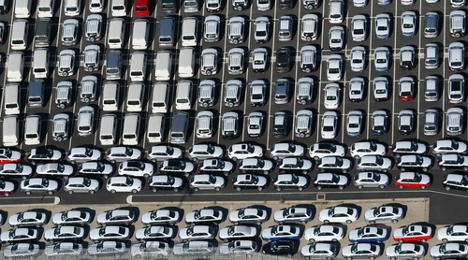

Manheim is currently hosting a national promotion, titled “Pump Up Your Volume,” that is aimed at aiding dealers in their inventory building efforts to prepare for the impending selling season.

The national promotion, expected to drive traffic at all of Manheim’s 79 wholesale auctions, will include offers from DealShield and Ready Auto Transport via a national email campaign. The promotion will also include daily prizes, including a grand prize — a guitar signed by Aerosmith.

The campaign started Monday and runs to May 3.

“We want to promote the message to dealers that Manheim is where you’ll find the right inventory to win at your lot,” said Stephen Smith, senior director of customer marketing at Manheim. “We are the go-to source for both the volume and the variety of vehicles that dealers need to drive traffic to their lots and ultimately sell more vehicles.”

More information can be found on the Pump Up Your Volume website.

Upcoming Wholesale Webinars

- The National Auto Auction Association will host its webinar on the 2015 Arbitration Policy Updates on two different dates: Friday (at 2 p.m. EST) and Monday (also at 2 p.m. EST). Each webinar will last approximately 45 minutes, featuring Matt Arias, the auction standards committee co-chair at NAAA, who will review the updates to the NAAA Arbitration Policy that take effect on May 4. Registration links are above; to review the updated arbitration policy, click here.

- AIADA and ADESA will host a free webinar, “Buy and Sell Wholesale … Without Leaving Your Desk!” on Tuesday, April 21 at 10 a.m. EST and again at 4 p.m. EST. The webinar is designed to provide an in-depth overview of “real life” wholesale inventory management solutions. To register, click the corresponding time you are interested in above.

Manheim Pennsylvania will host its fourth annual Xtreme Spring Sale on Thursday and Friday this week.

The two-day event will feature more than 13,000 vehicles, starting with Manheim’s 100 Grander Sale on Thursday. Like its name suggests, the event will have over 400 high-end exotic vehicles, including Corvettes, classic cars, muscle cars and motorcycles.

The events on Thursday will also include a gala and charity auction hosted by Manheim following its normal highline sale. The charity auction will feature a decked-out Toyota Tacoma to raise funds for the Save A Warrior program in Malibu, Calif., an organization that helps veterans readjust and cope with their past combat experiences.

More information on the Save A Warrior program can be found here.

I thought the illuminating sidewalk and staircase in Michael Jackson’s “Billie Jean” music video were simply the coolest.

That is, until I saw the Lite-Brite set of stairs at Google's headquarters, each step glowing a different color and scrolling what I presume was a top search term for that day.

(Uma Thurman, Brian Williams and Jon Stewart must have been pretty popular that Wednesday.)

Upon stepping out of the cab, my first impression of the Mountain View, Calif., headquarters was that it had the feel of a hightech college campus.

This made sense — because inside the doors for Haystak Digital Marketing's 2015 Digital Summit being hosted at Google was an invaluable learning experience.

I had the good fortune of seeing presentations from Haystak founder Duncan Scarry, Google head of customer analytics Neil Hoyne and Autotrader president Jared Rowe.

Here's one point from Hoyne that struck a particularly strong chord with me: data will always beat intuition.

That should resonate with the auto industry, including the dealers, auctions, consignors, vendors, OEMs, etc., who work in the remarketing space.

There’s arguably more data at your fingertips than ever before — all to help you determine how your customers think, behave, shop and buy — and how you can best respond to them.

That brings to mind one of Rowe's points: Value is not created by data alone. Actionable insights bring the real value, but it requires true partnerships to extract that true potential.

This is good news for the remarketing business, which thrives these days on partnerships (i.e. the multiplatform buying and selling technology, for instance), and particularly those that promote data-directed decision-making.

You see, it's not just the King of Pop's walkway or Google's steps that illuminate.

