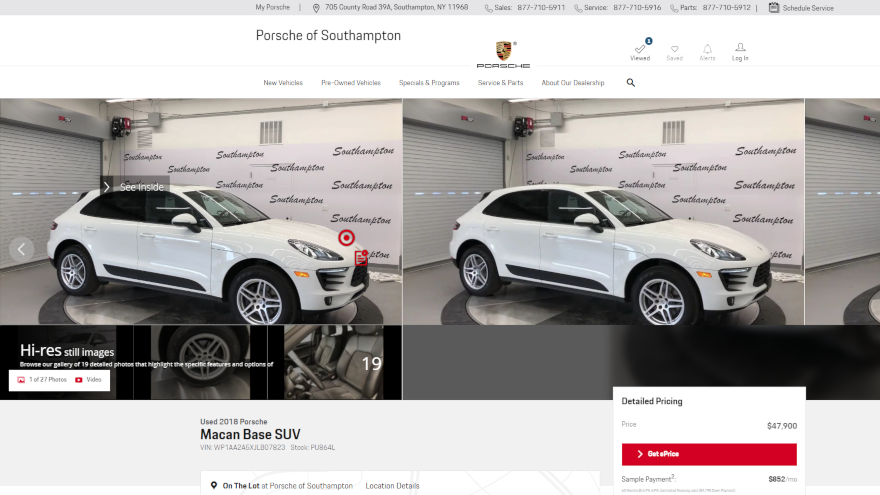

Through a new partnership between Carfax and digital automotive merchandising software company SpinCar, auto dealers can offer shoppers easier access to Carfax reports while they view vehicles on a dealer’s website.

The partnership allows shoppers to access vehicle history reports through 360° Walkarounds. For any used car, Carfax dealers can now showcase vehicle history reports from within exterior and interior vehicle views.

SpinCar says it is the first and only digital merchandising platform to offer this integration.

SpinCar says that by delivering more engaging and personalized experiences for shoppers, its digital merchandising platform enhances online vehicle detail pages. Through the Carfax partnership, on all exterior and interior 360° vehicle WalkArounds, vehicle history reports are now available as clickable feature buttons. As a new capability available for all active Carfax dealers, to gain access to the vehicle history report, shoppers can click on the Carfax button from within any walkaround.

“SpinCar and Carfax both share a commitment to helping people more confidently shop for used vehicles,” Carfax spokesman Jim Sharifi said in a news release. “Whether it’s by providing valuable vehicle history information or by delivering interactive tools to empower consumers, we share a common goal of helping buyers and sellers build trusted relationships. This partnership is a win for both consumers and dealers, and we look forward to working with SpinCar to find even more ways to create greater levels of transparency in the car buying process.”

“Carfax is the most trusted source of vehicle history information for used car shoppers, and we are thrilled to be partnering with them to make it even easier for consumers to access the information they need to make more informed buying decisions,” said SpinCar co-founder and chief executive officer Devin Daly. “The increased visibility and seamless access to vehicle history reports make virtual walkarounds an even more engaging online experience. For dealers, this integration provides a powerful new way to promote Carfax reports for their vehicles and build even greater levels of trust and confidence for online shoppers.”

automotiveMastermind founder and co-chief executive officer Marco Schnabl says now that almost 300 Jaguar Land Rover retailers will have access to his company’s Market EyeQ product, those dealerships will receive data-driven insights of their entire market.

That means those dealers can “provide an individualized approach for each customer, enhancing the overall experience and allowing dealers to sell more cars,” Schnabl said in a news release.

Dealers will have access to the product starting this month, and automotiveMastermind says that improves the customer experience for prospective customers who are looking for a new vehicle.

For a dealer, Market EyeQ provides access to all prospective buyers, According to automotiveMastermind. The dealer receives that access by segment, on a single sales platform.

To identify, communicate with and close more buyers in a dealer’s market, the system is backed by real-time proprietary data and algorithms, according to automotiveMastermind.

automotiveMastermind is a business unit of IHS Markit and provides predictive analytics and marketing automation products for the automotive industry.

When dealers use other IHS Markit data including descriptive demographic and lifestyle insight as well as vehicle history details, according to automotiveMastermind, that gives them “an exclusive 360-degree market view of their market and customers.”

The company said that automotiveMastermind’s relationship with TransUnion means dealers can uncover potential sales opportunities with customers who have not previously bought from a dealership.

