NADA Show 2021 is going virtual. The National Automobile Dealers Association is holding its annual convention and expo online from Feb. 9 through Feb. 11.

When the move to digital was announced in October, NADA said in the release that among the features of the digital convention will be more than 60 educational workshops and sessions, an online expo hall and OEM franchise meetings.

Complete details are available at https://show.nada.org/, but below is a list of some of the education sessions at NADA Show 2021 that are specific to the used-car market.

The information is from the NADA Show 2021 website.

- Jason Stum, who is director of strategy at Dealer Inspire, will discuss how to “Turn Your Marketing into a Trade-In Machine” at 11:30 a.m. on Feb. 9.

- Tommy Gibbs, president of Tommy Gibbs & Associates, will present on “6 Strategies to Improve Gross and Volume in Your Used-Car Department,” at 1:30 p.m. on Feb. 9.

- Tim Scoutelas, who is director of strategic accounts at MAX Digital, and Patrick McMullen, senior vice president of strategic accounts at MAX Digital, will present “Creative Ways to Acquire Used Inventory” at 12:30 p.m. on Feb. 10.

- Michael Hayes, who is the NADA Academy chair, will present “Pre-Owned Success with CPO” at 1:30 p.m. on Feb. 10.

- Zach Hallowell, who is vice president of Manheim Digital, will discuss “Wholesale Decisions in a Digital World” at 12:30 p.m. on Feb. 11.

- Dale Pollak, executive vice president of vAuto, will discuss “New Metrics to Maximize Used Vehicle ROI” at 1:30 p.m. on Feb. 11.

- Dennis McGinn, founder and CEO of Rapid Recon, and Anthony Martinez, who is director of customer performance at Rapid Recon, will present on “Advanced Reconditioning: Best Practices” at 1:30 p.m. on Feb. 11.

- Michael Lucki, management instructor at NADA, will discuss how to “Manage Pre-Owned Inventory for Investment Quality” at 3:30 p.m. on Feb. 11.

As part of our association leadership series in the January edition of Auto Remarketing, we connect with the American International Automobile Dealers Association for a Q&A with its 2021 chairman, Steve Gates, who will formally begin that role in February. Gates is the owner of Gates Auto Family, with locations in Kentucky, Indiana and Tennessee.

The emailed Q&A with Gates, covering a wide range of topics, can be found below.

Auto Remarketing: What are your top priorities for AIADA in 2021?

Steve Gates: For 51 years, AIADA has been focused on automotive trade policy in Washington, D.C. We will continue that mission into 2021 and beyond.

The last few years showed us plainly how trade wars can impact the day-to-day operations of international nameplate auto dealers. The national security tariffs we fought against on imported vehicles and parts would have devastated our stores, caused massive unemployment and put safe and reliable vehicles out of reach of regular American families.

As I told the Senate Finance Committee in my 2018 testimony on auto tariffs, “American auto dealers strongly support a pro-growth economic agenda, and believe it can be accomplished with a positive trade message, not the threat of tariffs and taxes. We don’t need more tariffs. We need more trade agreements. Trade keeps our economy open, dynamic, and competitive, and helps ensure that America continues to be the best place in the world to do business.”

AR: What are some of the most pressing legislative/political issues in Washington, D.C., that you believe are most pertinent to new-car franchise dealers, overall?

SG: While we know we will have our hands full in 2021 with a new administration and a new Congress, the main issue on dealers’ minds this new year will be the COVID recovery. Dealers are still handling PPP loans and supply chain issues, and working night and day to keep their employees and customers safe. That’s going to be the focus for at least the first quarter of 2021.

That said, the wheels of government continue to turn. The rollout of the U.S.-Mexico-Canada trilateral agreement is going to be one of our most pressing challenges in 2021. While USMCA has been ratified, it still needs to be implemented. AIADA will be front and center in helping our members navigate that process.

We have an agile and well-rounded advocacy team on the ground in D.C., which allows us to focus on issues like regulatory policy and taxes in addition to trade. We will be watching closely to see how the Biden administration uses the CFPB, approaches emissions rules and handles small business tax policy.

AR: Specific to international nameplate dealers, what are some legislative/political issues unique to them versus a Big 3 brand dealership?

