Group 1 Automotive announced this week the acquisition of two dealerships located in Houston: Munday Chevrolet and Munday Mazda.

The two dealerships, which will continue to do business with their current names, are estimated to yield $225 million annually.

Earl Hesterberg, the president and chief executive officer of Group 1, believes the acquisition of two of Houston’s big hitters will greatly improve the group’s market appeal.

“Munday Chevrolet is the second-largest Chevy dealership in Texas and sixth-largest in the country,” Hesterberg said. “We are delighted to add this high volume store to our growing family of dealerships in our hometown of Houston. The addition of Chevrolet and Mazda expands our scale and brand offerings to a total of 17 brands across 19 stores serving over 300,000 customers in the greater Houston metropolitan area.”

In other Group 1 Auto news, the collective disposed of Long Island-located Hassel Volvo at the end of June.

Both second quarter and first-half used-vehicle sales for AutoNation beat year-ago figures, but the improvements in used-car gross profits per vehicle were even more impressive.

AutoNation moved 52,565 used retail units in Q2 for a 1.0-percent year-over-year gain, and it sold 104,792 used retail vehicles through six months of the year, which beats the year-ago pace by 2.1 percent.

But gross profit per vehicle retailed in the second quarter was up 5.4 percent at $1,685. And for the year, the rate of improvement was stronger — gross profit per used unit was at $1,732, a 6.7-percent increase.

Total used-car retail gross profits were at $88.7 million in Q2, a 6.5-percent increase. For year-to-date, it was at $181.5 million, an 8.9-percent improvement.

In terms of overall results, AutoNation recorded its best-ever second-quarter earnings per share ($0.83). Net income from continuing operations in Q2 was $101 million, up from $90 million a year ago.

Mike Jackson, chairman and chief executive officer, said, “AutoNation delivered its 15th consecutive quarter of double-digit year-over-year growth in EPS. We reconfirm our expectation of U.S. industry new-vehicle unit sales to increase 3 percent to 5 percent, bringing U.S. industry new-vehicle sales above 16 million units in 2014.”

When Asbury Automotive Group discussed its first-quarter results and announced its Q auto stand-alone pre-owned store concept this spring, chief operating officer Michael Kearney talked about the retailer’s used-car culture.

It’s an approach that has led to significant used-vehicle growth for Asbury in recent years, setting the group up nicely to roll out such an endeavor as Q auto.

“In terms of pre-owned, we have a very strong, dedicated culture toward pre-owned business, and we continue to push. So I think the pre-owned (success) is a result of continuing to talk about it and the culture we have created on how to maintain trades and take more trades at the desk, managing our inventory very carefully and how we price them on the Internet,” Kearney said during the April conference call with investors.

Such an outlook and emphasis on used cars was also apparent in early June, when Asbury president and chief executive officer Craig Monaghan and Asbury senior vice president/chief financial officer Keith Style spoke at the at the Stephens Spring Investment Conference in New York.

The Wall Street Webcasting website provided a webcast of their presentation made by the Asbury executives, who provided an update on the progress the retailer has made toward its used-car goals. Monaghan also offered a glimpse into how Asbury’s used operations run.

“Philosophically, where we are in used cars is that we continue to march down the path towards our objective of selling one used car for every new car. The way we go about that is, we’ve got a used-car team that are really used-car veterans, who are there to support these … company commanders in the stores,” said Monaghan.

“And they will help them buy cars from auction when we need to supplement our inventory. They will review our cars that go to inventory to make sure we’re only sending cars that we couldn’t retail ourselves. They are the experts in the software that we have available in our stores; they are the power users, so they will train on that,” he continued. “They will also help the stores train on their systems and processes to make sure we are following … really basic techniques of essentially accelerating the speed to which we get a car put back on a front line.

“The tools themselves are the tools that help us decide what we pay for a car and where we price that at retail. The store’s allowed to keep a car for roughly 60 days. Once the 60-day period is up, those cars essentially become property of Asbury and move into a virtual auction where we do whatever we please with them. It may be moving them to another store or even potentially moving them to an auction.”

Progress Continues

In presentation slides posted to the company’s website, Asbury indicated its same-store used unit sales were up 10 percent in Q1.

Asbury said it has realized more than 76-percent growth in its used-car business since 2009, increasing its monthly per store used unit sales from 39 in 2009 to 73 this past year.

During the June presentation, Style provided some perspective to the trends that Asbury is seeing in its used-car margins, while also touching on the company’s used inventory levels.

“If you look back at last year, in Q2 and Q3, we had a large acceleration in our used unit volume increases. We invested heavily in the used business. Our inventory is up 40 percent, but we’re turning that inventory at the same days’ supply as we were before we began this large investment in our inventory,” Style explained.

