Amid the COVID-19 pandemic, the vehicle showroom has become a virtual one. And car dealers, like many other businesses, are having to shift their business to a mostly digital one.

With that in mind, Cox Automotive's Mo Zahabi joins the show to discuss his Digital Retailing Best Practices webinar and how dealers can adjust to these changes and thrive in the online retail environment.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Franchised dealerships in the nation’s capital are answering the call to help healthcare workers with patients who have the coronavirus.

On Monday, the Washington Area New Automobile Dealers Association (WANADA), also producers of The Washington Auto Show, made a $50,000 donation to MedStar Georgetown University Hospital, to help support its work screening and treating patients during the COVID-19 pandemic.

As the COVID-19 crisis continues to spread across the world, WANADA acknowledged hospitals are being stretched to the limits, while doctors, nurses, and support staff members are putting themselves at risk to heroically provide care to at-risk patients. Through this donation, WANADA said the group is supporting a vital institution in its region at its time of greatest need.

“MedStar Georgetown staff members are on the front lines of the COVID-19 pandemic, working tirelessly to help save lives,” WANADA chairman Kevin Reilly said in a news release. “WANADA, and our member auto dealers, are thankful for their service to the Washington metro area in this critical time of need.”

Hospital president Mike Sachtleben offered his reaction of what the donation did to help.

“MedStar Georgetown University Hospital is deeply grateful for this remarkable gift of support from WANADA,” Sachtleben said. “This gift will further enable us to strengthen our efforts in responding to the COVID-19 pandemic.

“This is an unprecedented time in our nation and this hospital’s history, and I want to express our sincere thanks to the members of WANADA and those in our community who have given so generously of themselves to help support our mission during this critical time,” he added.

WANADA invited other parts of the automotive industry to support MedStar Georgetown Hospital during this time of critical need by going to this website where there are a variety of options to give.

“WANADA continues to serve and support our customers and our community throughout this crisis,” WANADA president and chief executive officer John O’Donnell said. “In our 103-year history, WANADA and our member dealers have weathered many periods of strife.

“I know that we will get through this acutely difficult time, and that when we do, we will owe an immense debt of gratitude to the front-line health professionals like those at MedStar Georgetown for all they have done to serve us,” O’Donnell went on to say.

Carvana’s rush of recent activities continued on Monday with the online used-vehicle retailer making a move to help buyers who just took delivery.

The company announced on Monday that it is now giving customers up to 90 days to make their first payment.

Customers financing with Carvana are eligible to opt in to the payment extension option, as long as they complete their purchase by April 20.

“Carvana has always been a company intensely focused on doing the right thing for our customers, and in a time when many are feeling the strain between needing safe transportation to an essential job and personal finances, we want customers to know we’re here for them,”, Carvana founder and chief executive officer Ernie Garcia said in a news release.

“Our hope is that those who simply can’t put a vehicle purchase on hold are able to get what they need quickly and easily, so they can keep moving,” Garcia added.

Monday’s announcement arrived after Carvana:

—Landed up to $2.0 billion in origination funding from Ally Financial

—Rolled out its touchless delivery program

—Secured $600 million from investors

More than 40 ADESA auctions in North America are set to run simulcast-only sales this week, following a roughly two-week stoppage of all ADESA physical sale operations (which included Simulcast) announced on March 20, in response to the COVID-19 pandemic.

The first of those simulcast sales was set to begin Monday in the U.S. and Tuesday in Canada.

The company did note that the sales are "subject to change pursuant to government directive and labor availability."

ADESA will continue waiving simulcast fees through the end of the month.

All ADESA auctions will continue to be at minimum business operation status while also following social distancing guidelines recommended by the Centers for Disease Control and Prevention and the Public Health Agency of Canada, according to an update posted to the website of parent company KAR Global.

ADESA is not allowing customers or other visitors at its auctions except to drop off or pick up vehicles.

Whether an auction is currently 1) receiving inbound vehicles, 2) offering simulcast-only sales and/or 3) offering DealerBlock sales varies by location.

A U.S. state-by-state and Canadian provincial breakdown of which ADESA locations are offering any/all/none of the above can be found here.

