CapStreet Group, which invests in owner-managed, lower middle market companies, has completed the majority recapitalization of TradePending LLC.

TradePending builds software for car dealerships, stating that it uses vehicle pricing data to enable digital retailing and boost online conversions and increase profitability for trade-in vehicles.

TradePending chief executive officer Brice Englert said the new partnership sets the stage for accelerated organic growth.

“From the outset, we were impressed with the CapStreet team,” Englert said of the Houston-based private-equity firm.

Englert also said, “They took the time to not only understand the industry and our business model, but also the culture and spirit that makes our company tick. “As we continue to build a scalable organization, that opens up opportunities for us to explore new areas within automotive as well.”

Englert went on to say, “Our dealer customers continue to face a more competitive market than ever, especially in pre-owned, that necessitates solutions to help them source, manage, merchandise and sell used and new inventory. TradePending has given thousands of dealers a competitive edge for seven years, and this partnership with CapStreet will allow us to be more innovative and aggressive than ever before.”

CapStreet partner Adrian Guerra said TradePending is a dynamic company, and because of its unique value proposition, it has created strong growth momentum. TradePending was founded in 2014 and headquartered in Carrboro, N.C., stating that its software brings accuracy, transparency, and simplicity to its customers.

CapStreet vice president Chas Richard said Englert and the rest of the TradePending management team have built the business well. Richard said Capstreet looks forward to partnering with TradePending in the next phase of growth.

“TradePending has tremendous potential as a platform with numerous opportunities to expand and enhance its solutions through internal investments and add-on acquisitions,” Richard said.

The investment in TradePending is the second investment for CapStreet V, LP, which has $500 million of committed capital.

Mark Lanwehr describes Car Keys Express as the first and only company to offer a line of modern, aftermarket keys, and he says that allows retailers and key professionals to offer customers an alternative to what he describes as “expensive OEM devices.”

Lanwehr is founder and chief executive officer of Car Keys Express LLC, and on Wednesday, his company added two new remote keys to its line of aftermarket products, with coverage including 3 million late model Ford Fusion and F-series trucks.

The new keys feature integrated remotes and retractable blades, and the company says they bring the same functionality as the original manufacturer’s versions.

“This latest release is yet another demonstration of our commitment to saving the industry and consumers time and money,” Lanwehr said in a news release.

The keys are the latest of a line of remote and smart keys from Car Keys Express.

“Retailers, key professionals, and consumers no longer have to pay top dollar for OEM keys,” the company said.

The latest release follows the previously released universal Ford, Lincoln, Mercury, and Mazda remote key.

It also follows the previously released Nissan and Infiniti Smart Key; Chrysler, Dodge, and Jeep FOBIK; and the Chrysler, Dodge, and Jeep remote key.

Car Keys Express says that along with the Universal Car Remotes and Universal Car Keys it developed and manufactured, it offers aftermarket keys and remotes that provide coverage for most of the 250 million North American cars on the road today at a lower cost.

Among the features of the latest release are two configurations: three- and four-button. They are compatible with nearly 3 million vehicles from 2013-2019, according to the company.

Additional notes about the new release:

— Replaces OEM models 164-R8130 and 164-R7986

— Cost is 40% to 70% lower than OEM, according to the company

— FCC-certified

— Water-resistant design

— Compatible with all standard industry diagnostic tools and equipment

— Can be reprogrammed multiple times

— The company says the three-year warranty is “better-than-OEM.”

— Designed and assembled in the United States

A CDK Global plan to divest its digital marketing business allows the CDK management team to work on increasing momentum in its core auto software business and to accelerate fiscal 2020 growth, CDK Global president and chief executive officer Brian Krzanich said in a news release.

The company’s digital marketing business includes all of its Advertising North America business segment and some assets of its Retail Solutions North America segment that relates to mobile advertising and website services.

CDK Global reached the divest decision after thoroughly evaluating the CDK portfolio. The company said the decision aligns with its strategy of focusing on the core suite of SaaS software and technology products for the markets it serves through its Retail Solutions North America and CDK International segments.

The company said it will present the digital marketing business as discontinued operations beginning with the fourth quarter. CDK Global, which provides its services to dealers in more than 100 countries and serves about 30,000 retail locations and most automotive manufacturers, has engaged Allen & Company to identify potential buyers and evaluate proposals for the digital marketing business.

