A new partnership between the American International Automobile Dealers Association and Dell Technologies aims to help AIADA members upgrade and improve their technology.

Dell Technologies has joined with AIADA as an affinity partner, giving AIADA members discounts of 5% to 10% on purchases of Dell products.

Those discounts are stackable with additional Dell promotions. That means AIADA dealers could save even more on their technology upgrades, according to AIADA.

With the partnership, AIADA members gain access to discounts on what they need to securely connect, produce, and collaborate anywhere at any time.

Those products include desktops, laptops, 2-in-1s, thin clients, work stations and devices made for specialized environments, as well as monitors, docking and endpoint security solutions and services.

Program benefits include:

— Exclusive member savings: Stackable 5% to 10% coupon.

— Access to a dedicated tech advisor or by phone.

— Access to Dell Financial Services.

— Access to AIADA’s direct point of contact and account executive, Steven Shipe at [email protected].

Dell Technologies’ various business tools can help dealers increase efficiency and productivity, AIADA president Cody Lusk said. “Having access to those tools at a significant savings is a big win for our members,” Lusk said in a news release.

“AIADA members can now receive healthy discounts on Dell’s vast range of technology products,” Dell director of strategic partnerships Mobolaji Sokunbi said. “We strongly believe AIADA and its diverse base of members will receive great value from this partnership and can in turn get more done in their day-to-day operations by repurposing the savings they earn.”

A recent auto dealership study looked at the question, “How often did the brand’s dealerships email or text an answer to a website customer’s question within 30 minutes?”

Infiniti, Volvo, Subaru, Acura and Jaguar accomplished that feat more than 45% of the time on average.

Overall, the 2021 Pied Piper PSI Internet Lead Effectiveness Benchmarking Study sought to answer the question, “What happens when customers visit a dealer website and inquire about a vehicle?” Ranking highest were Infiniti dealerships, followed by Subaru and Acura.

Infiniti, Subaru, Acura, BMW and Land Rover were the brands showing the greatest improvement from 2020 to 2021.

Also from 2020 to 2021, a dozen brands improved their performance.

Performance for 18 brands, however, and the industry overall, declined.

Pied Piper said COVID-19 has generated much more interest in digital retail tools.

With those tools, website customers can complete more of their purchase path from home.

Pied Piper said dealer feedback shows that customers using the digital retail process still benefit from “assisted selling,” in which dealership personnel are easy to reach throughout the process.

But dealers whose websites featured a “buy now” button failed to quickly respond to customer attempts to “chat” 44% of the time on average, according to the study.

For the study, Pied Piper submitted customer inquiries through the individual websites of 4,356 dealerships. Pied Piper, which said it helps brands and manufacturers improve the omnichannel performance of their retail networks, asked a question about a vehicle in inventory. Pied Piper then provided a customer name, e-mail address and local telephone number.

Pied Piper went on to evaluate how the dealerships responded by e-mail, telephone and text message over the next 24 hours.

Regarding the question on how often the brand’s dealerships emailed or texted an answer to a website customer’s question within 30 minutes, Buick, Genesis, Ford, Mitsubishi, and GMC accomplished that less than 25% of the time on average.

How often did the brand’s dealerships send a text message reply to a website customer’s inquiry? Kia, Toyota, Nissan, Ram, Hyundai, Mitsubishi accomplished that more than 57% of the time on average, while Mercedes-Benz, Jaguar, MINI, Porsche, and Alfa Romeo accomplished that less than 35% of the time on average.

The study also looked at how often the brand’s dealership reply e-mails landed in the customer’s junk/spam folder. For Porsche, Lincoln, Volkswagen, Ford, and Mercedes-Benz, that happened less than 16% of the time on average.

However, for Mitsubishi, Fiat, Kia and Genesis, that happened more than 33% of the time on average.

Pied Piper said digital retail tools have become much more common on auto dealer websites. The 2021 ILE study measured whether dealership websites for each brand featured the following digital retail tools:

— Did the website have a “buy now” or “buy from home” button?

For Cadillac, Buick, GMC, and Genesis, more than 40% of the websites on average had that feature.

For Fiat, Porsche, Mitsubishi, and Ford, fewer than 12% of the websites on average had the feature.

— Did the website offer to provide a trade-in value?

More than 95% of the websites on average for Ram, BMW, Kia, Chrysler, Dodge, and Lincoln provided that, while fewer than 75% of the websites on average for Cadillac, Mitsubishi, GMC, Buick, and Porsche provided it.

