Although last month’s sales slowed from a year ago's pace, the certified pre-owned segment remains a bright spot in automotive, says Cox Automotive, which projects CPO will return to 2019 levels this year.

In a Data Point report Monday, the company — citing Motor Intelligence — said there were 209,744 certified sales in February. That’s down 12% year-over-year, steeper than the total used-car sale decline of 3%, but it beats January CPO sales by 4%.

There were 201,023 CPO sales in the opening month of 2021, down from 215,999 certified sales in January 2019, according to Cox’s analysis of Motor Intelligence data.

Year-to-date, there have been 410,767 certified sales. That’s down more than 9% from the 454,188 CPO sales in the first two months of 2020.

But consider where the market was after February 2020, just before COVID-19 was declared a pandemic.

The first month of 2020 was the strongest January for the certified pre-owned market in a decade. February 2020 then beat those sales by 10%.

As reported previously in Auto Remarketing, February 2020 sales were up 13% year-over-year, and sales through the first two months of 2020 were at 454,188, Cox Automotive said in that report, again citing Motor Intelligence.

Consider this: in 2018 and 2019, each a record year, respective certified sales through two months were:

- 2018: 415,140 units

- 2019: 411,160 units

As Cox Automotive put it in the analysis, the first two months of 2020 were already 40,000 sales ahead of both 2018 and 2019.

(Then, of course, the world changed and you know the rest).

And despite a start to 2021 that’s comparatively much slower than the hot start to 2020, Cox is forecasting 2.8 million CPO sales in 2021, which would be similar to the record-setting 2019 sales, which marked the ninth straight best-ever year for CPO.

It would also be more than a 7% hike from the 2.6 million certified sales last year.

“The CPO market has been one of the strongest performing segments within the auto retail market despite the ongoing pandemic,” analysts said in Monday's report. “Going into 2021, we expect the CPO market to resume its consistent performance of annual growth after a dip in 2020.”

Nearly of a third of February’s CPO sales (32%) came from Chevrolet, Honda or Toyota, according to Cox. Nearly half (45%) came from those three, Ford or Nissan.

Looking at the overall used-car market, the total used-car SAAR for February was an estimated 38.0 million, Cox said. In January, it was at 38.1 million, and for February 2020 it was 39.4 million.

As far as dealer sales specifically, that is measured by Cox’s used retail SAAR estimate, which was 20.8 million for February. That’s steady with January and slightly softer than February 2020’s 20.9 million

In another Data Point report, this one released Wednesday, Cox Automotive pointed to another good sign for the used-car market: inventory is tighter, thanks to a speedier pace of sales.

There were 2.66 million unsold used vehicles at the end of January, the company said, citing its vAuto Available Inventory data. By the end of February, that figure had dropped to 2.59 million.

And although used supply has remained “fairly stable within that range” for three months, Cox points out, the supply of unsold used vehicles in February was down 12% compared to the same month of 2020.

Meantime, while there has been stability in day’s supply of used vehicles going back to October, February’s reading (48 days) was down from 54 in February 2020.

There were 1.42 million used vehicles in inventory at franchised dealers last month, representing a 43-day supply. There were 1.17 million used vehicles at non-franchised dealers, which equates to a days’ supply of 54.

“Spring traditionally is strong for used-vehicle sales, due mostly to tax returns and maybe some optimism that spring and summer are coming,” Cox Automotive senior economist Charlie Chesbrough said in the analysis.

One thing that has added more fuel in 2021 has been COVID-19 stimulus checks, he said, as those often go to an income bracket where a used-car purchase is more likely.

“Those buyers may be surprised to see tight inventory and high prices,” Chesbrough said. And that could slow sales down the road.

As it is, used-vehicle values have already seen an early spring bounce, according to Cox Automotive chief economist Jonathan Smoke, as the Manheim Used Vehicle Value Index reached a record high in February.

On the retail side of the equation, dealers were listing their used vehicles at an average price of $21,627 at the end of last month, Cox’s analysis of the vAuto data shows.

That’s close to the level at the end of January ($21,572) and down from early January’s peak of $22,131. But it’s up more than $2,600 from the year-ago figure of $18,974.

