May represented a best-ever month for certified pre-owned sales, as dealers moved 207,371 CPO vehicles, beating year-ago figures by nearly 11 percent.

That’s according to numbers released Wednesday afternoon by Autodata Corp., which said May sales were “the highest ever” and beat April by 7.4 percent and eclipsed May 2013 by 10.9 percent.

What’s more, seven brands reported their respective strongest CPO months of all time, Autodata said. Those included Audi, Infiniti, Kia, Land Rover, Lexus, Mini and Nissan.

Additionally, the daily selling rate of 7,680 was the second strongest in history.

Through the first five months of 2014, there have been 952,234 certified sales, which is 10.6 percent ahead of the year-ago pace.

These days, certified pre-owned vehicles can command a wide spectrum of premiums, depending on the specific model-year, brand and other factors.

That’s according to NADA CPO value data included in the latest NADA Perspective report, which highlighted the mainstream and luxury brands generating the strongest values on their CPO models.

NADA gathered data from automakers to plot the distribution of CPO premiums, and in doing so, found that premium on three-fourths of certified purchases came in between $500 and $2,000.

The report suggests “this disparity implies that CPO’s value proposition actually exceeds consumer expectations.”

A vehicle’s brand, age, price and the competitiveness of its OEM’s program are the four key drivers behind differences in certified prices, NADA says.

NADA takes these four elements and couples them with CPO sales data to formulate its certified value methodology and the CPO values in its Official Used Car Guide.

“Generally speaking, CPO values are greatest for newer and more expensive models backed by programs that extend bumper-to-bumper and powertrain warranties out the furthest, while values are lower for older, less expensive and less competitive programs,” NADA said in the report.

When digesting average premiums based on model year and vehicle type, NADA’s data suggests quite a range, as well.

For instance, certified vehicles from the 2008 model-year have an average premium of $1,532, while those from the 2014 model-year year fetch an average premium of $1,737. The spectrum for average premium goes from $1,166 to $1,371 for mainstream brands and $1,992 to $2,381 for luxury brands.

NADA also dissected its analysis by looking specifically at the 3-year-old CPO vehicles from the 2011 model year. What it found was that Ford had the strongest certified values among mainstream brands ($1,486) with GMC not far behind ($1,424). Third was Toyota ($1,284), followed by Chevrolet ($1,222) and Nissan ($1,190).

Mercedes-Benz topped the list of luxury brands ($2,909). Second on the luxury side was Porsche at $2,605, with Lexus third ($2,175), Jaguar fourth ($2,161) and Land Rover fifth ($2,068).

It’s one thing for certified pre-owned demand to have grown in recent years. But to have had the supply of late-model cars simultaneously skyrocket makes for a rather fortunate one-two punch.

And it’s a combo that’s made CPO an emerging heavyweight in the used-car industry, as automakers continue to shatter certified sales records.

“The sharp increase in CPO demand that has occurred over the past two years has come at an opportune time for manufacturers,” NADA Used Car Guide said in its latest NADA Perspective report.

“After years of declines stemming from the falloff in new vehicle sales during the recession, late-model supply — or the primary pool from which CPO vehicles are derived — finally started growing again in 2013,” NADA added.

Interestingly, the growth in supply of CPO-friendly cars that began in 2013 occurred right after the certified market had just recorded two straight best-ever years.

With more bountiful supply of late-model units in 2013, the industry reached yet another record year for certified sales and appears headed that way again in 2014.

CPO sales in the year’s first four months were up 11 percent from the same period of record-breaking 2013, NADA indicated.

Jonathan Banks, NADA’s senior director of vehicle analysis and analytics, alluded to this growth during a press conference at January’s NADA Convention & Expo, when he said the record sum from 2013 would likely be “blown away” by what happens in 2014.

“The big story here is, there will be more availability for the franchised dealers for inventory for those CPO units, which is great for consumers and great for dealers,” Banks said during the press conference.

“We think that 2.1 million CPO sales (figure) … will be blown away, driven by the availability of lease returns that will inevitably come back in 2014,” he said.

That seems to be case, if NADA’s data on late-model supply is any indication. Citing NADA’s used-vehicle supply forecast, the report called for 8-percent growth in late-model supply this year topped off with 9-percent growth next year.

NADA said that “combined, the 17-percent increase in used supply through 2015 will act as an additional catalyst supporting a continued increase in CPO sales.”

To illustrate this notion, the report hammers home the fact that brands who have boosted their supply of late-model supply the furthest are also among those generating the most CPO growth.

Consider this: Kia (up 44 percent), Subaru (up 37 percent) and Hyundai (up 26 percent) are at the top of the list of year-over-year sales gains so far this year for mainstream brands.