The right kind of detailed data — plus the knowledge of how to use it and the partnerships to implement the best practices it uncovers — can teach us on how to best serve our customers.

This From the Editor column appeared in the March 15-31 issue of Auto Remarketing.

The Independent Auction Group and the International Automotive Remarketers Alliance have signed a four-year sponsorship agreement, IAG announced Monday.

Under the agreement, IAG becomes the lead sponsor of the IARA’s Summer Roundtable and IARA’s website.

The first IAG-sponsored event will be during the IARA Summer Roundtable scheduled for Aug. 18 and Aug. 19 at the Downtown Fort Worth Hilton.

“The mutual benefit of this sponsorship is strong. The IARA responds to a need for national representation within the vehicle remarketing organizations of our multi-billion dollar per year industry,” said Lynn Weaver, IAG co-chairman “ The IAG organized to bring together resources and services for independent auction owners, managers, and employees to support that same industry.

“IAG’s mission has always been to promote independently owned auctions and to sustain an alliance within the industry that gives its membership a group conscience and voice. The opportunity to join with IARA strengthens that voice and increases the reach throughout our industry to better opportunities for all,” he continued.

Levi McCoy, IARA president, added: “We are pleased to have the Independent Auction Group as our new partners. The Independent Auction Group is a diverse and growing component of the remarketing industry. IAG auctions are members of the National Auto Auction Association and represent everything that is great about IARA’s working partnership with NAAA.”

IARA executive director Tony Long added: “This partnership brings IARA a long-term stability to our sponsorship program and will raise the bar for quality at our meetings. In turn, our agreement provides improved membership opportunities for IAG members and increased opportunities for dialog with consignors, service providers, and other key players within the remarketing industry.”

AutoAlert LLC announced Tuesday its sponsorship of the Automotive Leadership Under 40 Retreat (ALU40).

Auto Alert CEO Brian Skutta, who took the helm at the company in September, will also speak about his own experiences at the retreat, as well.

The event, designed to recognize and bring together the industry’s up-and-coming dealer leaders, is scheduled for March 17-19 at the SLS Las Vegas Hotel.

"Given the pace and complexity of automotive retailing, younger dealer principals, managers and service provider leaders often learn on the job and on the fly. Events such as the ALU40 retreat create a collaborative forum to discuss the leadership skills and behaviors needed to run successful and profitable dealerships," said Skutta.

"The retreat also provides an opportunity for all of us to invest in leadership development and learning opportunities for up-and-coming leaders and have a positive impact on our industry. I am excited to hear from the fantastic list of presenters the ALU40 team has assembled," he continued.

Skutta, also part of the under 40 demographic, is set to speak about leadership observations from his experience of progressively successful auto industry and civic leadership roles at the upcoming event, AutoAlert shared.

In his presentation, Skutta aims to help attendees understand how to “purposely define and communicate leadership principles, create a playbook for repeatable success, and find their ‘A’ team.”

For more information, see ALU40.com.

As 2015 chairman of the National Automobile Dealers Association, Bill Fox will represent and lead the nation’s nearly 16,000 new-car dealers. But it’s not just new cars that these dealers are selling.

The used-car department has been and will remain an important focal point for franchised dealers, whose pre-owned operations are benefitting from advancements in technology and data, vehicle quality, awareness in certified pre-owned offerings and more.

“Used-vehicle operations will continue to be a point of emphasis for new-car dealers in 2015 and beyond for a variety of reasons,” Fox said in an emailed Q-and-A with Auto Remarketing at the end of December. “Consistently higher new-vehicle prices make used vehicles an attractive alternative for value-conscious car buyers, as does the ongoing improvement in the promotion to raise consumer awareness of manufacturer certified pre-owned programs.”

Fox, who is a partner in Fox Dealerships Inc. in upstate New York, added: “Technology and access to data will continue to support used operations, as well. The insight gained allows dealers to make more informed decisions regarding trade-in appraisals, wholesale and retail pricing and inventory acquisition. Used-vehicle sales also present greater opportunities in the service and parts departments.

“The pool of used vehicles is also much better from a historical perspective. Vehicle design and technology have never been better,” Fox continued. “With the average vehicle age still above 11-years-old, there will continue to be strong demand for used vehicles as cost-conscious car buyers enter the market to replace their aging vehicles.”