“We saw a decline in the gross per unit during that time. We pushed volume heavy and the gross did suffer a bit. In the first quarter here, we did see it pick-up; it’s still down quarter-over-quarter, about $50, but it’s up sequentially,” he continued. “I’d like to tell you that that is the new norm, but … we need to recognize that the first quarter is a very strong used-car quarter for the industry, and there is a lot of demand in the first quarter as people use their tax refunds as down payments on used vehicles.

“So we have to recognize that. I would like think that we’re challenging ourselves internally, I would tell you, to maintain that level, but we’ll have to see what we’re able to bring in the second quarter.”

And as Monaghan would attest, the demand from consumers is there.

Industry-wide, there were 4.39 million used sales in May, according to CNW Research, which counts sales from franchised and independent dealers as well as private-party transactions.

Although this number was basically flat from a year ago, franchised dealers increased their used sales 4.3 percent and moved 1.61 million pre-owned cars.

On the new-car side, the seasonally adjusted annual rate hit a seven-year high at 16.8 million in May, according to Autodata Corp., which pinpointed the monthly new-car sales total at 1.61 million.

This marked an 11.4-percent year-over-year rise.

“I think the used market is very much a reflection of the new market. It’s there (demand). Now I will say, when the SAAR bumps to the levels that we saw last month (May), it’s harder to get to the 1-to-1 ratio,” Monaghan said. “It’s just math.

“But it’s still a good place to be.”

For more on Asbury's used-car strategy, check out our coverage of the retailer in the July 1 digital edition of Auto Remarketing, which can be found here.

Editor’s Note: Staff Writer Sarah Rubenoff contributed to this report.

When CarMax announced a successful first quarter of its 2015 fiscal year — notching a 9.8-percent increase in used sales — company management attributed much of this spike to an increase in both foot and Web traffic.

In fact, Web visits grew to over 14 million, representing a 25-percent increase compared to the same period last year.

Tom Folliard, company president and chief executive officer, pointed out during the company’s quarterly conference call last week that mobile site traffic soared, as well.

This metric represented 30 percent of total Web visits, while visits from the mobile app represented another 13 percent of the total site traffic.

And there were more shoppers making it onto the physical lots, as well.

Folliard said the boost in used comps this past quarter — used sales in comparable stores increased 3.4 percent — were driven by growth in store traffic.

During the Q-and-A portion of the call, investors were eager for more information on the increases in both Web and store traffic.

As for what factors are behind the increase of interest on the Internet, Folliard cited a few different variables.

First, he said, “I think we have a great website. I think we have a great search engine. I think we’ve done a really nice job of making sure that when customers are on our site, whether it’s through mobile or desktop or touchscreen, that they have a good experience.”

He also pointed out that every year, the Internet becomes an ever bigger source of information for consumers, “So, I think customers just naturally are going to go to the Web first.”

And though shoppers don’t have the option to complete a full transaction online, CarMax has been ramping up its website capabilities.

“We’ve been adding more and more capabilities for customers to do from home, and they’ve been taking advantage of that, and we’re very pleased with that so far,” Folliard said.

For example, CarMax recently added the capability for shoppers to put cars on hold and make appointments online without picking up the phone.

“We still have the capability in the number of stores for customers to transfer cars, even a pay transfer by giving their credit card online without speaking to anybody and having that car delivered,” said Folliard. “They can actually start their paper work online, making appointment for the sales consultant and show up a lot of the work already done. But in terms of fully consummating the deal online, we’re not doing that yet.”

He also pointed out that many CarMax shoppers still desire to test drive their used vehicle before purchasing.

And those very same customers may have contributed to some of the increase in store traffic this past quarter.

Folliard pointed out during the call another reason for higher levels of shoppers on the lots, of course, is store count growth.

During the first quarter, the used-car giant opened four stores, including three stores in new markets (Rochester, N.Y.; Dothan, Ala.; and Spokane, Wash.) and one in an existing market (Harrisburg/Lancaster, Pa.).

“We continue to expand our geographic footprint. So we are in more markets. So we are going to get some growth (in traffic) there as wel," Folliard said.

He also pointed out he expects store traffic to continue to grow in line with company expansion.

Folliard was also asked if the company has ever considered opening physical stores based on areas with high Web traffic.

“Well, it hasn’t … at this point, we think the CarMax consumer offer works in just about any market in the U.S. and we are very excited to go to the places that we’re not, but we are also very excited to continue to add stores in the places where we are. And we haven’t seen that Web traffic by a particular locale is an indicative of where we should build the next store,” Folliard said.

“We really want to go build our stores where people are, because then they need cars and then they are buying from us,” he concluded.

For more on CarMax’ performance in Q1 as well as why the company’s wholesale unit sales are soaring, see the Auto Remarketing story here.