“Not coincidentally, NADA estimates that late-model supply will grow the most for Kia and Hyundai this year, while supply growth for Subaru is expected to be among the industry leaders,” the report noted.

The certified pre-owned market opened 2014 with the highest first-quarter share of franchised dealers’ used-car sales in five years.

That’s according to the latest Used Market Quarterly Report from Edmunds.com, which said CPO vehicles accounted for 19.7 percent of all used sales by franchised dealers in Q1.

The last time the certified market made up that much of franchised dealer used activity in the first quarter was 2009.

What’s more, CPO share of franchised used was down 0.5 percentage points from the fourth quarter, but this represented the smallest Q4-to-Q1 share decline ever, Edmunds said.

Dealers sold 551,707 certified vehicles in Q1, which beat year-ago numbers by 14.2 percent.

Overall, there were 9.1 million used cars sold in the first quarter, including numbers from franchised and independent dealers as well as private-party sales.

This is down 6.7 percent year-over-year, but the entirety of that decrease is within independent sales and private-party transactions, Edmunds indicated. Franchised dealers sold 2.8 million used vehicles in the first quarter, which was an improvement of 5.7 percent from Q1 of 2013.

“As expected, there have been used sales gains at franchise dealers,” the company said in its analysis accompanying the data. “This pattern, driven by lease returns and trades, will continue through the next quarter and throughout the year.”

It added: “During this uneven economic recovery, lower income consumers are staying out of the market. This is why independent and private-party sales are down. Those with stronger purchasing power will facilitate used sales growth at franchise dealers.”

And part of that may include stronger CPO operations, as well.

Edmunds indicates that with high lease penetration rates, automakers are motivated to make a “long-term push” for certified among their dealers.

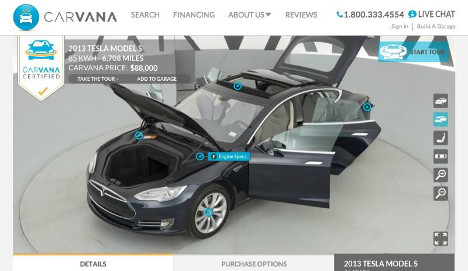

Online auto retailer Carvana announced Friday that what it’s calling the first Carvana certified pre-owned Tesla is now available on its website.

The vehicle is a 2013 Tesla Model S and can be found at www.carvana.com.

(Carvana also clarified that the CPO offering is via Carvana.com, versus coming directly from Tesla)

Carvana says the Model S is the first of many Tesla cars that will be available on the site, adding that it is the first online retailer to allow shoppers to shop, buy and finance Telsas completely online.

“We’re excited to offer the first certified pre-owned Tesla that is available for sale and delivery nationwide”, says Ernie Garcia, president of Carvana.

“There has been a lot of news recently around the regulatory limitations Tesla has faced selling their cars in certain states, but because of our unique business model we are able to sell pre-owned Tesla’s to anyone, anywhere,” Garcia added.

Indicating that retail prices on pre-owned Telsas have hit record highs, Carvana said its initial model will be up for $88,000. The car is covered by Carvana Certified’s 100-day/4,189-mile bumper-to-bumper warranty as well as a seven-day “test-own” return policy.

Tesla is no stranger to the news, as of late, for its alternative method for retailing vehicles.

Just last month, a trio of Federal Trade Commission staffers released a blog post asserting car shoppers should be able to decide how they shop for their next vehicle, in regards to the ongoing controversy and legal battle Tesla’s direct-to-consumer sales model has sparked in the dealer community.

It didn’t take long for NADA to respond to the post. A press release from the dealer organization soon followed, claiming the individual states should, in fact, decide how consumers shop for new cars.

NADA claimed that the in implying consumers should be able to choose whether they want to visit a dealership or buy directly from the automaker the FTC staffers “failed to acknowledge how the franchised dealer network actually benefits car buyers through price competition and safety, and provides enormous economic benefits to local communities.”

In the NADA release, Jonathan Collegio, NADA vice president of public affairs, was quoted saying, “For consumers buying a new car today, the fierce competition between local dealers in a given market drives down prices both in and across brands — while if a factory owned all of its stores it could set prices and buyers would lose virtually all bargaining power. And buying a car isn’t like buying a pair of shoes online. Cars require licensing to operate, insurance and financing to take home, and contain hazardous materials, so states are fully within their rights to protect consumers by standardizing the way cars are sold.”