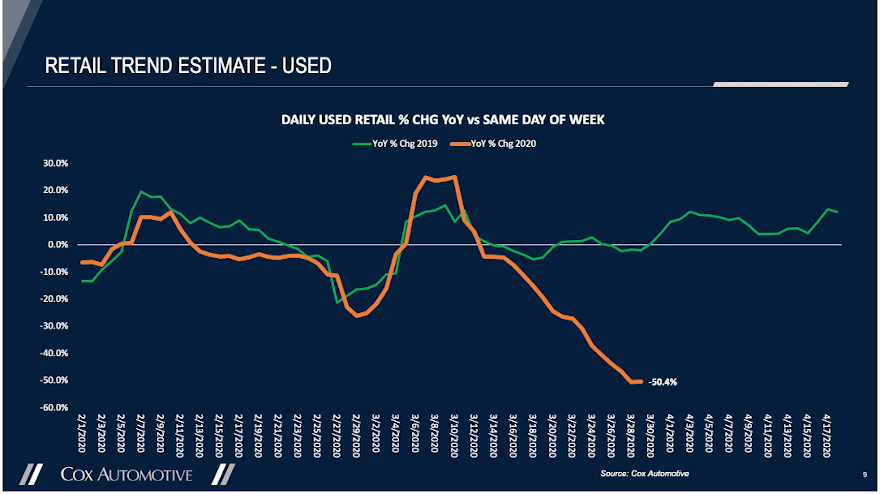

Used-vehicle sales declined 50% year-over-year in the last full week of March, according to the latest video report from Cox Automotive chief economist Jonathan Smoke that was released Tuesday.

They fell 50.4% during the week, then “stabilized” on that Sunday (March 29).

“However, when we look at the leading indicators of what these sales are likely to be, the underlying unique credit application submissions, they suggest that sales will continue to fall this week, especially as stay-at-home orders continue to grow all across the country,” Smoke said in the video, referring to this most recently completed week.

On March 27, TrueCar’s ALG business unit was forecasting just over 2.7 million used-vehicle sales for March, a 29% year-over-year slide and a 24% month-over-month dip.

Full-year used-car sales are likely to be less than 38 million, best case scenario, Smoke said in the video. They potentially could end up below 36 million, he said.

One positive note, however, for the auto retail market, in general: online shopping began to improve midway through the last week of March and continues to improve, Smoke said.

Vehicle detail page views on Autotrader were up 7% the last weekend in March against the prior weekend and visits were up 11% on the Kelley Blue Book.

“Dealer.com, which manages thousands of dealer websites, saw deceleration over the weekend in traffic declines that were much worse two weeks ago,” he said.

There is likely to be a shortage of used vehicles some three years down the road, as automakers halt production amid the COVID-19 pandemic, cutting the would-be off-lease volumes hitting the market in 36 months.

There could also a supply impact much sooner in the off-rental sector, says Black Book’s Laura Wehunt, who outlined short- and long-term used-car supply scenarios in a phone interview Tuesday.

“Long-term, we’re going to end up with a shortage 36 months from now in the used market,” said Wehunt, who is Black Book’s vice president of automotive valuations. “At this point, with production being shut down for the majority of the automakers, we are going to have a shortage. That’s inevitable.

“Short-term, again, there will be a shortage of new vehicles … it will help used values, but I think there’s also going to be a pent-up supply once things start to open back up,” she said. “Right now, we’re really seeing the sellers holding to their floors. We’re seeing large no-sell rates, but we’re seeing the supply at the auctions.”

The supply is there at the auctions, as sellers try to sell the inventory through simulcast, where available, she said.

“Each week, what’s being offered for sale is going up. And we’ve got these really high no-sell rates,” Wehunt said. “So, I think once things really get back going, there is going to be this increased supply of vehicles there for dealers to choose from.”

But again, the long-term impact is different, as 36 months out, the market won’t see a strong crop of lease returns coming back.

Wehunt also expects to see some supply impact in the 12- to 24-month range on the off-rental side.

“They will likely pull back on some of their buying,” she said of rental companies, who aren’t going to have a strong supply of cars to buy from this year, amid OEM production cuts.