With that increase in proprietary data the retailer's own data held in its dealer management system is enriched, allowing the dealers a view of their local market that the company describes as “holistic.” That includes more knowledge on prospects that they are not aware of.

“Jaguar Land Rover is synonymous with luxury, innovation and a great customer experience,” Schnabl said. “When dealerships implement Market EyeQ, they will be able to take that experience immediately to the next level.”

Carvana’s latest launches in Florence, S.C., and Spartanburg, S.C., which the company announced Wednesday, make it seven markets for the company in South Carolina.

With these launches, Carvana now offers as-soon-as-next-day vehicle delivery in 133 U.S. markets.

“We have steadily been increasing our South Carolina presence since launching here in 2017,” Carvana founder and chief executive officer Ernie Garcia said in a news release. “As we’ve seen growing demand for ‘The New Way to Buy a Car,’ we’re looking forward to bringing our easy, transparent process to Florence and Spartanburg residents.”

The South Carolina announcement continues Carvana’s June activity, which included earlier launches in Lakeland, Fla., and North Port, Fla.

Southeast Toyota Distributors has expanded its 15-year data relationship with data and technology company Acxiom, and the result will help Southeast Toyota Distributors better understand its customers and prospects, have meaningful conversations with them and lower the company’s cost of acquisition while improving conversion.

Southeast Toyota Distributors, which describes itself as the world’s largest independent distributor of Toyotas, will use Acxiom’s Unified Data Layer (UDL) framework to power its marketing platform at the data layer. Southeast Toyota Distributors hopes that creates a unified and privacy-compliant view of its customers and prospects across channels while connecting its Martech and Adtech ecosystems.

Acxiom said in a news release that in the current “digitally disrupted” landscape, the path to auto purchase has changed. Although consumers still visit dealerships, online research, reviews and comparison are included in their path to purchase.

But with all of the landscape change, people still appreciate “good service, relevance and being heard,” Acxiom said. That is important to customer relationship management, but it also means the seller should recognize and understand the customer digitally and offline. That will help bring a frictionless, easy buying experience and a satisfying ownership experience, according to Acxiom.

More data is available than ever before, and at the same time, customer expectations are higher than ever. But because the data explosion also comes with tougher regulations, harnessing data and empowering the available marketing technology is not easy. The Southeast Toyota Marketing Platform is powered by Acxiom’s UDL framework and IdentityBuilder, and Acxiom says it will connect the distributor’s relevant data across channels and technologies. That will help the distributor better understand its customers and prospects, according to Acxiom, and that means more meaningful engagement wherever and whenever they connect.

The platform includes a data environment for customers and leads data. Also through the platform, dealers can verify the customer information that Acxiom says is important to delivering a strong experience for customers. In addition, to optimize its marketing campaigns, Southeast Toyota Distributors will also now be able to connect digital data with offline data. Also included in the Southeast Toyota Marketing Platform is an analytics data mart that allows the company to explore and fine-tune its up-sell, loyalty and new customer targeting strategies.

“Southeast Toyota Distributors has been on a digital transformation journey to better enable a seamless experience to our existing customers and those considering a purchase,” Southeast Toyota Distributors director of customer journey Sheri Gosselin said in a news release.

She continued, “The Acxiom solution allows us to bring together all of our data and existing marketing and advertising technologies, like our onboarding provider, campaign management tool and DMP, into one activation center that has privacy-compliance built in. We’re able to continue to build on our capabilities without replacing things that are working well.”

“Expanding our 15-year relationship with Southeast Toyota Distributors is both rewarding and exciting,” Acxiom vice president, strategic growth Steve Letourneau said.

“The innovation we’ve achieved with our Unified Data Layer framework is particularly meaningful when a long-time client recognizes additional value Acxiom can bring to their marketing efforts,” Letourneau said. “Acxiom has gained a lot of traction with UDL; from the launch of our UDL framework, we have successfully implemented 20 UDL solutions, and the UDL won a BIG Innovation Award presented by the Business Intelligence Group earlier this year. We are thrilled to bring this capability, along with our experience in identity resolution and expertise in ethical use of data, to our valued partners at Southeast Toyota Distributors, enabling them to navigate this disrupted digital landscape with relevance and respect, so every customer journey is a memorable one.”

“Customer centricity begins with getting your data, and your data strategy, right,” Acxiom chief technology officer Chris Lanaux said.

