Dealers with import brands had nice gains in certified pre-owned sales during July, as yearly sales continue down a blistering path.

First, Asian brands sold 104,555 certified vehicles in July (up 9.5 percent), according to Autodata Corp.

Meanwhile, their year-to-date figures are at 684,778 units through seven months, which beats the year-ago pace by 8.1 percent.

As for European brands, their CPO sales reached 38,343 units in July, which was up 8.8 percent from July 2014. Seven-month sales reached 260,148 units, up 11.7 percent from the year-ago pace.

A week ago, Auto Remarketing shared an early rundown of certified sales for many of these import brands.

Additionally, the latest installment of the annual Power 300 issue of Auto Remarketing includes a Q&A with Sam Liang, who was recently named senior manager of certified pre-owned at Infiniti USA.

Domestic automakers increased their certified pre-owned sales by more than 14 percent in July, and one of the Big 3 had its strongest CPO month of all time.

According to Autodata Corp., Fiat Chrysler Automobiles had its best month ever for certified sales.

Including the Fiat brand, FCA US had 16,710 CPO sales in July, a 31.4-percent increase from July 2014, Autodata said.

Without Fiat, it had 16,622 CPO sales, a 31.7-percent gain.

Year-to-date through July, FCA is at 107,359 certified sales without Fiat (up 29.9 percent) and 107,863 with Fiat (up 30.1 percent).

The previous best-ever month for FCA occured in May, when it sold 16,579 CPO units without Fiat and 16,661 units with Fiat included.

Domestics, as a whole, moved 78,993 certified vehicles in July, beating year-ago figures by 14.1 percent. Through seven months, they have sold 552,437 units (up 18.3 percent).

The CPO sales at Ford totaled 25,166 units in July for a 9.4-percent increase, with year-to-date sales reaching 170,814 units (up 10.2 percent).

At General Motors, certified sales for the Buick, Chevrolet, GMC, Pontiac and Saturn brands were at 35,032 units for July (up 10.0 percent), with yearly sales at 259,324 (up 19.1 percent).

Cadillac posted 2,173 CPO sales in July (up 23.5 percent) and its year-to-date sales reached 14,940 units (up 25.8 percent).

As we continue our series of features from the Power 300 issue of Auto Remarketing, we turn to a Q&A with Avi Steinlauf, chief executive officer at Edmunds.com.

In this story, Steinlauf discusses the grassroots technological ventures at Edmunds, the off-lease environment, the growing online retail space, the certified pre-owned market and more.

Auto Remarketing: One of the things that sticks out to us about Edmunds.com is the grassroots work you have done in the technological space with events like Hackomotive, Fastlane accelerator and sponsoring the DataFest programs on college campuses this year. What are some of the top benefits for Edmunds.com from these efforts, and how do you see some of these technological advancements impacting dealers?

Avi Steinlauf: These types of programs demonstrate our unrelenting commitment to innovating to build a better car-shopping experience for both buyers and sellers. We have an exceptionally talented staff here at Edmunds that works toward this goal every day, and we also recognize that there are many start-ups and other young innovators who have great ideas that deserve exposure, too.

By giving them access to our resources, we hope that they can better test their products and ideas to see how they stand up to a larger marketplace. The way we see it, if these ideas and innovations can prove themselves out, then the entire industry stands to benefit. These emerging technologies are playing an important part toward helping dealerships keep up with — and perhaps even shape — America’s evolving car shopping behaviors. It’s truly one of those “rising tide lifts all boats” scenarios.

AR: A key point that has been brought up a few times in used-car analyses from Edmunds.com and others is the impact of increased off-lease volume, particularly on resale values. What are some ways you have seen the industry (be it dealers, lenders, OEMs) manage this risk?

AS: Lenders can move used vehicles around to different auctions houses where they may fetch a higher price. For instance, full-size pickup trucks might be sold for more in Texas than in San Francisco, due to those markets’ differences in demand.

Lenders will also want to keep auction prices high so they will ensure vehicles going through auction house are in top condition. They will also have them lined up properly as to not miss an opportunity for a sale.

Automakers, meanwhile, will try to optimize the schedule of lease returns to ensure they aren’t flooding the market at one particular time. They could also move up the lease returns to be earlier in the year so the newer vehicle can sell for more money. Wholesale values tend to be the highest in the spring, so selling vehicles in the right time of year could also be beneficial.

AR: How much of the dealer-consumer relationship and car-buying process do you see moving online, and what role does Edmunds.com play in that process?

AS: It’s clear that we see more and more shoppers moving to mobile devices to perform many of their shopping activities. The share of mobile traffic to Edmunds, for instance, has doubled in the last two years.

