Group 1 Automotive on Monday announced the appointment of Daryl Kenningham to the new position of president of U.S. operations effective May 1. Currently, Kenningham serves as Group 1’s regional vice president of the dealer group’s Western region.

In his new role, the company said Kenningham will be responsible for all of Group 1’s U.S. dealership operations, which include 111 dealerships and approximately 9,400 employees. Group 1 added that it will also consolidate its Eastern and Western regional operations into a single unit with current Eastern region vice president David Fesmire assuming the new position of vice president of operations reporting to Kenningham.

Kenningham joined Group 1 in 2011 in the role of regional vice president for the Eastern region. Prior to joining Group 1, Kenningham served in a variety of sales, marketing, and operational roles with both Nissan and Gulf States Toyota, a private distributor serving the south central U.S. for Toyota Motor Sales USA.

“Daryl's extensive experience with major automotive manufacturers, as well as his thorough understanding of our retail operations, makes him the perfect person to lead our U.S. business. As our company continues to grow in all three of our markets – the U.S., Brazil and the U.K. – there are increasing demands on my time,” said Earl Hesterberg, Group 1's president and chief executive officer.

“Daryl’s appointment to this new role will enable me to focus more on strategic and growth initiatives and will be a seamless transition from an operating viewpoint as Daryl has detailed knowledge about every one of our 111 U.S. dealerships,” Hesterberg went on to say.

Wyatt Johnson Automotive Group recently announced the acquisition of Crown Ford in Nashville, Tenn. With this purchase, Wyatt Johnson, based in Clarksville, Tenn., added to its list of brands in the group portfolio, which already included Buick, GMC, Hyundai, Kia, Subaru, Mazda, Toyota and Volkswagen.

The dealer group highlighted Crown Ford, home of “Crown Charlie,” has been in business for more than 50 years as one of Nashville’s premiere Ford dealerships, winning the Blue Oval’s prestigious Chairman’s Award multiple years. Crown Ford is located on 646 Thompson Drive in Nashville and has almost 100 employees that will join the Wyatt Johnson Ford team.

Group executives pointed out the upgraded, state-of-the-art facility offers customers a "comfortable, fun" environment to purchase, service and repair their vehicles.

“We are pleased to have found a company that shares our same family values,” said Charlie Coats, Crown Ford dealer principal. “We built our company based on honesty, integrity and quality service.”

Wyatt Johnson Automotive dealer principal Katherine Johnson Cannata went on to say, “We are thrilled to represent Ford in the growing Nashville market. Crown Ford has such an excellent reputation for customer service and employee longevity. We look forward to continuing that tradition with Wyatt Johnson leadership.”

The car brands whose dealers currently deliver the highest-rated customer experience are Lexus, Kia, Chevrolet and Toyota, according to the findings of customer research and consulting firm Temkin Group’s seventh annual Temkin Experience Ratings report, which evaluates 331 companies across 20 industries.

Temkin surveyed 10,000 U.S. consumers and evaluated their recent experiences with companies across the three different “dimensions” listed below.

• Success: Can you do what you want to do?

• Effort: How easy is it to work with the company?

• Emotion: How do you feel about the interactions?

The firm averaged the three scores to produce each company's Temkin Experience Rating.

Of the 21 auto dealers included in this year’s ratings, Lexus dealers rank number one with a score of 77 percent.

Kia dealers came in second place with a score of 74 percent, and with a score of 73 percent, both Chevrolet and Toyota tie for the third spot.

The following lists the ratings of all auto dealers included in the annual report.

• Lexus: 77%

• Kia: 74%

• Chevrolet: 73%

• Toyota: 73%

• Mercedes-Benz: 72%

• Volkswagen: 72%

• Jeep: 71%

• Nissan: 71%

• Ford: 69%

• Subaru: 69%

• Cadillac: 68%

• Buick: 67%

• Honda: 67%

• Audi: 66%

• Hyundai: 66%

• BMW: 64%

• Chrysler: 63%

• Dodge: 62%

• GMC: 62%

• Mazda: 61%

• CarMax: 60%

A score of 80 percent or more is considered "excellent," a score of 70 percent and higher is deemed "good," and any score below 60 percent is considered "poor," the firm said.