Lanaux added, “Acxiom’s UDL framework unifies data across channels and enterprise silos to deliver a holistic view of each customer, applying the necessary privacy governance through its privacy-by-design approach, while managing increasing complexity and delivering faster speed to value at lower cost. The solutions we implement utilize cloud-based architecture, allowing us to easily plug into our clients’ existing Martech and Adtech stacks, reducing rip and replace costs and accelerating the orchestration of data for key use cases.”

Former General Motors International director of marketing and customer experience Mark Harland will join automotive professional services and technology company motormindz as a senior partner. In making the announcement, motormindz described Harland as “a global leader with an appetite for change and innovation.”

Harland’s more than 20 years of global automotive experience at General Motors includes positions in sales operations, brand building and customer experience. Working in locations in North America, Europe, Asia, Middle East, Africa and Australia, he has helped gain brand alignment, improve CSI/NPS, and improve sales, according to motormindz.

Six years ago, Harland moved to Asia, and he has overseen regional marketing and customer experience teams for GM International based in Shanghai and Singapore.

In a more recent position as executive director, marketing, Harland in 2017 supported the Holden brand transformation post-manufacturing closure.

Currently based in Melbourne, Australia, Harland is working in his areas of passion such as e-mobility, electric vehicles and online retail innovation. In those areas, he oversees consulting projects for AGL, which is Australia's largest energy supplier, according to motormindz. He also oversees consulting projects for Gumtree/eBay.

Supporting the online retail/dealership of the future transformation and providing strategic advice for EV/AV and other mobility initiatives will be Harland’s areas of focus.

Motormindz founder and chief executive officer Jeff Van Dongen said in a news release that Harland’s passion for innovation is “a perfect fit for our entrepreneurial culture.”

“Mark grew up at the dealership, so he has a unique ability to understand the retail environment, as well as thinking about next steps and trends that are impacting the automotive industry worldwide,” Van Dongen said. “Importantly, this is a significant step towards expanding on our global team given Mark's experience and contacts in APAC, where he is still based.”

Harland said that all over the world, the automotive industry is undergoing dramatic changes, “helping to further establish motormindz' international footprint, [creating] an opportunity to connect across a team of global industry experts to provide some direction, and future driven solutions, during a time of intense disruption for OEMs and dealers alike.”

He added, “This team has lived through many of the changes and understand[s] the need to balance the day-to-day business solutions with innovative ideas that will drive growth in the future. It's an exciting time to join a team [that] will play an important role in the evolution of our industry.”

DealerSocket president and chief executive officer Sejal Pietrzak describes the company’s upgraded version of its Inventory+ software product as “yet another step as we continue transforming our inventory management product suite to support the entire vehicle lifecycle.”

The auto industry software provider says that with the new version, the inventory management tool features a new interface, intuitive navigation and expanded reporting capabilities. The company says those capabilities offer value to single-store operations and multi-rooftop dealer groups.

An all-new Inventory Manager with a simpler user experience is one of the new enhancements. The company considers Inventory Manager as the hub of Inventory+, and its new look and feel includes search engine and group management capabilities. The company said whether the user is managing inventory across a single lot or a multi-store group, tasks that previously took hours to complete can now be completed in minutes.

DealerSocket said that the new version fits with the company’s focus on providing “profit over velocity.” to its customers, allowing them to sell their vehicles at a higher profit.

The company also said the user experience and design of Inventory+ now matches the rest of the company’s suite of products. That means a user of DealerSocket’s suite will be familiar with and have experience with the design. Because of that, training of staff on DealerSocket’s software can be simpler and more effective for dealers, according to the company.

Bulk Pricing Engine is another enhancement, built into the backbone of Inventory Manager. Using the feature, dealers and dealer group operators can identify new and used vehicles by age, trim, make and other features. Also, they can adjust pricing by dollar amount or percentage.

Using the new bulk pricing engine, pilot customers are making real-time price changes to vehicles on their lot to match market conditions, according to the company. That means they can sell faster and at a greater profit.

Another enhancement is Transportation Notifications. Through that feature, when a group trade or dealer transfer occurs, Inventory+ can now notify a shipper or carrier. Dealers, with just two clicks, can send a shipper or carrier the most important information necessary for quick and efficient ordering of vehicle transportation, the company said.

Group Management is another new enhancement, and DealerSocket says that along with the Inventory + available business intelligence, dealer groups can segment by region, pre-owned, and additional attributes. Pilot customers, with the new Group Management capabilities, will experience strong inventory management, reporting and analytics, group trade and centralized appraisals, according to the company.