The authors of the original FTC blog post — Andy Gavil, director of the Office of Policy Planning; Debbie Feinstein, director of the Bureau of Competition; and Marty Gaynor, director of the Bureau of Economics — began by focusing on how sales and consumer behavior is always evolving.

They gave the following example, as stated in the blog post: “Consumers once shopped predominantly at their local stores; but first mail order catalogs and today the Internet have created new ways to shop for and purchase a wide range of goods and services. Similarly, consumers once arranged for taxis by hailing one from a street corner or by calling a dispatcher; yet today, smartphones and new software applications are shaking up the transportation industry, creating new business opportunities and new services for consumers.”

The authors contend that the same evolution is being stalled in the business of buying cars, due to local laws in many states that require consumers to buy cars from licensed auto dealers.

Carvana's approach, it would seem, is cut from a similar, if not the same, cloth.

The Phoenix-based company operates out of Atlanta and says it is the “first complete online auto retailer that allows consumers to shop, finance and purchase a car entirely online, and have it ready for home delivery or pick-up at the nation's first vending machine as soon as the next day.”

In essence, it offers a platform for shoppers to browse vehicles, find financing and coordinate delivery all online.

Staff writer Sarah Rubenoff contributed to this report.

The overwhelming majority of import brands listed in Autodata Corp.’s set of monthly certified pre-owned sales results showed year-over-year increases in April, many by double-digit percentages.

As a whole, Asian brands increased their sales by 5.8 percent last month, moving 91,027 CPO units, according to Autodata. Year-to-date, they have sold 352,808 certified units for a 6.4-percent increase.

European brands moved 33,811 CPO vehicles in April, which was a 12.1-percent gain. Through four months, they have sold 127,726 certified vehicles for a 9.9-percent hike.

Among the import brands, one of the many notable increases was at Infiniti, which nearly doubled its CPO sum from April 2013. It moved 1,739 certified vehicles last month, a 93.4-percent increase from the 899 CPO cars it moved the same month of last year.

Meanwhile, Jaguar (up 110.5 percent with 560 sales) and Land Rover (up 116 percent with 1,069 sales) both managed to double their respective April CPO sales.

Another stronger player in April was Hyundai, which had its best April ever. It moved 7,930 CPO cars for a 27.5-percent year-over-year increase. Through four months, Hyundai has sold 30,278 certified vehicles (up 26.4 percent).

The Big 3 combined to sell more than 68,000 certified pre-owned vehicles last month, as their year-to-date figures race ahead of 2013 numbers by nearly 17 percent.

That’s according to figures released last week by Autodata Corp., which said the programs within General Motors, Ford and Chrysler moved a grand total of 68,253 CPO units in April for a 13.5-percent year-over hike.

Through four months, domestics have sold 264,327 certified vehicles this year, up 16.9 percent from the year-ago time frame, Autodata indicated.

Ford’s brands sold 21,911 CPO units in April (up 16.2 percent) and have moved 85,771 certified cars in 2014 (up 24.1 percent).

There were 33,063 sales of certified Buick, Chevrolet, GMC, Pontiac and Saturn vehicles at GM last month, a 10.9-percent improvement, the data indicated. Those same brands have sold 125,625 CPO cars year-to-date (up 12.5 percent).

There were 1,872 Cadillac CPO sales last month (up 18.9 percent) with yearly sales at 6,705 (up 8.4 percent).

At Chrysler, the Dodge, Chrysler and Jeep brand certified sales came in at a combined 11,407 units for April, which beat the year-ago sum by 15.4 percent.

Through four months, the company has moved 46,225 certified vehicles, which is 18.4 percent ahead of where it was at this point of 2013.

There were 193,091 certified pre-owned sales in April, according to Autodata Corp., which said this was a 9.5-percent improvement over year-ago figures.

Through the first four months of the year, dealers have sold 744,861 certified units, which beats the year-ago sum by 10.5 percent.

Asian automakers sold 91,027 CPO cars in April, which marked a 5.8-percent gain. Europeans moved 33,811 CPO units for a 12.1-percent upswing. The Big 3 posted 68,253 CPO sales for a 13.5-percent lift.

Stay tuned to Auto Remarketing for more CPO results from April.

Tax season evidently helped the used-vehicle sales market rebound nicely as the first quarter closed.

CNW Research reported monthly used-vehicle sales surpassed 3 million units for the first time this year as analysts computed the March figure came in at 3.088 million. That figure represents a gain of more than 50 percent from February’s sales amount, which was 2.055 million.

“And it wasn’t just in the franchised channel. Independents and casual sales also showed significant 50 percent increases versus February,” CNW president Art Spinella said.

