The used-car market was a strong suit for publicly traded dealer groups in the first half of the year, including Asbury Automotive Group and Penske Automotive Group, both of which released earnings reports this week.

Starting with Asbury, it retailed 50,375 used vehicles during the first half of the year, a 30% increase from the same period of 2020.

The average selling price of a retail used car for Asbury in the first half ($27,134) was up 22% year-over-year.

Asbury reached total used-car revenues of $1.20 billion in the first half of the year, beating 2020 figures by 34%.

Used-car retail revenue of $1.12 billion was up 36%, while wholesale used-car revenue was up 13% at $89.6 million.

Asbury generated $114.1 million in used-car gross profits in the first half, a 73% spike. Used retail gross profits climbed 67% to $101.3 million, while used wholesale gross profits soared 151% to $12.8 million.

Asbury generated $2,402 in average gross profit per used vehicle retailed in the first six months of 2021, a 48% leap from the first half of 2020.

Used retail gross margins were at 8.9%, up from 7.3%.

Meanwhile, over at Penske Automotive Group, its retail automotive operations results (including U.S. and international) showed the dealer group retailed 135,151 used units in the first half of the year, a 27.9% increase.

Its used retail revenue was at $4.14 billion in the first half, a 48.5% increase.

Revenue per used car retailed came in at $30,599 in the first six months of the year, a 16.1% increase. Gross profit per used car retailed at Penske was $2,246, a 67.5% uptick.

Used retail gross margins were at 7.3% in the half, up from 5.1% a year ago.

Within retail automotive operations at Penske, is the CarShop used-vehicle SuperCenters, which include 19 stores throughout the U.S. and U.K.

In the first half of the year, the CarShop locations combined to move 30,137 used retail units, a 31.5% uptick from the same period of 2020.

Revenue for these stores came in at $650.8 million, a 48.6% increase.

In the second quarter, CarShop moved 18,742 units, a 184% spike. Q2 revenue for these stores was $408.2 million, a 207.9% gain.

Specific to the U.S., CarShop unit sales were up 113% in the second quarter.

It was a busy week for Sonic Automotive’s standalone used-car store program.

On Thursday, the retailer announced an EchoPark Automotive retail sales center in Marietta, Ga., to serve the greater Atlanta market as well as an EchoPark delivery center in Salt Lake City.

Then on Friday, Sonic added an EchoPark delivery center in Greensboro, N.C. to serve the Greensboro-Winston Salem-High Point market.

Consumers can go to EchoPark.com or the EchoPark location in these respective markets to shop. If they utilize the website, they can complete the purchase online and then pick the car up at a retail sales center or a delivery center.

An EchoPark experience guide works with the customer when they arrive at the location, helping to answer questions and finalize details on the purchase.

In Friday’s release on the new Greensboro delivery center, Sonic and EchoPark chief executive officer David Smith said: “The pre-owned vehicle market continues to grow, and the way consumers shop and buy vehicles is trending toward a more modern, consumer-friendly approach. We are excited to meet this growing demand by bringing our unique EchoPark experience to the Greensboro – Winston-Salem – High Point market, where we will offer a new population of car buyers an exceptional selection of high-quality, pre-owned vehicles, priced up to $3,000 below market with a modern, flexible guest-centric experience.”

In the Thursday release, Sonic and EchoPark president Jeff Dyke added: “As more people get back on the road, consumers are increasingly looking for a better value in their pre-owned vehicle purchase. EchoPark’s mission is to offer our flexible, seamless car-buying experience to a growing population of happy guests as we continue to expand our nationwide reach.”

Lithia & Driveway nearly doubled its used-vehicle revenue in the second quarter, part of an all-around strong first half for the dealer group’s pre-owned operations.

Starting with those revenue figures, Lithia pulled in $1.80 billion in used retail revenue during Q2, a 95.7% year-over-year increase. In the first half of the year, Lithia’s used retail revenue was up 75.7% at $3.16 billion.

The gains in wholesale used-vehicle revenue were even more pronounced.

For Q2, Lithia’s wholesale revenue more than quadrupled, climbing 323.8% from $51.3 million to $217.4 million.

In the first half, Lithia’s wholesale revenue was at $352.6 million, a 198.8% spike.

Lithia sold 70,254 used retail units in Q2, a 61.5% uptick. For the first half, it moved 129,281 used retail vehicles for a 50.1% lift.