“But I think your largest reduction will come in 36 months when you’re not getting those off-lease vehicles,” she said. “And that’s part of what you saw in our forecasting.”

Wehunt added: “By 36 months, we’re not going to have that the negative impact on the values that we’re going to see in the short term, just because you will have the lack of supply to balance out what’s going on right now.

“We should get back to normalcy by then,” she said.

So, what about off-lease volume for 2020, which analysts projected to be another year of more than 4 million off-lease units hitting the market? What’s happening with leases that were initially scheduled to end?

The automakers “are encouraging and offering programs for the consumer to just hold on to their lease right now and to defer returning it for a time,” Wehunt said.

There are some lease returns being brought to the auction, but others are extending lease terms.

“Traditionally, that would mean you’re going to end up with a higher-mileage unit,” she said. “Right now, nobody’s driving, so I don’t know that we’re going to see that big of an impact there that you normally would expect by extending a lease term.”

It could be an interesting scenario to watch play out, particularly as J.D. Power indicated Thursday in its 2020 U.S. End of Lease Satisfaction Study that 1.8 million leases are slated to mature between March and July.

“Retaining lease customers is crucial for dealer and lender profitability as they navigate a constricting market and economic downturn,” Patrick Roosenberg, director of automotive finance intelligence at J.D. Power, said in a news release. “Communication through customer-preferred channels is paramount as dealerships temporarily close and lease customers navigate an unprecedented event, uncertain of their available options to defer payments, extend or terminate their leases.

“The market will recover and competition from banks and captive lenders will be fierce for the 1.8 million returning lease customers scheduled to turn in their vehicles in the next five months. Aggressive retail programs, some of which have already launched with 0% financing and deferred payments up to 120 days on extended term loans, will create more obstacles for lease retention.”

The last off-lease slowdown

Any off-lease shortage would not unprecedented. In 2009, amid the Great Recession, lease volume was just 1.4 million and lease penetration had dropped to 17%, according to data provided by Edmunds last year.

Off-lease volumes had dropped to 1.5 million by 2012, after having reached 2.5 million just three years earlier, according to data shared by Cox Automotive.

It has been moving upward even since. The company shared a year-by-year off-lease volume count since 2007, noting that pre-2011 data used a different calculation methodology:

|

Year

|

Off-Lease (millions)

|

|

2007

|

2.2

|

|

2008

|

2.4

|

|

2009

|

2.5

|

|

2010

|

2.4

|

|

2011

|

1.9

|

|

2012

|

1.5

|

|

2013

|

1.8

|

|

2014

|

2.2

|

|

2015

|

2.5

|

|

2016

|

3.0

|

|

2017

|

3.4

|

|

2018

|

3.8

|

|

2019

|

4.1

|

|

2020

|

4.1

|

Source: Edmunds

Going back to the Black Book data, Wehunt agreed that it’s also possible to see a repeat of a dozen years ago on the trade-in side, when dealers held on to trades — because they need to retail them — instead of wholesaling them.

“Already, even right now what we’re seeing sell at the auction is your lower-condition vehicles, older vehicles, those cheaper units,” she said. “So, I think there will be a demand for good trade-ins, good lease returns — those nicer quality units. They don’t have to go to the auction and pay the transportation, pay the buy fees … they’re going to hold on to those.”

While remaining upbeat about the industry’s long-term prospects, Kerrigan Advisors acknowledged the ongoing tailspin experienced by franchised dealerships when the firm released its latest Kerrigan Index, which is comprised of the seven publicly-traded auto retailers.

Through Tuesday, the Kerrigan Index generated a devastating 37.7% decline for the month, more than triple that experienced by the S&P 500. Year-to-date, the firm said the Kerrigan Index is down 42.6%, and the index is currently 47.9% below its 52-week high, which was achieved in mid-December, just three months ago.

The Kerrigan Index is now trading at levels not seen since 2012, according to a news release the firm distributed on Wednesday.

“After an incredible year in 2019, it has been a roller coaster since news of COVID-19’s spread started to consume the industry,” said Erin Kerrigan, founder and managing director of Kerrigan Advisors. “We had a strong start to 2020 but, not surprisingly, March has been a very challenging month for auto retailers.

