Morrie’s Auto Group has purchased fellow Minneapolis area-based Forest Lake Auto Group, according to a news release Monday from Haig Partners, who was the sell-side advisor to Forest Lake in the deal.

“It’s been my pleasure to work with a great staff at these two stores to serve many thousands of customers in the greater Minneapolis area,” said Randy Wilcox, Forest Lake Auto Group owner said in a news release.

“We built a terrific business and I expect Morrie’s will provide even more opportunities for our people and our customers. I wish them all much success for the future,” Wilcox said. “I’d like to thank Alan Haig and Nate Klebacha from Haig Partners for running a confidential sale process that brought me the outcome that I wanted.

“Also, I’d like to thank Chris Penwell and Scott Weaver at Siegel Brill for their astute legal advice to help get this transaction closed,” he said.

Forest Lake Auto Group includes two stores located outside of Minneapolis. Those include Forest Lake Chevrolet and Forest Lake Chrysler-Dodge-Jeep-RAM.

With this acquisition, Morrie’s has now purchased 14 stores in seven transactions since 2016.

“We are excited to add these dealerships to the Morrie's platform and expand our presence in Minnesota,” Morrie’s chief executive officer Lance Iserman said in a news release. “This acquisition will strengthen our offering across the Midwest as we continue to grow and acquire additional stores.

“The Forest Lake dealerships share a similar strategy and community approach to that of Morrie’s, with a customer friendly, best-price sales process and a focus on customer experience,” Iserman said. “We look forward to working with the existing team to drive benefits for our collective customers, employees and brand partners.”

Haig Partners president Alan Haig added: “We congratulate Randy Wilcox on the sale of his dealerships to Morrie’s. He grew his stores into two of the highest-performing domestic dealerships in the upper Midwest. Also, we applaud the Morrie’s team with this acquisition that adds further strength to their position in Minneapolis. This transaction demonstrates that buyers remain confident about the future of auto retail and want to continue to grow.”

Jensen-Wood Chrysler Dodge Jeep Ram of Montpelier, Idaho, has been sold to Casey Wheeler, who recently launched his own dealership group and is expanding, according to a news release from Performance Brokerage Services, which advised sellers Kirk and Lorrie Jensen.

The latter have been third-generation owners of the store since 2000 and are retiring.

Kirk Jensen said in a news release: “We worked with Jonny and his father, John Mecham, of Performance Brokerage Services to sell our dealership. Being in a small town, we were worried about the ability to sell our store as well as maintaining confidentiality.

“Jonny and John were truly assets to the transaction. The process was foreign to us, but Jonny was available to guide us through each step with his expertise and found a buyer that fit our small-town needs. We were very pleased with the outcome and recommend Jonny and John Mecham to anyone,” Jensen said.

This is Wheeler’s third dealership in Idaho.

The store is now known as Liberty Chrysler Dodge Jeep Ram.

“John and Jonny Mecham of Performance Brokerage Services have always been a trusted resource of mine. They understand the complexities of the business and have a tremendous amount of experience,” Wheeler said.

“This was not our first transaction with the Mechams and it won’t be the last. They did a terrific job bringing both parties together, and the transaction was smooth from start to finish. I think both parties would agree it was a win-win. I would confidently recommend John, Jonny, and Performance Brokerage Services.”

The NYE Group has sold its six dealerships in upstate New York to Atlantic Coast Automotive Group, according to a news release from the Tim Lamb Group, which brokered the sale.

Harold Nye founded NYE Group in 1968, and his son William Nye has helmed the group since 1998.

The transaction closed May 24.

“The sale of my six dealerships was a large and complicated transaction,” NYE Group owner Bill Nye said.

“Rob Lee of the Tim Lamb Group was always readily available, experienced with answers, and prompt with decisions,” he said. “The OEM approval stage is also not simple. Tim Lamb was there with support, ‘go to’ people and steady advice. They are a great team.”

