The board of directors for the National Automobile Dealers Association has elected its 2015 chairman.

Chosen for the post during the board’s annual meeting in Scottsdale, Ariz., is Bill Fox, who is currently NADA’s vice chairman and also represents New York’s franchised dealers on NADA’s board. He is a partner in Fox Dealerships, which includes eight franchises in upstate New York.

Fox will officially begin his tenure as NADA chairman and chief executive officer at the 2015 NADA Convention & Expo in January.

“It is a true honor to serve this industry and this board. This is an exciting time for the auto industry and for dealers across the country,” Fox said. “We will continue to advocate strongly for dealers, and the franchise system which is the best and most efficient model for consumers, dealers and manufacturers alike.”

Meanwhile, elected vice chairman is Jeff Carlson, president of Glenwood Springs Ford and Glenwood Springs Subaru in Glenwood Springs, Colo. He is also partial owner of Summit Ford in Silverthorne, Colo., and represents Colorado dealers on NADA’s board.

The board elected Neale Kuperman as treasurer and David Shepherd as secretary.

Data collector Vast announced early this week the availability of its new CarStory Market Reports, the company’s grouping of data models that analyze more than 100 million used-vehicle searches.

The reports, available for free to dealers as well as consumers, provide individual vehicle information such as supply, demand and market features, as well as special features about a vehicle that makes it different from others.

“We are thrilled that we can now bring that data to such a broad audience of people who can benefit from it,” said John Price, Vast’s chief executive officer.

The company is offering dealer-branded market reports for free to dealerships who sign up before the end of the year.

“CarStory Market Reports are built for simplicity so that they both enhance and accelerate the car-buying process,” said Joe Webb, founder and president of DealerKnows Consulting.

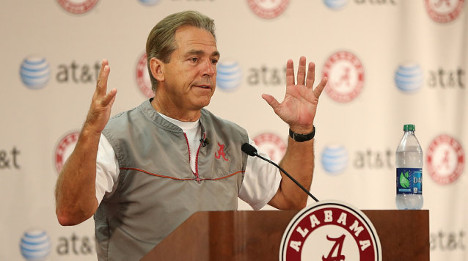

If Alabama football coach Nick Saban has any extra time from running the Crimson Tide, he can check to see how his pair of luxury brand dealerships are doing.

Two dealerships previously owned by Crown Automobile recently were sold to a partnership including Saban and the chief executive officer of Dream Motor Group, Joe Agresti. These dealerships will take on the new names of Mercedes-Benz of Birmingham and Infiniti of Birmingham, effective immediately.

“I am proud to announce we have acquired Crown Automobile which will now be named Mercedes-Benz of Birmingham as well as Infiniti of Birmingham,” Agresti said. “This is an incredible opportunity and one that we have been pursuing for some time. We are extremely excited about the benefits the dealership will bring to Birmingham and the surrounding areas.”

The all-new Mercedes-Benz of Birmingham is now open for sales and service, located in the former Crown Automobile dealership off Highway 31 in Hoover, just one block south of the Galleria.

Day-to-day operations for the store will be conducted by new general manager and partner, Randy Powell, who has 30 years of experience with the Mercedes-Benz brand.

And if Powell wants some assistance in turning certified pre-owned inventory, perhaps he can turn to Saban, who owns four national championships with three titles coming in a four-year span with the Crimson Tide. That success if part of the reason Saban already makes more than $7 million annually with Alabama, making him one of the highest-paid coaches in any sport.

“We consider ourselves luxury retailers and that seemingly subtle difference in how we view ourselves is actually a monumental deviation from the status quo. We intend to delight folks,” Agresti said.

“We will improve the customer experience every single day. We are certain our employees and customers will feel coach Saban’s influence on the company,” Agresti continued. “Our company mantra is: We will trip, fall and skin our knees trying to delight our customers.”

“I would like to buy a car with bitcoin.”

The majority of dealers and their sales staff likely have not heard those words from a customer. At least, not yet. The global emergence of cryptocurrencies in the last five years has brought to question one serious issue: what can be accepted as money?