Temkin also ranked the overall auto dealer industry against several other industries.

The auto dealer industry averages a rating around 69 percent, according to the analysis.

The industry came in 9th place out of the 20 industries examined and improved its average rating by twelve points between 2016 and 2017, from 57.1 percent to 68.6 percent.

To read the firm’s full report, visit www.TemkinRatings.com.

Particular car shoppers respond better or worse to different words when debating which car to buy, according to new research released by CDK Global on Tuesday.

The company’s latest edition in its Language of Closers series provides demographic specific entail that is valuable to dealers seeking out ways to most effectively describe inventory on their vehicle description pages.

“Our research examined the words that would eventually lead buyers of different demographics to leave a review website and head to a dealership site,” Jason Kessler, lead data scientist at CDK Global, said in a news release. “In our most recent analysis, we were able to pinpoint specific words that shed valuable light on what vehicle traits matter most to women, Generation-X consumers, recent college graduates, and parents."

CDK found a number of words that it says resonate with multiple demographics heavily.

For example, the research revealed that mentioning the word "power" attracted several groups. CDK suggests it helps to illustrate the experience of driving a vehicle in a relatable way.

“Certain words fell flat and failed to lead prospective buyers to a dealership site,” the provider of integrated information technology and digital marketing solutions said.

Women responded negatively to “bigger,” Generation-Xers would rather read "performance" over "design" and most parents fell that both "sound" and "tech" were low priorities compared to others.

Below is a list of the top and low performing words associated with four demographics that CDK highlights.

WOMEN

Top: drive, power, trip, comfortable, luxury

Low: bought, transmission, owned, bigger, cargo

GEN-X

Top: truck, power, luxury, package, performance

Low: back, seat, design, built, difference

COLLEGE GRADS

Top: buy, work, truck, power, highway

Low: company, designed, inside, warranty, light

PARENTS

Top: truck, leased, row, nice, purchase

Low: sounds, buying, control, tech, company

"As a leading provider of websites and digital advertising for dealers and OEMs, we are always looking for the best ways to help our customers bring the right buyers into their dealership. By making subtle changes to the language used on vehicle description pages, dealers can help customers easily identify cars that they both connect with and fit their lifestyle needs," Kessler added. "Ultimately, these changes will prime both dealers and customers for success."

For more information about The Language of Closers, visit http://www.cdkglobal.com/promo/language-of-closers-reviews.

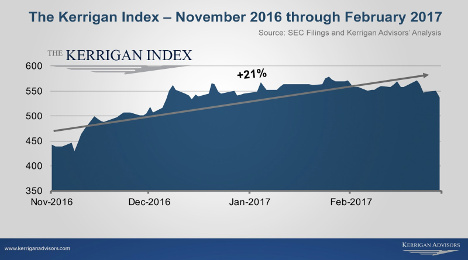

Two firms — Haig Partners and Kerrigan Advisors — each shared upbeat reports about the “robust” outlook for dealership buy-sell activity.

In fact, The Blue Sky Report from Kerrigan Advisors went so far as to say dealership buy/sell activity is set to rebound to record levels in 2017 as the firm released its analysis for the full year of 2016.

Although there was what Kerrigan classified as a slight decline — 8 percent — in overall transaction activity a year ago, and rising real estate costs are set to present a challenge for buyers, the report indicated what’s driving robust optimism are five factors, including

—An increase in “serious” sellers coming back into market

—Improved valuations

—Private buyer demand for large acquisitions

—Advantageous market fluctuations

—The “Trump Bump”

“Most dealers understand that the opportunity has passed to obtain above-market blue sky prices and, instead, are satisfied knowing that today’s valuation levels are still very high, particularly on a historic basis,” said Erin Kerrigan, managing director of Kerrigan Advisors.