The Transparent Reporting and Analytics enhancement means the new reporting engine provides more dealer group capabilities that provide increased transparency across stores, DealerSocket said, adding that it eliminates costly and time-consuming manual reports.

Maximizing profit for dealers is DealerSocket’s main goal for the Inventory+ software, said DealerSocket’s general manager of Inventory+ Steve Meeker.

“The major enhancements we have just released ensure that every vehicle has an opportunity to be sold at a timely profit,” Meeker said. “Whether a dealer has a single lot or multiple rooftops, the innovative functionality we released today will provide benefits to help our dealers grow their business successfully.”

Mobile customer engagement and geofencing company Mobile Dealer says customers of Trophy Automotive Dealer Group are demanding a mobile experience when they research, purchase and engage with their preferred Trophy dealerships.

Mobile Dealer says the collaboration with Trophy has allowed the dealer group to enhance its digital strategy.

“Adapting to meet consumers’ digital demands with mobile tools gives Trophy the opportunity to better connect with a new generation of vehicle buyers, differentiate their experience, and create customers for life,” Mobile Dealer said in a news release.

Mobile Dealer said the partnership with Trophy helps improve the customer experience and increase profits and grow service for Trophy’s family of dealerships that include Mercedes-Benz of Valencia, Mercedes-Benz of Encino, Kia Downtown Los Angeles, Kia of Carson, West Covina Nissan and Universal City Nissan.

Mobile Dealer said that with more than 30,000 vehicle sales per year, Trophy is one of the largest automotive dealer groups in California. As part of a mid-term plan, the group plans to expand to 200,000 vehicles through organic growth and acquisition within 30 months.

When downloading the free Trophy Automotive Dealer Group app to their smartphones, customers and shoppers receive targeted notifications, service scheduling, live chat, inventory browsing, test drive scheduling, mobile offers, and digital loyalty rewards.

“Delivering a superior experience to our customers is at the very center of Trophy’s strategy,” Trophy Automotive Dealer Group Group digital marketing director Andy Maleki said in a news release. “As our customers continue to move toward a mobile-first approach, we pride ourselves on delivering the best mobile customer experience when they buy and service a vehicle with our family of dealerships.”

“We are very pleased to partner with a forward-thinking leader like Trophy who puts their customers at the heart of their business,” said Mobile Dealer president and chief executive officer Tony della Busa. “Engaging shoppers at every stage of their buying journey and connecting with customers throughout their vehicle ownership lifecycle will help Trophy to increase customer acquisition, improve service retention, and drive storewide profitability.”

Sales of cars and trucks have risen since the end of the 2009 Great Recession, and because vehicle owners are driving their vehicles longer, service has also expanded. Consumer awareness of the need for preventive maintenance, repairs and scheduled servicing to extend the overall value of their vehicles has created rising demand for parts and services.

That has resulted in new growth and revenue opportunities for many businesses such as independent auto repair shops, collision shops and original equipment-franchised dealerships, according to a new educational white paper for original equipment parts manufacturers and the greater automotive parts industry from automotive data supplier Motor Information Systems.

The paper analyzes the strong opportunity for automakers and franchised dealers to sell more of their parts to independent repairers and the need to partner with a trusted data provider to code OE parts to aftermarket standards to provide “enhanced information for everyone.”

Motor writes that independent shops perform more than 70% of all post-warranty service and repairs, and they typically buy most of their parts from non-OE sources that often don’t offer OE-branded parts in their database.

“There is significant untapped opportunity for OEs and dealers to sell more of their parts to independent repairers, and this additional demand can be met with existing programs by partnering with a trusted data provider to code OE parts and make that enhanced information available to everyone involved in the parts-purchasing decision,” Motor Information Systems writes in the white paper.

The new white paper notes that with the advent of electric and autonomous vehicles and the ownership model moving toward mobility-as-a-service, the need to properly maintain vehicles no matter the propulsion system or ownership model is the one constant in that changing market.

“Maintaining vehicles with [OE] parts ensures proper fit and function,” Motor writes.

“There is great opportunity to create additional parts demand from OE manufacturers given the abundance of cars on the road today with sophisticated drive chains and technology,” Motor executive vice president Jeff Nosek said in a news release. “These cars are built with great quality and servicing them with OE parts keeps them operating at an optimal level. This paper is an opportunity to educate OE manufacturers on how trusted data providers today can amplify this parts demand across the channel.”