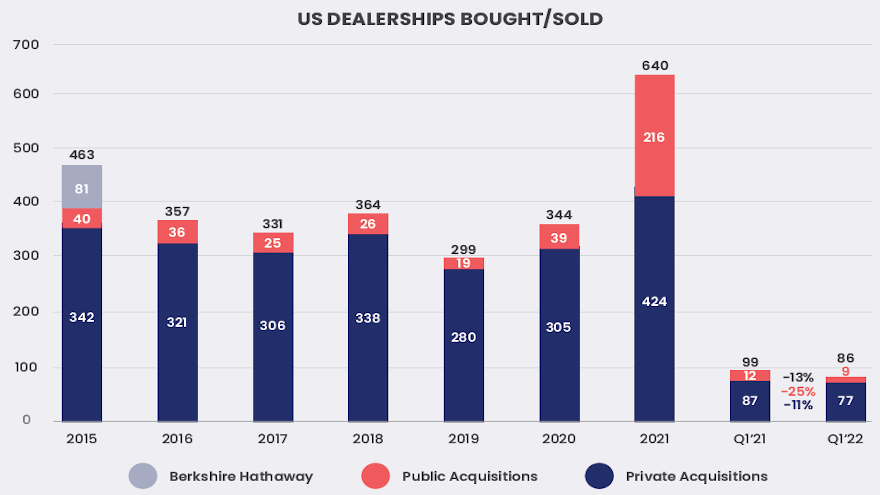

Dealership buy-sell activity is abuzz again in 2022, though it is not likely to reach the same staggering, record-setting heights of 2021, according to The Haig Report for the first quarter.

The report, which Haig Partners produces based on its own research and through using Automotive News and The Banks Report data, found there were …

Read more

Northern California’s Del Grande Dealer Group purchased three dealerships in the first quarter that expand the retailer’s presence in the region and adds Honda to its franchise portfolio.

After buying Fremont Hyundai in the fourth quarter, DGDG began 2022 by acquiring Stevens Creek Hyundai and Genesis of Stevens Creek in Santa Clara, as well as Salinas Honda in Salinas.

The latter was formerly known as Sam Linder Honda and represents DGDG’s first store in Monterey County.

“These acquisitions are complementary to our existing portfolio of top brands and are in line with our continued growth strategy,” DGDG chief executive officer Jeremy Beaver said in a news release.

“All of the new dealerships will offer DGDG’s world-class modern automotive retail experience and No Brainer Online Vehicle Checkout,” Beaver said. “These stores will also be key to market expansion throughout Northern California with our soon to launch home vehicle delivery.”

A pandemic-induced dealership business model that forces dealers to make do with lean vehicle inventories, more digital interaction with consumers and engage in other cost containing measures, is yielding fatter dealership profits.

In turn, those profits are stoking a red-hot dealership buy-sell market.

So say dealership buy-sell advisors who handle those transactions for dealership groups that want to get bigger and dealers eager to cash out of their businesses.

“There’s no question that the buy-sell market in auto retail is probably a …

Read more

Dealer groups have kicked off the week of NADA Show 2022 much like they’ve spent the past year-and-a-half: with a flurry of buy-sell moves.

Starting with the publicly traded variety, Group 1 Automotive announced Monday it has purchased Charles Maund Toyota in Austin, Texas, a store expected to bring in annual revenues of $435 million.

The store will be renamed Toyota of North Austin and would be the retailer’s 16th U.S. Toyota dealerhip.

“We are pleased to welcome the team at Toyota of North Austin to the Group 1 family. The Austin market is leading the way as a home for numerous large companies which have been relocating to Texas in recent years,” Group 1 president and chief executive officer Earl Hesterberg said in a news release.

“The Austin metro market has grown by more than 30 percent and added over 500,000 residents to become the nation's fastest growing large metro area from 2010 to 2020,” he said.