“Our firm expects the buy/sell market to slow dramatically in the second quarter of 2020,” Kerrigan said. “Having said that, we believe private dealership values will not decline to the same degree we’re seeing public company values plummet.”

A special edition of The Kerrigan Index released on March 23 highlighted that auto retail is primarily a private industry with the publics owning just 6% of dealerships. As such, while the publics’ valuations provide insight into valuation trends, they do not usually determine the market value of a private dealership.

The firm’s Blue Sky Report also noted that the publics represented only 5% of the buy/sell market in 2019.

“Car dealers have proven time and time again their ability to survive, even in the worst of times,” Erin Kerrigan said. “We expect they will do so again, once this pandemic is under control. Those who are considering a sale will wait until the industry returns to a more normal state and the buy/sell market reactivates, likely in the second half of the year. In the meantime, we focus on health and hope for calm.”

The firm also noted its latest Kerrigan Index showed that while COVID-19 will undoubtedly force some distressed dealership sales, those sales are not considered benchmarks for industry valuations, as most dealers today have strong balance sheets and can patiently wait for the right time to go to market.

According to Kerrigan Advisors’ 2019 Blue Sky Report, after a slow start in the first half of the year, the 2019 auto dealership buy/sell market had the most active second half on record leading to 233 completed transactions for the full year — the second highest number since 2014, and the sixth consecutive year of over 200 transactions.

The firm explained this activity was fueled by a high level of multi-dealership transactions and an increase in average dealership earnings and blue sky values.

“We are profoundly aware of dealer anxiety in the current crisis, but auto retail will bounce back much faster than many other sectors of retail. We just need to wade through this crisis, get to the other side, and then start rebuilding. Experienced dealers know the playbook,” said Ryan Kerrigan, managing director of Kerrigan Advisors.

“The business model is resilient because of its diversification with fixed operations and used vehicle revenue often sustaining losses in new vehicle sales,” Ryan Kerrigan continued. “It is for this reason that buyer demand has recently been so high for dealerships. We anticipate demand will bounce back as we come out of this crisis.”

More details from latest Kerrigan Index

The firm explained the mid-March Kerrigan Index vividly details the altered state of the automotive retail industry as it grapples with state-wide lockdowns, uncertainty about the crisis and the continuing economic freefall — albeit with optimism for the future.

The special edition also examined the balance sheet strength of the seven public auto retailers, including CarMax, AutoNation, Penske Automotive Group, Lithia Motors, Group 1 Automotive, Asbury Automotive Group and Sonic Automotive, in light of the global COVID-19 pandemic and its economic aftermath that has rattled investors and sent stock prices plummeting.

After dissecting the data, among the notable points Kerrigan Advisors found:

— Major banks now predict a global recession (defined as two quarters of negative growth).

— Goldman Sachs expects U.S. GDP to decline by 24% in the second quarter of 2020 and 3.8% for the full year.

— RBC Capital Markets now predict U.S. auto sales will fall to 13.5 million vehicles, 20% below last year’s sales.

— The uy/sell market is likely to be impacted through Q2 2020; expect a resurgence in the second half of 2020, with optimistic trends playing into 2021.

As a group, the firm computed Kerrigan Index component companies have a combined total debt (including floorplan)-to-equity ratio of 2.7 times, and long-term debt-to-equity ratio of 0.7 times. Historically, the firm acknowledged floor plan debt has not proven to be risky as long as operators stay “in trust;” as such, overall debt levels are reasonable and should provide ample resources to work through the financial challenges of the coming months.

Excluding CarMax’s $8.8 billion market capitalization, the firm determined new-vehicle retailers composing the Kerrigan Index as of March 31 are now collectively valued at just over $9.3 billion. This compares to their collective value of $17 billion at the end of 2019.

For the month of March, the firm discovered Sonic Automotive posted the largest loss of 51.7%, followed by Group 1 Automotive (down 48.1%), Penske Automotive Group (down 39.2%), CarMax (down 38.4%), Asbury Automotive Group (down 37.8%), Lithia Motors (down 31.3%) and AutoNation (down 29.7%).