“We believe the digital marketing business is an attractive asset for someone who is better positioned to leverage the technology platform and management team that we have built,” Krzanich said. “During this transition period we remain committed to our CDK Digital Marketing customers, and will continue to support our comprehensive suite of digital marketing technologies and services.”

Those interested in seeing additional details about the decision can review a Current Report on Form 8-K filed with the Securities and Exchange Commission on Thursday. In early August, the company will hold its fiscal fourth quarter and fiscal year ending June 30 earnings call. That call will include updates on the plan and fiscal 2020 guidance, as well as an update to the capital allocation strategy.

A new integration between dealership software provider Selly Automotive and independent used-car dealer management software company Frazer will help Frazer users manage leads from several websites and other sources, Frazer Computing president Michael Frazer said in a news release.

More than 21,000 active users work with Frazer, which says it provides dealer management software that is full-featured and affordable.

San Francisco-based Selly Automotive is an independent and BHPH dealership software vendor that works with U.S. and Canada dealership clients. The company’s dealership sales platform includes customer relationship management, Internet lead management, mobile tools (driver’s license and VIN scanner), communication management (voice and texting), and e-mail services.

Selly Automotive founder and chief executive officer Zach Klempf said Selly and the Frazer DMS team have worked for the past year create an integration for the independent market that will eliminate the need for double entry. He said the companies also wanted the integration to complement the Frazer DMS.

For new and existing dealerships using both platforms, Selly and Frazer are offering an early access program before the integration’s official release. Interested dealerships can sign up at the Selly site.

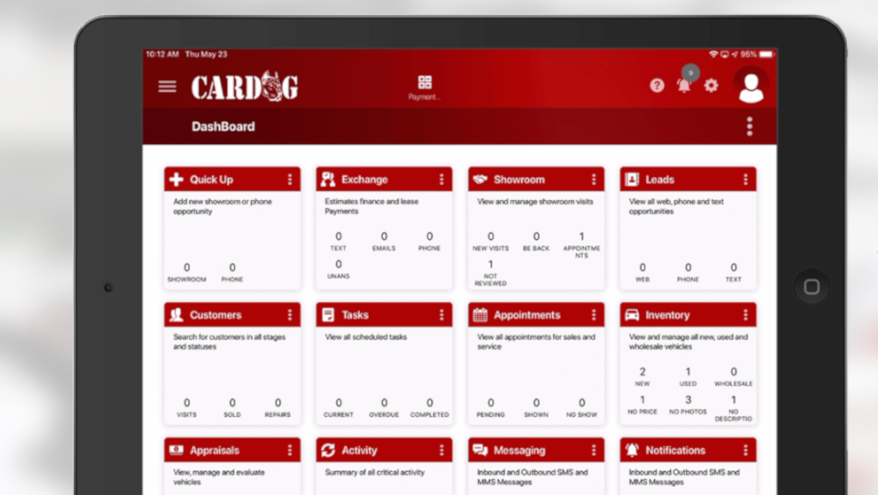

DealerPeak says its new car dealership CRM for independent dealerships helps busy dealers manage “nearly every aspect” of the business, including customer sales, communication, website management, inventory control, sales leads, SMS and MMS texting.

Called CarDog, the CRM is “the first complete mobile-accessible automotive car dealership CRM software solution,” DealerPeak said in a news release.

DealerPeak said that with the CarDog automotive CRM — accessible through mobile smartphone and tablet devices, as well as desktop and laptop computers — users can navigate at their speed and comfort level.

The DealerPeak technology team led by chief product officer Rick McLey designed the mobile independent car dealership CRM. The company will introduce the product at the National Independent Automobile Dealers Association Convention & Expo, taking place in Las Vegas this week.

In 1999, DealerPeak LLC debuted with a primary goal of supporting a rapidly expanding 17-location automotive franchise. The team started by developing an enterprise-level website to capture sales leads. To manage those leads, the task expanded to include development of an Internet lead management system.

DealerPeak has focused on developing new technology over the last few years to create products that it says several of its customers sought. Listening to its independent car dealership customers, the team quietly worked in the lab to develop CarDog, which the company describes as a “practical and completely accessible” mobile CRM.

The company describes CarDog as “the next DealerPeak evolution.”

According to DealerPeak, CarDog is similar to all DealerPeak products in that its support team includes “technical gurus” with extensive automotive industry experience. That experience includes practical car dealership knowledge and technical expertise.