Announcing a deal Sunday valued at more than $360 million, Lithia Motors and DCH Auto Group entered a definitive agreement to combine their companies — a transaction that would merge two of the largest dealer groups in the country.

Per the agreement, Lithia will buy up the entirety of DCH’s outstanding shares for approximately $340 million in cash and $22.5 million — or approximately 300,000 shares — of Lithia common stock.

Once the deal is closed, DCH’s 27 stores will be combined with Lithia’s 101 stores.

This transaction would stretch the dealer body reach of Lithia — whose dealers currently are all located in the Western U.S. — from coast to coast. DCH’s stores are located in Southern California, New Jersey and New York.

DCH’s current management will continue to lead the DCH stores, as president George Liang will report to Lithia president and chief executive officer Bryan DeBoer.

Once the deal is finished, DCH founder Shau-Wai Lam will likely join Lithia’s board of directors.

DeBoer said: “For the past several years, we have been seeking a strategic partner to help us to enter the Eastern United States. The DCH organization is an ideal fit with our existing team. We share similar strategic goals and core values, and have complementary strengths.

“DCH has proven their ability to ‘Deliver Customer Happiness’ while executing a high volume strategy in metro markets. Lithia embodies continuous improvement and produces sector leading operating efficiency. Together, the organization will be able to grow in multiple markets, learn from each other, and deliver improved efficiencies due to scale,” he added.

It has only been a matter of weeks since Asbury Automotive Group opened its first Q auto store.

So, in speaking to the crowd at the Stephens Spring Investment Conference in New York this month, the retailer made it clear that it is a bit early in the game to get any real measurable feel for the success of Asbury’s debut in the world of stand-alone pre-owned stores.

The company’s president and chief executive officer did acknowledge that the proposition of launching this type of retail outlet is a risky one, but it’s one that Asbury is willing and prepared to take.

The Wall Street Webcasting website provided a webcast of their presentation made by Asbury president and CEO Craig Monaghan and Asbury senior vice president/chief financial officer Keith Style at the New York event, where the executives provided an update on the progress on Asbury’s Q auto program.

With the debut store — located in the Tampa, Fla. area — having just opened May 25, Monaghan said it was “too soon to know anything” about the store’s success, and he emphasized that the primary activities of Asbury’s team there revolves around getting acclimated with the various technological applications at their disposal.

“We’ve got a number of applications in that store that are, I would say, next-generation from what are in our core stores. The sales process happens on a tablet. There is no F&I office. The car is fixed price, the F&I product is fixed price. It’s a single associate that works a customer through that process,” he said.

“It’s somewhat of a place for us to experiment with technologies that could one day find themselves in the core stores, as well. That’s one of the reasons we’ve done it. It’s very interesting for us to see how this plays out,” Monaghan continued.

One of the more important philosophical question around Q auto, Monaghan said, is why the retailer decided to go with this concept in the first place.

He began his answer to that by noting that when Asbury purchases a store, it’s not uncommon for half or more of the purchase price to be goodwill. So, rolling out something along the lines of Q auto can be quite cost-effective.

“If we can figure out how to solve this used-car puzzle, we can put that store in place, if you would, at essentially a 50-percent discount,” Monaghan said. “Accordingly, the returns that we could achieve, if it works, could be quite handsome. And that we find highly motivating.”

Motivating, yes, but also risky, he would acknowledge. Keeping the risks in mind — including those that Monaghan has seen firsthand — he says the company’s expertise in the used market, the technological amenities and access to capital can help Asbury succeed in rolling out this concept.

“We’re not naïve in that we recognize that many have tried this and failed. And I, myself, was part of an undertaking that didn’t work out. So, we’re very sober about that, but we also recognize that there are a number of people around the country who are successful with this,” Monaghan said.

“Many of them are regional players, but there is a lot of success. And we think the world has changed quite substantially in just the last two to three years that we’re actually in a position that there’s a real good chance that this is going to work,” he continued.

“And what I would tell you specifically that’s different is, the way we think about it is, I think we’ve demonstrated that there are a lot of used-vehicle expertise within our organization. And you can see that in our used-vehicle growth rates. So, one, we’ve got some people who are very knowledgeable about this. Two, the movement in technology has been almost mind-blowing,” Monaghan said.

He later added: “We think the risk is worth the potential reward, but we won’t know until we see how it plays out.”

Asbury Automotive Group this week announced the election of Thomas Reddin to its board of directors.

Reddin's election brings the total number of directors to nine, seven of whom are independent.

"Tom's understanding and familiarity with digital services and retail-based technologies make him a valuable addition to our board," said Thomas DeLoach, chair of the board.

Reddin, 53, is currently the managing partner of Red Dog Ventures LLC, a venture capital and advisory firm he founded in 2007.