— Did the website provide a financing/payment estimator, and/or credit application?

Ram, Dodge, Jeep, Ford, Lincoln accomplished that for more than 95% of the websites on average, but for Land Rover, GMC, MINI, Porsche, and Lexus, that was provided on fewer than 82% of the websites on average.

Pied Piper conducted the 2021 Pied Piper PSI-ILE Benchmarking Study (U.S.A. Auto) between April 2020 and January of this year by submitting website inquiries directly to a sample of 4,356 dealerships nationwide representing all major brands.

“Digital retail technology promises to improve the car shopping experience,” said Fran O’Hagan, president and CEO of Pied Piper, in a news release. “On the other hand, we can’t allow the presence of digital retail tools to excuse ignoring website customers who reach out for help.”

Auto brands ranked by Pied Piper PSI — Internet lead effectiveness

| Infiniti +14 (change from 2020) |

71 |

| Subaru +6 |

67 |

| Acura +5 |

65 |

| BMW +5 |

62 |

| Volvo +4 |

62 |

| Mazda +1 |

60 |

| Land Rover +5 |

59 |

| Mercedes-Benz +1 |

59 |

| MINI +2 |

59 |

| Porsche +1 |

59 |

| Lexus +0 |

58 |

| Toyota -6 |

58 |

| Alfa Romeo +1 |

56 |

| Cadillac -6 |

56 |

| Chrysler -1 |

56 |

| Volkswagen +0 |

56 |

| Audi -2 |

55 |

| Fiat +4 |

55 |

| Jaguar +3 |

55 |

| Nissan -0 |

55 |

| Industry Average -2 |

55 |

| Honda -6 |

54 |

| Hyundai +1 |

54 |

| Jeep -2 |

54 |

| Kia -3 |

54 |

| Ram -2 |

54 |

| Mitsubishi -1 |

53 |

| Buick -2 |

51 |

| Dodge -7 |

51 |

| GMC -2 |

50 |

| Chevrolet -2 |

50 |

| Lincoln -10 |

50 |

| Ford -6 |

48 |

| Genesis -5 |

48 |

Noting that it made the investment to expand its service to West Coast customers, auto retailer HGreg.com closed on its acquisition of Metro INFINITI Monrovia and opened a West Coast regional fulfillment hub. Those are both located in the Greater Los Angeles area.

HGreg said that through the acquisitions, it can offer an expanded fleet of new and pre-owned cars and e-commerce services to area customers.

Metro INFINITI Monrovia will now become HGreg INFINITI of Monrovia.

HGreg estimates the acquisition of physical and business assets to be at a value of more than $40 million.

The acquisition will be supported by ongoing investments in fulfillment and online services. With those services, HGreg will be able to offer what it describes as its signature customer experience.

That includes same-day delivery and three-day or 300-mile money-back guarantee.

The signature customer experience also includes the HGreg Direct contactless car-buying process and what it describes as an intuitive, transparent and powerful auto industry e-commerce platform. The experience also plans new storefronts in the future.

“We’ve been planning our expansion into the West Coast for quite some time,” HGreg president John Hairabedian said in a news release.

Hairabedian continued, “We’ve had a growing number of customers from the West Coast over the years, but now, through this move, we will be able to offer them our full breadth of services including same-day delivery, easy returns or exchanges and a fully seamless omnichannel experience.”

Hairabedian also said the company’s brand promise of using a customer-first and tech-first approach in redefining the car-buying experience is more-needed today.

“Through life’s many twists and turns, our customers appreciate access to quality cars that fit their particular stage in life and changing needs,” Hairabedian said. “We’re here to help make this happen over and over for our customers.”

