventory? What is your acquisition plan? What do you buy each week to inventory?

“If I price to market, my grosses are too low.”

This is so common. Question: Have you ever put more money into a trade to make a new car deal? If so, of course you reduced the new car gross — right?

If not, what have you just done to the integrity of your pricing model and your used unit gross potential? (Most OEM incentive money is being paid on new-car sales. Why in the world would you destroy your acquisition disciplines, bumping used trade-in inventory values and not reduce new-car gross to its true transaction value?)

A new-car deal is a new-car deal, albeit an OEM incentivized transaction. A used-vehicle trade acquisition is an investment decision. Buy it right or understand the impact on potential grosses, salability, and aging of your used vehicle dollar investment; in other words, your true return on investment of your dollars, Mr./Ms. Dealer.

Have the conversation.

Understand and clear the air on these misconceptions, if they apply. Ask your manager to give you a plan to increase used unit volume profitably beginning right now. Get it in writing. There is too much missed profit opportunity, let alone the impact of adding new customers to your owner base.

Note: This post appeared on an NCM Associates blog in July 2014. Paul Stowe is the former director of retail operations at NCM and recently retired after nearly 50 years in the automotive business.

As we continue our series of features from the Power 300 issue of Auto Remarketing, we turn to a Q&A with Avi Steinlauf, chief executive officer at Edmunds.com.

In this story, Steinlauf discusses the grassroots technological ventures at Edmunds, the off-lease environment, the growing online retail space, the certified pre-owned market and more.

Auto Remarketing: One of the things that sticks out to us about Edmunds.com is the grassroots work you have done in the technological space with events like Hackomotive, Fastlane accelerator and sponsoring the DataFest programs on college campuses this year. What are some of the top benefits for Edmunds.com from these efforts, and how do you see some of these technological advancements impacting dealers?

Avi Steinlauf: These types of programs demonstrate our unrelenting commitment to innovating to build a better car-shopping experience for both buyers and sellers. We have an exceptionally talented staff here at Edmunds that works toward this goal every day, and we also recognize that there are many start-ups and other young innovators who have great ideas that deserve exposure, too.

By giving them access to our resources, we hope that they can better test their products and ideas to see how they stand up to a larger marketplace. The way we see it, if these ideas and innovations can prove themselves out, then the entire industry stands to benefit. These emerging technologies are playing an important part toward helping dealerships keep up with — and perhaps even shape — America’s evolving car shopping behaviors. It’s truly one of those “rising tide lifts all boats” scenarios.

AR: A key point that has been brought up a few times in used-car analyses from Edmunds.com and others is the impact of increased off-lease volume, particularly on resale values. What are some ways you have seen the industry (be it dealers, lenders, OEMs) manage this risk?

AS: Lenders can move used vehicles around to different auctions houses where they may fetch a higher price. For instance, full-size pickup trucks might be sold for more in Texas than in San Francisco, due to those markets’ differences in demand.

Lenders will also want to keep auction prices high so they will ensure vehicles going through auction house are in top condition. They will also have them lined up properly as to not miss an opportunity for a sale.

Automakers, meanwhile, will try to optimize the schedule of lease returns to ensure they aren’t flooding the market at one particular time. They could also move up the lease returns to be earlier in the year so the newer vehicle can sell for more money. Wholesale values tend to be the highest in the spring, so selling vehicles in the right time of year could also be beneficial.

AR: How much of the dealer-consumer relationship and car-buying process do you see moving online, and what role does Edmunds.com play in that process?

AS: It’s clear that we see more and more shoppers moving to mobile devices to perform many of their shopping activities. The share of mobile traffic to Edmunds, for instance, has doubled in the last two years.

Our job is to provide important tools for dealers to better meet the needs of these mobile shoppers. We recently made our CarCode SMS texting technology freely available to all dealers to make it easier for them to receive, manage and respond to incoming text messages, which is increasingly becoming a critical mode of communication for many shoppers, especially millennials.

We also make our wealth of data available through our API so that dealers can more easily leverage it on their own sites to better inform and connect with their shoppers.

One important point I want to make, though, is that the in-dealership experience still plays a very important role in the car buying process, even with younger tech-savvy shoppers. A recent Edmunds study found that 64 percent of millennials said that they prefer face-to-face interaction with dealers as opposed to remote communications, and 96 percent said that it is important to test drive the car before they buy it.

AR: Lastly, we talked recently to Jessica Caldwell of Edmunds.com about how consumer awareness should help drive continued growth in certified pre-owned. Through the interactions that Edmunds has with both dealers and consumers alike, what are some opportunities dealers might have to further educate consumers about CPO?

AS: Not all customers may be aware of CPO and its benefits, so something as simple as signage at a dealership or clear designation on inventory listings can get more shoppers to ask about the program. A strong CPO brand helps (e.g. L/Certified from Lexus), so consumers know there is something tangibly different about these vehicles.

Dealers also have an opportunity to preach the benefits of CPO when they connect with incentive-driven shoppers, such as those who come to them through our Used+ product. A shopper who is enticed by exclusive pricing, a $200 gas card, a 30-day warranty and free roadside assistance will almost certainly be intrigued by the extended benefits that CPO programs can offer.

Other features in this special section include:

4 questions with NextGear’s Brian Geitner

4 questions with NADA Used Car Guide's Larry Dixon

4 questions with Infiniti CPO manager Sam Liang

4 questions with Black Book’s Anil Goyal

4 questions with Autotrader president Jared Rowe

4 questions with Geoff Parker of ADESA Cincinnati-Dayton

4 questions with Hudson Cook chairman Tom Hudson

Consolidated Asset Recovery Systems — again the sponsor of this year’s Re3 Executive of the Year Award to be presented during Used Car Week — is offering two chances to attend a free webinar examining the issues associated with vehicle transportation.

The session titled, “Leveraging Transportation to Optimize Recovery Costs: A Look Into the Future,” will delve into four specific topics, including:

• What does the existing transportation industry look like?

• What are the challenges we face?

• What steps to take to manage a more efficient /compliant model?

• What does the future hold for transport?

The free webinar is being presented by Steve Brown, CARS’ director of sales for the Central and Western U.S. The hour-long session also will include a Q&A segment.

CARS is hosting the webinar twice on Aug. 18. Managers interested in participating in the session that begins at 1 p.m. ET can register here while managers who prefer to join in at 4 p.m. ET can register here.