Stand-Alone Used-Car Stores

Going back to Fox’s point on technology, that has been a major cog in the development of both Q auto and EchoPark Automotive, the respective stand-alone pre-owned store programs from public retailers Asbury Automotive Group and Sonic Automotive.

In discussions last year that Auto Remarketing had with leaders of those two programs — both of which launched in 2014 — technology, particularly as it relates to shoppers utilizing the iPad during the shopping experience at the store, was central to how they were approaching the in-store experience.

And early overall reaction to both Q auto and EchoPark has been positive.

Fox, himself, sees potential in this type of used-car concept store, but acknowledges it will take some time for them to grow.

“It’s not surprising to see public dealer groups invest in stand-alone used-vehicle stores given the potential benefits cited earlier,” he said. “It’s likely that the concept will spread slowly over time for larger dealer groups. From a valuation standpoint, the technology and data that public dealer groups use must be robust and dependable enough to determine competitive retail prices on used vehicles.

“If done right, loyalty, and subsequently business, will improve over the long term. In addition, the experience for car buyers should also be consistent across stores and be on par with the experience at new-car dealerships,” Fox added. “This won’t happen overnight.”

CPO Growth to Continue

A more seasoned and perhaps proven concept in the used-car business has been the certified pre-owned market. In 2014, the industry posted record CPO sales for the fourth consecutive year, as dealers sold 2.34 million units.

A presentation from Cox Automotive in November forecasted another all-time high for CPO in 2015 and more record-breaking years down the road. Manheim chief economist Tom Webb has said the market could grow as high as 4 million to 5 million annual sales.

Fox said franchised dealers have put “an increased emphasis” on certified, given the records in recent years, and he also mentioned ways dealers can realize the full potential of CPO.

“To maximize potential, new-car dealers and their manufacturer partners should increase CPO marketing, which includes informing car buyers about the CPO benefits,” he said. “For example, the majority of car buyers are not aware that manufacturers are involved in the certification process.

“Most do not realize that CPO vehicles can be financed with competitive rates, which helps ease the upfront premium associated with CPO vehicles.”

As for his own stores within Fox Dealerships, he shared a bit about how they have fared in CPO and what kind of emphasis has been placed on certified.

“We’ve had greater success with some brands over others. Ultimately, it’s up to the car buyer to decide if he or she wants to invest in a slightly used vehicle or purchase a new one,” Fox said. “From a competition standpoint, new-car dealers can use CPO sales as a differentiator compared to other independent, used-vehicle retailers who do not have manufacturer-backed certification programs available.”

While much of the political discussion around the nation is already buzzing about the 2016 presidential election, the National Automobile Dealers Association has its sights set on a more immediate governmental topic bubbling up in Washington, D.C.

The issues and challenges surrounding the Consumer Financial Protection Bureau are at the top of the to-do list for incoming NADA chairman Bill Fox, who shared some of his chairmanship goals with Auto Remarketing at the end of the holiday season.

“One of our most pressing regulatory challenges is the CFPB issue. The auto financing market is huge and fiercely competitive, and that’s good for car buyers,” Fox said. “We are continuing to demonstrate the value of NADA’s optional Fair Credit Compliance Program for dealers as a central means to addressing the CFPB’s fair credit concerns while preserving robust competition in the marketplace.

“We’re also working to ensure that guidance documents issued by the CFPB on auto finance in the future are the result of a transparent and informed process,” he continued. “Many of the problems that resulted from CFPB’s guidance issued in March 2013 could have been avoided had the process simply been more open and informed.”

With a Bachelor’s degree in finance from Georgetown University and a Juris Doctor degree from St. John’s University, Fox is no stranger to the financial or legal worlds, nor to the myriad of challenges and opportunities facing auto dealers, given his near-40 years as a car dealer and extensive experience on dealer leadership boards.

Fox, a partner at Fox Dealerships Inc. in upstate New York, was elected to NADA’s board of directors in 2006, has worked in a number of its committees and served as the association’s vice chairman this past year.

Now, he steps into a new role: front-and-center of NADA as its 2015 chairman.