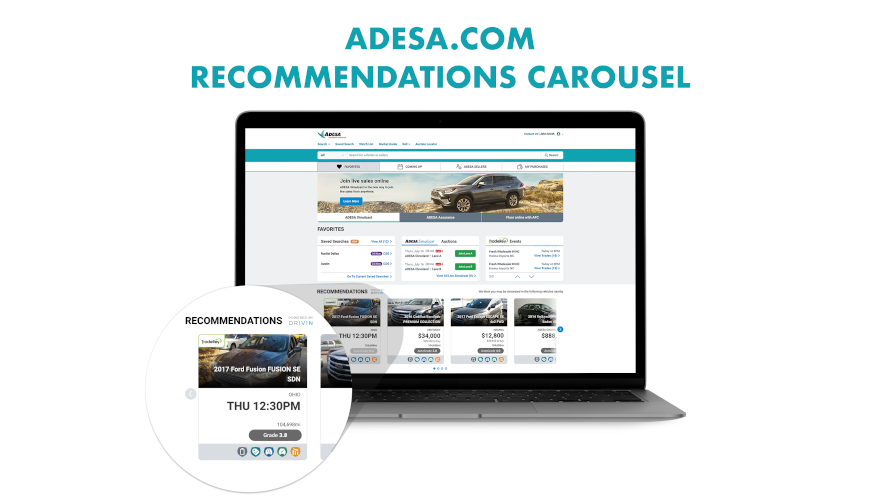

KAR Global says it has enhanced its ADESA.com recommendations carousel to include dealer trade-ins from TradeRev.

The updated recommendations carousel is the latest of modernizations to ADESA’s digital marketplace. The company said the modernizations can help dealers find profitable and high-demand used vehicles tailored to their unique business needs.

KAR said that with the new integration between the ADESA and TradeRev marketplaces, U.S. dealers can gain more data, choices and opportunities to turn a higher profit in less time.

The more than a dozen real-time personalized vehicle suggestions in the carousel are based on recent successes, low lot supply, under-supplied market, past purchases and recently viewed vehicles.

The company also said that to boost profits, dealers can use KAR’s exclusive tool to calculate potential profit on under-priced vehicles.

TradeRev’s marketplace integration adds thousands of fresh dealer-to-dealer trade-ins to the recommendations carousel. With the integration, dealers can gain increased access and visibility into more vehicles.

The company said dealers also can gain a simpler method of finding the vehicles that meet their specific inventory needs. TradeRev vehicles are identified via the company logo on the listing, including the sale day and start time. KAR’s data science and analytics engine DRIVIN, using propriety algorithms and data to deliver actionable market intelligence, powers the vehicle recommendations.

KAR chief commercial officer and ADESA president John Hammer said dealers want to sell more cars, and they want to do so faster and more profitably.

“So we’re focused on developing tools and technologies that help them do exactly that,” Hammer said in a news release.

Hammer continued, “Since launching the ADESA.com recommendations carousel, our dealers have enjoyed increased success from their personalized vehicle suggestions. Using DRIVIN’s proprietary data and technology, recommended vehicles bring in an average margin of $2,500 and turn in 35 days, which is 40% faster in comparison to market averages.”

KAR president of digital marketplaces Rick Griskie said the company was providing tools for its dealers to improve their outcomes with greater accuracy in purchasing decisions so they can source inventory faster and secure top profit potential.

“KAR’s recent marketplace integrations offer dealers greater convenience and a seamless experience through the combined power of our industry-leading data and technology,” Griskie said.

TradeRev president Mark Endras added, “This enhancement matches dealers with nearly 50% more vehicles that they can turn quickly while making a sizable profit—using cutting-edge data analytics to save time and eliminate the guesswork out of the decision-making process.”

Endras continued, “Our new functionality also supports TradeRev sellers, increasing views, bids and buys with potential visibility by more than 150,000 active buyers across KAR’s marketplaces.”

Under a new partnership between connected car platform Dealerware and mobility and logistics provider RedCap Technologies LLC, a single-screen product could help simplify and improve auto retailers’ pickup and delivery and loaner management process through a contact-free contracting experience.

The product also offers automation of fuel and toll recovery and real-time visibility into vehicle location.

Throughout the entire loan, it flags any important safety-related events.

The integration will include Dealerware’s automated cost recovery and loaner management feature set within the RedCap driver application.

The companies say that the combination of products will provide real-time visibility, SMS-based communication and receipts, customized agreements, and a “differentiated user-first experience” for customers, drivers, and dealers. Further details on how the integrated service works are available.

Dealerware president Russell Lemmer said the company chooses partners while keeping dealers’ most crucial challenges in mind.

“Giving our dealer partners a single screen solution for better fleet management that allows them to provide exceptional customer experiences and continue to drive service revenues, all while reducing their costs is a valuable combination,” Lemmer said in a news release. "With this integration, dealers unlock new operational efficiencies while delivering more modern conveniences customers value.”

RedCap Technologies is a subsidiary of Solera Holdings.