Our job is to provide important tools for dealers to better meet the needs of these mobile shoppers. We recently made our CarCode SMS texting technology freely available to all dealers to make it easier for them to receive, manage and respond to incoming text messages, which is increasingly becoming a critical mode of communication for many shoppers, especially millennials.

We also make our wealth of data available through our API so that dealers can more easily leverage it on their own sites to better inform and connect with their shoppers.

One important point I want to make, though, is that the in-dealership experience still plays a very important role in the car buying process, even with younger tech-savvy shoppers. A recent Edmunds study found that 64 percent of millennials said that they prefer face-to-face interaction with dealers as opposed to remote communications, and 96 percent said that it is important to test drive the car before they buy it.

AR: Lastly, we talked recently to Jessica Caldwell of Edmunds.com about how consumer awareness should help drive continued growth in certified pre-owned. Through the interactions that Edmunds has with both dealers and consumers alike, what are some opportunities dealers might have to further educate consumers about CPO?

AS: Not all customers may be aware of CPO and its benefits, so something as simple as signage at a dealership or clear designation on inventory listings can get more shoppers to ask about the program. A strong CPO brand helps (e.g. L/Certified from Lexus), so consumers know there is something tangibly different about these vehicles.

Dealers also have an opportunity to preach the benefits of CPO when they connect with incentive-driven shoppers, such as those who come to them through our Used+ product. A shopper who is enticed by exclusive pricing, a $200 gas card, a 30-day warranty and free roadside assistance will almost certainly be intrigued by the extended benefits that CPO programs can offer.

Other features in this special section include:

4 questions with NextGear’s Brian Geitner

4 questions with NADA Used Car Guide's Larry Dixon

4 questions with Infiniti CPO manager Sam Liang

4 questions with Black Book’s Anil Goyal

4 questions with Autotrader president Jared Rowe

4 questions with Geoff Parker of ADESA Cincinnati-Dayton

4 questions with Hudson Cook chairman Tom Hudson

Today’s installment of the Q&A series from the recent Power 300 issue of Auto Remarketing features Jared Rowe, the president of Autotrader. In this story, Rowe covers everything from certified pre-owned opportunities to facilitating quicker F&I processes and the consumer experience.

Auto Remarketing: You’ve said in the past that although good work is being made toward adapting old sales processes, consumers say changes aren’t being made quickly enough. What do you see as the key area that some dealers are having a hard time changing and adapting to that would, in your opinion, make the biggest impact on consumer satisfaction?

Jared Rowe: Great salespeople and great experiences both trump lowest price when consumers are selecting a dealership to buy from, and one of the greatest areas of opportunity is to improve consumers’ perception around the amount — and the value — of the time that they spend at the dealership. From our research, we know that buyer satisfaction with the dealership begins dropping after 90 minutes in store on the day of purchase.

By focusing on the parts of the process that contribute to purchase-day delays and dissatisfaction, particularly around the finance and trade-in, dealers can significantly increase consumer satisfaction, which will have a positive effect on dealership and brand loyalty. Both of these areas are evolving in really interesting and positive ways.

The F&I process alone accounts for an average of 61 minutes on the day of purchase — more than two-thirds of the ideal time consumers are satisfied spending at the dealership. The great thing about this area of opportunity is that there are more tools available than ever before to accomplish what we need to as an industry and also meet the ever-increasing expectations of the consumers.

AR: CPO sales set a quarterly record at the end of June. When you spoke at the 2015 Digital Summit in February, you focused heavily on the CPO market and said “that’s a lever we haven’t fully pulled” — what have you seen in recent months that dealers are doing differently to increase CPO sales, and what sorts of benefits are they reaping because of it?

JR: A large influx of CPO-eligible vehicles that have come off lease recently, and that trend will only amplify, with around 9 million certifiable cars coming into the market over the next three years. We have also seen CPO inventory levels rise significantly on Autotrader, with an increase of 12 percent from 2014 to 2015.

Dealers realize that CPO vehicles offer an opportunity for better revenue, and more satisfied customers, so they are putting more focus on promoting CPO vehicles. But as the Autotrader CPO Study found, educating consumers about CPO is key to increasing their consideration and likelihood to purchase CPO.

Autotrader’s 2014 CPO study showed that familiarity with CPO is still low, as less than half of used-car shoppers report being familiar with the option. However, once exposed to a comprehensive definition, 69 percent of used-car shoppers said they would consider purchasing a CPO vehicle. These shoppers ascribed a significant economic value to the benefits — at around $2,000 — with peace-of-mind being the top reason to purchase a CPO vehicle.