SG: AIADA was founded as a trade organization for international nameplate dealers, but the truth is ALL dealers need to care about global trade in 2021. There isn’t a car on the road today that is built with 100% American parts. Any tariff on imported parts, therefore, impacts the entire industry.

It’s also notable that international brands were responsible for 47 percent of all U.S. vehicle production in 2019, and not a single automaker outside of Tesla assembles all of their vehicles in the U.S. So, while AIADA’s members may be more exposed to the impact of trade wars and tariffs, they are hardly the only sector of the industry that is vulnerable. In that sense, our members are doing a lot of heavy lifting for the industry as a whole!

AR: The association leadership in the auto industry is quite active. What are some ways you partner with fellow auto industry trade associations like NADA, NIADA, NAMAD on the dealer side, NAAA on the vendor side, as well as manufacturer associations?

SG: AIADA believes strongly in working together with other auto organizations inside and outside the D.C. beltway. The coalitions we join amplify all of our voices, and force legislators to sit up and take notice of our members’ concerns.

One of the best examples of these partnerships is the annual economic impact report we produce in conjunction with Autos Drive America, the international brand manufacturer association. The report has proved invaluable when working to illustrate the scope of our influence on the U.S. economy before members of Congress.

Another great example is the Driving American Jobs coalition, an organization we are active in, along with the American Automotive Policy Council, the Auto Care Association, the Alliance of Automobile Manufacturers, the Motor & Equipment Manufacturers Association, the National Automobile Dealers Association, and the Specialty Equipment Market Association. When we all speak with one voice, we are impossible to ignore.

AR: From an outsider’s perspective, dealer education appears to be of great importance to AIADA. What are some ways the association works to educate dealers, and what are some messages you aim to get across?

SG: We’ve realized over the years that everyone wants to receive information differently, so we have developed a variety of channels to reach and educate our members. They include our daily e-newsletter FirstUp, our print magazine AutoDealer, our Beltway Talk podcast, our social media feeds, our YouTube channel, and of course, AIADA.org. Basically, we never want our members to wonder what we’re up to; we want them to see it every day!

In the summer of 2020, AIADA’s AutoTalk webinars were a vital resource for dealers as we worked with some of our partners to share information on COVID-19, with topics like: "What if my employee tests positive for COVID-19?" and sanitization and decontamination processes to reduce virus risk. We were able to quickly adjust our programming to answer the questions our members were asking, and the positive response was overwhelming.

AR: Like most industries, automotive has been heavily impacted by COVID-19 this year. What are some ways that AIADA has served as a resource for dealers during these times?

SG: In addition to serving as an information resource for dealers, we have also been active on the COVID-19 policy front, working to ensure dealers were at the table when decisions were made determining who was eligible for PPP loans and what types of businesses were considered essential during lockdowns.

AR: How has the pandemic impacted the in-person meetings, events side of AIADA?

SG: Jason Courter, our 2020 chairman, has done an incredible job of leading our organization in a pivot from in-person meetings to virtual advocacy. Because of him, AIADA hasn’t missed a step. He established something we’re calling “virtual dealer visits” in which we take a member of Congress, via Zoom or FaceTime, through a dealership, allowing him or her to meet with dealers and dealership employees and see their work firsthand. He’s also taken our 51st annual meeting in February virtual; something I’m very much looking forward to and in which Toyota’s Bob Carter will be participating. The content is going to be invaluable for dealers, and available at their fingertips.

In 2021, we will continue these virtual offerings as long as necessary and beyond. One thing this crisis has allowed us to see is how much we can accomplish through our digital connections.

Independent dealers who use ACV Auctions to acquire inventory now have another option for their floor planning.

On Tuesday, First Business — which just launched its floorplan service in June — announced a new agreement to offer floorplan financing through ACV.

The company highlighted that the partnership can allow independent dealers who have earned competitive pricing and upscale service to purchase inventory through ACV with their First Business floorplan.

First Business’s Floorplan Financing offers independent dealers the flexibility to finance their inventory purchases, preserving cash flow and allowing them to buy preferred inventory.

According to a news release, floorplan programs are available from $500,000 to $10 million for larger, well-established independent dealers.

The company explained this limited focus, a hallmark of First Business’s business model, facilitates a smaller clientele than large competitors, empowering personalized concierge service.

“Our team is thrilled that First Business clients can now floorplan their auction purchases directly through ACV Auctions, one of the largest and most popular digital wholesale car auctions in the world,” says Jeff Widholm, managing director of First Business Floorplan Financing.