Kerrigan Advisors’ long view

In its latest update, the firm also focused on its long-term performance, highlighting some upbeat projections in comparison to the sour data coming to light during the past month.

Kerrigan Advisors expects strength and stability in the buy/sell market, as evidenced by outside capital’s growing interest in auto retail.

“We continue to speak with investors who are seeking investments in auto dealerships,” Erin Kerrigan said. “These investors are keenly aware of how well auto retail performed coming out of the Great Recession and believe now is the time to invest as the industry consolidates and capitalizes on efficiencies from digital retailing.”

The 2019 Blue Sky Report mentioned that an increasing number of experienced operators are linking up with private equity sources to grow their dealership groups. The number of dealerships owned by Top 100 Dealership Groups backed by private equity capital has increased 123% since 2014, according to the report

This year, Kerrigan Advisors said this trend will continue as investors seek to buy on a downturn, knowing strong growth prospects are ahead.

“Now that we are in a more challenging time, we are hearing from more family offices, high net worth individuals and private equity firms,” Ryan Kerrigan said. “They believe valuations will be more attractive and, as a result, they will be more interested in buying dealerships; plus, they see a long runway of acquisitions ahead as the industry continues to consolidate and digitize”

The Blue Sky Report by Kerrigan Advisors covers dealership M&A activity as well as franchise values, including analysis of all transaction activity and lays out the high, average and low blue sky multiples for each franchise in the luxury and non-luxury segments. The 2019 annual report also includes Kerrigan Advisors’ annual review of each franchise, discussing buyer demand, franchise profitability, product pipeline and sales expectations for 2020.

For the fourth quarter of 2019, the firm indicated the following adjustments were made to Kerrigan Advisors’ Blue Sky Multiples:

— Increased Chrysler Dodge Jeep Ram (CDJR) blue sky multiple to 3.5 – 4.5

— Lowered Buick, GMC’s blue sky multiple to 2.75 – 3.75

— Lowered Infiniti’s blue sky multiple to 2.5 – 3.5

— Initiated Lincoln’s blue sky multiple at 2.5 – 3.5

For more details about the firm’s reports and industry analysis, go to www.kerriganadvisors.com.

Sure, consumers are not going to dealership showrooms very much, if at all, right now.

But it doesn’t mean they’ve stopped shopping or looking at vehicle inventory.

Far from it.

According to data from Cars.com, “tens of millions” of shoppers are still involved in the car-buying process — they’re just doing it online and looking for other avenues to transact or work with dealers besides in-store visits, as cleanliness concerns and stay-at-home mandates mount.

Likewise, Black Book is hearing “good reports” from its dealer contacts on transitioning to a digital retail operation, says Laura Wehunt, vice president of automotive valuations.

“They're getting actually a lot of leads coming through right now,” Wehunt said in a phone interview earlier this week. “Even if their sales team can't be physically at their dealerships, they are fielding those calls from home and having a lot of success there, preparing to make sales — and then in some cases, actually being able to make the sale and then deliver to their home.”

In fact, Cars.com said that based on its internal Lot Insights data from March 16-24, close to 80% of its visitors have “high intent to purchase.”

Similarly, Market Update data provided by LotLinx also offers some encouraging signs.

Looking at new- and used-car data among more than 14,000 dealers, sales were off 47.5% from February, as of end of day Monday, and shopper fell 14.6%. However, shopper engagement was up 12.1%.

The online shopping data comes from LotLinx’s proprietary market intelligence platform; the company is able to utilize multiple avenues to caption more than 100 million daily shopping interactions.

In its comprehensive, 61-page COVID-19 Market Analysis Report, LotLinx urges dealers to go digital.

“Consumers are still shopping for cars, and right now, they’re online more than ever. Businesses that stop advertising in times of crisis are likely to lose share of mind and market,” the company said in the report. “Stay present, but acknowledge the issue at hand.”

Going back to the Cars.com data, consumers have been looking to take care of more of the car-buying steps online in recent weeks, including tasks like price negotiation (48% want to do this online) and financing (42%), according to Cars.com internal data from March 16-24.

“Though showroom visits are declining nationwide, the auto industry has the technology and digital tools available to meet shoppers where they are,” CARS Inc. chief executive officer Alex Vetter said in a news release.