"With the current demand for digital solutions which enables contactless customer service and support, we're excited to provide the RedCap driver application along with associated services to empower dealerships with a streamlined and automated process for pickup and delivery to help move their business forward," Solera/RedCap managing director David Zwick said.

With Dealerware, automotive retailers and OEMs can better manage all of the vehicles on their lots, customize their loaner or mobility programs, and deliver “customer-centric” experiences, according to the company.

Dealerware customers will now experience newly added features such as contactless contracting and vehicle groups, and customer-centric experiences from those features include pickup and delivery, extended test-drives, and tiered loaner programs.

Automated cost recovery is another feature, and Dealerware says its customers recover an average of $65 in fuel, damage, and tolls per vehicle, per month.

Customers will also see improved operational efficiencies, experiencing an average 15% vehicle utilization increase, according to Dealerware.

In the area of customer experience, Dealerware sourced J.D. Power in stating that customers see a 27-point CSI increase on average, compared to other market offerings.

The company also said its customer support reduces response time from hours to minutes and says its NPS ranks among the top 1% of all technology companies.

Dealerware says it grew 100% year-over-year in 2019 and since the start of this year it has seen a 20% increase in daily active users.

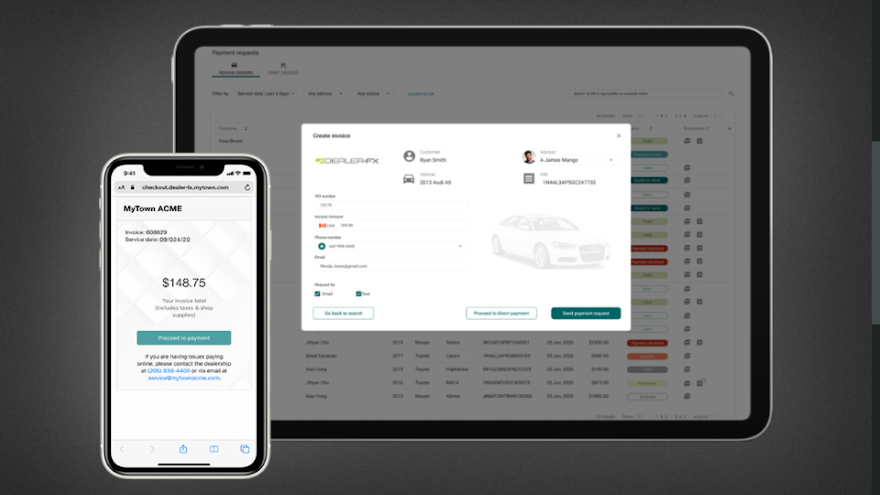

Technology provider Dealer-FX says interacting in a self-serve, mobile-centric capacity is “increasingly important to vehicle owners.”

The company, stating it is designing services “with that exact approach in mind,” has enhanced its end-to-end service suite, which includes self-service for the consumer.

The company’s newest addition is “payments,” and that addition gives consumers an increased ability to choose how they interact at every step of the service process.

That can take place by text, on a mobile device, on a website, in person or over the phone.

Dealer-FX’s service technology platform allows consumers to schedule, check in, receive updates, communicate, pay and check out from their mobile device.

That, according to the company, leads to increased customer satisfaction and retention.

With payments, dealerships gain the ability to send service invoices by text or email. It provides consumers with flexible payment options that include mobile wallet choices such as like Apple Pay and Google Pay.

Payments is powered by Stripe and integrates invoice data with the DMS and the Dealer-FX platform. It consolidates all charges into one invoice.

Dealer-FX payments’ check-out experience includes fraud protection.

Dealer-FX adds that dealers can also see strong financial opportunity from the self-serve approach. The company says Dealer-FX clients have experienced an average of 20% lift in dollars per RO when their customers use online scheduling to book a service appointment.

That increase occurs by an even greater amount when scheduling is combined with mobile check-in. With that combination, dealers are seeing up to $31 in additional services per RO.

Dealer-FX chief executive officer Bill Lucchini says he has seen many dealers “saddled” with software from companies that built their code in the ‘80s and ‘90s. Customers now want a modern, “mobile-centric experience,” he said.

“And when dealerships disappoint them, it results in low satisfaction and customer defection,” Lucchini said in a news release.

He continued, “As an industry, we need to provide a better experience, and if we do, customers will be more loyal and dealerships will thrive. This payments launch is a powerful new tool we’re providing to dealers to help them delight their customers.”

