Today's episode of the Auto Remarketing Podcast features Chris Little, who is vice president of variable operations and a market area VP at Hendrick Automotive Group.

Little and Cherokee Media Group president Bill Zadeits discuss the automotive market rebound, how Hendrick weathered COVID-19 challenges and bright spots that have emerged.

Little also talks about Hendrick's emphasis on certified pre-owned, what may be in store for used-car values, how Hendrick sources used cars and more.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Michael Bor, chief executive officer of CarLotz, joins the Auto Remarketing Podcast, where he provides an update on the company and how its stores and operations have adjusted to the pandemic, as well has how they have begun to recover.

Plus, Bor discusses the online car-buying option from CarLotz, its work with commercial consignors, the gap between wholesale and retail prices, expansion plans and more.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

AutoNation began a program this week where for the next two-plus months, it will offer free vehicle sanitization for first responders from 1-4 p.m. each Tuesday at its dealerships.

The program, which started Tuesday and runs until Aug. 25, can be utilized at any AutoNation store. First responders can have their personal or work vehicles sanitized with a free EPA-approved treatment.

"AutoNation is committed to keeping America safe. So, while First Responders are out caring for our communities, AutoNation is here to also care for our first responders. Thanks for all you do for us," said AutoNation’s Marc Cannon in a news release.

To have their vehicles sanitized, first responders can visit the service drive at any AutoNation store. They simply show their credentials. The process takes 30 minutes.

In the news release, AutoNation shared this disclaimer: All efficacy claims & statements are relevant when the disinfectant product is applied correctly. This disinfectant product has been approved & registered by the EPA for use against SARS-CoV-2, the virus that causes Disease 2019 (COVID-19). Disinfectant methods or claims should not be deemed to state or imply that the products can eliminate or prevent transmission of any virus, illness or disease. For product manufacturer or EPA registration information, please see an AutoNation Service Associate for details. Offer expires August 25, 2020.

The Greater New York Automobile Dealers Association has brought on a former top official with the state’s DMV to serve as its director of dealer compliance.

Thomas Higgins, who was the deputy commissioner of compliance for the New York State Department of Motor Vehicles, spent nine years with the DMV, and will now help GNYADA dealers “navigate the complexities of the industry’s federal, state, and local regulations,” especially as auto retail business starts to come out of the pandemic, the association said.

“Downstate New York’s franchise new car dealers are extremely fortunate to have the expertise of someone with Tom’s extensive background and deep knowledge of the complex regulations and laws under which our industry must operate,” GNYADA president Mark Schienberg said in a news release.

“As we begin to emerge from the COVID-19 pandemic, our members, which are small businesses, collectively support more than 70,000 jobs in local communities, and will help lead the way to economic recovery,” Schienberg said. “Having this crucial new support will help ensure that they can best serve their customers and employees.”

Higgins responsibilities as deputy commissioner included the Division of Field Investigations (which heads up fraud inquiries), the Title Bureau and the Office of Vehicle Safety and Clean Air.

Higgins also helped craft the state DMV’s registration and title system that the retail car business uses.

“GNYADA serves as an invaluable resource for its members, providing support to small business owners trying to operate in what can often be a challenging regulatory environment,” Higgins said in the release.

“Dealers are integral to our local economy and they serve vital roles in their communities,” he said. “I am looking forward to offering my knowledge and experience to help dealers and their employees understand how to ensure full compliance so they can thrive, providing high-quality jobs and maintaining important, long-term relationships with their customers.”