“Digital retailing, home-delivery options, increased comfort and reliance on chat tools to connect with shoppers in real-time and enhanced engagement with social channels are very valuable mediums for dealers to generate sales during this challenging period,” Vetter said.

“Our automotive industry has always proven to be an incredibly resilient and resourceful industry,” he said. “We are committed to helping car shoppers and dealerships navigate these unprecedented times with an array of dealer tools that are well suited to connect with the at-home shopper.”

Speaking of at-home shopping and home-delivery, demand for technology facilitating those services is spiking.

LotLinx, in its report, is encouraging dealers to broaden such services.

“Get your finger on the pulse of what consumers need in these turbulent times,” the company said. “Free at-home deliveries and online check-outs are just some offerings that can go a long way in a consumer’s mind.”

Cars.com said its Dealer Inspire business unit had nearly a 250% month-over-month uptick in demand for its Online Shopper digital retail service in March. Dealer Inspire’s Conversation chat tool climbed nearly 65%.

Going back to Vetter’s comments on the auto industry being “incredibly resilient and resourceful,” a lot of dealers are proving that point right now.

In a Cars.com dealer survey from March 16-27, 57% of respondents were looking to increase online financing capabilities and 40% were looking to do more online estimates for trade-ins. Thirty-six percent were looking to boost online chat options and 49% were looking at-home delivery.

In an interesting side note, Cars.com has found that consumer concerns around cleanliness may provide some help for vehicle ownership over other transportation models.

For instance, 17% of respondents who don’t currently own a vehicle said the COVID-19 pandemic has led them to consider buying one, Cars.com found.

Consumers wanting to stop taking public transportation and not trusting the cleanliness of other people’s cars are among the factors driving that urgency.

Cars.com consumer metrics from March 16-24 show that a third of consumers who plan on purchasing a vehicle intend on doing so sooner, in light of the pandemic.

Citing the March 13-16 general population survey, Cars.com said 42% of consumers aren’t using ride-hailing services as frequently.

Lastly, one more bit of advice from LotLinx, which emphasized communication in times of crises like these.

“Stay informed and inform your consumers: Inform shoppers of in-stock inventory and available services,” the company said. “Transparently communicate how your business is being responsible, including statements about your strict adherence to CDC guidelines and your commitment to the community.”

Editor's note: More days and times for online testing have been added.

The International Automotive Remarketers Alliance (IARA) is taking steps to ensure members still can complete testing for its Certified Automotive Remarketer (CAR) program via online proctoring.

IARA scheduled online testing times for Wednesday, Thursday and Friday. First, individuals must complete the IARA Online Proctoring Member Request Form that’s available on this website.

Once individuals complete the form, IARA said they will receive instructions for setting up your testing space, as well as IARA’s standard ethics for an online testing environment.

“You will need to read, review and acknowledge receipt of the standards,” IARA said. “Once acknowledged, you will receive information prior to the session on how to connect online with your proctor on the day of testing.”

More information about the CAR program can be found on this website.

The coronavirus pandemic has made it difficult to impossible for dealers to perform certain contractual obligations. Especially where shelter-in-place orders are in effect and auto dealer sales operations are considered to be non-essential businesses, a dealer forced to close its sales business may be unable to make payments due on floorplan loans or meet franchise sales quotas. Other contractual obligations may be difficult or impossible to perform, as well.

One possible avenue for relief may be available in contract “force majeure” or Act of God clauses. “Force majeure” means unforeseeable circumstances that prevent someone from fulfilling a contract. These clauses are typically contained in the contract boilerplate and are designed to allow a party to delay its performance or even terminate the contract if an enumerated force majeure event occurs. The clause will list a series of events that typically include acts of military intervention, strikes, civil unrest, natural disasters, acts of God, and other calamities. Some contracts include a “catch all” provision making reference to any unforeseen act beyond a party’s control, or words to that effect (e.g., “any act or occurrence beyond a party’s reasonable control and due to no fault of the party”).