Stating that mobile technology has changed how people interact with the world, Dealer-FX notes that it designed its new payments product to use the convenience of mobile.

That, according to the company, can reduce what it says is one of many “friction points” consumers commonly experience when they get their vehicle serviced.

Dennis Carson, service director at Hickory Toyota in Hickory, N.C., said that because all customers have a mobile device, they expect the dealership to provide a digital experience when they come in for service.

“It’s familiar and convenient for them,” Carson said. “Dealer-FX has helped us take advantage of mobile technology to provide a world-class level of service for our customers.”

Sonic Automotive and its chain of standalone used-car stores, EchoPark Automotive, have chosen Darwin Automotive as their digital retailing partner for their 95 dealerships across 12 U.S. states.

The companies said the partnership marks an extension of Sonic and EchoPark’s existing relationship with Darwin following the implementation of Darwin’s F&I presentation software in its dealerships.

With Darwin online, dealership personnel anywhere in the world can virtually “desk” their online customers, conducting several deals and options while the customer is online.

Darwin says that with that functionality, the online customer can interact anywhere and at any time with the dealership, just like if the online customer was in front of the dealership’s employees.

The dealership’s sales team, in just seconds, can view several lenders, programs, and items including dealer cash and front and back end profits, “desk” deals virtually with their customers and close transactions.

Darwin described how the process is fast and simple for the customer: First, the customer visits the dealer‘s website, selects a vehicle and clicks on “Create my Deal.” The customer then receives up to five sets of options: an out-the-door cash price, two financing options and two leasing options.

At that time, the customer can transact using one of the available options or customize it, such as by changing the down payment level.

Then, the system moves the customer onto aftermarket sales. The customer can select value-add options such as maintenance, vehicle service contracts, and tire and wheel. The customer at any point in the deal-creation process can share the deal with his or her significant other, a parent, or friend — anywhere in the world.

The customer then visits the dealership, test drives the vehicle and signs the paperwork to drive away in about 15 to 30 minutes.

“Currently dealers need as much help as they can get with the online sales process, and Sonic has always been ahead of the curve, providing its dealers and customers with the best in technology,” Darwin Automotive chief executive officer Phillip Battista said in a news release.

Battista continued, “They are already seeing a boost in business by simplifying the online sales process, and enabling their salespeople and customers to transact the way they need and want to transact right now. Sonic and EchoPark join a successful group of over 1,000 leading retailers nationwide who use our digital retailing platform, including Holman Automotive, Leith Automotive, Herb Chambers and Hertz,” Battista added.

“Our guest experience is our top priority, and Darwin is helping us create an efficient online experience that provides our guests with options to choose the online transaction method that’s best for them,” said Sonic Automotive and EchoPark Automotive president Jeff Dyke.

Darwin Automotive currently operates in all 50 states. More than 6,000 dealerships subscribe to its programs. Last month, Darwin delivered 504,000 deals on its platform and says it is on track to deliver 6.5 million units for the year.

Black Book has integrated its values into a new product from ReconVelocity that matches buyers to recon inventory “the minute it comes into inventory.”

ReconVelocity is an end-to-end recon management platform that recently introduced the new product, called ReconMatch.

The company said that with the addition of Black Book Values into ReconMatch, dealers can now determine the vehicle’s value and the margin they can sell the vehicle for instantly to “jumpstart their sales process.”

Black Book’s values are now available in ReconMatch nationwide.

Also with ReconMatch, dealerships can determine if a potential buyer is interested in a vehicle so that it can be given priority in the reconditioning process.

“Knowing a potential buyer is interested in a vehicle allows you to start setting a sales appointment before the reconditioning process is even complete,” ReconVelocity owner Hugh Hathcock said in a news release.

Hathcock continued, “ReconMatch not only does this, but it also scores and rates the leads so you can further prioritize vehicles and customers.”

“ReconMatch allows dealers to fuel their turn velocity,” said Black Book executive vice president, revenue, Jared Kalfus.

Kalfus continued, “Instantly determining the margin dealers can sell a car for allows them to sell more used cars faster and hold more gross. Quite simply, it’s about profit and turn times.”

Hathcock recently joined the Auto Remarketing Podcast. That episode can be found below.

Digital buying in the wholesale space. Manheim says a great deal of discussion is taking place about that topic.