Is it an item the government declares has value? Is it backed by a finite resource?

Arguably, the answer to that question, boiled down, is that currency is anything that someone believes is valuable. And some people, around the world, have expressed that belief and invested their faith in bitcoin.

The reality is, at the time of this writing in mid-September, bitcoin is trading at a value of roughly $475 per unit, according to CoinDesk’s Bitcoin Price Index. After years of exchange, the value has fluctuated violently between $0 and $1,200 per unit, but appears to be stabilizing throughout this year.

Bitcoin has produced millionaires who bought into the cryptocurrency in its infancy — and many of those people want to buy your cars.

BitPay, Atlanta’s own bitcoin merchant processing and services provider, is one of a growing number of institutions that have seen the potential in bitcoin and have decided to facilitate merchant transactions for those businesses opening their doors (and their computers) to sell goods in exchange for bitcoin.

In short, BitPay converts bitcoin to any of nine different currencies requested by the merchant.

Stephanie Wargo, BitPay’s vice president of marketing, took the time to speak with Auto Remarketing about this “cash for the Internet” and explained the current demographic that are out buying cars with bitcoin.

“Right now it is the early adopters into bitcoin, that have now turned into bitcoin millionaires, that are buying the Lamborghinis and the Teslas and the Land Rovers and those,” Wargo said. “But I think as bitcoin continues to become more mainstream, you’re going to kind of get that next level.”

According to Wargo, the bulk of purchases made with bitcoin via her company have been for consumer electronics. BitPay has, however, been processing larger purchases. With millions in sales for houses and a handful of dealers’ car sales under their belt, the company is gaining traction as the bitcoin currency continues to find its own. You can even buy a trip to space for $250,000, or roughly 526 bitcoins, through one of BitPay’s clients, Virgin Galactic.

So how exactly does car purchasing work through a service like BitPay’s? Much like a traditional credit card transaction.

Wargo explained that a customer would walk in and then, “from a dealer standpoint, on a face-to-face purchase, we would set them up really quickly with a point-of-sale system off of an iPad or tablet or phone.”

She added: “They would put in the dollar amount; we would do the transaction in bitcoin. We would show the current rate. The consumer would have 15 minutes to complete that transaction in the dealership and push the money from their bitcoin wallet through.

“The dealer knows right then and there that this is approved; the money’s been sent; the money will show up in their bank account the next day. And we guarantee the transaction once we confirm.”

The risk taken on working with bitcoin, at least with BitPay, is only as big as the dealer wants it to be. With BitPay’s free service, a dealer can have 100 percent of the bitcoin from the sales transaction converted into their native fiat currency. Or they can choose to receive it all in bitcoin. Or any percentage in between.

For those concerned with the legality of dealing with bitcoin, rest assured that, although it is not our nation’s official currency, it is still legal. As of March 25, the IRS ruled that bitcoin will be taxed as property and subject to capital gains tax. For more information on what you need to do to prepare yourself for handling your own bitcoin funds, follow us online for an update to this story.

In my previous post I discussed why pre-owned profit margins are under pressure. The factors driving this trend include transparency from the Internet, market-based pricing, and rising overhead costs from new dealership buildings. And that’s not the bad news — the bad news is that the problem is only going to get worse over the next few years.

The NADA average gross profit of about $2,300 likely represents a bubble in used car profitability. Why? It’s a simple matter of supply and demand.

The Rubber on the Road

New-car dealerships sell the bulk of late-model used cars, typically aged one to five years. That means the number of new cars sold in a particular year impacts the supply of late-model used cars over the next five years.

During the financial crisis from 2008 to 2010, new car sales fell dramatically. That means the supply of late-model used cars plummeted over the last three to five years, as depicted in the chart below. In the wake of the recession, consumers’ increased frugality also led to an increased demand in used cars at a time when there was less inventory available.

So in the last five years, while the supply of used cars decreased compared to the prior five-year period, demand was on the rise. As a result, used-car prices have climbed. And because supply and demand moved in opposite directions, that led to an increase in the average gross profit per vehicle.