“Buyers are finding pricing more reasonable in part because today’s sellers are serious about a sale. The market testers who were seeking ‘crazy’ blue sky values have primarily returned to operating their businesses, discovering those unrealistic values were not attainable,” Kerrigan continued.

Laying out the high, average and low multiples for each franchise in the luxury and non-luxury segments for the quarter, the report is geared to offer a detailed view of public and private company dealership acquisition activity. Other key findings from the report include:

• 221 dealership buy/sell transactions were completed last year, compared to the record of 241 transactions in 2015.

• 57 multi-dealership transactions were completed last year, resulting in an 8 percent increase over that 2015 record.

• Ford, Chevrolet, Toyota, Honda and Subaru are likely to be chief targets of acquisition activity.

• Domestic franchises saw their buy/sell market share increase by 42 percent in 2016.

• With truck sales still on the rise, domestic buy/sells will continue to dominate the 2017 buy/sell market.

• Public auto retailers’ acquisition spending decreased 21 percent in 2016 compared to 2015, with Lithia and AutoNation the only publics to make acquisitions of U.S. dealerships in 2016.

• Publics sold nearly as many dealerships as they acquired.

• The private sector acquired 89 percent of the franchises sold in 2016.

• The average dealership’s real estate value is estimated at $10.3 million, while the average dealership’s blue sky (goodwill) value is estimated at $6.6 million.

The report also identifies the following four market trends, which Kerrigan Advisors expects to affect the buy/sell market in 2017 and beyond. They included:

• Buyers’ return on investment parameters drive buy/sell activity

• Sellers’ pricing expectations rationalize with a plateauing market

• Buyers seek investments in higher margin auto retail business segment

• Dealers are increasingly open to equity and growth capital partners

“Overall, we expect 2017 to be a very active year for buy/sells with private and more public buyers eager to put their capital to work. We find an increasing number of sellers coming to market motivated by current prices and a strong desire to capitalize on today’s buy/sell activity,” Kerrigan said.

“As more dealers find their succession plans have run their course, we expect the number of sellers to rise, given the generational shifts underway in auto retail and the aging of the U.S. dealer network,” she went on to say.

The Blue Sky Report, a Kerrigan Quarterly, is published four times a year and includes Kerrigan Advisors’ signature blue sky charts, multiples and analysis for each franchise in the luxury and non-luxury segments. The multiples are based on Kerrigan Advisors’ view of franchise values in the current buy/sell market and can be applied to adjusted pre-tax dealership earnings to estimate blue sky value.

To download the Kerrigan Advisors report, go to this website.

Haig Partners findings

The number of dealerships sold in the U.S. declined 6.5 percent from the peak levels reached in 2015, according to data published in the 2016 year-end edition of the Haig Report.

Haig Partners indicated demand shifted from luxury and import brands to domestic brands that are heavier in trucks and SUVs. The firm also said most franchise values remain unchanged.

Despite a decline in the number of dealerships sold, Haig’s report also mentioned the number of dealership groups sold increased 17.6 percent, as their owners took advantage of market conditions to exit the industry.

Haig went on to state demand for dealerships remains strong with public dealer groups, private dealer groups and institutional investors all looking for fairly priced acquisition opportunities.

The Haig Report is based on data gathered from many public sources, as well as interviews with leading dealer groups, and bankers, lawyers and accountants who specialize in auto retail.

Key findings from the 2016 Year End Haig Report include:

—357 dealerships sold in 2016, down 6.5 percent from 2015.

—Public company spending on U.S. auto dealerships fell 14.5 percent from 2015 as they spent more of their capital on stock buy-backs, European auto dealerships and truck dealerships/leasing.