Gross margins on used retail sales came in at 12.9% for the second quarter, compared to 10.7% a year ago. First-half gross margins on used retail sales came in at 11.7%, compared to 10.5% in the first half of 2020.

Lithia generated $3,311 average gross profit per used retail unit for the quarter, up 46.6% year-over-year. For the first six months of the year, it came in at $2,852, a 30.5% uptick.

Offering some overall commentary on the results, Lithia & Driveway president and chief executive officer Bryan DeBoer said: "Our team's high performance, alongside the robust, demand-driven retail environment in the second quarter, resulted in same-store revenue growth of 20% for new vehicles, 49% for used vehicles, 39% for F&I and 3% for service, body and parts compared to 2019.

"We achieved our initial Driveway monthly volume milestone in the final month of the quarter and are on pace to reach our target of 15,000 Driveway transactions this year. Combined with our outpaced growth in our core business and network development, we are considerably ahead of our year one goals laid out in our 5-Year Plan announced in July 2020," DeBoer said.

LMP Automotive Holdings announced Monday it has entered a definitive agreement to buy dealerships in Texas representing General Motors and Nissan brands, along with the associated real estate of those dealerships, for a grand total of about $141 million.

The deal is expected to add approximately $250 million in annualized revenues and $27 million in adjusted EBITDA.

The names of the dealerships were not disclosed in a news release, but LMP noted they were in “prime major metropolitan locations.”

LMP is funding the purchase via cash on its balance sheet, $42 million in common stock and debt financing.

“We are excited to be expanding into the South-Central Region, one of the most important markets in the United States, which is consistent with our business plan,” LMP chief operating officer Richard Aldahan said in a news release. “We intend to continue expanding aggressively in this region. This acquisition significantly increases LMP’s management team and revenues in this important region along with materially enhancing LMP’s profitability and expanding its reach with a growing reservoir of new- and used-vehicle inventory.”

LMP chief executive officer Sam Tawfik added: “This acquisition, combined with our previously announced acquisition of two CDJR dealerships in New York which is expected to close this quarter, and Hometown Subaru in West Virginia which closed last quarter, would bring LMP’s total franchise and dealership count to 21 and 20, respectively, with expected consolidated annualized revenue, adjusted EBITDA and adjusted EBITDA per share run rate to be approximately $1.16 billion, $80 million, and $7.37, respectively.”

Tawfik continued: “This brings us a step closer to our goal of having approximately 100 dealerships in our network by the end of next year. We project these additions to our network have the potential to add approximately $5 billion in revenue, $229 million in adjusted EBITDA or $8.80 in adjusted EBITDA per share.”

On Friday, LMP announced that it brought in James Serenius as senior corporate controller. On July 12, it announced Amanda Bailes as its senior automotive controller.

Galpin stores to sell digital license plates

In other dealer group news, ReviverMX, which develops digital license plates, said Tuesday it has reached a deal with Galpin Motors to sell the Reviver Rplate digital plates through the dealer group’s Land Rover, Aston Martin, Jaguar and Lotus stores in Van Nuys, Calif.

Reviver says the partnership gives the company “an accelerated path to direct sales.” Meantime, it offers another revenue stream for the Galpin dealerships as well as another way to make their vehicles stand out.

“We are excited to be working with Reviver to offer Galpin customers an innovative product to enhance their vehicle ownership experience,” Galpin Motors president and chief operating officer Beau Boeckmann said in a news release.

Added Reviver founder and CSO Neville Boston, “Rplates add incremental value to the purchasing process.

“Customers notice and compliment them immediately adding a very positive dynamic to the conversation,” Boston said. “Once they understand the Rplate’s value, the common response is, ‘Why didn't anybody think of this before?’”

AutoNation increased its used-vehicle sales by more than 32% in the first half of the year and pulled in nearly 22% higher gross profits on those cars, according to quarterly earnings from the dealer group released Monday.