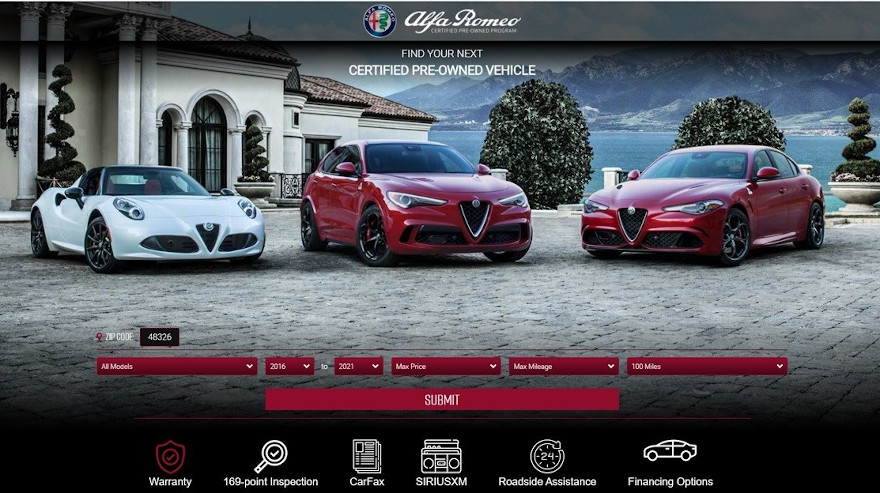

Alfa Romeo, which is part of the Stellantis family of brands, announced a revamped website Wednesday for its certified pre-owned vehicle program where consumers can locate, research and buy CPO vehicles online.

Shoppers can access the new site at alfaromeousacertified.com or through the alfaromeousa.com homepage.

In addition to undergoing certification and reconditioning processes, Alfa Romeo’s certified vehicles include a five-year/100,000-mile Maximum Care Warranty, roadside assistance, CARFAX Vehicle History Report, three-month Sirius XM All Access subscription, financing options and certified warranty upgrade options.

The CPO program also touts E-Shop as one of its benefits, where consumers can research vehicles and set up their purchase from home, including home delivery.

The Alfa Romeo program includes a 169-point inspection on all CPO vehicles.

A sluggish start has not dimmed Cox Automotive’s outlook for certified pre-owned vehicle sales this year.

According to the company’s analysis of Motor Intelligence data, January’s 201,023 CPO sales marked a 7% year-over-year decline and a 13% month-over-month drop.

But take last month's softening with a grain of salt. The year-ago figure marked a decade-high for January certified sales, and December’s tally was “seasonally strong,” Cox said in the Data Point report from Feb. 12.

What’s more, Cox is projecting there will be 2.8 million CPO sales this year. While that’s subject to change, it would handily beat year-ago figures of 2.6 million and put the industry back to where it was in 2019 — which happened to be the ninth consecutive year of record sales, a streak that ended last year.

“The CPO market has been one of the strongest performing segments within the auto retail market despite the ongoing pandemic,” Cox said in the analysis. “Going into 2021, we expect the market to continue its consistent performance for year-over-year gains.”

Nearly a third of all certified sales in January (32%) were either Toyota, Honda or Chevrolet models, the company said.

Add Ford and Nissan to the mix and you’ve got about half the market (45%).

Looking elsewhere around the industry, Mazda North American Operations reported a 12.4% year-over-year gain in CPO sales, with 5,247 vehicles moved last month. In its news release, MNAO said it, “oversees the sales, marketing, parts and customer service support of Mazda vehicles in the United States and Mexico through approximately 620 dealers,”

Canada CPO sales trends

Moving to Canada, there appeared to be a bit of auto retail challenge around shutdowns in Ontario and Quebec as 2021 gets underway, and that is impacting certified pre-owned sales. Here's a roundup of January CPO sales results shared by automakers, thus far.

At Hyundai, its certified sales fell 25% year-over-year, coming in at 642 for January. Of course, last year marked the strongest ever CPO January for the brand, and despite the decline, “we are still very satisfied with the results considering the headwinds facing the market in January,” said Charles Plewes, who heads up remarketing and CPO for Hyundai Auto Canada Corp., in an email.

“Most of our dealers in Quebec and Ontario were closed to walk-in traffic, which made sales very challenging,” Plewes said.

Nissan and Infiniti also faced similar headwinds in Canada during January.

Nissan had 599 CPO sales, down from 1,023 a year ago. Infiniti CPO sales fell from 151 in January 2020 to 80 last month.