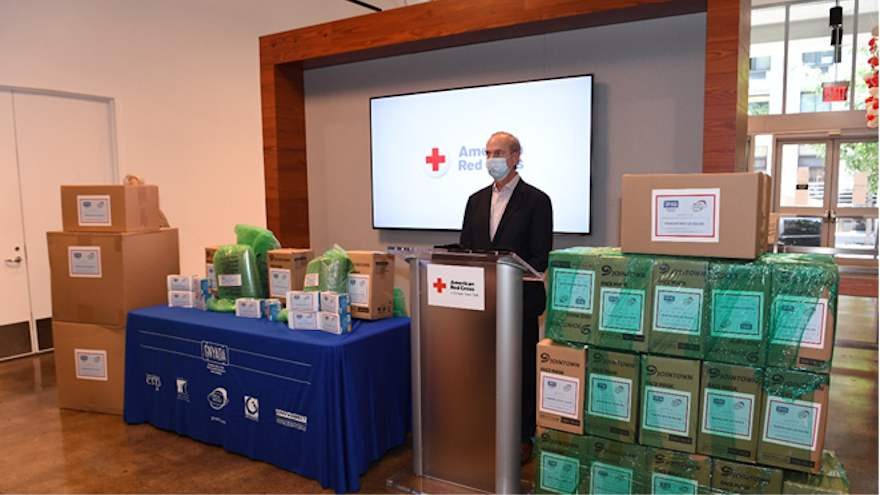

GNYADA dealers donate face masks, shields

In other news from the association, dealers in the downstate New York area have worked via GNYADA to donate 150,000 face masks and 25,000 face shields to the American Red Cross Greater New York Region.

The Red Cross will utilize the masks and shields during blood drives, including when patients who have recovered from COVID-19 donate plasma.

“When our fellow New Yorkers are in need, as they have been throughout this terrible pandemic, franchise new car dealers and their employees step up to the plate and give back to the communities where they live and work,” Schienberg, the GNYADA president, said in a release.

“Like many local businesses, auto dealers in recent months have faced enormous economic challenges, which threaten their livelihoods due to Coronavirus. Nevertheless, our members have been nothing short of remarkable when it comes to the generosity and community-minded spirit they have shown by donating vital personal protective equipment to keep New Yorkers safe.”

Susan Rounds, who is the interim CEO of the American Red Cross Greater New York Region, added: “Communities across the country count on the American Red Cross for help every day, and we are so grateful to be able to count on our partners like the Greater NY Automobile Dealers Association to help us deliver our lifesaving mission safely

“Our work never stops, even during this coronavirus crisis, and this personal protective equipment will help protect our Red Cross team members and the people we serve, as we respond to disasters, collect lifesaving blood products, offer CPR and first aid courses, and support military families and veterans.”

HyreCar said its carsharing marketplace for ridesharing and delivery not only is back on a track the company enjoyed before the coronavirus pandemic arrived, but it’s also actually on a record-setting pace.

HyreCar also announced the completion of a new auto insurance program with Lloyd’s Apollo 1969 syndicate.

“We are very happy that our weekly rental days have now quickly rebounded to over 19,500, putting us back to pre-COVID-19 growth, and we set a new all-time high month with over 79,000 days in May,” HyreCar chief executive officer Joe Furnari said in a news release distributed on Tuesday.

“We believe this is because our business model and platform allowed us to leverage new opportunities within this crisis and create a larger market with ridesharing and delivery. As states reopen we should continue to see steady revenue growth in the second half of 2020,” Furnari continued.

HyreCar also just completed moving its primary and excess automobile insurance liability programs over to Lloyd’s Apollo 1969 syndicate, a leading insurance provider in the gig economy that provides insurance to many of the top companies in rideshare transportation and food delivery.

Hyrecar’s new insurance program was issued by Assurant, with the backing of Apollo 1969.

“We are excited to partner with Apollo 1969 to provide the very best insurance programs for our car owners and drivers, an important part of our value proposition,” HyreCar chief financial officer Scott Brogi said.

“Apollo is the clear leader with the most relationships in the gig economy space for ride-sharing and delivery, and working with them should significantly improve our cash flow going forward and allow us to operate at a more cash neutral basis and grow cash on the balance sheet for the remainder of 2020,” Brogi continued.

Christopher Moore, head of ibott at Apollo 1969 of Lloyd’s, added this perspective.