For a long time, automakers have had successful mechanical wholesale and collision wholesale programs designed to sell parts, Motor writes. Although the programs are robust, they do not capture a sizeable portion of part sales for older vehicles.

Motor says industry estimates show the global automotive aftermarket industry reaching about $722.8 billion by 2020.

“However, many dealers and OEs are missing out on a large opportunity since a majority of this is represented by non-OE parts utilized by independent auto repair shops,” the company writes.

Most automakers have not made their parts data widely available and coded to Aftermarket Catalog Enhanced Standard, or ACES, standards, Motor writes. That means they are missing out on the opportunity to have their parts available to the 160,000 U.S. automotive service and repair locations that need quality parts for repairs, the company writes.

“Making properly coded OE data more widely available will generate more demand for OE parts,” the company writes.

Motor says automakers have the products to compete.

“Creative pricing and packaging and placement in the right channels will create demand for existing mechanical and collision wholesale programs,” the company writes.

Music. Movies. TV shows. And even … razors.

The subscription economy has completely taken over.

Customers now expect to pay a flat monthly fee for unlimited services. That expectation is moving into the automotive industry, according to Syncron, a provider of cloud-based after-sales services. The company said in a news release that because of those expectations, auto manufacturers are looking to identify additional revenue opportunities.

Syncron released new research showing that because of customers’ increasing interest in subscription-based services, auto manufacturers have been forced to redefine their dealer service operations.

“As the world shifts to a subscription-based economy, the responsibility for maintenance and repairs is shifting from the end-user to the manufacturer,” the report states. “This shift will completely transform dealer service as we know it today.”

In the report, titled, "Shifting Gears from Reactive to Proactive: How Customers' Rising Interest in the Subscription Economy is Revolutionizing the Automotive Dealer Experience," Syncron writes that until now, automotive service has followed a model in which the dealer service department repairs vehicles after they have already broken down. But to meet the demands of subscriptions, OEMs will need to equip dealers to repair vehicles before they ever fail.

To provide OEMs with the resources they need for the new model, Syncron surveyed 500 vehicle owners across the United States and Europe to understand how customers view the dealer service experience today and what their expectations are for the future.

Dealers: Strong service must continue

The new report shows those findings by first focusing on the dealer side. It notes that as auto manufacturers seek to transform their organizations to prepare for a subscription-based business model future, they must also continue providing strong service at their dealers. Retaining service customers is a challenge for OEMs in areas such as having the right service parts in stock.

But in spite of those challenges, almost 59.1% of vehicle owners say they use their dealer for maintenance and repairs. And more than 90% say their most recent dealer transaction was a positive experience, with 52.7 answering “good” and 38.5% saying “very good.”

The survey then addresses why customers would leave their dealers for a third-party service provider. More than 90% of respondents said price was the biggest factor.

Subscriptions: Familiarity low, interest high

Moving on to address the subscription economy, the report states that although vehicle subscription services are “shaking the industry to the core,” almost 62% of survey respondents still say they are not familiar with the vehicle subscription services concept.

But interest is high. More than 57% of respondents say they would consider a subscription if maintenance, repairs and insurance were included in a flat monthly cost.

At 60.1%, included maintenance and repairs was the biggest advantage survey participants saw in a vehicle subscription service, followed closely by “fixed monthly cost” at 57.9%. Coming next at 43.9% was “No concern/worries for scheduling repairs and incurring long wait times.”

Just over 57% said they would be willing to pay a premium beyond their current monthly car payment for vehicle subscription services.

The new move toward subscription services “changes everything for OEMs,” who will become fleet owners, Syncron writes. They will have to work to “maximize product uptime and work to develop a subscription service model that is scalable and profitable.”

So what should auto manufacturers do next? Syncron says they should retain customers “through exceptional customer service experiences.” Customer expectations should rise, and subscription services will become more commonplace. That will increase the importance of the service organization.

“Automotive manufacturers will no longer just sell vehicles, instead selling access to and the outcome those vehicles deliver – and the service supply chain must be ready today to meet these needs of tomorrow,” Syncron writes.

More than half of survey respondents said they were not loyal to a particular brand, which Syncron found surprising. But the respondents did feel loyal to a positive customer experience. Thirty-six percent said a negative dealer experience would impact their perception of a customer brand, and Syncron said that could mean those customers would not hesitate to look for a different dealer with a better service experience.