“There are several important issues on the front burner at NADA. Preserving the ability of new-car dealers to competitively price auto loans in their showrooms for their customers is one of our top priorities. America’s auto finance market is very competitive, and we want to keep it that way,” Fox said.

“When banks, credit unions and captive finance companies compete for business, car buyers win. We’re urging members of Congress to cosponsor legislation that will rescind the Consumer Financial Protection Bureau’s flawed guidance on auto finance and will keep auto loans affordable and accessible for car buyers. In the last session of Congress, nearly 150 House Democrats and Republicans supported legislation to rescind the CFPB guidance,” he added.

The Importance of the Franchised Dealer

Of course, Fox has plans for NADA beyond the financial and regulatory sphere. Emphasizing the advantages of the dealership network to the masses is also something that NADA has on its radar for 2015.

“Local new-car dealerships provide the most competitive and most cost-effective way of buying and selling new cars for both car buyers and manufacturers. The consumer benefits of the dealer network sometimes gets lost, so we’re promoting the price competition, accountability during warranty and recall claims and the local economic benefits that dealerships bring to communities across the country,” Fox said.

“NADA launched a ‘Get the Facts’ initiative last June to inform car buyers, policymakers and the media about the benefits of the dealer network, and we plan to launch even more materials next year. A series of videos, fact sheets and infographics are available at www.nada.org/getthefacts,” he added.

An Evolving Automotive Space

Fox got into the car business nearly four decades ago when he and his sister bought a Weedsport, N.Y., Chevrolet dealership. Starting with this small store, the siblings would then expand their acquisitions, and today Bill Fox and Jane Fox run four dealerships located throughout Auburn, N.Y., and Phoenix, N.Y.

The brands they sell and service include Chevrolet, Chrysler, Dodge, Honda, Jeep, Ram, Scion, Subaru and Toyota.

When asked how the business has changed during his time in the field, Fox said: “Over the years there’s been some consolidation and a decline in the number of new-car dealerships across the country, but the marketplace will determine the right number dealerships.

“New-car dealers have been at the forefront and catalysts for change. Dealers have survived economic recessions, the credit crisis and automaker bankruptcies because we meet the challenges and adapt to change,” he said. “Changes in automotive retailing are driven in part by customer demands and new technology.”

And technology is actually one of the top areas of opportunities for dealers, Fox said.

“The online world of automotive retailing and digital marketing continues to evolve. The Internet and advances in technology present new ways of retailing vehicles, managing inventory and how we interact with our current and future customers on a day-to-day basis,” he said.

“Car buyers demand transparency. Dealers are striving to speed up the car buying and delivery process,” Fox continued. “It all comes down to how well we implement these new technologies with the ultimate goal of improving the car buying experience for our customers.”

The owners of the 31 ServNet Auctions locations met up at the end of October in Waverly, N.Y. for the Fall Owners’ Meeting. The event, which took place Oct. 23 through Oct. 25, was hosted by the Barber family at State Line Auto Auction. The family, as part of the founding members of the auction group, is moving into its third generation of ownership and management.

“This year’s meeting was outstanding,” said ServNet president Patty Stanley, who owns Carolina Auto Auction with her husband Henry. She and Henry also own Indiana Auto Auction with their son Eric Autenrieth.

“We decided to start a new tradition for the fall meeting that includes visiting a ServNet auction facility. It is refreshing to get back to our roots in seeing how other high performing businesses operate in our industry,” Stanley said.

The meeting took aim at several tasks, the first to endorse the membership of Winchester Auto Auction, the newest ServNet location. A significant focus was made on discussing multi-platform selling, along with other strategies. The success of two new programs that began in 2014 was also reviewed, including ServNet’s 20 Group and ServNet’s Fleet/Lease Manager Conference.

“Programs such as these bring tremendous value to our member auctions,” Stanley said, “as they allow us to share best practices and discuss both common challenges and successes.”

Several other topics were covered, including the succession plans for ServNet’s leadership team.

News from Sparkling City

Nearly 2,000 miles away, in San Antonio, Texas, the Sparkling City Auto Auction announced a couple of expansions to its sales plans, including the opening of a sixth lane and a second sale day.