This all goes to show that if dealers can help close the knowledge gap on CPO, they can reap major benefits, as the study also showed that people who purchase CPO are highly satisfied and more loyal to both the dealership and the brand. Eighty-five percent of CPO owners are likely to buy from the same dealership for their next purchase, and 77 percent of owners are likely to buy the same brand again (49 percent are likely to be a new vehicle from the same brand).

AR: The 2015 Automotive Buyer Influence Study released by Autotrader put a heavy emphasis on creating a dynamic experience for mobile and non-mobile users — what do you see as the key difference in marketing effectively specifically to someone using a mobile device as opposed to someone utilizing more traditional forms of media?

JR: The use of mobile devices for car shopping has been growing exponentially, and Autotrader’s projection is that by 2020, 80 percent of car shoppers will use multiple devices to shop for vehicles. But the key phrase in that projection is “multiple devices.” Right now, we see a very small percentage of car shoppers using mobile only, so dealers should not think about marketing platforms in silos.

The most successful strategies are those led by cross-platform thinking — where there is consistency in messaging, price and branding. Consumers spend just under 17 hours shopping for vehicles, with 75 percent of that time online — and 42 percent use multiple devices. They visit 9.3 sites (up from 8.8 a year ago). What they’re doing is triangulating information and narrowing their selection — not just of vehicles, but of dealers they want to buy from. The more consistency and reinforcement that dealers provide online across all of the platforms consumers use, the better their chances are of influencing those shoppers.

AR: Looking forward, what do you see as the biggest challenge for your company, and what is its primary focus to maintain and/or grow its influence on the automotive industry?

JR: Autotrader is in the midst of an exciting strategic pivot that will further differentiate us from the competition. Our primary focus right now is on evolving into an integrated marketing solution provider that is focused on matchmaking the right buyers with the right sellers.

As more dealers use advanced tools to focus on price to market and scarcity when acquiring inventory and pricing vehicles for sale, we’ve seen the difference between asking and selling prices narrow.

With that, we have seen more dealers focus on differentiating themselves in other ways — through their unique value propositions and the experiences they will offer consumers. Autotrader’s Car Buyer of the Future study showed that 54 percent of consumers would buy from a dealer that offered their preferred experience, even if it didn’t have lowest price.

So by enabling dealers to better communicate their unique value, we can help them build value in the experience and relationship that is connected with doing business with them.

One way we’re doing that is by more fully integrating Haystak into Autotrader’s digital solutions portfolio, which will help dealers more effectively target the “right” consumers and provide them with the “right” message by means of an enhanced search engine marketing product.

Sixty-seven percent of all consumers visit Autotrader and KBB.com each month, which gives us unique insight into where they are in the shopping process. By leveraging this knowledge, along with our unique perspective on scarcity and price-to-market through the combined insights of vAuto and Haystak, we can help dealers do more than just push sales volume. We can also help support their inventory turn preferences while enabling them to put their best foot forward to shoppers.

Other features in this special section include:

4 questions with NextGear’s Brian Geitner

4 questions with NADA Used Car Guide's Larry Dixon

4 questions with Infiniti CPO manager Sam Liang

4 questions with Black Book’s Anil Goyal

Stay tuned to Auto Remarketing Today for more.

Industry-wide certified pre-owned sales climbed 11 percent year-over-year in July, and one automaker (Fiat Chrysler Automobiles) had its best month ever.

That’s according to data and analysis released by Autodata Corp., which pinpointed the total industry CPO figure at 221,891 sales for the month.

Through seven months, year-to-date sales are just a shade under 1.5 million and ahead of last year’s pace by 12.3 percent, Autodata said.

The daily selling rate in July was 8,534, compared to 7,690 in July 2014.

Including the Fiat brand, FCA US had 16,710 CPO sales in July, a 31.4-percent increase from July 2014. Without Fiat, it had 16,622 CPO sales, a 31.7-percent gain.

Domestics, as a whole, moved 78,993 certified vehicles in July, beating year-ago figures by 14.1 percent. Through seven months, they have sold 552,437 units (up 18.3 percent).

Asian brands sold 104,555 certified vehicles in July (up 9.5 percent) and their year-to-date figures at are 684,778 units (up 8.1 percent).

European brand CPO sales reached 38,343 units in July (up 8.8 percent), with seven-month sales at 260,148 units (up 11.7 percent).

Early indications are that July was yet another strong month for the certified pre-owned market. Here is a rundown of a few brands reporting sales thus far.