“We are excited to partner with HyreCar to provide insurance solutions that support their continued growth in an ever-expanding marketplace,” Moore said. “We believe that both companies will benefit from our goal to provide flexible insurance solutions to innovative growing companies.”

|

Weekly Rental Days Update

|

|

Beginning Date

|

|

Ending Date

|

|

Weekly Rental Days

|

|

12/30/19

|

|

01/05/20

|

|

16,912

|

|

01/06/20

|

|

01/12/20

|

|

16,995

|

|

01/13/20

|

|

01/19/20

|

|

17,156

|

|

01/20/20

|

|

01/26/20

|

|

17,271

|

|

01/27/20

|

|

02/02/20

|

|

17,447

|

|

02/03/20

|

|

02/09/20

|

|

17,804

|

|

02/10/20

|

|

02/16/20

|

|

17,923

|

|

02/17/20

|

|

02/23/20

|

|

18,352

|

|

02/24/20

|

|

03/01/20

|

|

19,942

|

|

03/02/20

|

|

03/08/20

|

|

20,071

|

|

03/09/20

|

|

03/15/20

|

|

19,580

|

|

03/16/20

|

|

03/22/20

|

|

16,280

|

|

03/23/20

|

|

03/29/20

|

|

14,319

|

|

03/30/20

|

|

04/05/20

|

|

14,141

|

|

04/06/20

|

|

04/12/20

|

|

14,602

|

|

04/13/20

|

|

04/19/20

|

|

15,800

|

|

04/20/20

|

|

04/26/20

|

|

15,961

|

|

04/27/20

|

|

05/03/20

|

|

16,808

|

|

05/04/20

|

|

05/10/20

|

|

17,293

|

|

05/11/20

|

|

05/17/20

|

|

17,776

|

|

05/18/20

|

|

05/24/20

|

|

18,317

|

|

05/25/20

|

|

05/31/20

|

|

18,553

|

|

06/01/20

|

|

06/07/20

|

|

19,247

|

|

06/08/20

|

|

06/14/20

|

|

19,587

|

Source: HyreCar

The coronavirus pandemic continues to intensify one of the basic principles of economics. Dealer demand for inventory is growing, but supply at the auction still isn’t back to the level seen before facemasks, stay-at-home orders and other COVID-19 connected elements became commonplace.

The new COVID-19 Market Update from Black Book released on Tuesday described the latest viewpoints from both auctions and dealers that are all trying to serve their customers bases with limited manpower and social-distancing challenges.

Meanwhile, auction prices keep ticking higher, eroding at dealer margins already slim in some instances.

Black Book reported that according to its volume-weighted data, overall car segment values increased 0.88% this past week. Analysts determined all car segments experienced increases, except for sub-compact cars, which have been on a continual decline since the end of March.

“For the past four weeks, the compact car segment has had the largest car segment increases, but this past week the top spot was taken by the sporty car segment with a 1.65% increase,” analysts said in the newest update.

When volume-weighting is applied, Black Book found that the overall truck segment values — including pickups, SUVs, and vans — increased by 0.52% last week with all segments increasing except full-size vans.

Analysts added that the minivan segment led the increases with a strong rebound of 1.65% after 11 consecutive weeks of declines.

When recapping what the firm heard in discussions with auctions, Black Book mentioned what Auto Remarketing previously reported that Manheim is allowing consignor representatives back on the auction block to rep their vehicles during sales.

“Auctions, both physical and digital, continue to be hot with bidding activity and sales rates returning, and in some places exceeding expectations for this time of year,” Black Book said.

“Supply available at the auctions continues to be low and is contributing to the increase in sales rates and higher prices that buyers are having to pay to secure inventory,” analysts continued.

“Lease extensions and lack of repossessions over the last three months are resulting in some auctions being light on inventory to consign,” Black Book went on to say. “The estimation by some of the auctions we’ve been in contact with are expecting to be low on inventory for another two to three weeks.”

Auctions being low on inventory to cross virtual blocks is not helpful to dealerships, based on what Black Book shared about its conversations with store buyers and personnel.

“The most common comment we heard from dealers this past week is centered around their lack of inventory, both new and used,” Black Book said. “Dealers are finding themselves having to pay more for inventory, resulting in a smaller margin when the unit is retailed.

“However, most dealers we’ve talked to would rather keep the inventory moving and make the money on turning volume to prevent getting stuck with any units if the demand slows,” analysts continued.

“Availability of good condition, low mileage units are a rarity right now, and dealers are finding themselves having to settle for vehicles that require some reconditioning to be retail ready,” Black Book added.