“January was a real tough month,” said Joel Gregory, who heads up CPO for Nissan and Infiniti in Canada, via email.

“Provincial ‘lockdowns’ in the two highest volume provinces (Ontario and Quebec) hampered business making any type of foot traffic into dealerships very challenging,” Gregory said.

Volvo continued to show gains, it said, with 229 CPO sales in Canada, a 6% increase.

After falling 7% in 2020 but still remaining relatively strong, certified pre-owned sales are likely to bounce back in 2021 to what would be one of the strongest years on record, according to Cox Automotive.

There were 2.6 million certified sales in 2020, down from 2.8 million in 2019, says a Cox Automotive analysis of Motor Intelligence data released Friday.

The year closed with 231,042 CPO sales in December, down 2% year-over-year. However, that beat November sales by 24%, Cox said.

“The CPO market in December normalized from its November drop that was attributed to a combination of factors including, seasonality, the ongoing pandemic, broader economic conditions and supply/demand,” analysts said in the Data Point report.

Looking forward, Cox Automotive is projecting 2.7 million CPO sales this year.

While that would not be a record, it would still rank among the three best years ever for certified sales, based on Auto Remarketing’s previous reporting.

And while 2020 sales failed to extend the streak of record years, they were still close to recent highs and have shown considerable gains since the spring.

“Where we saw the biggest improvement from April was in the CPO market. In December, CPO sales declined 2% year-over-year and were up 24% month-over-month,” Cox Automotive manager of economic and industry insights Zo Rahim said in a presentation earlier this month. “CPO sales ended the year with 2.6 million units (sold), down 7% in 2020.

“Gently used and younger used vehicles should continue to see consumer interest this year.”

Going back to 2020 CPO sales, Cox said the programs at Toyota, Honda and Chevrolet —the industry’s largest — combined to move close to 800,000 CPO vehicles last year. That’s close to a third (30.5%) of the market and similar to their combined market share in 2019 (32%).

Several automakers included certified results in their most recent sales reports.

CPO numbers at Mazda improved 8.4% in 2020, as its dealers sold 66,193 certified units. Mazda had an especially strong December, moving 5,945 CPO vehicles for a 23.9% gain.

Porsche finished the year with 27,261 certified sales, an 8.6% increase. It had 7,081 CPO sales in the fourth quarter.

The BMW brand had 108,593 certified sales in 2020 (down 9.3%) and the MINI brand had 9,488 CPO sales (down 25%).

In Q4, BMW had 25,811 certified sales (down 20.5%) and MINI had 2,175 (down 21.2%).

Certified pre-owned sales took major tumbles on both year-over-year and month-over-month bases in November, but that shouldn’t cause alarm about the overall strength in CPO, according to Cox Automotive.

The 21% decline from November 2019 admittedly could be seen as “a big shock to the market,” but that slowdown was largely driven by last month having three fewer selling days than the year-ago period, says Kayla Reynolds, an economic industry intelligence analyst at Cox Automotive.

Moreover, the 20% decline from October is essentially a normalization following strong summer and autumn CPO sales, the company said in a Data Point report released Thursday.

During an interview earlier this week, Reynolds also points out that November is typically a weaker month for CPO, so the softness has to do with seasonality, along with supply/demand factors, “broader economic conditions” and “possibly a combined credit tightening.”

Getting into specifics, the Cox Automotive analysis of Motor Intelligence data indicates there were 186,861 CPO sales in November. That’s the lowest monthly sum since April.

However, certified remains one of the bright spots in auto retail. Reynolds said the company is maintaining its forecast for 2.6 million CPO sales. That would break the streak of nine record years in a row, but it would still rank in the top five years ever for CPO, based on Auto Remarketing’s previous reporting of certified sales numbers.

“And then we do expect a rebound, a manageable rebound, in 2021 to 2.7 (million),” Reynolds said.

As far as the current month, Reynolds said the past five years have shown that December tends to be stronger than November, but not as robust as CPO sales in the spring and summer.

In terms of next year’s forecasted rebound in CPO, Reynolds is hopeful that lease return gains will provide an “assist” to dealers.

She also agrees that a greater emphasis by large dealer groups and automakers on the used-car side should help the market next, too.

"I think it will assist the market somewhat, especially because the used market is so important to the industry as a whole,” Reynolds said.