“ACV Auctions also believes in a quick, efficient client experience, aligning with our team’s goals,” Widholm continued.

Floorplan Financing is offered through First Business Equipment Finance, a subsidiary of First Business Bank.

For more information, call (844) 418-2493.

As part of Used Car Week's Pre-Owned Con next week, Cherokee Media Group will recognize honorees in the annual Used Car Awards, a program presented by KAR Global.

That includes our annual Independent Dealer of the Year, which this year goes to Kevin Condon, who is general manager of Auction Direct USA in Raleigh, N.C.

Below is a Q&A with Condon, which is available to CMG Premium subscribers now and to all readers in the upcoming December edition of Auto Remarketing.

Auto Remarketing: What was your first job in the car business and what did you learn from it?

Kevin Condon: When buying a used Geo Storm from a family-owned Chevrolet/Oldsmobile dealership in a small town in upstate New York, the sales manager involved in the deal recruited and convinced me to work on his sales floor, selling new and used vehicles. I knew nothing about the business, so I did what I was told without exception — even if I didn’t believe in the instructions, I followed them to the T.

During my seven-year sales consultant stretch, I was able to build a significant book of repeat and referral business. To this day, I’m grateful to my hiring sales manager, Tom Rosati, for his influence and sport metaphors during moments of self-doubt. I learned you can never stop learning if you want to keep the odds in your favor. I learned that I can’t be afraid to fail if I wanted to keep trying, and I learned that this business can only be fun if you don’t take yourself too seriously. And by the way, I still have a lot to learn.

AR: What do you enjoy most about the car business today?

KC: What I enjoy most about the car business today is training and development. Every business, no matter the industry, is only as good as the people and practices that our customers experience. Proactive approach with individuals and departments to identify stress or bottlenecks in process or people can seem daunting if not addressed fist hand to better understand the best remedy for positive results. I enjoy seeing customers and employees exceed their expectations.

AR: How has automotive retail changed the most since your started?

KC: As much change as I’ve seen over the years, I never expected people willing to buy used vehicles without seeing, touching and driving them first. Online interaction has gone from “when can you come in to see us?” to “when can we deliver your car?” Our industry is changing faster than the resources needed to keep up. To evolve in this new age, innovative minds is a prerequisite.

AR: How has COVID-19 impacted the way your store does business, and how have you adapted?

KC: Special thanks to all the men and women of the NIADA and NADA for their part in the automotive industry categorized as essential throughout this national pandemic with thoughts and prayers to the businesses that are still struggling due to reasons outside their control.

The impact of COVID-19 has affected us all in many different levels. We consider ourselves very fortunate to have only one of 79 employees test positive post COVID-19. Our 100% compliance to CDC protocols helps make our customers and employees feel safe to perform their jobs with minimal risk.

AR: Outside of COVID, what are some top challenges facing independent dealers in the used-car space? And what are some major opportunities?

KC: Being an independent used-car dealer gives us the freedom to sell any make and model but does leave us dependent on the franchised dealer for recalls and warranty repairs; consequently, customer experience is out of our control and vulnerable for unnecessary upsell. Having a good relationship with local franchised dealerships can make all the difference.

As part of Used Car Week's Pre-Owned Con next week, Cherokee Media Group will recognize honorees in the annual Used Car Awards, a program presented by KAR Global.

That includes our annual Franchise Dealer of the Year, which this year goes to Rick Ricart, president of Ricart Automotive Group.

Below is a Q&A with Ricart, which is available to CMG Premium subscribers now and to all readers in the upcoming December edition of Auto Remarketing.

Auto Remarketing: The auto business, of course, is a family business for you at Ricart Automotive Group. What was your first job in the family business and what did you learn from it?

Rick Ricart: My first tax paying real position at the dealership was selling new Chevrolets in the summers while in college. However, I can joke that long before that I would “work” occasional days doing manual labor, helping the maintenance department, or painting light poles as punishment. I look forward to passing that privilege to my children as well one day (I’m funny, too).

AR: What do you enjoy most about the car business today?

Ricart: The challenges. More specifically, the game of disruption between the traditional OEM/dealer network and the new start-up “Wall Street ventures.” I’m a firm believer that we must not let the disruption happen, but do the opposite which is innovate ourselves. Technology is becoming available for dealers to take the next steps.