Meanwhile, on the new-car side, dealers are struggling there, too. Analysts recapped that some dealers are still reporting being down by as much as 50% in available new-model inventory.

“Lack of new inventory has some dealers concerned about making it through the month with their current supply,” Black Book said.

“Manufacturing has resumed, but most of the facilities are not yet back to running all shifts and operating at full capacity,” Black Book continued. “New deliveries continue to be few and far between, contributing to the increased demand for used units.”

EchoPark Automotive is making a “v-shaped” rebound, its president said, with sales for Sonic Automotive’s line of standalone used-car stores up double-digits in the first half of June and likely returning to pre-pandemic expectations this month.

That was part of sweeping improvements Sonic shared on Tuesday, which included year-over-year hikes in pre-owned sales for the retailer’s franchised dealerships and its EchoPark used-car stores, along with improving conditions elsewhere, including new-car sales and parts and service gross profit.

“We continue to see improving operating conditions since the onset of the COVID-19 pandemic, including steadily increasing automotive retail consumer demand,” Sonic and EchoPark chief executive officer David Smith said in a news release.

“Both new- and used-vehicle unit sales volumes, as well as fixed operations revenues, continue to meet or exceed our forecast at the outset of the pandemic, with used-vehicle sales actually higher than last year in both the franchise and EchoPark locations in June,” Smith said.

“More importantly, we have continued to be disciplined in controlling expenses, allowing our franchised dealerships and EchoPark stores to generate greater than expected profitability in May and June month to date, driving our updated outlook for second quarter earnings,” he said.

At Sonic’s franchised dealerships, same-store used-vehicle sales were up 7% year-over-year in the first half of June. This improves upon an 8% drop in May and a 32% decline in April.

For the EchoPark stores, same-store used sales were up 18% in the first half of June, following a 3% dip in May and a 36% decline in April.

The year-over-year growth was nearly twice as strong when considering all EchoPark locations. June month-to-date used sales were up 34%, compared to the 9% gain in May and the 30% decrease in April.

In slides accompanying the update, used-vehicle sales at Sonic’s franchised dealerships in May ended up being 13% better than the prior forecast. Sonic expects them to return to original forecast conditions in July and stay above the original forecast from August through December.

Those same slides show that EchoPark’s used vehicles ended up 6% stronger in May than the previous forecast. They are expected to be back to the original forecast in June before going above the original forecast from July through December.

“As we anticipated, EchoPark sales have experienced a v-shaped recovery and we expect to be back to our original pre-pandemic forecast unit sales volume this month,” Sonic and EchoPark president Jeff Dyke said in a news release.

“Our guests continue to see tremendous value in the inventory selection, pricing, and purchase experience EchoPark offers. From an inventory perspective, at the end of May we had 57 days’ supply of new vehicles at our franchised dealerships and as consumer demand continues to rebound, manufacturer production challenges may drive inventory shortages over the next few months,” Dyke said. “We continue to maintain less than 30 days’ supply of used inventory at both our franchised dealerships and EchoPark stores, positioning us to meet increasing consumer demand as well as capitalize on expected near-term inventory acquisition opportunities.”

Sharing more results, same-store new-vehicle unit sales at Sonic's franchised dealerships were down 10% year-over-year in the first half of June, improving on the 20% and 40% drops from May and April, respectively.

Parts and service gross profits were down 10%, better than the 27% decline in May and the 43% downturn in April.

Looking at consolidated Sonic results, total gross profits were off 19% year-over-year in May, compared to a 47% slide in April.

SG&A expenses were up 23% year-over-year in May. In April, they were up 32%.

Pre-tax income climbed 20% in May after falling 241% in April.

Sonic reaffirmed plans for “permanent SG&A expense reductions of approximately $7.0 million per month on a go-forward basis, as compared to pre-COVID-19 levels.”

Prior to his notes on EchoPark’s recovery, Dyke had said in the release, “Business conditions have continued to improve throughout the majority of our markets, with some areas already showing sales volume above pre-COVID-19 levels. This increase in consumer traffic has allowed us to begin to bring back many of our teammates to support these higher levels of business activity.