The used-car market is already much larger than the new-car side, and the industry is also balancing out some supply and demand, which has shifted some focus to used, Reynolds explained. She also expects auction prices to “normalize” in 2021, so that should help, as well.

For 2020, the year is expected to close with 36.3 million used-car sale overall, with used retail (sales from dealers) at 19.3 million, Reynolds said.

Next year, it is expected that the used total will climb to 39.3 million.

And CPO, she said, has helped the overall used-car market “not have as weak of a year as everybody would have expected.”

In fact, even though there has been an 8% dip in CPO sales year-to-date, it’s better than the estimated 9% to 10% decline in the overall used-car market, according to Cox Automotive.

Cox estimated there was a 10.3% year-over-year drop in used-car sales last month and a SAAR of 37.0 million units. In November 2019, the used-car SAAR was 39.7 million. In October, it was 38 million.

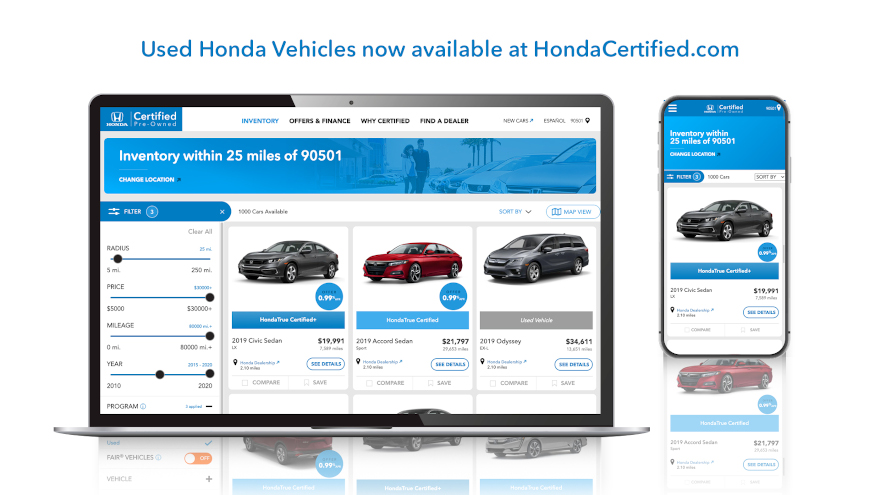

American Honda is adding non-CPO used vehicles to its HondaCertified.com platform, a move the company says can help it capture more of the used Honda market and more efficiently and effectively introduce younger buyers to the brand.

When consumers arrive at HondaCertified.com, they will now be able to search Honda dealers’ inventories for used Hondas up to 10 years old, as well as the already available certified pre-owned inventory at those stores.

“When we look at the overall used-car market, it's almost 40 million cars a year. And all the big growth with the big box stores, it really showed us that we're not really capturing as much of that opportunity as we'd like,” Dan Rodriguez, American Honda’s manager of auto remarketing, said in an interview Friday.

“We'll sell, between Honda and Acura, a little over 3 million used cars a year, industry-wide. Through our dealers, we're about a million of that,” he said. “So, we think there's great opportunity there.”

And it could help grab back some of the share of used Hondas that might have otherwise been sold at a competitive-brand dealership or some of the new entrants to the used-car space, Rodriguez said.

“And we think there's nobody better to represent our product than our dealer network and we want to make it easy for customers to find product through that channel, where we know they're motivated to make sure they have a great brand experience,” he said. “In a utopic world, our goal would be to bring that young first-time buyer in through a used car and really graduate them to a CPO and then eventually to a new car. So, we can kind of keep them for a lifetime."

The latter point underscores another reason for the expansion of the site: that there’s also an opportunity to bring in buyers who might otherwise be priced out. The hike in new-car prices has made it “a little more challenging for that younger buyer to experience our brand,” Rodriguez said.

So, Honda is utilizing its existing CPO website to give them an easy way to do so.

“We know we've got a great dealer network; we've got a great product. Who better to prepare a car and optimize that first experience than our dealer network?” Rodriguez said.

The next step in the process is rolling out the inventory, he said, and then expanding the program in 2021. Additional features will be added to this platform in coming months.