But over the last couple of years, used car units in operation have been on the rise and will be peaking over the next three to four years, climbing to levels last seen in 2006. Back then, according to NADA, the average gross profit per vehicle was less than $1,800 — more than $500 less than 2013 average gross profits.

Are you ready to take that kind of hit to your profit margin on every pre-owned vehicle you sell?

The good news is that there is one thing every dealer can fix to avoid eroding pre-owned gross profits. In my next post, I’ll detail what that is.

This is the second installment of a three-part series on gross profit. See the first installment here.

Pat Ryan Jr. is the CEO and Founder of several high-growth tech companies focused on transforming automotive retail, including FirstLook and MAX Digital. This and more of his posts can be found at getrelevantordie.com.

It's been verified. In The Wall Street Journal last month, it was reported there are now more women drivers on the road than men. The last several years the auto industry has witnessed a big and not so surprising shift in the car buyer demographics, particularly in terms of gender.

Men, who have been strongly associated with cars, touted as their "first love" and accounted for the biggest chunk of auto sales, have now taken the back seat as women take the lead and are the fastest growing car buying segment.

This leaves many dealerships shifting their paradigm in terms of how to re-strategize their business and marketing game plan to truly optimize sales to women. It’s leaving more dealers unsure as to exactly how to do that. Most dealers say quickly and unequivocally that they know exactly how to market to women. It’s the brave and daring ones that share they are looking for more than just a "women spokesperson in the family" to market to this powerful buying group. If you don’t have an exceptional understanding of this market, ups and potential customers are likely to slip away.

Women Walkouts: A $4 Million Cost Analysis

Dealerships don’t even know that they can increase their sales another $4 million dollars a year. How? Most walk 10 to 15 women out their door each month and don’t even know it. By paying more attention to women and providing critical respect and trust the whole way through the sales engagement process, those browsers can be converted to buyers. Easily.

Lets take a closer look. Maybe a decade ago when a woman walked out of a dealership without buying it wouldn’t have mattered. Today, when a woman walks out your store dissatisfied without making a purchase, it’s a matter of concern, because:

- If she isn’t buying from you then she IS going to buy from your competition.

- If she isn’t buying from you then there is a good chance she will be writing a review on a car dealer review platform about that experience.

- If she isn’t buying from you, you not only lost the sale, you lost the RESIDUAL REVENUE.

- RESIDUAL REVENUE = Vehicle + (Service Drive Visits X 3-6 years) + Future Vehicle(s)

- THIS is happening at your store EVERY DAY; it’s what you DON’T KNOW THAT YOU DON’T KNOW.

Double Check Your Automatic Response, "That Doesn’t Happen Here; We Treat Everyone the Same"

Women shop at 1.9 dealers before buying a vehicle or the equivalent of 30 percent more dealerships than men. Why is that?

They want to get it right, and avoid getting it wrong. Don’t be so quick to think she is not leaving your store. An unhappy potential car shopper walking out of your store costs you a fortune — literally. Here’s what is put on the line when this happens:

1. You Lose the Opportunity to Make a Quarter-of-a-Million Dollar Sale

Women buy or lease an average of eight cars in their lifetime. At today’s average price of $32,500, that money adds up quickly, especially for larger dealerships. Add service drive visits in there over the long haul, that is a huge chunk of gross profit and sales, too.

2. You Lose a Customer for Life, or at least a Long time

The larger dealerships lose the loyalty that this woman and family and friends bring. Not to mention, her many referrals. Huge miss. Even if she had a bad experience at one brand, rarely will she return to this “family dealership” to buy from another brand. You lost her and her referrals.

3. You Lose More Potential Buyers

Women are influential. This can work in your favor or against you. So, whether a woman is just looking around and browsing in your store or actually thinking of purchasing a car, you need to offer the ultimate shopping experience so that she walks out that door with a smiling face and feeling content. If that happens, she will spread the word and refer you to her friends, family and – she will return to buy. And if she doesn’t have a great time at your dealership, she will walk and talk.

It’s a pretty simple formula. Which side of the $4 million will your dealership be on? In today’s hyper- competitive market, its time to pay much closer attention.