Hesterberg added, "The combination of the Toyota brand and the Austin market represents a positive growth opportunity for Group 1. Additionally, our current financial position allows us to continue to return capital to shareholders, as evidenced by our year-to-date repurchase of 390,201 shares at an average price of $177.53, for a total of $69.3 million, which represents over 2 percent of our beginning of the year outstanding share count.”

Next up, Larry H. Miller Dealerships has sold its Toyota of Colorado Springs store to Omaha, Neb.-based Baxter Auto Group.

The store will be Baxter’s second dealership in Colorado, and its 23rd overall throughout Nebraska, Kansas and Colorado.

“We are delighted to have Toyota of Colorado Springs join the Baxter Family,” Baxter president and CEO Mickey Anderson said in a news release. “This is a part of our long-term strategy to diversify our geographic footprint, while deepening our longstanding relationship with Toyota Motor Company.”

Anderson added: “We welcome the 80 employees of Larry H. Miller Toyota to the Baxter Family. Our team looks forward to a smooth transition as we onboard these new teammates.”

Moving from the Heartland to the Southeast, the Mitchell Family Office has sold Summerville Ford in the Charleston, S.C., area to Hudson Automotive Group, according to a news release from Haig Partners, which advised the Mitchell Family Office.

“We made the decision to sell the Summerville Ford store to allow us to completely focus on the family’s core business opportunities in healthcare,” owner Mark Mitchell said in a news release.

“We’ve been impressed with John Davis and the team at Haig Partners. Their depth of relationships secured the absolute right buyer, and their knowledge and experience ensured a smooth transaction from the beginning through the end of the deal.”

Hudson Automotive Group CEO David Hudson added: “We are looking forward to bringing another well-respected dealership and team into the Hudson Automotive family. This addition aligns well with our mission of providing great service and brands to customers and communities throughout the Southeast.”

LMP Automotive Holdings said Wednesday that its board has approved the company exploring strategic alternatives, including the option of selling the company.

In a news release, LMP also said it plans on ending all of its pending purchases.

“The company intends to terminate all of its pending acquisitions in accordance with the terms of their respective acquisition agreements, primarily due to the inability to secure financial commitments and close within the timeframes set forth in such agreements,” LMP chief executive officer Sam Tawfik said in the release.

“The board of directors believes that LMP’s current stock price does not reflect the company’s fair value,” Tawfik said. “Given the record M&A activity in our sector and multiples being paid for these transactions, LMP’s board of directors has directed management to immediately pursue strategic alternatives, including a potential sale of the company.”

LMP, which is traded on NASDAQ, closed trading Tuesday at $6.65. As of Wednesday afternoon, its low for the day was $3.35 and its high for the day was $7.11.

Penske Automotive Group has expanded its presence in the Austin/Round Rock market in Texas with the grand opening of Honda Leander.

The new dealership, located in Leander, Texas, is the retailer’s 14th Honda store overall and is its ninth dealership in the market.

The store has more than 46,000 square feet of facilities, located on more than nine acres. It includes 27 service bays.

“We are pleased to add Honda Leander to Penske Automotive Group,” Penske president Rob Kurnick said in a news release.

“The new Honda dealership adds to the company's existing dealership presence in the Austin/Round Rock, Texas market where we currently operate eight other dealerships and two collision centers,” Kurnick added.

In other expansion moves among dealer groups, Keeler Motor Car Co. teamed up with Bain Capital-backed Open Road Capital to purchase BMW Ridgefield in Connecticut, according to a December news release from seller-side advisor Haig Partners, LLC.

Haig Partners founding partner Nathan Klebacha was the seller’s advisor.

“As we were evaluating our strategic options with Nate it became clear that market conditions were very attractive and the BMW brand was in high demand,” BMW of Ridgefield dealer principal Ed McGill said in a news release.

“It was the right time and the right buyer for us. I am extremely proud of the reputation we built at BMW of Ridgefield and congratulate the team at Keeler. We look forward to seeing the continued growth of BMW of Ridgefield, and additional opportunities for all our talented associates.”