AR: How has automotive retail changed the most since you started?

Ricart: Since the early 2000s, I have seen dramatic change. My first summer selling cars, I had one of those spiral bound green books (and analog CRM) and a pen.

We had a DMS but no CRM and barely a website. Now the website, digital retailing tool (we use AutoFi), CRM and DMS are all flowing together with very little communication and human contact, and we are selling cars.

AR: How has COVID-19 impacted the way Ricart does business and how has your group adapted?

Ricart: We are lucky. We adopted AutoFi and began offering remote/online buying almost three years ago so our staff was trained and ready when the pandemic hit.

We had experience and immediately sprang into action offering remote deliveries and express delivery at the dealership. We also opened a very large fleet/commercial service department in March and that turned out to be a home run because of all of the delivery and work vehicles needing repairs to keep moving. We also changed up marketing messages to be more community focused and show care and that has been a powerful move.

AR: Lastly, what sets your dealership group apart?

Ricart: Simple. It’s our people. Our culture. The family we have here does not just stop at the nine Ricarts that are working here: it’s the dozens of managers and leaders that have become family over the years. We have great tenure and low turnover and they are absolute superstars in everything they do.

Grené Baranco explained why her recognition from Ally Financial and the National Association of Minority Automobile Dealers (NAMAD) sends “an important message.”

On Tuesday, Ally and NAMAD joined forces to name Baranco, who is the new and used sales manager of Mercedes-Benz of Buckhead, as the recipient of the third annual “Ally Sees Her” award in recognition of her automotive leadership and commitment to community and diversity.

In conjunction with the award, Ally is donating $10,000 to Meals on Wheels Atlanta in Baranco’s honor.

“A lot of women, younger than me, have not been able to see themselves in this industry,” Baranco said in a news release distributed by Ally.

“This award is really about telling women of color that their contributions are valued,” she continued. “It recognizes me and what I represent, an African American woman having a successful career in retail automotive. This is also an important message for our industry as we seek new leadership and talent in areas that may not have traditionally seemed available to some.”

Ally recapped that it developed the “Ally Sees Her” award with NAMAD three years ago to recognize the next generation of promising minority women leaders in auto retail who also are highly involved in their communities. The award was inspired by the Association of National Advertisers #SeeHer campaign to elevate women in media and marketing.

Previous winners include Amber Martin, who leads business and community partnerships for the Martin Management Group in Bowling Green, Ky., and Karmala Sutton, who in 2018 was the dealer in training at Honda of Kenosha in Bristol, Wisc.

“The award is our way of lifting women of color by spotlighting a leader who is making a difference in her community and at her dealership. We want to showcase leaders like Grené, who inspire other women,” Ally senior director of corporate citizenship Jacqueline Howard said in the news release.

“Grené has kept her eye on innovations throughout her career, implementing one of the first-ever auto Internet sales departments in the country in 1997,” Howard continued. “She’s dedicated to continually improving the industry while also forging a path for the women who follow her.”

Baranco, whose parents — Greg and Juanita Baranco — bought the Buckhead dealership in 2003, serves on several boards in Atlanta, including Meals on Wheels Atlanta, Common Cause Georgia, the Georgia State University Department of Religious Studies Alumni Board and The Arts Xchange.

In response to Ally’s donation to Meals on Wheels Atlanta on her behalf, Baranco said the nonprofit is special to her because it provides nourishment for the community’s “body and soul” as recipients benefit from the volunteer visits as much as the food they bring.

“The relationships they build during the visits are equally as important as the meals they serve,” she said.

Baranco began her auto career in 1997 at her family’s Pontiac GMC dealership in Lilburn, Ga., where she created the internet sales department. She also has managed internet sales at Infiniti of Beverly Hills and at Mercedes-Benz of Buckhead and served as general manager for the Baranco family’s Smart dealership franchise.

Baranco is a graduate of Georgia State University and the National Automobile Dealers Association Dealer Academy.

“Grené is the true example of being a leader, innovator, and trailblazer in the auto industry,” NAMAD president Damon Lester said.

Baranco was to receive her award during a virtual NAMAD recognition ceremony on Tuesday that can be viewed on this website.