Editor's Note: Anne Fleming is president and car-buying advocate of Women-Drivers.com and a guest contributor to Auto Remarketing. She was also recognized as one of AR's 2013 Women in Remarketing.

Lobbying efforts by organizations such as the National Automobile Dealers Association prevented dealerships from being directly regulated by the Consumer Financial Protection Bureau when it was formed four years ago.

But Automotive Compliance Consultants general counsel David Missimer explained how the CFPB’s latest moves could greatly influence how stores operate — especially in the F&I office.

As SubPrime Auto Finance News covered last week, Missimer recapped that the CFPB proposed a new rule to oversee larger nonbank auto finance companies for the first time at the federal level.

If enacted, Missimer says this rule will significantly affect auto dealer practices, including compensation. He emphasized that earlier CFPB documents related to this proposed rule make clear to auto finance sources that any continuation of markup as a compensation model for dealer generated financing will require a significant compliance management system.

“The CFPB is moving full-steam ahead to directly affect, change and establish compensation policies in dealerships,” Missimer said.

“The only way to protect the lending model currently in place is for dealerships to institute strict controls through a robust compliance management system,” Missimer continued. “And work with their finance sources to establish controls and procedures to respond to CFPB inquiries and accusations of disparate impact.”

As proposed, Missimer pointed out the rule would allow the bureau to supervise nonbank auto finance companies that make, acquire or refinance 10,000 or more loans or leases annually. If approved, the rule will place 90 percent of all nonbank auto finance under CFPB supervision. The proposed rule is open for comment for 60 days.

In addition to what’s being dubbed the “Larger Participant Rule,” CFPB director Richard Cordray reiterated the bureau’s focus on dealer markup, “and the agency’s general disdain for the practice,” according to Missimer.

The CFPB also issued supervisory highlights focused exclusively on auto finance.

Missimer contends the supervisory document makes clear to auto finance sources that any continuation of markup as a compensation model for dealer generated financing will require a significant compliance management system.

“The CFPB suggested a move to flat-rate compensation, or limiting dealer markup to 1 percent, may significantly reduce a company’s fair lending compliance obligations,” he said.

Furthermore, Missimer declared that the CFPB’s actions make clear that compliance would include providing dealer education and training, as well as assisting the dealer in developing a strong fair lending compliance management system.

Missimer closed his assessment of the latest CFPB actions by touching on the abstract legal theory that’s also stirred debate in the auto finance industry.

“The CFPB’s use of disparate impact is questionable from a legal context. Until the Supreme Court weighs in on use of the theory in lending, fair lending practices and procedures must be adopted to prove legitimate business purpose and necessity in response to disparate impact claims,” he said.

For information Automotive Compliance Consultants and its materials on dealership compliance, audits and training and more, contact Missimer at [email protected] or visit www.compliantnow.com.

The acquisition of dealerships nearly doubled in the first half of 2014 compared to the same period in 2013.

That’s according to The Blue Sky Report from Kerrigan Advisors, along with research gathered from The Banks Report, which highlighted the 95 completed dealership transactions in the first half of 2014, a 75-percent increase over the 54 made in the same period the prior year.

By far the most bought and sold amongst franchises, General Motors accounted for 25 of the 115 individual franchises sold in the transactions, which also reflects the increase in multi-dealership transactions in the first half of the year. Twenty-one of the 95 dealership transactions included multiple dealerships, a 40-percent increase over 2013’s first half.

Despite the attention GM has received over recent recalls, its perceived value in the dealership market has not wavered. In fact, Erin Kerrigan, the founder and managing director of Kerrigan Advisors, shared her insight with Auto Remarketing and explained how GM franchises may have come out of the situation worth more than they’ve been in at least a decade.

“The values of those franchises really improved dramatically and the handling of the recalls was so well done that there’s a lot more faith in the franchise in the long term, particularly for Chevrolet, which is just such a strong brand,” Kerrigan said. “And I think a lot of the buyers recognize that General Motors is on really solid ground, from a financial standpoint.