Reviewing contract force majeure provisions

Force majeure clauses are not consistent across all contracts. Your contract’s force majeure clause will dictate what events may delay or excuse performance. An act of God is generally defined as an unusual or extraordinary natural event, such as floods, earthquakes, volcanic eruptions, tornadoes, hurricanes, blizzards, etc. The contract clause may list pandemics or acts of government authority as examples of force majeure events or contain other language that may cover the coronavirus and associated government responses. A general “catch-all” clause could also be argued to delay or excuse performance. The contract language of the clause will ultimately determine whether you may be able to delay performance of a contractual obligation.

Know that courts generally interpret force majeure clauses strictly, meaning they will not give an overly expansive interpretation to the enumerated events such as by limiting acts of God to mean extraordinary weather-related events. A contract without a catch-all clause will be most strictly construed. A catch-all clause at least gives you an argument that the list is not meant to be exclusive and a party’s ability to control the event is the determinative factor. Know, however, that most courts interpret a general catch-all provision to cover only externalities that are like those specifically stated in the balance of the clause.

If a force majeure event applies, what performance does the contract require?

Assuming there is a specific reference to a pandemic or you want to argue a “catch-all” clause applies to make the coronavirus outbreak and government responses a force majeure event, you still need to review the contract clause to see what performance is required.

Force majeure clauses may codify an impossibility standard and require that performance of contractual obligations be “impossible” before all obligations are excused. Others may be less stringent, requiring only that the performance, considering the triggering event, would be “commercially impractical.” So, if your state or municipality has adopted a ban on gatherings of more than 50 people, that may provide a basis to fail to perform a meeting scheduled during the applicable time. Also, not all force majeure clauses provide for termination of an agreement; many only excuse a delay in performance, providing that any failure to perform due to a triggering event during the force majeure event will not constitute a breach under the relevant agreement.

Many force majeure clauses also require the affected party to make reasonable efforts to perform during the force majeure event to the extent it can do so. Again, it is the language of your specific contract that determines whether this is the case.

Notice required to be given to the other party

All force majeure clauses require the non-performing party to give notice to the other party, sometimes within very tight time deadlines. Notice provisions may specify the form of the notice, to whom it must be sent, and the way it must be sent. Additionally, many agreements will require that notices must provide enough specificity to make clear why the relevant triggering force majeure event applies to a given provision in a contract.

Be sure to read the clause carefully and give timely notice in the manner required by the contract.

Impossibility of performance defense

In many states under the common law, there is an implied defense to performance if a situation occurs that makes performance impossible.

The party asserting this defense will bear a heavy burden of proving that the event was unforeseeable and truly rendered performance impossible, and the doctrine generally is applied narrowly. For example, assertions that the event rendered performance more expensive or difficult have been rejected under the impossibility doctrine. As a result, some states, like California, have enacted statutes to address the impossibility of performance defense. In California, the California Civil Code excuses performance under a contract when: “it is prevented or delayed by an irresistible, superhuman cause, or by the act of public enemies of this state or of the United States, unless the parties have expressly agreed to the contrary.”

The presence of a force majeure clause in a contract does not necessarily negate the defense of impossibility of performance but may cause the court to interpret the impossibility defense in a manner consistent with the force majeure clause.

Summary

For any contracts made difficult or impossible to perform due to the coronavirus or the acts of government authorities such as shelter-in-place orders, review your contract carefully with your attorney and pay particular attention to the force majeure clause. Note whether you can argue it applies and, if so, deliver timely and sufficient notice, and comply with any performance standards the clause requires. Again, note that these clauses tend to be strictly construed by the courts, but they may provide at least a bargaining chip to negotiate new performance arrangements with your counterparty.

Randy Henrick is an auto dealer compliance expert who serves as a head of the franchise dealer practice group for Ignite Consulting Partners. Randy also offers compliance consulting services to dealers directly at www.AutoDealerCompliance.net. He served for 12 years as Dealertrack's lead regulatory and compliance attorney and wrote all of Dealertrack’s Compliance Guides. He has presented workshops at five NADA national conventions and speaks to dealer associations, 20 groups, and prepares training and other compliance materials for dealers. Because of the general nature of this article, it is not intended as legal or compliance advice to any person but raises issues you may want to discuss with your attorney or compliance professional.