Read more

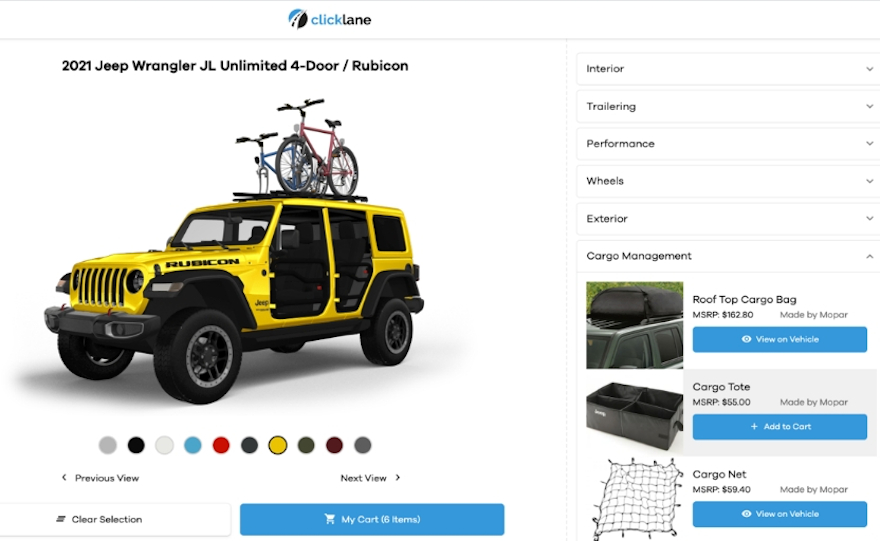

Asbury Automotive Group has made another enhancement to its Clicklane online car-buying and -selling platform, this time on the parts-and-accessories side.

Four days after announcing a partnership with insurtech company Salty to add an insurance tool to the digital platform, Asbury said Monday it has teamed up with the Insignia Group to bring vehicle customization accessories to Clicklane.

Insignia Group’s visualization platform will allow customers on Clicklane to browse and buy accessories prior to completing the car purchase, while also being able to see what those vehicles would look like on a digitally rendered version of the car they’re looking to buy.

The tool also shows installation costs and reminds the customer to buy any needed parts for installation that aren’t included with the accessory.

And even if the customer did not buy their vehicle via Clicklane, they can still utilize the vehicle customization experience if they own a platform-supported vehicle.

"Our partnership with Insignia Group and our recently announced partnership with Salty make Clicklane a truly complete digital car-buying experience and sets Clicklane apart from similar platforms," Asbury chief executive officer and president David Hult said in a news release. "Asbury customers want to make their vehicles unique and special to them. This new visualization platform gives customers confidence that they are making the right selection before they purchase."

Insignia Group CEO David Stringer said: "We're delighted to partner with Clicklane to enhance the shopping process for Asbury customers. Vehicle personalization is a key component to developing customer loyalty and satisfaction."

LMP Automotive Holdings has named a new chief financial officer, promoting senior corporate controller Robert Bellaflores to the role.

Bellaflores has held that position since April, and was a senior-level executive in the projects division at Steven Douglas & Associates before joining LMP. He had been there since 2006.

Bellaflores’ background also includes time as controller for several public and private companies prior to joining Steven Douglas.

LMP chairman and chief executive officer Sam Tawfik said in a news release, “I, on behalf of myself and LMP’s board of directors, would like to congratulate Mr. Bellaflores for earning the role as CFO.

“Robert has demonstrated his diverse experience and in-depth knowledge of accounting operations, including managing projects and functions relating to all aspects of GAAP, audit and internal controls, budgeting, forecasting, financial analysis and research, internal and external financial reporting, including SEC filings, reporting and compliance,” he said.

Tawfik added: “MP plans to announce additions to senior management personnel in both the accounting and operational departments in the coming weeks to accommodate its rapid growth and M&A strategy.”

Asbury Automotive Group has hired a Group 1 Automotive executive as its new chief financial officer.

The retailer said Tuesday that Michael Welch, who was most recently vice president and corporate controller at Group 1, will be the new Asbury senior VP and CFO effective Aug. 9.

Welch had been with Group 1 since 2000 and held the VP/corporate controller role since June 2019.

“Michael has spent over 20 years working in the automotive retail industry so he brings with him a deep understanding of the auto retail business along with broad experience in financial management, treasury, accounting and auditing, which will prove invaluable as we continue to execute on our five-year growth plan,” Asbury president and chief executive officer David Hult said in a news release.

“I am very excited to have Michael join the Asbury team.”

Speaking of Group 1, it announced Tuesday that it has purchased nine franchises from the Robinsons Motor Group in the U.K. The stores are located Northeast of London, mostly in the East Anglia region.

The franchises included the Volkswagen Group brands and one Citroen location.

Group 1 anticipates the stores will bring in an estimated $300 million in annual revenues. With the acquisition, Group 1 now has 55 locations in the U.K, including 75 franchises representing 14 brands.