Starting with Kia, it reported its third-strongest month of all time, with 5,811 CPO sales in July. This beat year-ago figures by 31.4 percent. Through seven months, it has sold 38,269 certified vehicles for a 45.6-percent gain.

At Hyundai, dealers moved 7,906 certified vehicles for the month, which was off 6.9 percent year-over-year. But year-to-date figures (55,541 sales) remain ahead of the 2014 pace by 2.2 percent.

Next up, Volkswagen moved 8,339 certified vehicles in July (up 2.6 percent) and has hit 55,653 CPO sales for the year (up 4.7 percent).

The CPO brands at Ford sold 25,166 vehicles in July, beating the year-ago sum of 23,000. In seven months, they have sold 170,811 CPO units, compared to 154,958 in the same period of 2014.

Lincoln sold 2,097 in July, while the Ford brand had 23,069 CPO sales.

Continuing on, Mazda sold 3,437, against July 2014 sales of 3,638 units. Through seven months, Mazda dealers have posted 23,807 certified sales, versus 24,392 in the year-ago period.

Volvo sold 1,845 CPO vehicles for the month, up 41.4 percent from a year ago. Its year-to-date sales of 11,675 are up 45.6 percent.

At BMW of North America, the BMW brand had 9,645 CPO sales for July (up 6.6 percent), and its year-to-date sales are at 68,041 (up 21.0 percent).

The MINI brand had 1,108 CPO sales for July (up 31.7 percent) and 6,791 year-to-date CPO sales (up 30.2 percent).

At Mercedes-Benz USA, the Mercedes-Benz Certified Pre-Owned program had 9,669 sales in July (up 6.1 percent) and 68,543 sales year-to-date.

Porsche sold 1,256 certified vehicles in July, which was a 26-percent improvement.

Audi had 4,542 CPO sales in July.

In the latest installment of the annual Power 300 issue of Auto Remarketing, we launched a new feature to spotlight just a few of the companies on the list. In a Q&A format, we go behind the scenes with some of the leading companies in the used-car space.

Next up in this series is Sam Liang, who was recently named senior manager of certified pre-owned at Infiniti USA.

Auto Remarketing: As you move into this role heading up Infiniti’s certified pre-owned division, what are some of your goals for the program?

Sam Liang: Our goal is to grow the program moving forward. Infiniti is moving from two regional sales offices to four regional sales offices, allowing us to provide more on-the-ground Infiniti field support to the retailers with their pre-owned business.

AR: We hear a lot about engaging and educating the consumer about CPO. How are Infiniti dealers working to boost CPO awareness and understanding with the consumer?

SL: The Infiniti retailer body has done a great job in training their sales staff as well as marketing the benefits of the Infiniti CPO program. Some of the benefits include the certification process and inspection, Carfax Buy Back Guarantee, and our clients only being able to buy an Infiniti CPO from one of our 208 Infiniti retailers nationwide.

AR: We see in our reports from Autodata Corp. that Infiniti just posted its best-ever month for CPO sales and that your year-to-date CPO sales through May are up more than 33 percent. What is driving this incredible year for you?

SL: The retailer body has been the most vocal and best advocate for the Infiniti CPO program. We’ve also worked internally to align our retailer and customer incentives to support the CPO business.

AR: Given your experience working as a dealer operations manager for Infiniti, can you tell us some of the top challenges dealers face in CPO and how some of the top ones overcome those hurdles?

SL: We always encourage retailers to make sure their vehicles are listed, as the highest correlation to CPO sales is CPO listings. We provide an exclusive partnership on the largest automotive websites to market the vehicles that leverages Infiniti’s digital advertising.

Other features in this special section include:

4 questions with NextGear’s Brian Geitner

4 questions with NADA Used Car Guide's Larry Dixon

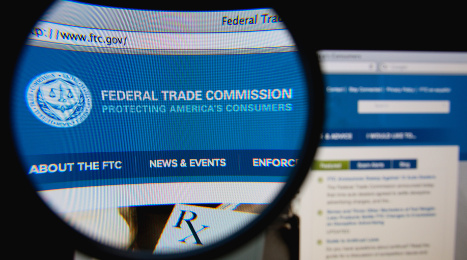

General Motors said in a filing with the Securities and Exchange Commission on Thursday that the automaker received notice of an investigation by the Federal Trade Commission concerning certified pre-owned vehicle advertising.

The notice — which came on June 3 according to the OEM’s document — stems from where dealers certified vehicles that allegedly still needed recall repairs.

“We continue to investigate these matters and believe we are cooperating fully with all requests for information in ongoing investigations,” GM said.