“With the continued rise in new-vehicle prices, the first vehicle purchase for many buyers will come from the used-car market, and our upgraded website makes this process more simple and enjoyable,” Rodriguez said in a news release. “As a leading brand among first-time and younger buyers, expanding our branded website to include used vehicles up to 10 years old offers customers more high value options with quality Honda products and their local Honda dealer standing behind their purchase.”

Not only were certified pre-owned vehicle sales up 1% year-over-year in October, they snapped a three-month streak of month-over-month declines.

That’s according to a Cox Automotive analysis of Motor Intelligence data, which indicated there were 233,514 CPO sales in October.

That beats September figures by 4%.

And the CPO market has now shown year-over-year gains for two straight months and in four of the last five months.

The 224,536 CPO sales in September were up from 204,946 a year earlier, according to the Cox analysis of Motor Intelligence data.

CPO sales for August dipped from 260,725 to 238,498.

Meantime, CPO sales in July came in at 254,982 units, up from 236,579 in the same month of 2019. In June, there were 261,586 CPO sales, up from 240,844 a year earlier.

And even though year-to-date sales are off 6% through 10 months, they are faring better than the overall used-car market, which is down 8%, Cox said.

The company is projecting 2.6 million certified sales this year, slower than the record 2.8 million CPO sales in 2019, which was the ninth consecutive record year.

However, the expected full-year tally remains in the same ballpark that annual CPO sales have been over the last handful of years.

For instance, both 2017 and 2016 — which were record years — had certified sales in the neighborhood of 2.64 million, according to Autodata Corp. data previously reported by Auto Remarketing. There were 2.55 million in 2015 and 2.34 million sales in 2014, which again were both record years at the time, according to our previous reporting on Autodata info.

And its latest forecast of 2.6 million is stronger than forecasts earlier in the year, when it projected 2.5 million certified sales for the year in August.

And a few months earlier, Cox Automotive was projecting 2.0 million CPO sales in its 2020 Market Insights & Outlook

During Cox Automotive’s Q3 2020 U.S. Auto Sales Forecast Call in late September, manager of economics and industry insights Zo Rahim said of CPO: “So far, the certified pre-owned market has seen the quickest rebound in sales performance, making CPO the strongest performing segment of the auto retail market.

“Consumer demand for these … like-new used vehicles has really improved from the peak of the crisis back in April,” Rahim said.

Looking at the overall used-car market, Cox estimated October showed a 5% drop in sales. It estimated the 13-month rolling seasonally adjusted annual rate at 37.5 million for used cars in October.

In September, it was 39.0 million, and in October 2019, it was 39.6 million.

Specific to used retail, or those sales that come through a dealership, the used SAAR for October was an estimated 20.4 million. In September, it was 20.7 million and in October 2019 was 20.6 million.

Below are how the overall used SAAR and retail SAAR levels have trended over the last 13 months. Data courtesy of Cox Automotive.

| Month |

Used SAAR (in millions) |

Used Retail SAAR (in millions) |

| October 2019 |

39.6 |

20.6 |

| November 2019 |

39.7 |

19.3 |

| December 2019 |

40 |

20.1 |

| January |

39.5 |

20.7 |

| February |

39.8 |

21.2 |

| March |

32 |

17.3 |

| April |

27 |

14.4 |

| May |

32 |

16.7 |

| June |

36 |

18.9 |

| July |

38 |

20.4 |

| August |

38 |

20.3 |

| September |

39.0 |

20.7 |

| October |

37.5 |

20.4 |

Auto Remarketing is recognizing its 11th annual CPO Dealer of the Year, and receiving the honors in 2020 is Ford dealer Jerry Mullinax, whose group includes five Mullinax Ford stores in Florida, one in Mobile, Ala., and another in Olympia, Wash. The group also includes a Hyundai store in the Orlando, Fla., area.

Mullinax has roots in auto industry going back 50 years when his father, the late Ed Mullinax, got into the car business in Ohio. As elementary schoolers, Jerry Mullinax and his brother Larry started doing odd jobs at the family’s dealership.

“Typical kid growing up in the Midwest, our first job was picking the rocks out of the front yard (of the dealership), because we bought it and the previous owner didn’t really bother to pick the rocks out of the front yard, so that’s what we did,” Jerry Mullinax said.

“We cleaned the service department floors, and mowed the grass … I said to myself when I was a kid, if I can ever afford to pay somebody to mow my grass, I will never mow grass again — not unlike a lot of kids,” Mullinax said.