But Manheim Digital vice president Zach Hallowell says sellers need as many options as possible to liquidate inventory, as the wholesale market “continues its steady climb.”

“No matter what their disposition strategy is, consignors have convenient access to tools across the Manheim Marketplace that can help them generate much needed cash while staying safe,” Hallowell said in a news release.

The company says that when the remarketing industry transitioned to all-digital during COVID-19, that increased the importance of providing sellers with the ability to remotely manage their inventory.

Manheim said it was ready to help dealers keep their inventory moving. The company is doing that with various digital investments over the last few years.

Those investments included the creation of a Remote Seller tool, an enhanced Manheim.com Seller Center and additions to the Manheim Express app.

The company said Simulcast Remote Seller was important in making a smooth transition to all-digital sales. With the tool, consignors can rep their vehicles in real time from anywhere.

That allows them to stay actively involved in a live sale and at the same time keep their people safe.

As bids come in, consignors can click the “OK to Sell” button. That lets the block know when they’re ready to accept the highest bid. They can also reject offers at any time, propose counteroffers and send instant messages to all participants or just the clerk and auctioneer.

The Remote Block tool is complimentary to the Simulcast Remote Seller tool. With the Remote Block tool, Manheim’s block clerks can also operate remotely.

“Our sellers have told us that they value the convenience of being able rep their vehicles from anywhere, particularly in these times,” Hallowell said.

The all-new Manheim.com Selling Center is completely reimagined for 2020. With the selling center, Manheim says consignors have an advanced platform to optimize and execute their vehicle portfolio management across channels.

Also with the Selling Center, consignors get a snapshot of their overall inventory at a glance. With the introduction of new data points and inventory groupings, they can more quickly see inventory totals across channels.

The Selling Center also highlights listings that possibly need attention or action.

With recent enhancements to the Manheim Express app, dealers receive more information and control over their listed inventory. Manheim Express is designed for dealers wanting to wholesale vehicles right from their lots, and it provides listings with condition information, audio/video tags and 360-degree imaging.

The company says that can help buyers make informed decisions.

In addition, the company this year launched the new Manheim Express Overview tab for sellers. The tab brings the Selling Center experience to the app.

That, according to Manheim, makes data points and account activity easily accessible. Dealers can list their vehicles themselves. Or, a dedicated expert from the Manheim Express Concierge force can perform the listing legwork and consult on pricing and strategy.

In addition, Manheim has extended through May its $0 sell fee for self-listed vehicles on Manheim Express.

The company describes that as “an added bonus for sellers.”

Sellers’ ability to efficiently manage their vehicles across digital platforms is important to boosting momentum in the wholesale space. Manheim says its development of new digital solutions, and its enhancement of new ones, will continue.

That, according to the company, can “help clients keep their businesses moving forward.”

Automotive online services provider Carzato says its new Online Retailing Experience, or ORE, platform is a cross-tier and brand-customizable online car-buying tool.

The tool routes high-intent shoppers directly to dealer online retailing tools.

Carzato says ORE provides an efficient experience to the car-buyer and generates incremental, high closing leads to the dealers.

And it does that regardless of whether people are shopping through a brand website, dealer website, social media, CRM email, search, display or video campaigns.

Working with automakers and their dealers, Carzato provides a platform offering customization to meet highly-specific needs. The modular and white-label-ready digital experience includes customizable high-converting landing pages and CTAs, VIN-specific dealer pricing, dealer choice of trade-In valuation and F&I products, and dealer-customized service and protection plans and pricing.

Carzato said it built its platform to be modular and flexible. That, according to the company, allows OEMs and dealers to integrate existing retail tools into the platform.

The result is a retailing experience in which dealers do not have to upend their existing and proven sales processes. Creative delivery can also be tailored to the specific needs of each brand, using messaging that Carzato says is targeted to the intended audience.

Carzato started last year with one brand, said the company’s chief executive officer Javier Ruiz.

“Since the global pandemic, we accelerated our efforts to provide a fully integrated, brand-specific solution,” Ruiz said in a news release.

The company currently services more than 2,600 dealerships across six automotive brands.

“Our ORE platform is helping dealers and OEMs take advantage of the ‘new car-buying experience.’ Within a month of launching, these brands are collecting more high-closing leads than ever. And during this difficult period, they are collecting more leads, more online sales…ultimately contributing to increases in market share,” Ruiz said.