—Sales of dealership groups increased 17.6 percent from 51 groups in 2015 to 60 groups in 2016, as owners took advantage of conditions to exit near all-time high valuations.

—21 percent fewer luxury dealerships sold, 25 percent fewer midline import dealerships sold, while sales of domestic dealerships increased 31 percent as compared to 2015.

—Macroeconomic indicators such as GDP, interest rates, employment, number of miles driven, gas prices and consumer sentiment are all highly favorable for dealers at the moment.

—Other trends such as used-vehicle pricing, incentive spending by the OEMs and loan losses are growing less favorable to dealers.

—Haig Partners average blue sky multiple fell 2.9 percent from 2015.

—Average profits per dealership fell 2.4 percent compared to 2015 to $1.467 million per dealership.

—Average estimated blue sky values per dealership dipped 5.4 percent from to 2015 to $6.83 million.

—Private equity firms and family offices are increasingly active and making substantial investments in auto retail.

“Despite the small contraction in 2016, we expect 2017 will be another strong year for dealership buy-sell activity,” said Alan Haig, president of Haig Partners. “There remain many buyers looking for dealerships, financing is still readily available, and more sellers are realizing that if they want to sell their dealerships before the next recession they will likely need to accept today's offer since tomorrow's offer could be lower.

The 2016 Year End Haig Report also addressed the potential impact of the Trump administration on the value of dealerships. The report found values could go up if regulations are reduced, taxes are reduced and we enjoy faster economic growth, or down if we face higher interest rates, trade wars, escalating international tensions or a recession.

Haig Partners is seeing these conditions in its current engagements that include domestic, import and luxury dealerships that range from Florida to New York to California. The value of the transactions they have closed over the past two and a half years is approximately $900 million, including two of the largest transactions of 2016, so they have unique insights into current market conditions and how they impact dealership values.

The Haig Report is published each quarter and is a valued source of information to many in the auto industry who look to it for its comprehensive data, analyses and opinions about the auto retail industry. Included in each edition are Haig Partners' blue sky multiples that serve as a gauge for franchise values.

To download the Haig report, go to this website.

Lithia Motors announced this week that Shau-wai Lam said he would be retiring from the dealer group’s board of directors at the completion of his term in April. Lam was formerly the chairman of DCH Auto Group, and joined Lithia's board when DCH was acquired in October 2014.

Lam said he will now focus on a new partnership with Lithia that expands the presence of minority dealers in the U.S. The company said minority consumers represent approximately 30 percent of new-vehicle sales but own only 6 percent of auto dealerships.

Since 1980, the National Association of Minority Auto Dealers (NAMAD) and automakers have been seeking to provide sustainable dealership ownership opportunities for minority candidates. For many years, Lam served on the board of directors of NAMAD and the Toyota-Lexus Minority Owners Dealership Association.

Lam has partnered with Lithia to create the Automotive Minority Dealer Academy (AMDA) program. AMDA will address problems frequently faced by minority dealers, provide more desirable opportunities for minority candidates, support their professional development, and increase the number of minority-owned dealerships.

“Together, we will leverage the scale and resources of our two companies to ensure more minority candidates fulfill the dream of owning their own dealerships with sustainable success, and to help our manufacturer partners increase their dealer diversity,” Lam said.

Lithia president and chief executive officer Bryan DeBoer described the impact Lam had on the company and the industry in general.

“We thank Shau-wai for providing two years of valuable contributions during the transformational combination of our companies,” DeBoer said.

“Shau-wai and the DCH group have been an incredible addition to our team, through expansion to metropolitan markets and strengthened manufacturer relationships that are key to our future,” DeBoer continued. “We look forward to Shau-wai's ongoing mentorship and positive impact on our culture.

“We’re grateful for Shau-wai's service on our board and are excited to develop the AMDA program to increase the diversity of our network while creating ownership opportunities for minorities,” DeBoer went on to say.

eBay Motors announced on Tuesday it has recently added new partners to its Dealer Referrer Network, further expanding its selling platform to the U.S. dealer community.