“As we got older, we started cleaning cars and those types of things,” he said. “Once we could drive, we started actually getting more of the learning about the business.”

And helping the family business grow.

Ed Mullinax grew the business to five Ford dealerships, Jerry said, eventually selling to AutoNation in 1996. His father was credited by many as the inventor of one-price selling, Jerry said, which was the business model AutoNation was aiming to use, he said.

Jerry Mullinax ended up working for AutoNation for three years before deciding to go out on his own. In 2000, he restarted his dealership business from scratch.

Mullinax, now in his late 50s, has been in the car business for a half-century, the last 20 years of which have been running his own stores.

While he doesn’t “want to sound like one of these 80-year-old men,” Mullinax has seen it all, and has firsthand experience in the car business from the ground level as a youngster doing odd jobs on up.

“It’s very hard to replace just being around and just seeing what happens. I’m 58 and so I’ve been working around a dealership for 50 years,” he said.

But for the auto industry at large, and many other industries, few if any of those years have been quite like 2020, as the COVID-19 pandemic has impacted seemingly every aspect of daily life and business.

As for the Mullinax stores, “It’s kind of a mixed bag,” Mullinax said.

“Most of our stores, it’s been a pretty good year … Car dealers in Florida are considered an essential business, so we never had to close,” he said. “Of course, when COVID came along first, it affected business negatively and then when the manufacturers put 0% (financing) on, we sold a lot of trucks and did pretty well.

“Now we have a store in Olympia, Washington that the state mandated that we close there and certainly that affected that store very negatively. But overall, most of our stores are up,” Mullinax said.

And most have seen used-car growth. In the mid-September interview, Mullinax mentioned a few Florida stores with used sales up between 2% and 9%, plus a 40% gain in pre-owned at its Vero Beach, Fla., store.

“So overall, with the exception of our Washington store, we’re up in used cars this year. Our new is down slightly, but again in Olympia, it’s down the most out of any of our stores,” Mullinax said.

“Looks like our average store is probably, on new, is probably off about 5% or less. So overall, it’s not been a bad year,” he said.

Mullinax said the group is “fortunate” in Florida, as he looks around the country and sees other areas with stronger dips.

CPO sales for Mullinax stores have been similar to used overall, he said. One challenge, however, has been the high demand for 1- to 3-year-old vehicles that are the bread-and-butter of certified inventory.

Doing the math on various costs, fees and profitability, the Mullinax stores have not been able to purchase as many vehicles in this age bracket that they typically would.

So, what about alternative methods to sourcing CPO vehicles?

“I don’t think we’ve done enough, certainly we’ve gone out a lot further. And I think a lot of dealers do this now, but we’ll go out 1,200 miles to find, sometimes even further, to find the inventory,” Mullinax said. “So, I guess I’d say searching further away has been one thing that we’ve done. Looking at trying to find other auction sources, like ACV … Our buyers a lot of times spent a lot of time on the Ford factory sales. They still do, but looking other places as well. They’ve spent more time looking at other places, as well, to try to get enough inventory on the ground.”

Another odd year for the auto industry, of course, was 2008, during the height of the Great Recession. With the new-vehicle industry crashing, Mullinax ramped up its focus on used and “started getting better at them.”

Based on his data, Mullinax doesn’t find that gross on CPO cars is higher, but he has found that they turn quicker.

“That’s half the equation, is how fast you sell them, and typically we sell a CPO faster than we sell a non-certified,” he said.

Certified also tends to help out the service business, Mullinax has found. Not only do the Ford CPO vehicles come with the respective warranties of that program, Mullinax said that “we sell a lot of wraps as well … The wrap is when you cover the other components on top of the powertrain. And those cars end up in the shop a lot faster than a new car. And the customer, since they have a warranty, they don’t want to go someplace else. They’ve got the warranty here and they bring their car here.

“And I think that’s probably one of the biggest things about CPO that we appreciate is, we turn the cars faster and we see them back in our service lane a lot more. That may also ultimately lead to more customer loyalty, as well,” he said.

“If that car’s not a CPO and they go take it down to a local repair shop, you don’t have that same interaction with the customer. And it’s kind of proven the more interaction you have with a customer, the more likely they are to come back.”