“We are pleased to further expand our strong relationship with the Volkswagen Group in the U.K.,” Group 1 president and CEO Earl Hesterberg said in a news release.

“Our previous experience in these market areas has been very positive and we are confident that these businesses will contribute further growth to our U.K. operation,” he said.

Elsewhere, actor Mark Wahlberg and business partner Jay Feldman have purchased Joe Firment Chevrolet in Ohio and are renaming it Mark Wahlberg Chevrolet of Avon.

The dealership is the pair’s fifth in Ohio.

“The people of Ohio have really embraced our sales and service standards,” Wahlberg said in a news release. “With this expansion into the Cleveland area, we are deepening our bond with our Midwestern customers.”

Feldman added: “Having five dealerships in Ohio gives us the opportunity to provide consumers with a consistent sales and service experience and a huge product inventory. We'll be able to provide our Ohio customers even more brand choices at the lowest prices with this new location.”

The flurry of dealer group moves continued with activities in California and Texas involving Qvale Automotive Group and Principle Auto.

According to a news release from the Presidio Group on Thursday, the investment bank specializing in mergers and acquisitions, capital raising and investments in the auto retail and consumer mobility sectors exclusively advised Bruce Qvale and Qvale Automotive Group on the sale of six dealership franchises to the Umansky Automotive Group.

The dealership franchises include Audi, Honda, Jaguar, Land Rover, Porsche and Subaru in Livermore, Calif.

The transaction meant the departure out of California by the Qvale Automotive Group, which was founded by Bruce Qvale’s father, Kjell Qvale, in 1947.

In March, the Presidio Group advised Bruce Qvale on the sale of his Jaguar Land Rover Stevens Creek dealership franchises to US Auto Trust. In the news release from Presidio, Qvale recapped the latest transaction.

“This was a complex transaction involving many manufacturers, and it went smoothly thanks to the Presidio team’s expertise, unmatched process, and careful attention to detail. They are consummate professionals and are the best advisors in the business,” Qvale said.

“This transaction, while bittersweet, marks the sale of our family’s remaining dealerships in California as we consolidate and focus our efforts on our Florida dealerships,” he added.

Meanwhile, Presidio’s news release also conveyed the anticipation Umansky has for venturing into the Golden State in Livermore, which is southeast of San Francisco and draws on the Silicon Valley, San Francisco, and East Bay markets. Presidio noted the area has a median household income of more than $100,000 and is home to 38 Fortune 500 companies including eBay, Netflix, Apple, Nvidia and Gap.

Presidio went on to mention the Tri-Valley area, where Livermore is situated, also includes the fast-growing cities of San Ramon, Danville, Dublin, and Pleasanton. The population in the Tri-Valley area is growing twice as fast as the Bay Area as a whole.

“This strategic acquisition of strong brands and significant volume is the ideal way for us to enter the California market,” Umansky Automotive Group chairman Dan Umansky said. “We look forward to continuing our tradition of world-class customer service and community involvement with the teams at these dealerships.

“The Presidio Group’s deep knowledge of the market and the manufacturers made this a very smooth transaction,” Umansky added.

Like the entire M&A space, it’s been an active year for Presidio. Two of its top executives recapped what’s happened so far this year, including the Qvale transaction, as well as looking ahead for what might be in store for dealership transactions.

“We were honored to again represent Bruce Qvale, a long-time friend and client, in this transaction,” said Brodie Cobb, founder and chief executive officer of The Presidio Group. “The Qvale family has made exceptional contributions to the West Coast automotive market for many years.”

Presidio president George Karolis then said, “The Qvale family made a strategic decision to exit the California market, and we were privileged to help them achieve that goal. This collection of dealership franchises is an exceptional combination of luxury and volume brands that are all in high demand, especially in such a strong M&A market.

“So far in 2021, Presidio has represented our clients in the sale of 71 franchises, including Lithia’s acquisition of The Suburban Collection, the largest number of franchises sold to date in a strategic transaction. We have a very full pipeline and expect the rest of 2021 to be very active,” Karolis went on to say.

Alex Kurkin of Kurkin Forehand Brandes, LLP served as legal counsel to Qvale. David Porteous of Evans Petree, PC served as legal counsel to Umansky.

The Presidio Group provided exclusive M&A advisory services to the Qvale Automotive Group through its wholly owned investment bank, Presidio Merchant Partners LLC.