“At the same time, we remain committed to controlling our expense structure going forward and achieving greater return on investment through rigorous inventory and vendor service management as well as optimizing marketing expenses,” Dyke said. “We continue to see a slower recovery in California, particularly in our fixed operations business, resulting in a reduction of our fourth quarter fixed operations gross profit projections back to our original pre-pandemic forecast.”

The next update is planned for the week of July 27, which is when Sonic plans to report second-quarter financial results.

Sonic notes in its slides: "Due to uncertainty related to the COVID-19 pandemic and the resulting economic impact, actual results may differ materially from management’s forecast."

The volume of off-rental vehicles making its way into the wholesale market in 2020 is expected to be 250,000 higher than forecasted pre-pandemic, according to Black Book, which said in last week’s COVID-19 Market Updates report that rental companies are likely to shed units from their fleets in the back half of the year to align with softer consumer-facing demand.

In a domino-like fashion, spurring this was the pandemic-driven downturn in the business and leisure travel sectors, both of which are likely to see major declines the rest of the year and not bounce back to normal for some time, Black Book said

“According to IATA (The International Air Transport Association), air travel will not return to pre-COVID-19 levels until after 2023,” Black Book said in the report.

“This puts tremendous financial pressure on rental companies, that rely on air travel, to reduce both their current fleet and future acquisitions,” the company added, pointing to Hertz’s bankruptcy filing late last month. “In addition to Hertz, we expect other rental companies to reduce their fleet during the summer and fall months to match lower demand for rentals.”

The aforementioned additional quarter-million rental vehicles reaching the wholesale market in coming months is the “base case scenario in which rental companies (excluding Hertz) can gradually reduce their fleet instead of a rapid-fire sale,” Black Book said.

Conversations with remarketing leaders at two of those rental companies reveals methodical, measured approaches to such volumes, as to preserve vehicles and avoid flooding the market.

Through a spokesperson, Hertz declined an interview request for this rental remarketing story.

Strategies in rental remarketing

For Avis Budget Group, the adjustments started early, as it ramped up de-fleeting in the first week of March, says Gregg Nierenberg, the company’s senior vice president of fleet services.

Avis Budget moved about 35,000 cars out of its fleet during March, he said.

“So, when you factor that in with the success we had, like much of our industry and my peer group, working with our OEM partners, we were able to cancel also a large proportion of remaining 2020 model-year new vehicles coming in,” Nierenberg said in a phone interview earlier this month. “In fact, we were able to cancel approximately 80% of our incoming rental orders.

“Because of some of those swift actions that we took, not only in canceling orders, turning back repurchased vehicles, and then the aggressive de-fleeting in March, it alleviated a fair amount of pressure that we had in terms of rightsizing our fleet (to meet) rental demand,” he said.

April was a major challenge across the board in the wholesale industry. And with steep declines in vehicle values, Avis Budget “really minimized” its wholesale participation, focusing instead on direct-to-consumer channels to remarket vehicles, Nierenberg said.

Things started to turn in May, as the company “saw really strong demand heat up throughout all of the sales channels,” he said.

“From our perspective, it really led with strong retail demand compounded by really limited supply of desirable used vehicles in the marketplace,” Nierenberg said.

“Each week that goes by, we have a really disciplined process within Avis Budget Group to review our fleet levels at the geographic area down at the make/model level, vehicle-class levels to make sure that we continue to have alignment of our rental demand,” he said. “And then we’re also continually looking at the used-car values to see what makes sense to de-fleet.”

Similarly, the remarketing team at Enterprise Holdings has taken a “very thoughtful approach” to how it handles its fleet, says Nate Lattimer, the company’s vice president of remarketing sales and operations.

In general, Enterprise’s primary remarketing avenue has been direct sales, Lattimer said.

“Through this pandemic, that has not changed,” he said. “The way we’ve interacted and transacted with our dealership partners has, however.”

Lattimer estimates that “low-touch, no-touch” sales have represented 95% of Enterprises’ remarketing sales.