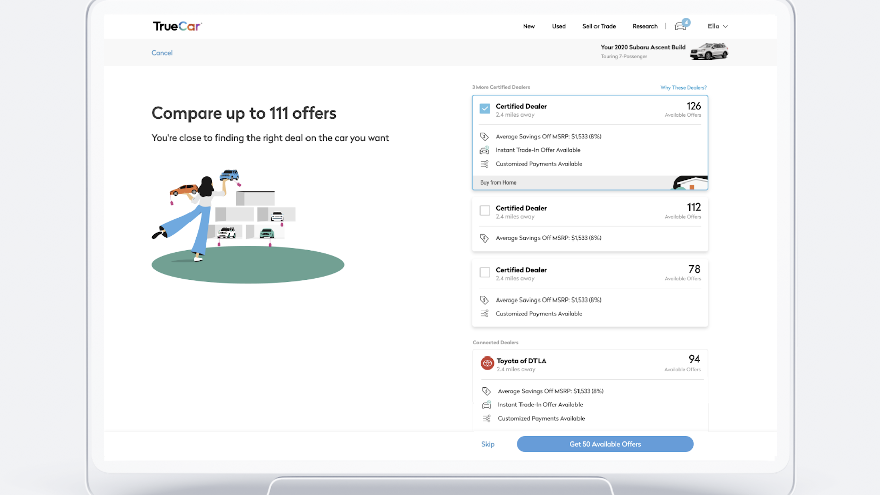

Dealers that utilize TrueCar now have more tools from the provider to use — for free.

TrueCar announced on Thursday that it is offering complimentary access to its Payments and Trade Retail Solutions tools for network dealers.

The company said the tools are available for onboarding starting now to franchised dealers and are planned to roll out to independent dealers by the end of the year.

Participating retailers will be part of TrueCar’s Access Network, and will receive badging on the TrueCar marketplace highlighting to consumers that these features are offered by the dealership.

Retailers must opt in to the Payments tool to also be eligible for complimentary access to the TrueCar Trade tool, according to a company news release.

TrueCar explained this new offering was prompted by the recent acceleration in demand for digital car-buying solutions and aligns with TrueCar’s strategic vision of creating a flexible end-to-end buying experience.

Recent TrueCar research of consumer car-buying preferences showed three things the company’s tools can accomplish, including:

— 76% of shoppers would like to calculate and compare monthly payments online

— 65% would like to receive an offer for a trade-in online

— 61% would like to set up the entire deal online, including monthly payment, trade-in and financing.

“Consumer demand for digital retailing is no longer debatable. While we recognize that not all consumers want to shop 100% digitally or 100% offline, most consumers today fall somewhere along that spectrum and would like to complete more and more of the deal online,” TrueCar president and chief executive officer Mike Darrow said in a news release.

“The key is providing options,” Darrow continued. “Offering our Payments and Trade tools complimentary to our retailer network ensures that they have access to the very best technology to help them stay relevant and competitive to sell cars in today’s market.”

The company highlighted early results from a pilot that included over 2,500 TrueCar Certified Dealers using these tools showed that shoppers who built and submitted their deal online including both Trade and Payments demonstrated a significant lift in close rate.

In fact, TrueCar said AutoNation plans to onboard all 300 franchises with TrueCar Access Payments and Trade tools after a successful pilot.

Based on the company believing that 85% of consumers either finance or lease their vehicle, the company said TrueCar’s Payments tool can serve as a critical piece of the car-buying equation for consumers.

The tool can educate consumers around what their estimated payment will be based on dealers’ own payment structure and customized to the consumer’s preferred term for a retail installment contract or lease, down payment and anticipated credit score.

TrueCar pointed out this process can align expectations earlier in the deal building process and reduce friction at the point of sale.

“Having worked in and operated dealerships for 24 years, I know that a high quality, high closing connection happens when a consumer has done their research and has realistic expectations around all the deal components,” TrueCar senior vice president of retail solutions David Green said.

“Allowing the consumer to self-service parts of the deal online by discovering lease and finance payments on specific inventory and receiving an accurate VIN-specific trade-in value creates efficiency and delivers our dealer clients more buyers,” Green continued.