“Most CRM companies simply offer a scaled down version for mobile-accessible dealership CRM’s, we offer a complete solution,” McLey said. “CarDog provides time-strapped independent car dealerships a powerful, yet scalable CRM that can be accessed from their desktop, laptop, tablet, and mobile device. Every user-friendly tool and app included in the CRM can be accessed on any device, from any location with an Internet connection.

“The flexibility of CarDog helps streamline communication, improve the sales process, and even complete deals from the lot,” McLey said. “Users can update vehicle inventory, upload images, and video, or edit and add content to their website directly from their mobile device. It’s the perfect CRM solution for the small independent car dealership and the sales associate looking for a competitive advantage.”

For more than 100 years, Deluxe has been a supplier of business incorporation services and automotive business products with more than 115,000 automotive small business customers.

Now, the company is a partner of the National Independent Automobile Dealers Association. Deluxe will offer its products and services through NIADA's National Member Benefit program, and the company says in a news release that its offerings are “a strong fit for the program and NIADA's 16,000 independent dealer members.”

Deluxe is offering NIADA members up to 60 percent off first-time orders through the partnership. It is also offering everyday discounts of up to 30% off at deluxe.com/niada.

The company said that through the partnership, NIADA members can order and save on products such as business incorporation services, business checks, cash management solutions, automotive forms, promotional products and branded apparel.

“We have a great opportunity to help NIADA members with their incorporation filings as well as supplying members with their payment solutions and marketing products,” Deluxe partnership manager Andrew Isenberg said. “NIADA does a great job supporting and advocating on its members’ behalf, and we are thrilled to be working together to support the used vehicle industry.”

“Deluxe has been serving small business owners for more than a century with best-in-market checking and cash management services and branding/marketing solutions,” NIADA senior vice president of member services Scott Lilja said. “Those immensely valuable tools are now available to our member dealers at substantial discounts negotiated by NIADA on their behalf. Another great reason to be an NIADA member.”

A new method of automotive customer reviews will provide insights for vehicle manufacturers into how customers are talking about brands and their experiences with vehicles, sales and service.

With this insight, manufacturers can identify areas for improvement, identify ways to attract and retain car buyers, and provide consumers with a trustworthy source for purchasing decisions.

J.D. Power Verified Reviews, created through an alliance between J.D. Power and customer sourced-review technology company Reevoo, is what the companies describe as “an unparalleled way for U.S. automotive manufacturers to listen and showcase customer opinions.”

The collection of customer evaluations for brands, vehicles and dealerships will take place through digital platforms, providing content that an auto manufacturer can publish online.

Reevoo is a supplier of services that result in customer-sourced reviews for brands, products and services.

“We are very excited at the prospect of working so closely with J.D. Power, given its 51-year history of being the voice of the customer,” Reevoo chief executive officer Lisa Ashworth said in a news release. “Together we will be able to offer U.S. automotive companies an unrivaled source of data and tools to help them grow and develop their business. At the same time, car buyers will have a proven and trustworthy route to gain consumer insights and share their opinions.”

“Given our shared philosophy that the customer is the focal point of every business, there is a natural synergy between J.D. Power and Reevoo,” J.D. Power vice president, U.S. automotive retail practice Chris Sutton said. “Our passion and pursuit of measuring customer feedback is strengthened with this alliance and provides brands with another channel to listen to what their customers are saying.”

The Appraisal Lane launched its consumer app for iPhone earlier this year, allowing consumers to tap into its live community of appraisal experts to receive a guaranteed cash offer for their used car in 30 minutes or less.

Now, the company has launched the Android version of the app for consumers.

After downloading The Appraisal Lane app to their phones, consumers can connect with live appraisers in real time, upload their vehicle photos, and answer simple condition questions. The guaranteed cash offer in 30 minutes or less is redeemable for trade-in value or for cash at a nearby dealership.

The Appraisal Lane said this latest edition means it now offers a full selection of apps for consumers who want to know what their car is worth, and for dealers who are interested in buying and selling used car inventory at any curb.

The Appraisal Lane launched in 2016, and since then it has delivered more than $2.5 billion in offers on used vehicles.

Appraisal experts generate those offers. Each month, those experts evaluate thousands of cars across all makes and models. In addition to its consumer app, The Appraisal Lane said its TAL Dealers product helps dealerships move and manage used-car inventory and connect with in-market consumers in real time.

Its TAL Buyers product aims to help dealerships and dealer groups source in-demand inventory from any curb.