Thirty-eight percent of respondents reported little to no issues with dealer service, and 78% were likely to use their dealer service center for a future repair. That is despite challenges they mentioned such as high prices and long wait times.

What about the other 22% who weren’t likely to go to the dealer service center? They said they might use the dealer for service if the dealer had the exclusive ability to send a notification that a specific vehicle part was about to fail and could preemptively schedule the repair.

“This sort of proactive maintenance won’t happen overnight, however,” Syncron writes. “OEMs must invest in the technology and human capital to make this vision a reality.”

More evidence of low subscription awareness

Another recent survey shows similar results to Syncron in revealing that consumers’ familiarity with the subscription concept is low. A new survey from Autolist finds that consumers are still mostly unaware that vehicle subscription is another alternative to buying or leasing. But how can vehicle subscriptions become more popular? The answer, according to Autolist, is lifestyle vehicles.

“Car shoppers clearly view subscriptions as a way to get access to a type of vehicle they might otherwise not commit to,” Autolist analyst Chase Disher said in a news release.

The Autolist survey asked participants which cars they would consider for subscription. Sports cars, pickup trucks and luxury vehicles were the top three.

“While subscriptions are having a hard time gaining traction with consumers, interest in lifestyle vehicles is one way they could succeed,” Autolist analyst Chase Disher said in a news release. “Car shoppers clearly view subscriptions as a way to get access to a type of vehicle they might otherwise not commit to.”

Autolist’s survey, which polled 1,548 current car shoppers to determine their awareness of and attitudes toward vehicle subscriptions, found that 36 percent of current car shoppers said they would consider subscribing to a sports car. That is the highest of any vehicle type offered.

Thirty percent said they would subscribe to a full-size pickup truck, and 30% said they would subscribe to a luxury vehicle.

More than two-thirds of consumers said they were unaware of subscriptions being offered for vehicles. Also, only 17% of shoppers could identify an automaker that offered any of their vehicles as a subscription.

But even with that low level of awareness, Syncron chief marketing officer Gary Brooks said customers will overwhelmingly demand subscription-based services.

And it’s not a matter of if, but when, Brooks said.

“In the coming months and years, auto manufacturers must optimize their current infrastructure to lay the foundation for a successful future,” Brooks said.

“Automotive OEMs must begin equipping their dealers today to prepare for a proactive service model where vehicles are repaired before they ever fail,” he continued. “In this new research report, we aim to inspire and motivate automotive manufacturers to do just this as they navigate today’s ever-changing customer expectations and prepare their businesses for the seismic shift to the subscription economy.”

With a service partnership between auto industry software provider MAX Digital and inventory consulting company Lotpop, MAX Digital says participating dealers can sell more cars and capture more gross through the use of its inventory management product along with Lotpop’s staffing and process guidance.

MAX Digital says it provides a dataset for inventory management with millions of VINs analyzed daily, and also provides rich market data and stores specific sales history to help drive what it describes as smart stocking decisions. Performance tracking can be customized by dealership. The tracking focuses on improvement areas such as time to market for vehicle descriptions with a dealer-set number of minimum images.

In addition to staffing and system guidance, Lotpop provides ongoing review of dealership inventory processes that it says builds sustained results over time.

MAX Digital says Galpin Honda is the second-highest-volume U.S. Honda store, and Galpin’s reconditioning manager Joe Uphoff said in a news release that since starting with Lotpop and MAX Digital, the company has begun producing record used car sales.

“We’ve seen a 36% increase in front end gross year-over-year, all with millions less in carry costs,” Uphoff said. “[Lotpop owner Jasen Rice] and the Lotpop team offer you easy-to-understand usable data so that you can focus on the areas that matter for your store.”

Everything Max Digital builds is focused on delivering performance for its dealerships, said MAX Digital executive vice president Mike Cavanaugh.

“Lotpop has the same total results focus,” Cavanaugh said. “Adding the dedicated experienced team that Lotpop provides to MAX tools [simply] creates a system that delivers undeniable results.”

Cavanaugh also said MAX Digital’s pricing advantage is important for Lotpop, “because it allows them to bundle in their hands-on services and fully engage in the dealer’s processes, while still delivering significant total savings over tools clients had been using.”

Rice of Lotpop said his company is proud of the “exceptional value this partnership provides.”

“MAX Digital has rock-solid professional grade tools that help us drive meaningful unit sales growth for our clients with a better gross per vehicle at a surprisingly low cost,” Rice said.