Through the Dealer Referrer Network, partners can sell eBay’s subscription packages to their existing dealer networks.

eBay said increased dealer partners can ensure that buyers on its platform have a wide selection of vehicles listings direct from dealers.

“At eBay, we’re committed to providing our buyers with the best choice and most relevant inventory. Specific to our automotive shoppers, the new dealers we’ve signed on will help expand the breadth and depth of our vehicle inventory,” Tony Hoang, general manager of Vehicles at eBay Motors said in a news release.

“With the Dealer Referrer Network, eBay will be able to extend its reach to many dealers nationwide, introducing a new subscription model that’s armed with strong-lead generation and seller insight tools.”

The subscription packages available through the program provide dealers with ability to combine local listings and national buy-on-site listings, flexibility to easily modify inventory promotion and convenience to list inventory faster on eBay’s Vehicle Merchandising Platform, according to eBay.

“We’ve been a longtime partner with eBay Motors,” said Ray Basha of Auction123.

“With the new eBay Dealer Referrer Network, we’re able to help bring more inventory onto the eBay site. Our dealers are particularly enthusiastic as it allows them to get exposure to millions of global buyers.”

eBay currently has 167 million active buyers and approximately 1.1 billion live listings on eBay Marketplace.

Prime Motor Group, a network of automobile dealerships and service centers, announced the completion of a $687 million financing facility.

The company said it wanted to refinance existing debt and prepare for future expansion opportunities.

"We could not be more excited about the opportunities that lie ahead for our company, employees and dealerships," Prime Motor Group founder and chief executive officer David Rosenberg said in a news release.

"Prime Motor Group has a bright future, and this new $687 million facility will provide the company with a substantial runway for growth over the next five years."

The five-year syndicated credit facility is oversubscribed.

It includes a $360 million floor plan financing, a $257 million term debt facility, as well as a $70 million of delayed draw capacity to be used for prospective acquisitions and other purposes, according to the company.

Financing syndication was organized by Manufacturers and Traders Trust Co. and with SunTrust Bank serving as the co-lead.

Eight lenders participated, including Manufacturers and Traders Trust Company, SunTrust Bank, KeyBank National Association, Mercedes-Benz Financial Services USA, NYCB Specialty Finance Company, TD Bank, N.A., Toyota Motor Credit Corporation and VW Credit.

Prime Motor Group’s network consists of 26 dealership and service center locations spread throughout the New England region of the U.S.

DealersLink introduced recently “Six Steps for Dealers to Get Their Cars to the Digital Front Line,” a free ebook currently available for download that offers tips to dealers on how to get inventory online timely.

The company said the ebook aims to direct dealers interested in reducing average turn time.

“We have the data that shows what’s working and not working when it comes to selling inventory,” Mike Goicoechea, chief executive officer of DealersLink, said in a news release.

“If implemented correctly, these and other tips we have will get cars to the digital front line quickly while saving dealerships thousands of dollars per month and significantly increasing front-end gross.”

The new ebook discusses mitigating reconditioning costs by sourcing inventory mix, buying the right inventory at the right price and adopting a market-based pricing strategy.

Below are highlights of three tips DealersLink offers:

“Most aged retail inventory has been previously reconditioned and is typically ready for the digital front line in less than two days,” DealersLink said.

-

Buy the right inventory at the right price via leveraging analytical data to optimize inventory supply for the local market

-

Adopt a market-based pricing strategy to market inventory online with market-based pricing on vehicles

“Six Steps for Dealers to Get Their Cars to the Digital Front Line” can downloaded here http://bit.ly/2lotFoS.

Sonic Automotive retailed a best-ever 119,174 used vehicles last year, including record fourth-quarter used-car unit sales of 29,621, the retailer said in results released Tuesday.

And prospects for its EchoPark used-car standalone stores are pretty rosy, too.