“If you think about it, even the best of companies go through crises,” Kerrigan continued. “Toyota had a major crisis. It’s how those companies handle the crisis, from a management standpoint, that determines the real value of the business in the long term. And clearly General Motors was able to handle this crisis and that bodes very well for the value of the franchises that represent the company.”

Although the domestic manufacturers’ sales are on the upswing, it’s probably not a good idea to target the first dealership you see as an acquisition prospect.

“One of the challenges that General Motors and other domestic manufacturers have is that there are still a lot of these franchises,” Kerrigan said. “So the average sale per franchise, of units, is much lower for domestics than for the high-volume imports, like Toyota and Honda.”

Kerrigan pointed out that the blue sky value of the domestic franchises is far more market-dependent when compared to their foreign-based competitors. But if found in the right area, buyers are willing to pay a premium to get their hands on those franchises that have high demand but are not oversaturated with supply.

“In some cases, like if you’re in a market in Texas, you have dealerships there where they’re not as over-dealered in the domestic side and you have domestic dealerships making a lot of money,” Kerrigan said. “In those cases, they can be just as expensive as an import store, or approaching the same value.”

Amongst the publicly traded dealer groups, Group 1 Automotive and Lithia lead the way in the first half of the year on the acquisition front. According to the report, their price-to-earnings multiples grew at double the pace of the sector in the second quarter of 2014. The greatest percentage of the dealership transactions, however, were handled by private acquirers, making up 88 percent, or 84, of the total acquisitions in the first half of this year.

The top-10 private acquirers accounted for 60 of those 84 transactions, with Berglund Automotive Group heading the list with 9 total acquisitions.

Custom dealership mobile app platform provider Dealerbaby integrated with Auto/Mate’s dealership management system on Tuesday.

Officials highlighted that users of Auto/Mate’s Open/Mate third-party integration system can now experience the benefits of a native mobile app without the high costs associated with custom mobile app development.

Dealerbaby co-founder Padraic Doyle insisted dealerships can increase customer retention, profits and leads and become a leader of the mobile dealership community.

“Our partnership with Auto/Mate gives us the ability to create a powerful user experience by letting the customer interact with the dealership on the device they use the most — their smartphone,” Doyle said. “The key is the two-way communication with the DMS, which is made possible with Open/Mate.”

To help improve the mobile experience for dealerships and their customers, Dealerbaby integrated the following features in its platform with Auto/Mate’s DMS:

— Service appointment scheduling: Dealership apps on the Dealerbaby platform can display service schedules, available service appointments and offer users the ability to schedule various services all within the dealership’s mobile app.

— Inventory listings: The Dealerbaby mobile app platform can display inventory updates in real-time as the inventory is updated in Auto/Mate’s DMS.

Auto/Mate president and chief executive officer Mike Esposito emphasized the company’s DMS is a full-featured, user-friendly solution that is scalable for any size dealership or dealer group. Esposito pointed out the system comes with the best customer support in the industry and is available in both Web-based and in-house server solutions.

“More car shoppers are using smartphones and tablets to shop for cars, and mobile apps are easier to use than browsing a mobile website,” Esposito said. “DMS integration ensures that all inventory and service data is displayed to customers in real time, reflecting all updates in your dealer’s DMS.”

The Russ Darrow Group announced this week the acquisition of Amato Mazda in northwest Milwaukee. The inventory from Amato Mazda will be relocated to an all-new Russ Darrow Mazda Milwaukee, expanding the Russ Darrow family in the area, according to the group’s president, Mike Darrow.

“With the addition of this new Mazda dealership, we will now have two Russ Darrow Mazda locations in Metro Milwaukee along with a third Russ Darrow Mazda on the east side of Madison,” Darrow said. “This new facility has enough capacity to easily service the current and future growing Mazda owner base. We truly believe in the Mazda brand and the quality and performance of its vehicles.”

The new dealership will include a full-service maintenance and repair department, for all makes and models, including quick oil changes, as well as a parts and accessories department. Collision repair will be offered at an offsite facility.

Aside from the new amenities, the dealership is also hiring an estimated 30 new employees for sales and technician positions. More information can be accessed via the Russ Darrow Group’s website.