The company recapped the most import functions of each of these tools, beginning with key features of TrueCar Payments:

• Pulls in the retailers VIN-specific pricing and allows them to customize their payment specifications through TrueCar’s payment configuration tool

• Enables more precise payment estimates that translate seamlessly from online to offline limiting surprises that cause friction between buyers and sellers

• Automatically pulls in most automaker incentives and rebates, and state level taxes

• Integration of Payments into TrueCar’s Create Offer tool enables dealership personnel to efficiently manage their payment inputs and quickly respond to consumer deal structure preferences allowing the deal to close faster, saving time for both dealers and consumers

• Dealer badging on the TrueCar marketplace highlighting that this feature is available to consumers

The company then reiterated key TrueCar Trade features, including:

• 17-digit VIN-specific evaluation tool allows dealers to accurately evaluate a vehicle so they don’t undervalue or overvalue it

• Makes real time adjustments to the vehicle value, which helps consumers understand the “why” behind the value, reducing friction when they see the cash offer

• Provides dealers with a list of common problems specific to the model that may reduce the value of the vehicle at time of appraisal

• Includes a transparent and proprietary daily depreciation calculation known as the "melt rate," which makes it easier for dealers to determine the most profitable timing to sell the trade-in

• Shoppers that interact with the TrueCar Trade tool are highly engaged. When receiving a side-by-side appraisal with the dealer after using the tool a consumer is almost twice as likely to say the offer they received was fair, twice as likely to give the dealer a five-star rating and nearly twice as likely to transact

• Dealer badging on the TrueCar marketplace highlighting that this feature is available to consumers

TrueCar mentioned that consumers would also like more transparency and accuracy around trade-in values with 75% of new-car shoppers using a third-party site for their trade-in value.

Since TrueCar Trade launched in November 2018 in partnership with Accu-trade, the company said more than 1.2 million consumers have received a value on their vehicle using the TrueCar Trade tool through the TrueCar marketplace or through retailer network websites.

“Our Payments and Trade tools were designed with dealer systems and processes in mind,” Green said.

“These best-in-class tools enable dealers to enhance their digital offerings and appeal to a broader consumer base while maintaining full control of their payment structures and ensuring a seamless online to offline transition,” he went on to say.

For more information, retailers can contact their sales representative or visit truecar.com/retailsolutions.

TrueCar wants to sustain the momentum generated by its special program tailored for servicemembers so it’s partnering with one of the largest providers of media and marketing services specializing in and reaching the military audience.

On Thursday, TrueCar announced a partnership with Refuel Agency that’s geared to support TrueCar in building brand awareness for TrueCar Military through strategic research that can deliver richer audience insights and differentiated brand positioning.

“While only launching earlier this year, TrueCar Military is already the fastest-growing affinity-based car buying program in TrueCar history. It’s very important to us that we invest in growing awareness of this program to the military community authentically and creatively,” TrueCar president and chief executive officer Mike Darrow said in a news release.

“Refuel is the right partner to help us achieve that goal,” Darrow added. “Bringing together Refuel’s deep expertise and insights into the military segment with TrueCar’s 13 years of experience powering car-buying programs for prominent military service organizations will ensure we build a strong marketing foundation for TrueCar Military that sets us up for long-term growth.”

TrueCar’s partnership with Refuel Agency will focus on:

• Brand positioning and messaging

• Custom persona profiles and segmentation

• Custom photography assets

• Digital, social and traditional media placement

“We are excited to partner with TrueCar and are confident that, through our military expertise and omni-channel approach, TrueCar will become the go-to online destination for the military and their vehicle shopping needs,” Refuel Agency president and chief executive officer Derek White said.

“By choosing a military marketing agency and utilizing veteran directors, photographers and producers for their campaign, TrueCar shows their dedication to the military and veteran community,” White continued.

TrueCar launched TrueCar Military in May as a dedicated vehicle purchase program that provides exclusive military incentives and benefits, on top of TrueCar’s existing benefits, to those who have served our country’s armed forces and their families.

TrueCar Military is available to all U.S. active duty service men and women, military retirees, veterans, and their spouses. Current TrueCar Military benefits include:

• $500-$4,000 bonus cash from select automakers

• Dealer discounts on new and used vehicles

• Up to $4,000 worth of benefits for repair and auto deductible reimbursement

• Dedicated military customer service hotline

For more information on TrueCar Military, visit http://www.truecar.com/military.

While the acceleration of wholesale prices moving higher dipped a bit, Black Book indicated dealerships with the most robust financial resources continue to have the best opportunity to secure used-vehicle inventory during the coronavirus pandemic.