“Such investigations could in the future result in the imposition of material damages, fines, civil consent orders, civil and criminal penalties or other remedies,” the automaker added.

Auto Remarketing reached out to GM for further comment about the investigation, and company spokesperson Jim Cain said, "We are not elaborating on the disclosure."

When contacted by Auto Remarketing, Frank Dorman from the FTC’s Office of Public Affairs said, “Since an FTC investigation has been disclosed by General Motors, we can acknowledge the existence of the investigation, but have no further comment.”

The FTC matter arrives as General Motors is in the midst of a strong CPO sales year.

According to Autodata Corp., CPO sales for the Buick, Chevrolet, GMC, Pontiac and Saturn brands reached 34,777 units in June, representing a 20.2 percent rise year-over-year. Six-month sales for those certified brands came in at 224,292 units, marking a 20.7 percent gain.

The Cadillac brand had 2,007 certified sales last month, up 25.7 percent year-over-year with year-to-date sales reaching 12,767 units (up 26.2 percent).

Say your dealership has new salespeople who are still learning the unique attributes about certified pre-owned vehicles that can make them so appealing to the “ups” who arrive at the showroom or through the business development center.

An advice column Autotrader compiled for shoppers on its site also could serve as a great checklist so those “green peas” can answer some of the questions about that CPO model that’s ripe to be turned. Here’s the rundown Autotrader’s Jason Fogelson shared in a blog post that contains a series of questions salespeople might encounter when working with customers:

— Bumper-to-bumper warranty: Does the certified pre-owned program extend the vehicle's basic new-car warranty with factory support?

— Powertrain warranty: Does the certified pre-owned program extend the vehicle's powertrain warranty with factory support?

— Roadside assistance: Is this included with the certified pre-owned program? For how many months and/or miles?

— Routine maintenance: Is this included with the certified pre-owned program? For how many months and/or miles?

— Vehicle inspection: What was inspected, and is a report available for the results of the inspection?

— Deductible/limit: Does the certified pre-owned program include a deductible or limit on warranty claims, repairs and/or roadside assistance?

— Transferability: Are the features of the certified pre-owned program transferable to the next owner if the vehicle is sold within the warranty/benefit period?

And with experts such as ADESA’s Tom Kontos and Tom Webb of Cox Automotive continuing to project that off-lease volume will grow in the wholesale market, the supply of potential CPO units is likely to continue to expand, potential pushing certified sales to more new heights.

Trucks and SUVs, in general, made an impressive showing on Autotrader’s list of most popular certified pre-owned vehicles in June, but pickups were especially strong: they accounted for four of the top 10 spots.

The overall story out of Autotrader’s Trend Engine data analysis — which looks at monthly shopping activity on Autotrader.com — certainly revolved around how attractive trucks and SUVs have become in the CPO market.

Two of the big reasons Autotrader.com saw such strong CPO traction in June were easy fuel costs (they were at a five-year low) and a robust economy.

“Americans’ love affair with large SUVs and trucks has been fueled by several factors, from low prices at the pump to the bustling economy,” said Michelle Krebs, senior analyst at Autotrader. “In addition to cheap gas driving people to larger — and less fuel-efficient — new and used vehicles, the recent uptick in housing starts and construction puts people back to work who need trucks for their jobs.

“Steadier employment also means people are using SUVs for not only work but also recreation. A growing pool of certified pre-owned models enable them to get into quality vehicles at a pre-owned price but with the peace of mind that warranties provide.”

Breaking down the top 20 CPO vehicles in June on Autotrader.com, there were five trucks and five large SUVs.

And, again, four of those truck models (the Ford F-150 at No. 1, the Chevrolet Silverado at No. 2, the GMC Sierra C/K 1500 at No. 9, and the Toyota Tacoma at No. 10) managed to rank in the top 10.

Meanwhile, the most popular CPO SUV was the Jeep Grand Cherokee, which ranked No. 5 on the overall list.

The complete list of the top 20 most popular CPO vehicles on Autotrader.com during June is as follows:

1. Ford F-150

2. Chevrolet Silverado 1500

3. Honda Accord

4. BMW 3 Series

5. Jeep Grand Cherokee

6. Ford Mustang

7. Mercedes-Benz E Class

8. Chevrolet Tahoe

9. GMC Sierra C/K1500

10. Toyota Tacoma

11. Porsche 911/911Turbo

12. Jeep Wrangler

13. Toyota Camry

14. Chevrolet Corvette

15. Toyota Highlander

16. Mercedes-Benz C Class

17. Chevrolet Camaro

18. Toyota Tundra

19. Ford Explorer

20. Honda Civic