“To coincide with that from an online perspective, we developed a strategy with our partners over at SmartAuction to provide another great channel for us to sell inventory,” Lattimer said. “We dipped into it about six months prior to the pandemic. We were focusing on a more digital selling strategy, and the current situation has pushed us more aggressively into this channel.

“And to be frank with you, the results have been fantastic,” he said. “It's definitely been a great compliment to our direct sales team and we believe that this will continue to be a significant component of our overall future strategy as well.”

Lattimer acknowledges the potential impact of too many rental vehicles hitting the market at once, a risk that would even exist in a traditional climate.

“Overall, car rental’s a significant link in the automotive value chain,” he said. “And there is a responsibility that we have in the day-to-day execution that we take very seriously, for sure. Protecting residual values is a significant piece of that responsibility.”

Nierenberg, the Avis Budget executive, points out that much of what rental companies would remarket are 1- and 2-year-old vehicles. Consider that with shutdowns in new-car production, delays in lease returns and the quality that these near-new vehicles bring, and the potential impact of more supply may not be so daunting.

“So, now what you're seeing is really tightness of new-car supply in the marketplace. And you compound that with a level of delay of vehicles coming back off of lease … in theory, even if there were additional rental vehicles coming into the market, we're in this sweet spot of pent-up demand from April and early May from consumers,” Nierenberg said. “And then I do believe that there is this distinct value that a 1-year-old off rental vehicle provides particularly from a quality, certification and condition level that I know we provide.

“Because unlike a 3-year-old off lease vehicle … our vehicles tend to have closest to new, (the) latest in terms of safety equipment and features from the OEMs,” Nierenberg said. “And so even though the miles might be similar to a traditional 3-year off-lease, we view, within the rental industry, that we might have a leg up on the used-car marketplace, if you will, because we do think we have a differentiated product in that it being only one model year old, and again, the way it's one-owner and the way we maintain our fleet.”

As Lattimer at Enterprise put it, “The rental car looks a lot different today than it did years ago.”

When Enterprise stocks its fleet, he said, they “really want to bring what the customers want, both on the rental side of business and on the sales side of the business.”

With that, the 1-year-old cars they’re selling are “very desirable, for sure,” Lattimer said.

Diversification of off-rental

As both Lattimer and Nierenberg point out, the channels in which rental volumes are remarketing is diverse. All the eggs are not in one basket, so to speak.

Rental remarketers use such levers as direct-to-dealer platforms as well as direct-to-consumer avenues like retail stores and the Ultimate Test Drive at Avis Car Sales. There are also the remarketing avenues of online and brick-and-mortar auctions.

And even traditionally dealer-to-dealer platform providers like ACV Auctions have started working with rental companies.

“Our model creates efficiencies for the rental car market. Our team of inspectors can work with these accounts and go to inspect the vehicles wherever they may be located and offer them for auction as soon as the inspection is complete,” ACV chief executive officer George Chamoun said in an emailed Q&A. “We work with several rental car companies and are adding more to our portfolio on a regular basis. We communicate regularly with them and help guide them on current market conditions to help ensure success on our platform.”

Chamoun added: “ACV has been partnered with several rental car companies for years now. We have been actively growing our fleet lease consignment. One of our more recent product enhancements was seller disclosure of fleet lease consignment. This enhancement now shows our buyers who the fleet lease consignor is. This has had a great impact on our conversion rate in this space especially with our rental car accounts.”

Longer-term expectations

While 2020 is expected to have 250,000 more off-rental vehicles in the wholesale market than initially expected, that’s not the case for the next four years, according to the Black Book Report.

Next year, it is expected there will be 730,000 fewer rental returns than initially forecast. That gap increases to 980,000 for 2022, the Black Book data shows. In 2023, it narrows to 460,000. Current projections for 2024 are 80,000 units softer than pre-COVID expectations.

“In the longer term (later 2021 – 2023), the drop in rental return volume will benefit the price of newer used units, as supply will be limited,” Black Book said.

Concerns remain

To be sure, there is some trepidation about the potential impact of de-fleeting. In a note earlier this month, Fitch Ratings said the bankruptcies at Hertz and Advantage Rent A Car (which also filed in May) may “further exacerbate the downward pressure on U.S. used-vehicle prices for the remainder of the year and pressure lease residual values and recovery rates on defaulted auto loans.”