Some of the original Colorado stores were cash-flow positive in Q4, with the initial Thornton, Colo., store profitable on a yearly basis, the dealer group said.

Sonic said it plans to open an EchoPark location in Colorado Springs, Colo., in the second quarter. The retailer aims to open least three in Texas this year and potentially as many as five or six there, chief executive Scott Smith said in Tuesday’s conference call with the investment community.

The full-year outlook on EchoPark is a $0.23 to $0.27 loss per diluted share, Smith said in a news release. Sonic executives were asked during the call when those stores might break-even.

Jeff Dyke, Sonic’s executive vice president of operations, explained that that range includes corporate overhead. He estimates that estimates that it will take about 25 stores operating to “make that happen.”

It’s likely to take until the end of 2018 to reach that kind of store count, he said. Sonic hopes to open eight EchoPark stores in 2017, which would put its store count at 13.

“So maybe it happens the next year; for certain, the next,” Dyke said. “The great news is our original store’s profitable in Thornton. It made money for the year. We have stores that are now cash-flow positive. We’re selling the volume.

“We think we’ve also, sort of, dialed in the right inventory mix and the number of cars that we carry on each lot, we’ve really been playing with that,” he said. “Our pricing tool is working, and working very well. How we have become a part of the community through a bunch of different organizations, in particular a lot of the public school systems and things that we’re doing, have all been a plus.”

Supply for stores

Another plus for EchoPark certainly has been the amount of used-car supply available in the market.

Mentioning the separate buying function for EchoPark, another analyst — Rick Nelson of Stephens Inc. —asked if that prevented the standalone stores from turning to the dealer network to source off-lease units.

“We can source inventory through the dealer network, no problem,” Dyke said. “There’s so much inventory out there right now, Rick, that it’s just not a problem to source inventory.”

Citing numbers from 2017, Dyke said that 34 percent to 36 percent of EchoPark cars are vehicles that they traded for or bought off consumers.

“That’s been gradually growing every quarter for us, and our goal is to get that up over 50 percent,” Dyke said. “So, plenty of inventory out there for us. We don’t do a lot of piggybacking off of the Sonic dealerships to get inventory. As a matter of fact, we really haven’t done any. But it doesn’t mean that we couldn’t. We can certainly do that if we need to open up and buy cars from that resource.”

EchoPark sold 1,330 retail units in the fourth quarter, which was a 74.1-percent year-over-year increase. For the year, sales came in at 4,865 units, which beat 2016 figures by 50.9 percent. Those numbers, Sonic Automotive confirmed, are included in the total used unit volumes mentioned above.

Margin disparity?

Nelson asked about the disparity in gross profit per unit during the fourth quarter, which came in at $1,162, versus consolidated same-store used-vehicle GPU, which was at $1,341.

Dyke said that buying inventory outside of Colorado and then having it shipped into the EchoPark stores in that state has an impact, so he anticipates that margins could improve with the upcoming launch into Texas.

Additionally, he points out that buying 50 percent to 60 percent of vehicles at auction may lead to “tighter” margins that would trading for those cars. At Sonic stores, he said, they’ll trade for roughly six of every 10 cars they look at, so that positively impacts margins.

“But really, our pricing system is dictating the PUR,” Dyke said. “And what we’re really looking for is the balance between the volume and the PUR, so we generate the most gross that we can, because that’s what you take to the bank.

“It doesn’t matter if your PUR is $1,300 or $1,100 or $1,700, as long as you mix it with the right volumes so you generate the most gross dollars,” he said. “And that’s what our system is doing. Just remember, at EchoPark, we price 100 percent electronically. So you don’t have an individual sitting down there; you have algorithms that are pricing that inventory for us.

“I would expect those margins to move around all year long. Our margins in February are actually better than they were in December and January. So, that’s just the system doing that, and as inventory goes up based on what we trade for and what we purchase off the street, I’d expect our margins to go up.”