“Needing more room to grow is an exciting opportunity for us at Sparking City Auto Auction of San Antonio,” said Wade Walker, the auction’s owner. “We started out with four auction lanes and added a fifth lane just last year. Now four years in operation, we’re adding our sixth lane and have added a second sale day on alternate Thursdays to keep up with rising demand and to best serve our customers.”

The auction’s sixth lane opened for the first time on Nov. 11, while the auction hosted its first Thursday afternoon sale the week before.

“Our new Thursday afternoon sale starts at 4 p.m. and features fresh consignment, giving our customers a second opportunity during the week to purchase the best inventory available in the San Antonio market,” Walker said. “We’ll be holding this Thursday afternoon sale every other week through the end of the year, and then expect to hold it weekly in January.”

There has been a lot of talk, as new automotive sales continue to increase, about what the overall sales number will be for this year. TrueCar forecasts total sales for the year will reach 16.4 million units — the best since 2007 — and could possibly reach toward 17 million units in 2015 if economic conditions continue to improve.

And as some predict that the demand for automotive products has nearly reached its peak, John Krafcik, TrueCar’s president, believes all manufacturers still have quite a bit of room for improvement. Presenting at the Automotive Press Association last week in Detroit, Krafcik outlined four key areas, coined as “super segments,” which cover four specific revenue streams associated with four product categories.

The four segments – mass-market cars, mass-market utilities, pickup trucks and premium brand vehicles (all types) – are what Krafcik believes manufacturers should be focusing on, because, according to him, no one is dominant in all four areas.

“For individual automakers the revenue mix across the four super segments varies considerably,” Krafcik said. “Some are overly reliant on mass-market cars – notably Volkswagen Group and Hyundai-Kia – while others are significantly over-weighted in pickup and utility segments, such as Fiat Chrysler. Remarkably, no automaker has a revenue mix even close to the consumer-driven industry mix.”

Krafcik recommends that those evaluating the industry should, instead of just looking at units sold, focus on the revenue streams. The market, based on TrueCar’s data, is forecasted to generate $521.5 billion in revenue by the end of the year, compared to $292 billion in 2009. Here are several other key observations, according to the company:

- From 2009 to 2014, total U.S. auto industry revenue growth of at least 79 percent is outpacing the 58 percent unit growth forecast for the same period.

- That trend should continue into 2015 as economic growth continues and the price of fuel remains relatively stable.

- Looking solely at industry volumes, without factoring in the richer margins and revenue generated by three of the four vehicle segments, masks how truly robust the industry is.

- During the 2009 to 2014 period, pickups and mass-market utilities, which deliver higher transaction prices and margins than mass-market cars, increased their share of industry revenue to 50 percent from 44 percent.

- Industry trends point to stabilization in revenue mix, though not unit mix, comprised of 30 percent mass-market car (“three-box'' vehicles); 30 percent utility (“two-box'' vehicles); 20 percent pickup; and 20 percent premium vehicle.

What do all the numbers suggest? According to Krafcik, there is a significant economic opportunity for each of the major players in the automotive industry to broaden their portfolios and potentially realign themselves with other manufacturers, whether it be through mergers, acquisitions, partnerships, etc. to create more “revenue-balanced OEM groups.”

Auto Auction Services Corp. announced that it had recently hosted a workshop with key consignors to “design the future of remarketing.” The Aug. 18 event lasted half a day and included 13 client organizations that represented a cross-section of the remarketing industry’s commercial consignors.

Those present at the meeting, dubbed “Project Client Insight,” discussed the business and technology opportunities and challenges that are faced in the remarking industry with the aim to brainstorm ideas for the future. While agreeing on issues such as multi-platform selling, vehicle grading consistency and condition reporting, all participants also agreed that more emphasis needs to be placed on performance-measuring data and business accountability.

Eighteen long-term ideas for new technology and services were presented, five of which were prioritized into a short-term project list, according to the AASC:

- A “Set for Sale Calendar” tool

- New sales results dashboard metrics

- Numerous additional pre-calculated “smart fields” in AutoIMS

- An effort to drive standardization in auction expense reporting

- The development of more robust mobile tools for the industry

“As a result of the PCI meeting, we are confident that these projects will have a meaningful, positive and lasting impact on the industry and our clients’ bottom lines,” said Joe Miller, AASC’s customer service director.