Black Book specifically mentioned large operations such as CarMax and Carvana showing their “dominance in the lanes” as analysts released their latest COVID-19 Market Insights report earlier this week.

“The increase in pricing related to winning bids is forcing smaller buyers to step back from bidding for fear of getting stuck with high-priced inventory,” Black Book said in the report.

“The divide continues to grow between the smaller dealers and the larger outfits as the money required to purchase inventory increases and retail fails to increase at the same pace,” analysts continued. “The larger dealers are relying on financing and add-on services as a revenue stream to overcome the small retail margins, but this is hurting the smaller dealers that do not have these services to offer.”

No matter who is cutting the floorplan checks, the amount needed to get those vehicles is declining at least a little bit.

Based on its volume-weighted data, Black Book reported that overall car segment values increased 0.96% this past week, representing the smallest amount of upward movement in the past seven weeks when prices first started a rapid week-over-week run of increases.

Analysts pointed out the latest movement is in sharp contrast to the same week last year when overall car segments values decreased 0.27%.

When volume-weighting is applied, Black Book determined overall truck segment values (including pickups, SUVs and vans) increased by 1.04% last week, marking the first time during the rebounding of values that the increases in the truck space exceeded the car arena.

“Last week, the minivan and full-size van segments had small declines that were viewed as stability, but the stability didn’t last long with all segments once again increasing this past week,” analysts said. “However, it is notable that many were at a smaller pace than previous weeks.”

Turning back to the atmosphere in the lanes nowadays, Black Book mentioned another trend that might be making it more challenging for dealerships with less financial horsepower to secure inventory they want.

“The portion of the market that is showing some stabilization and a slight softening are the ‘edgier’ units — those with higher mileage and lower condition scores,” analysts said.

“At the onset of the pandemic, the lower price point of these vehicles made them desirable, but this is a portion of the market that is showing some stability now,” they continued.

“The demand has shifted now toward newer-model-year, lower-mileage, and clean condition units that provide a viable substitution for consumers that are in the market for a new vehicle,” Black Book went on to say.

Black Book wrapped up its latest observations with two other anecdotes.

“Last week values continued to rise, but we did experience a small increase in no-sales as sellers continue to raise their floors and buyers show some hesitancy around what the future holds for used cars,” analysts said.

“Auction volume is showing some regionality in trends with volume increasing, particularly of rental units, in portions of the country that have been harder hit by spikes in COVID-19 cases,” they continued.

“Additionally, in the past two weeks, we’ve seen pockets of damaged units being sold in various parts of the country with sellers taking advantage of the strong market for late-model vehicles,” Black Book concluded.

Dealerships that leverage marketing tools from Dealer Specialties and Experian now have more robust information to present potential buyers about their inventory.

Dealer Specialties announced on Thursday that it has teamed with Experian to make C.A.R.Score reports available within Experian’s AutoCheck vehicle history reports.

The companies highlighted this new relationship is an added benefit to mutual clients as it gives dealers the opportunity to show C.A.R.Score vehicle condition reports in the history report in an effort to give consumers more confidence to make their next vehicle-purchase decision.

Dealer Specialties recapped that C.A.R.Score is an all-new, consumer-facing vehicle condition report that displays the exterior and interior condition of the vehicle, including instrument and control panels, mirrors, upholstery, even the scent of the vehicle.

These interactive condition reports can show specific details that vehicle shoppers are looking for, yet, until now, were not available on vehicle history reports, according to the company.

Dealer Specialties noted that its vehicle inspectors perform a full, cosmetic vehicle evaluation that includes photographs of any visual damage. After inspection is completed, the vehicle is rated from 1 to 5 stars in an attempt to give consumers a clear understanding of the vehicle’s current condition.

“Consumers have shown an increasing trend toward purchasing automobiles online over the past couple of years,” Dealer Specialties president Shane Marcum said in a news release.

“With the recent impacts to the automotive space attributable to COVID-19, our C.A.R.Score consumer-facing condition reports provide confidence to both dealers and their customers in a time where transparency has never been more important to the completion of an automobile transaction,” Marcum continued.

C.A.R.Score reports will be displayed under the inspection history check and detailed vehicle history sections of Experian’s AutoCheck vehicle history report. Each section provides inspection data, location and a link to the full C.A.R.Score report.

To see an example report, go to this website.