Keeler Motor Car Co. chief executive officer Jesse Hord added: “We are thrilled to welcome the team at BMW of Ridgefield to Keeler and excited about expanding our footprint into the state of Connecticut. Ed McGill and his team developed a special business at BMW of Ridgefield and we want to maintain that legacy.”

Elsewhere, Dobbs Equity Partners has acquired Papa’s Dodge in New Britain, Conn., according to a news release from M&A advisor Generational Equity, which advised the seller in the transaction.

Dobbs Family Automotive, which is a holding of Dobbs Equity Partners, is a Memphis, Tenn.-based dealer group with nine stores.

“At Generational Equity we are a strong believer of preserving the legacy of our clients. Dobbs' Family has a proven history of successful auto dealership ownership for an almost 100 years,” said Ahmad Behjati, who is managing director of M&A at Generational Equity, in a news release.

“I had a pleasure of meeting John Hull Dobbs, Jr. CEO and working with Rick Greene the COO of Dobbs Equity Partners to bring this transaction to a successful closing,” said Behjati.

“I am confident the Dobbs’ Family will be great steward of Papa's Dodge, and its generational legacy.”

Penske Automotive Group didn’t have to go far for its latest purchase.

The retailer said Tuesday it has acquired Erhard BMW of Bloomfield, which is just over a mile away from and located on the same street as Penske’s Bloomfield Hills, Mich., headquarters.

The store is Penske’s 48th BMW store globally and the automaker’s largest in Michigan, the retailer said.

Penske anticipates the store will generate annualized revenues of $100 million. The retailer has added roughly $1.2 billion in expected annualized revenues from its completed purchases so far this year.

“This dealership has a strong legacy of serving BMW enthusiasts in the metropolitan Detroit market for over 50 years,” Penske Automotive Group president Rob Kurnick said in a news release.

“We are thrilled to expand our presence and relationship with the BMW brand and welcome Erhard BMW of Bloomfield, the largest BMW dealership in Michigan, to the Penske Automotive Group team,” he said.

Moving from Michigan to Ohio, Ricart Automotive has purchased Dan Tobin Chevrolet and Dan Tobin Buick, according to a news release from Haig Partners LLC, which advised Dan Tobin on the deal.

Both Ricart and the Dan Tobin stores are located in the Columbus area.

In a news release from Haig, Dan Tobin said: “Spending the majority of my career in the automotive industry, making the decision to sell has been bittersweet. It was important to me the reputation my team and I have developed in the community continues, our employees have ongoing opportunities to succeed, and our customers continue to receive the great experience they have come to expect.

“Kevin Nill and his team at Haig Partners shepherded me along this journey and I couldn't be more grateful for their knowledge of the process, depth of their relationships, and commitment to finding us not just any buyer, but the right buyer with Rhett Ricart and his team and Ricart Automotive,” he said.

Rhett Ricart added: “We are so excited to be acquiring an incredible business from a great automotive dealer. Dan Tobin should be so proud of what he's built, and we're grateful for his trust in us to be the new caretakers of his dealership and his team. More than anything, we love the people in Dublin and can’t wait to be a part of the community.”

In additional dealer buy-sell news, North Carolina’s Team Auto Group has acquired John Greene Chrysler Dodge Jeep Ram in Morganton, N.C., according to this LinkedIn post from Team Auto Group president Kristin Dillard.

With the purchase, Team Automotive Group now has six stores throughout North Carolina.

Sticking with the Carolinas, Hudson Automotive Group has purchased Dave Edwards Toyota of Spartanburg, S.C., according to a LinkedIn post from The Presidio Group, which advised Hudson.

Hudson Automotive Group has more than two dozen dealerships throughout North Carolina, South Carolina, Georgia, Ohio, Louisiana, Kentucky, Alabama and Tennessee, according to its website.