As the 2020 CPO Dealer of the Year, Mullinax will be recognized during the Pre-Owned Con portion (Dec. 7-11) of the all-digital Used Car Week. Stay tuned to Auto Remarketing enewsletters and UsedCarWeek.biz for more information.

This is the award’s 11th year. Previous winners of the CPO Dealer of the Year award include:

2019: Cavender Toyota

2018: Trophy Nissan

2017: Kia of Irvine

2016: Fletcher Jones Motorcars

2015: Bill Luke Chrysler Jeep Dodge & Ram

2014: Hyundai of New Port Richey

2013: Galpin Ford

2012: Longo Toyota

2011: Karl Chevrolet

2010: Paragon Honda/Paragon Acura

Some good news, bad news in the certified pre-owned market.

After two months of improving figures, August CPO sales fell 9% year-over-year, according to Cox Automotive’s analysis of Motor Intelligence data. And they have also shown a 9% year-to-date decline through eight months. The year-to-date drop is “(r)eflecting huge decreases in March and April and the impact of COVID-19,” the company said in the Data Point report.

But Cox’s revised CPO forecast now predicts 2.6 million sales for 2020. That would be softer than the record figure of 2.8 million a year ago — the ninth straight best-ever year — but stronger than prior projections from the company.

Last month, Cox Automotive was projecting 2.5 million certified sales for the year.

And a few months back, Cox Automotive was projecting 2.0 million CPO sales in its 2020 Market Insights & Outlook

The current forecast for 2.6 million CPO annual CPO sales, which could change, would also be comparable to some of the annual CPO sales levels reached during the nine-year record run.

For instance, both 2017 and 2016 — which were record years — had certified sales in the neighborhood of 2.64 million, according to Autodata Corp. data previously reported on by Auto Remarketing. There were 2.55 million in 2015 and 2.34 million sales in 2014, which again were both record years at the time, according to our previous reporting on Autodata info.

Getting into specifics, there were 238,498 CPO sales in August, compared to 260,725 a year earlier, according to Cox’s analysis of Motor Intelligence data.

In July, there were 254,982 CPO sales, up from 236,579 in July 2020.

June’s certified sales were at 261,586, an improvement over 240,844 a year earlier.

“Coming off of two strong months, CPO sales in August show impacts of the ongoing pandemic and the Labor Day holiday being included in last year’s monthly sales,” Cox Automotive said in its analysis.

The overall used-car market also showed some decline in August, as Cox estimated there was a 4% year-over-year drop in total used-car sales.

The total used-car SAAR was estimated at 38.0 million for the month, compared to 39.7 million in August 2019 and steady month-over-month, according to the company.

In terms of retail numbers, which Cox determines are sales from franchised or independent dealers, Cox pegged the used SAAR for August at an estimated 20.3 million.

In August 2019, it was 20.7 million and in July 2020, it was 20.4 million.

Though still softer year-to-date, the certified pre-owned vehicle market has started the summer with two consecutive months of year-over-year gains, according to data shared Monday by Cox Automotive.

And the current forecast for the full-year tally, while not expected to be another all-time high, may still be in the same neighborhood as the record stretch in the 2010s.

More specifically, there were 254,982 CPO sales last month, up 8% from the 236,579 certified sales in July 2019, a Cox Automotive analysis of Motor Intelligence data shows.

In June, there were 261,586 CPO sales, up from 240,844 a year earlier, according to that same analysis.

May’s 237,495 certified sales were off from 251,863 CPO sales in May 2019.

Despite a record start to the year in January and February (and the gains in June and July), the “huge decreases” in March and April have put year-to-date certified sales 9% behind the 2019 pace, Cox said in the report.

Currently, the company is projecting 2.5 million certified sales for 2020, compared to the 2.8 million CPO sales in 2019, which was the ninth consecutive year of record-high certified sales.

While it could change, analysts said that projection is much stronger than the 2.0 million CPO sales Cox Automotive was projecting a couple of months back in its 2020 Market Insights & Outlook

It’s also comparable to some of the annual CPO sales levels reached during the nine-year record run. For instance, both 2017 and 2016 — which were record years — had certified sales in the neighborhood of 2.64 million, according to Autodata Corp. data previously reported on by Auto Remarketing. There were 2.55 million in 2015 and 2.34 million sales in 2014, which again were both record years at the time, according to our previous reporting on Autodata info.