CNW determined franchised dealerships sold more than 1 million used vehicles in a month for the first time in 2014 as these stores turned 1.096 million units. Sales at independent dealerships also topped the 1-million mark. Private party transactions settled just below that threshold as the firm put the total at 985,316.

During his quarterly conference call on Monday, Manheim chief economist Tom Webb praised the used-vehicle sales performance dealers enjoyed in March, touching on some of the reasons why he believes the retail side is healthy.

“Dealers are turning auction purchases quickly on their retail lots and they’re turning them efficiently,” Webb said. “As a result, profits are very, very strong. Why is that important? Because the competitive nature of the market means that dealers will keep on bidding on units up and to the point that their margins are reduced to the minimally acceptable level.

“I would say given the continued improvement in the labor market, and more importantly, a very favorable retail credit environment, I do not expect these market fundamentals to materially change in the months ahead,” he continued.

That credit seemed to be available as the amount of subprime buyers who made a used-vehicle purchase thanks to an influx of tax-refund cash significantly in March.

CNW indicated the number of subprime buyers in March rose 17 percent versus year ago and soared 57 percent above the February figure.

Meanwhile, the firm noted that sales to consumers with FICO scores below 550 spiked 51.6 percent month-over-month. Sales to those deep subprime buyers also jumped 11.8 percent in March versus the same month a year earlier.

All told, CNW said about 3 percent more units were financed in March versus a year ago.

As an industry on a year-over-year basis, CNW determined that used-vehicle climbed 2.7 percent with franchised dealer sales units up 1 percent, independent dealer sales up 4.8 percent and private party transactions gaining 2.55 percent.

“But the good news doesn’t stop there,” Spinella said. “Franchised transaction prices rose a healthy 10.8 percent on the back of growing certified pre-owned units.

“Independents also saw an increase in transaction prices but at a more modest 1.52 percent versus year ago while private party sucked a lot of newer (15-plus year old) models off the market and was able to make a 5 percent increase in transaction prices,” he continued.

Spinella pointed out that the used-vehicle industry generated these sales numbers with 13 percent fewer used shoppers searching lots versus year ago, “indicating the pent-up demand log jam may well be breaking.”

Manheim Consulting indicated new-vehicle leasing increased by more than 10 percent year-over-year during the first quarter, marking the eighth quarter in a row the market penetration rise has been by at least that amount.

During his quarterly conference call on Monday, Manheim chief economist Tom Webb explained how that development might be pointing toward another trend besides more potential inventory for franchised dealers to grow certified pre-owned sales.

“Interestingly, even though total new-vehicle sales in the first quarter were basically flat after a poor January and February, the retail lease penetration rate was up, and fleet sales were down. As a result, new-lease originations grew by more than 10 percent in the first quarter,” Webb said.

Because of what happened in Q1, Manheim slightly modified its off-lease volume estimates for 2015 and beyond, projecting the level could approach 3.5 million units five years from now.

Then, Webb dived back into what else growing lease penetration might mean.

“It should be noted that the increase in lease returns will approximate the increase the total increase in new-vehicle sales this year. Next year, I would fully expect that the increase in lease returns will likely exceed the increase in total new-vehicle sales,” Webb said.

“So what we have is what I would characterize is that we no longer have a new-vehicle market that is supported by pent-up demand. We have one that is supported by lease returns, and that’s a good thing,” he continued.

“But you all know I have my bias,” Webb went on to say. “If you consider that new vehicles are increasingly being bought by high-income households that do in fact want to trade on a regular cycle, then they should be in a lease and not a retail contract. Because remember, residual risk always has to reside somewhere. How better for that risk to reside with the lessor who has a portfolio of vehicles and hopefully has a professional remarketing arm.”

Even with the increase in off-lease volume, Webb pointed out that Manheim is forecasting that 2014 CPO sales are estimated to be greater than the total year-end off-lease supply. He noted that situation also unfolded in 2012 and 2013. Manheim’s data showed off-lease volume stood at about 2 million vehicles in 2011 with CPO sales settling a few thousands units below that figure.

When asked by Auto Remarketing, Webb discussed specifically when off-lease volume might increase as this year continues.

“It accelerates as the year progresses to the certain extent that new leases are sometimes written with contracts so they don’t come due in the weakest part of the cycle in November and December,” Webb said.

“There is still opportunities to pull leases ahead. I think you’re going to see more of that because the numbers are big and one of the advantages of leasing is that it maintains brand loyalty,” he continued. “By the same token, if you’re one of the other brands, you want to get it and capture that customer before they return back to that brand so you’ve got some marketing techniques you can use. And one of the strategies is pulling that lease ahead to capture the customer.”