New Hyundai store in Texas

In other dealer group news surfacing this week, Principle Auto announced the opening of its newest automotive dealership — Principle Hyundai Boerne — in Boerne, Texas.

Located at 32275 B W-Interstate 10 and adjacent to Principle INFINITI of Boerne, this new rooftop with inventory space for 360 vehicles is 10 minutes away from The Rim Shopping Center serving the Boerne, Fair Oaks, Helotes and San Antonio areas.

Principle Auto chief operating officer Mark Smith spent 25 years in the luxury automotive industry before teaming up with co-owner and chief executive officer Abigail Kampmann to create Principle Auto, which has growth plans to expand across Texas and the United States.

“Our mission statement at Principle Auto is ‘We live to provide exceptional care,’” Smith said in a news release. “As a member of our community, we want you to be comfortable with choosing Principle Hyundai Boerne and Principle Auto. Our online purchasing and online service scheduling tools are available to accommodate your schedule, and we will strive to make your sales or service experience as convenient as possible.”

Kampmann added, “At Principle Auto, our customers and their vehicles are an extension of our family, and we will treat you as a member of our family. Through a combination of exceptional value and our dedication to providing world-class service, we always aim to provide our customers with a great experience. We are thrilled to add Principle Hyundai Boerne to our family, and we cannot wait to serve you.”

Three large dealer groups are having a busy finish to June, not just related to meeting monthly and quarterly sales and revenue objectives.

Lithia & Driveway acquired another franchised dealership, a top Asbury Automotive Group resigned and Holman Automotive opened a luxury brand rooftop.

Beginning with Lithia, the publicly traded group announced its third store acquisition this month. Now in its portfolio is Michael’s Toyota in Bellevue, Wash., which is expected to generate $235 million in annualized revenues.

According to a news release, this Toyota location has historically been the largest volume dealer in the region and received numerous industry awards

“This exceptional Toyota store doubles our presence and offerings in the largest automotive retail market in our Northwest region,” Lithia president and chief executive officer Bryan DeBoer said in the news release.

“We welcome Erick Paulson and his high performing team as they continue to serve and create loyal, satisfied customers in the greater Seattle area,” DeBoer continued.

The company highlighted this location brings Lithia’s total expected annualized revenue acquired during the first full year of its five-year plan to $7.8 billion, nearly doubling the annual target for network development.

Lithia added this acquisition was financed using existing on-balance sheet capacity.

Asbury CFO resigns

Meanwhile, news from another publicly traded dealer group was connected with its leadership.

On Monday afternoon, Asbury announced that Patrick Guido provided notice of his decision to resign from the position of senior vice president and chief financial officer of the company for personal reasons.

According to a news release, Guido’s resignation was effective Thursday.

“We thank PJ Guido for his service to Asbury and leading the finance team,” Asbury’s president and chief executive officer David Hult said in the news release.

And Guido added, “I would like to thank David and the board for the opportunity to have served as CFO and wish the company and my former colleagues well in the future.”

Asbury also announced that William Stax, vice president, corporate controller and chief accounting officer of the company, was appointed as interim principal financial officer effective Friday while the company conducts a search for a new CFO.

Holman Automotive opens Jaguar and Land Rover store

On Monday, Holman Automotive, one of the largest privately owned dealership groups in the United States, announced the opening of an all-new, state-of-the-art facility that will be home to Jaguar San Diego and Land Rover San Diego.

Located at 9320 Miramar Road in San Diego, Holman highlighted the dealership features world-class showrooms and an extensive service center “that will deliver an extraordinary experience to customers throughout the region.”

The entirely new 214,000-square-foot facility includes five floors of new and pre-owned vehicles from Jaguar and Land Rover as well as an innovative service center with an indoor service drive, two customer lounges, and ample parking.

Holman noted the dealership features Jaguar Land Rover’s sophisticated ARCH design stylings, highlighted by simple elegance, contemporary colors, and rich wood tones.

“The new Jaguar Land Rover dealership in San Diego is absolutely stunning and is an impressive showcase for these two iconic luxury brands,” Holman Automotive chief executive officer Brian Bates said.

“Customers can expect the same personalized attention and expertise that Holman is known for, in a spectacular retail environment that embodies the DNA of these distinguished vehicles,” Bates added about the dealership that is one of 16 locations in the country to earn the prestigious 2019/2020 Pinnacle Retailer Excellence Award.