“Further vehicle sales or de-fleeting by rental car companies due to bankruptcies could increase used vehicle supply and pressure prices for used vehicles. Values were already negatively impacted by the still challenging wholesale market and auction conditions, with many auction houses conducting online sales only; these conditions have been exacerbated by significant economic uncertainty and U.S. unemployment in the mid-teens,” Fitch said.

The company added: “The effects of the pandemic have caused lenders to extend leases and auto manufacturers to increase incentives on new vehicles to stimulate sales. The rental car bankruptcy filings coincide with expected elevated used-vehicle supply due to delayed lease returns and a backlog of used vehicles. When coupled with weakened consumer confidence given the unprecedented spike in unemployment and significant economic uncertainty, these factors will exacerbate the already weak outlook for used-vehicle prices."

Digital retailing and vehicle deliveries in driveways certainly have gained momentum during the coronavirus pandemic. But no doubt, plenty of potential buyers remain who still want to complete their purchase at the store.

To help owners and managers, the National Independent Automobile Dealers Association compiled a guide to operating an independent vehicle dealership in the era of COVID-19.

The association highlighted the Independent Dealer’s Guide for Safely Operating During COVID-19 contains guidelines, best practices, policies and procedures gathered from government agencies as well as independent dealers across the nation.

“As the automotive industry continues serving its communities in a post-COVID-19 environment, protecting the health and safety of the driving public is the highest level of priority,” NIADA chief executive officer Steve Jordan said in a news release that accompanied the guide’s availability on Friday.

“We are proud to offer this important guide to the dealer community as a set of recommended guidelines to assist in their ongoing efforts,” Jordan continued.

NIADA insisted the guide is a tool to help dealers plan carefully and understand what changes they might need to make in their businesses to take advantage of post-pandemic opportunities while protecting the health and safety of their customers, employees and vendors.

Some of the highlights include:

• General considerations for creating a safe workplace, such as establishing a written plan and conducting daily health checks of employees.

• Best practices for policies regarding social distancing within the dealership, and cleaning and disinfecting in the showroom and in vehicles.

• Handling interactions with customers, including test drives, sales and financing, service department operations and collections.

NIADA said the guide contains information from the Centers for Disease Control and Prevention, the Occupational Safety and Health Administration, the California Department of Public Health and other agencies.

The association noted special appreciation goes to NIADA senior vice president of legal and government affairs Shaun Petersen for spearheading the effort to work with the organization’s dealer community, as well as NIADA’s ad hoc committee and the NIADA board of directors for their work in developing these guidelines.

The guide is available on NIADA’s COVID-19 resource page at covid19.niada.com.

The National Auto Auction Association has cancelled its 2020 annual convention, NAAA president Laura Taylor said in a letter to association members Thursday.

The NAAA Executive Committee voted Wednesday to cancel the convention, which had been scheduled for October 6-8 in Dallas.

In the letter, Taylor called the decision “hard to make, but the right thing to do.”

“We thought long and hard about canceling our 72nd annual meeting. I thank and applaud the executive team for taking the responsibility to safeguard the health and well-being of our members and their families by making that tough call,” she said.

“Although a disappointment, I don't feel that this cancellation diminishes us as an association or shakes my conviction in our resiliency,” Taylor said. “This decision displays the strength of NAAA to do what is necessary to protect the industry and always act with the best interests of our members at heart.

“I'm inspired by that commitment to those values and by the dedication of all our members to reopen for business — even with all the extra work to see that precautions are in place to operate safely for all,” she said.

Taylor went on to express encouragement from the auction industry’s rebounding conversions, volume and pricing, calling it a “bright spot.”

She also described 2020 as “the Year of Change.”

“Yes, this Year of Change will be one we remember. But not for the differences from our old normal. It will have a place in our memory as the time we adjusted, adapted and went on with life,” Taylor said.

“Throughout the history of NAAA, the industry and our nation, we have always strived to improve, to succeed, to be better than before,” she said. “We haven't lost that momentum from the past.”

The full letter can be found here.