The Appraisal Lane co-founder and vice president of product Scott Gales said the company launched the apps “to fill a significant void in the marketplace.”

“Unlike other appraisal tools, our intelligence isn't artificial and people appreciate that,” Gales said in a news release. “The Appraisal Lane’s offers are generated from real people in real time, backed by real money, not ranges or estimates.”

Gales also said that used cars “are as unique as the people who drive them,” and he said that is why human interaction is necessary.

“Our live appraisers understand the factors that impact trade-in value across all makes, models, and markets, versus computer-generated estimates,” he said. “Real time communication with live experts gives consumers the confidence and transparency missing in the traditional car valuation process.”

The Appraisal Lane is available for download at the App Store or on Google Play.

The data is in: Prospective car buyers’ love of technology continues.

Technology adoption is especially high among one of the sector’s most valued segments: 66% of those in-market for a new car or truck in the next 12 months say they are interested in trying the latest technologies, according to public opinion and data company YouGov.

Recent YouGov data provides a great deal of statistics about prospective car buyers and technology. One of the main findings: 55% of those in-market for a new car or truck in the next 12 months they are often first among their friends to try new technology.

The information from YouGov seeks to get into the minds of prospective car buyers. The data shows information such as the technologies they want to see in their next car purchase, their feelings about digital assistants in cars, the ads they seem to notice, and which channels gain their attention.

YouGov says that sales are in decline in the age of “post-peak auto.” The company says 37% of U.S. license holders are in the market to purchase a car or truck within the next 12 months. Auto industry marketers are working to be more efficient at learning about prospective car buyers. And they must identify the right channels to reach them.

Fifty-eight percent of prospective car buyers surveyed say e-mails from brands or companies influence their purchasing decisions. Fifty-seven percent say posters or billboards motivate them to search for products on their phones.

Fifty-two percent enjoy seeing ads starring their favorite celebrities.

The data also addresses technologies that potential buyers would consider, with 21% of those in the market for a new car or truck saying they would consider touchscreen/unified multimedia control interface. Eighteen percent would consider driver drowsiness detection, and 17% would consider automatic parking. The same number, 17%, would consider advanced driver assistance systems, 16% would consider hybrid drive, and 15% would consider emergency telematics such as eCall or OnStar.

The total weighted sample sizes for this study includes 1,197 U.S. adults age 18 and older with a U.S. driver’s license and who say they are in-market for a new car or truck in the next 12 months and 18,237 U.S. adults age 18 and over with a U.S. driver's license.

It’s a challenge for dealer groups: how to get the right trade-ins to the right rooftops at the right price.

The Appraisal Lane says that when a customer with a trade-in is online or in the showroom, dealer groups can access the Enterprise Trade View product from the convenience of their mobile devices in real time and at the point of sale. The company says that can provide each store with instant access to detailed information about any trade-in, any time, with photos and a condition report.

The Appraisal Lane — a mobile app-based community of appraisers who put guaranteed cash offers on used cars — says that real-time, instant access is important, especially on the heels of what it says was one of the weakest first quarters of car sales since 2014. Using ETV, the company notes, dealer groups gain immediate visibility into current traffic at any of their stores.

“Simply put, the trade-in is the gateway to the deal,” Appraisal Lane director of enterprise and OEM sales Jordan Walters said in a news release. “It determines the equity a customer has in their car and ultimately, their monthly payment. It determines whether or not the customer can afford their next purchase. It sets the tone for the experience they have with a dealer group. ETV improves the consumer experience, which helps dealers sell more cars and keep customers coming back.”

Walters says that with ETV, dealer groups can:

— Source more inventory from traffic that’s already in their stores, which is important when dealers have already committed significant advertising dollars to that traffic.

— Drive core inventory to the right stores on the first day rather than the 60th day, for example, after aged units have accrued major costs and dealers have taken the biggest hits.

— Close more customers in their showrooms, and reduce the acquisition costs of a retailable unit.

— Achieve a better return on investment on their marketing expenses.

“In a weak market, dealers can’t afford the downside risk of putting the wrong number on a non-core unit,” Walters said. “A dealer group’s best bet—one that improves the process for consumers, too — is to get a trade-in to the store that has the highest utility for it, and the most robust knowledge about it. It’s very easy to focus on what’s shiny and new, but the most effective tools focus on helping dealers close more of the traffic they already have.”