Prior to 2007, he held positions at Lending Tree LLC including chief executive officer, president and operating officer, and chief marketing officer. Reddin also previously worked at Coca-Cola USA and Kraft General Foods in capacities related to marketing, brand management, and finance.

He serves on three other public company boards: Tanger Factory Outlet Centers Inc., Deluxe Corporation, and Premier Farnell plc.

A name well known across the country already announced plans to open additional AutoMatch USA Supercenters in Salt Lake City and Fort Meyers, Fla.,this summer.

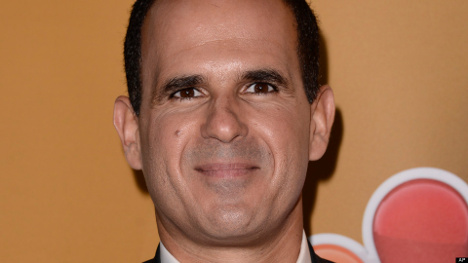

Entrepreneur Marcus Lemonis — chairman and chief executive of Camping World and Good Sam as well as star of CNBC’s “The Profit” — first showcased the pre-owned store brand in Chicago this past January, when the first store was featured on reality series “The Profit.”

The second location recently opened in Jacksonville, Fla., in April.

Interestingly, Lemonis is combining his business efforts, as AutoMatch customers receive customized Good Sam services such as its extended service warranty, financing, insurance and roadside assistance.

Lemonis said, "We have the key elements necessary to build a robust pre-owned car business that we expect to grow in various markets over time. My primary objective is to change the way customers shop for quality, pre-owned cars by offering a full service auto buying experience with sales, service and accessories."

Lemonis spent time as vice president of several auto dealerships in the Miami area, and has been running working to “streamline” the RV industry for the past 10 years through his efforts with Good Sam and Camping World.

Group 1 Automotive on Monday announced the acquisition of South Point Kia in Austin, Texas.

The dealership, which will operate as Kia of South Austin, is expected to generate $55 million in estimated annual revenues.

"We are delighted to further expand our footprint in the Austin market, which includes Maxwell Ford, Town North Nissan and Round Rock Nissan," said Earl J. Hesterberg, Group 1 president and chief executive officer.

Thus far in 2014, Group 1 has acquired six franchises with estimated annual revenues of $295 million, and disposed of one franchise with trailing-12-month revenues of $20 million.

In other auto group news, Patterson Auto Group has sold its Toyota Scion Dealership in Mount Airy, N.C., to Scott McCorkle of Charlotte, N.C.

Patterson Toyota has been owned and operated by the Patterson Automotive Group for more than 45 years. The dealership has reached an agreement with McCorkle, who will re-brand the store as Mount Airy Toyota Scion.

McCorkle currently owns Liberty Buick GMC in Charlotte and Matthews, N.C.

“I want to congratulate Dick, Paul, Richard and their families for their dedication and long tenure of serving the automotive needs in and around Surry County,” he said. “Their reputation for excellent service and family-oriented culture is what I have been looking for in a dealership.”

Along with the Toyota Scion dealership, Patterson Automotive Group is also selling its Patterson Chrysler Dodge Jeep Ram dealership to McCorkle. The Scott McCorkle Family of Dealerships now includes Liberty Buick GMC, Keffer Pre-Owned South, Mount Airy Toyota and Mount Airy Chrysler Dodge Jeep Ram.

“It’s been a pleasure to serve the automotive needs of Surry County and beyond with such great brands,” said Paul Patterson. “We have so many great friends in the community through this dealership. We look forward to continuing to have a presence in this community we call home.”

After boosting its global used-car retail sales by nearly 16 percent in the first quarter, Group 1 Automotive announced late last week a new stock offering.

The dealer group revealed the pricing of its private placement of $350 million of 5 percent senior unsecured notes due in 2022.

The offering size was increased to $350 million from $300 million. The offering is expected to close on June 2, subject to customary closing conditions.

“The company intends to use the net proceeds from the offering, together with the net proceeds, if any, from the termination of certain call options and warrants, to finance the purchase of its 3 percent convertible senior notes due 2020, to repay amounts outstanding under the acquisition line of its revolving credit facility, to make a contribution to its floor plan offset account and for working capital requirements and general corporate purposes,” the company explained.

The offering comes on the heels of a successful quarter for the dealer group.

Group 1 retailed 26,877 used cars throughout its U.S. and international operations during the first quarter, which marked a 15.7-percent year-over-year hike. It was pulling in gross profit per unit of $1,592 on these cars, which was 8.1 percent softer than a year ago.

In the U.S. alone, the retailer sold 22,743 used retail vehicles during the quarter, a 7.7-percent increase. Its gross profit per unit on these sales was $1,646, down 7.6 percent year-over-year.

For more on Group 1’s Q1 performance, see the below Auto Remarketing story:

Group 1 Talks Winter Impact on Used Margins